Alaska Labor Laws Guide

Ultimate Alaska labor law guide: minimum wage, overtime, break, leave, hiring, termination, and miscellaneous labor laws.

| Alaska Labor Laws FAQ | |

| Alaska minimum wage | Effective January 1, 2025 — $11.91 Effective July 1, 2025 — $13.00 |

| Alaska overtime | 1.5 times the regular wage for any time worked over 40 hours/week ($17.86 until June 30 and $19.50 after July 1) |

| Alaska breaks | Breaks not required by law |

Alaska wage laws

Unlike some US employers required to follow federal regulations, Alaska employers have to abide by state laws that offer added benefits to their employees. Before diving into the specifics, here’s a simplified table to help you understand the ensuing topics.

| ALASKA MINIMUM WAGE | ||

| Alaska regular minimum wage | Alaska tipped minimum wage | Alaska subminimum wage |

| Effective January 1, 2025 — $11.91 Effective July 1, 2025 — $13.00 |

Effective January 1, 2025 — $11.91 Effective July 1, 2025 — $13.00 |

No subminimum wage |

Alaska minimum wage

According to the Alaska Wage and Hour Act, the minimum hourly wage requirement is $11.91 starting January 1, 2025, tipped employees included. However, after July 1, 2025, the minimum wage increases to $13.00.

Equally important, tips do not include fixed amounts that customers must pay as part of their bill, such as automatic gratuity fees.

The minimum wage in Alaska is set to increase yearly due to the inflation rate and will always be at least $1 higher than the federal minimum wage.

Although labor laws tend to be universal, Alaska employment laws have exceptions in specific sectors. For example, a school bus driver’s minimum wage must be twice the regular minimum wage.

Subminimum wage in Alaska

The Alaska Wage and Hour Act regulates employment regulations and wages for minors in Alaska.

The said act states that employers do not have to compensate minors at the same rate as the hourly minimum wage.

The lower threshold is set at $4.25 (during the first 90 days of employment), but wages are usually higher, ranging from $4.25 to $11.91, depending on the specific job.

The only exception is a minor who has a special hours permit, specifically to work more than 30 hours per week. In such instances, employers are required to compensate them at the regular state minimum wage rate.

Exceptions to the minimum wage in Alaska

The exceptions to the minimum wage rule can go both ways — the hourly wage can be either lower or higher, depending on the nature of the work or the type of industry.

If you are employed in Alaska, below is the list of cases and occupations not bound by the regular Alaska minimum wage:

- Workers in agriculture,

- Workers taking care of marine life or hand-picking shrimp,

- Workers in household service (including babysitting),

- State or local government workers,

- Volunteers in nonprofit activities (religious, charitable, cemetery, educational, and other NGOs),

- Workers in a bona fide executive, professional, or administrative position, as specified by the Commissioner of Labor and Workforce Development and in the FLSA,

- Minors under 18 who are hired part-time or under 30 hours per week,

- Workers employed by a motor vehicle dealer with primary duties such as:

- Receiving, analyzing, or referencing requests for service, repair, or analysis of motor vehicles,

- Arranging financing for the sale of motor vehicles and related products, and

- Soliciting, selling, leasing, and exchanging motor vehicles.

- Workers providing emergency medical services, fire department services, and ski patrol services pro bono,

- Students partaking in a University of Alaska apprenticeship under AS 14.40.065. Regulation,

- Workers licensed under AS 08.54 and who are employed by a registered guide or master guide licensed under AS 08.54 for the first 60 work days during a calendar year,

- Independent taxi drivers working on a flat rate basis, who are compensated solely by the customers,

- Watchmen or caretakers working on assumptions that are out of operation for longer than 4 months,

- Workers who deliver newspapers,

- Workers in search of hard rock minerals and placers,

- Workers engaged in activities for a nonprofit religious, charitable, civic, cemetery, recreational, or educational organization where services are regulated by AS 47.27 (Alaska Temporary Assistance Program), and

- Individuals hired by a nonprofit educational or childcare facility to serve as parents of children who are compensated on a cash basis at an annual rate of no less than $10,000 for an unmarried person or $15,000 for a married couple.

Alaska payment laws

When it comes to requirements impacting pay and other benefits in Alaska, there are 4 key aspects to pay attention to:

- The type of payment —The total amount of employees’ earnings must be paid in cash, checks, drafts, or orders (without the discount by the bank or other depository).

- Frequency of payment —The pay frequency depends on the initial contract between the employer and employee, which commonly establishes monthly payments. Employees may choose between semi-monthly and monthly payments if the contract doesn’t regulate this section.

- Statements —The term ‘statements’ refers to documents listing earnings and deductions. They’re obligatory and are provided to employees for each pay period. Moreover, they must contain specific information, including gross and net wages, pay rate, straight-time and overtime hours worked.

- Deductions —In Alaska, employers may make certain deductions from their employees’ wages, including those required by federal and state law. Additionally, if an employee submits a written confirmation, other deductions, such as transportation costs or benefit contributions, may also be made.

Alaska overtime laws

Regulations established by the Fair Labor Standards Act (FLSA) define a workweek as any 7 consecutive working days, totaling 40 hours for this period.

As for overtime, the situation in Alaska aligns with federal laws. Overtime refers to any number of hours exceeding the 40-hour weekly requirement or the 8-hour daily requirement (the regular number for full-time employees), which is set at 1.5 times the regular pay rate.

This means that the overtime rate in Alaska comes down to $17.86 per hour ($11.91 x 1.5).

However, there are several exceptions to the overtime rules in Alaska.

🎓 Track Alaska overtime with Clockify

Overtime exceptions and exemptions in Alaska

Overtime laws prevent employers from exploiting workers and requiring them to work more than they should without adequate compensation. The FLSA regulates these illegal practices.

However, certain occupations and industries aren’t eligible for overtime protection. For example, employers with 3 or fewer employees in Alaska are exempt from overtime regulations.

The FLSA provides a series of tests to determine overtime eligibility.

There are 4 main categories of employees who are exempt from overtime laws, and federal or Alaska regulations do not protect them. Individuals working in these positions are commonly referred to as white-collar employees, and their jobs often require a college degree. However, an employee must earn at least $1,128 per week to be exempt from overtime regulations.

According to federal law, the following groups of employees are exempt from the overtime regulations:

- Executive — direct supervision and management of 2 or more employees at a salaried position, mostly positions of business, general, and executive management.

- Administrative — salaried, non-manual work related to business operations, management policies, or administrative training — positions of financial officers and analysts, accountants, talent acquisition specialists, budget and market analysts, etc.

- Professional — salaried positions of advanced knowledge and extensive education, including artists, certified teachers, and skilled computer professionals; positions of architects, software developers, engineers, lawyers, etc.

- Outside sales — salaried and commission-based positions of making sales or taking orders outside of their employer’s main workplace; positions of sales representatives who regularly visit potential and existing clients on their premises.

Other exceptions from the overtime rule in Alaska

Apart from the 4 categories above and any employees working in a business with fewer than 4 employees total, there are some other, more specific exceptions from overtime.

According to Alaska overtime law, the following groups of employees are exempt from overtime pay:

- Individuals employed in handling, packing, storing, pasteurizing, drying, canning, or preparing in their raw or natural state agricultural or horticultural commodities for market, or in making cheese, butter, or other dairy products,

- Agricultural workers,

- Individuals employed as seamen,

- Forestry or lumber workers (in a company with fewer than 12 employees),

- Individuals employed as outside buyers of poultry, eggs, cream, or milk in their natural state,

- Hospital workers who provide medical services,

- Employees under a flexible work-hour plan, which is part of a collective bargaining agreement,

- Workers under a Voluntary Flexible Work Hour Plan, under 2 conditions:

- Both parties had signed an agreement and filed it with the Labor Department, and

- The Labor Department has issued a certificate approving the plan — 40 hours per week, 10 hours per day, or the overtime rule applies.

- Community health aides employed by local or regional health organizations with terms defined by AS 18.28.100,

- Employees who are primarily engaged in servicing automobiles, light trucks, motor homes, and are paid at a flat rate,

- Workers in small mining operations employing fewer than 13 people (provided the worker doesn’t work more than 56 hours a week or 12 hours a day during a period not longer than 14 workweeks in any calendar year),

- Employees of newspapers with a circulation of fewer than 1,000,

- Casual employees, as regulated by the Commission of Labor and Workforce Development,

- Line haul truck drivers who work on routes exceeding 100 miles one way, when specific requirements are met for compensation,

- Switchboard operators employed by a public telephone exchange with fewer than 750 stations,

- Public employees handling telegraphic, telephone, and radio messages working under a contract, in cases where the agency's revenue doesn’t exceed $500 per month,

- Flight crew members employed by an air carrier, and

- Workers employed under a voluntary written agreement addressing the trading of work shifts among employees, if employed by an air carrier, including employment as a customer service representative.

Note: The above isn’t a complete list of overtime rules exemptions. For more detailed information, please refer to AS 23.10.055 and AS 23.10.060.

Alaska break laws

According to Alaska state law, an employer is not legally obligated to provide meal or coffee breaks to employees older than 18.

In case an employer allows such breaks, there are 2 important things to mention:

- If the break is up to 20 minutes, the employees must be compensated at their regular pay rate for that period, and

- If the break is longer than 20 minutes, employees don’t have to be compensated, as the time doesn’t count towards their working hours.

Exceptions to break laws in Alaska

As we have mentioned above, the lack of break regulations applies only to adults.

That’s not the case for minors, for whom employers are required to provide a 30-minute break after 5 hours of work.

Moreover, if a minor is scheduled to work 6 hours throughout the day, they’re entitled to a 30-minute break during the workday.

Also, minor employees don’t have to be compensated for the duration of those breaks.

Alaska breastfeeding laws

The state of Alaska does not explicitly regulate breaks for breastfeeding mothers in the workplace.

That means federal laws apply, so mothers are protected by the FLSA to pump at work.

The said law states that working mothers who are still lactating and breastfeeding must be allowed a reasonable break period to do so. Besides that, employers must provide a separate room for employees to pump milk. The room used for pumping milk to meet the following requirements:

- It has to be private,

- It has to be shielded from view,

- It has to be free from intrusion, and

- It cannot be a bathroom.

Alaska leave requirements

Now, let's examine how Alaska employment laws govern work absences.

For example, under what circumstances must employers provide leave to their employees without jeopardizing their position under Alaska labor law?

Also, are employers required to compensate their employees for the leave period?

Here are the answers about required and non-required leave in Alaska.

| TYPES OF LEAVES |

| ✅ REQUIRED LEAVE |

|

Family and medical leave — Under the Alaska Family Leave Act (AFLA), employers must provide covered public employees with a paid or unpaid leave of up to 18 weeks in a 12 or 24-month period for family and medical reasons. Moreover, employers must provide eligible employees with unpaid sick leave of up to 12 weeks, as mandated by the Family and Medical Leave Act (FMLA). To be eligible for FMLA protection, employees must have worked at least 12 months (not necessarily consecutively) for the employer and have accrued at least 1,250 hours of service. |

| ✅ REQUIRED LEAVE |

|

Jury dutyleave — If an employee is called for jury duty, the employer doesn’t have to pay them for that time. However, an employee cannot be penalized for performing their duty as a juror. |

| ✅ REQUIRED LEAVE |

|

Sick leave — Starting July 1, 2025, employers are required to grant employees sick leave under Alaska labor law. Employees are granted 1 hour of sick leave for every 30 hours worked. If the employer has 15 or more workers, the maximum accrual cap is 56 hours. If they employ fewer than 15 employees, the cap rests at 40 hours; carryover is allowed. |

| ❌ NON-REQUIRED LEAVE |

|

Vacation leave — Employers have no legal obligation to grant vacation leave to employees, but if employers decide to include this type of leave as a benefit, they must comply with it. |

| ✅ REQUIRED LEAVE |

|

Voting time leave — The state of Alaska protects all employees who want to take time off to vote. However, if there is at least 2 hours between their shift and the poll opening or closing, they will not have to be compensated. |

| ❌ NON-REQUIRED LEAVE |

|

Holiday leave — Unlike the public sector, employers in the private sector don’t need to offer paid or unpaid leave to their employees for federal holidays. |

| ❌ NON-REQUIRED LEAVE |

|

Bereavement leave — As there are no state laws regulating bereavement absences, employers aren’t legally obliged to grant such leave to their employees. |

| ✅ REQUIRED LEAVE |

|

Witness leave — Employers must provide paid or unpaid leave for an employee summoned to testify as a witness in any court. |

| ✅ REQUIRED LEAVE |

|

Military leave — Employees are entitled to this type of leave if their services are needed and they are registered members of:

|

Child labor laws in Alaska

The term refers to minors under 18 who CAN be employed — but with a different set of rules and regulations for various age groups.

These laws are also known as Alaska Child Labor Laws and include youth under 18, and occasionally under 21, for specific industries involving alcohol, gambling, tobacco, and cannabis or marijuana.

The most important distinctions between minors and adults working can be found in the following categories:

- Allowed occupations,

- Maximum number of hours worked per week, and

- Breaks.

Even though some industries are legal in Alaska (gambling, marijuana, etc.), they have specific restrictions regarding minors, including:

- Cannabis and marijuana industry — individuals under the age of 21 are strictly prohibited from working in any branch of this industry, including planting, cultivating, harvesting, processing, packaging, transporting, or selling,

- Alcohol — only minors 16 years of age or older can work for employers that are licensed to sell alcohol. Youths aged 16 and 17 are required to have an approved work permit, and

- Tobacco & pull-tabs — individuals under 19 aren’t allowed to sell tobacco products during their employment. When it comes to pull-tabs, individuals under 21 are prohibited from selling them.

Let’s examine some additional rules regarding Alaska state employment based on the specific age of the minors.

Since Alaska is an extremely specific example when it comes to child labor, we will meticulously cover the laws for different age groups.

Employment for children under 14 years of age in Alaska

Minors under 14 years of age aren’t allowed to work in most jobs and can only be employed in the following categories:

- Babysitting and other domestic employment in private homes,

- Newspaper delivery and sales, and

- Entertainment industry (provided they have an approved permit issued by the Alaska Age and Hour Administration).

Employment for 14–15-year-olds in Alaska

When minors reach the age of 14, they can engage in a broader range of work activities. However, the rules vary depending on whether school is in session or not:

- When school is in session — minors are limited to a total of 9 hours of school attendance and work hours combined. They can perform work only between 5 a.m. and 9 p.m. and can work a maximum of 23 hours per week.

- When school is not in session — minors can work a maximum of 40 hours per week between 5 a.m. and 9 p.m.

Prohibited for the age group of 14–15 year-olds in Alaska

On top of the restrictions mentioned above, certain professions and industries are entirely forbidden for this age category, including:

- Manufacturing, mining, processing,

- Any occupation requiring the operation of power-driven machinery (office machinery is excluded),

- Any occupation in construction except office work (including demolition and repair),

- Working in a place that serves alcohol,

- Public messenger service,

- Any occupation in or about canneries (office work is excluded),

- Any work performed in or about engine rooms, boilers, and retorts,

- Any work that is involved with the maintenance/repair of the establishment’s machines and equipment,

- Any occupation that involves working from ladders, scaffolding, windowsills (or a similar substitute),

- Any occupation that involves handling and operating power-driven food slicers, choppers, cutters, grinders, and bakery-type mixers,

- Any work in freezers and meat coolers, or related to the preparation of meat for sale,

- Loading and unloading to or from trucks, conveyors, and railroad cars,

- Any work in warehouses and storage (office work is excluded),

- Any occupation involving the use of sharpened tools, and

- Any occupation in transportation of people and property (office and sales work is excluded).

Employment of minors under 17 in Alaska

There are various restrictions concerning this age category, so let’s break them down into a comprehensive list.

Certain professions and industries are forbidden for minors under the age of 17:

- Any occupation in the manufacturing, use, or handling of explosives,

- Any occupation that requires handling motor vehicles,

- Any occupation in mining operations, including coal,

- Logging or other occupations in the operation of sawmills, lathe mills, shingle mills, and cooperage,

- Any operation of power-driven machinery in woodworking,

- Any occupation with exposure to radioactive substances and ionizing radiation,

- Any operations involving elevators and other power-driven hoisting apparatus,

- Any operations involving power-driven metal forming, punching, and shearing machines,

- Any occupations in regard to slaughtering, meat processing, packing, and rendering,

- Any occupation involving the operation and cleaning of power-driven bakery machines,

- Any occupation involving the operation and cleaning of power-driven paper product machinery,

- Any occupation involving the manufacturing of bricks, tiles, and kindred products,

- Any occupation involving the operation and cleaning of circular saws, guillotine shears, and band saws,

- Any occupation involved in wrecking, shipwrecking, and demolition,

- Any occupation involving roofing operations,

- Any occupation involving excavation operations,

- Any electrical work with voltages exceeding 220, outside erection, repair, and meter testing (including telephone lines and telegraph),

- Any occupation involving exposure to blood-borne pathogens, and

- Any occupation involving canvassing, solicitation, and peddling of door-to-door contributions, and acting as an outside salesperson.

🎓 Download the Alaska work permit for minors

Alaska labor laws — hiring and termination

The state of Alaska has various specific laws related to the beginning and termination of employment.

In this part of the article, we will provide answers to some questions, such as:

- What are the illegal categories of possible discrimination?

- Can employment be terminated at any time?

Termination laws in Alaska

Like many other states in the US, Alaska relies on an ”employment-at-will” policy.

So, what does at-will employment mean?

Apart from the discriminatory reasons we have just mentioned, employers can terminate their employees’ work engagement at any time, for any reason, or for no reason at all. Neither notice nor cause is required for the legal termination of someone’s employment.

The “employment-at-will” doctrine applies to both parties, so employees are free to leave their position for any reason or no reason without facing any negative consequences.

However, employers cannot fire workers in Alaska for the following reasons:

- Military service leave,

- Jury duty leave,

- Voting leave,

- Family and medical leave,

- Garnishment deductions, and

- Occupational safety and health issues reporting.

That’s how Alaska protects the rights of both employees and employers. Yet, some principles exist regarding what is right and wrong.

We are talking about wrongful termination, which is illegal.

Discrimination is one of the examples of wrongful termination — but not the only one. Other examples include:

- Breach of contract (when employers break the terms of a contract, e.g., do not pay wages), and

- Retaliation (when employers take adverse action against employees practicing their legal rights).

If you are an employee wondering, “What can I do if I was fired unfairly in Alaska?”, there is a solution.

🎓 Department of Labor and Workforce Development.

Organizational exit laws in Alaska

Organizational exit refers to the process of managing the conditions surrounding an employee’s departure from an organization. It can be categorized into 4 types:

- Retirements,

- Lay-offs,

- Dismissals, and

- Resignations.

There are 2 vital requirements for organizational exit: references and final pay.

Qualified immunity is obtained under Alaska labor law, indicating that employers provide job references in good faith.

There are also 2 situations in which a lack of good faith is shown, and those are:

- Employers recklessly or maliciously deliver misleading information, and

- Employers violate employees’ civil rights under federal law by disclosing information they are not authorized to disclose.

Final paycheck in Alaska

As for the final pay, employees who resign must be paid regularly on the next payday — provided that the payday is at least 3 days after receiving the notice of resignation.

In the event of a fired or laid-off employee, they must receive their final paycheck within 3 working days of the termination date.

Discrimination laws in Alaska

Alaska pays special attention to discrimination, as the state is one of the most diverse in the US — both racially and ethnically. For this reason, under the Alaska Human Rights Law, there is a comprehensive Policy on Anti-Discrimination and Equal Opportunity, which ensures that a high level of professional conduct is always applied.

Here are the grounds on which an employee cannot be discriminated against:

- Age,

- Race,

- Religion,

- Color,

- Gender,

- Nationality,

- Physical or mental disability,

- Marital status,

- Change in marital status,

- Parenthood,

- Pregnancy, and

- Veteran status.

Discrimination cases must be reported within 300 days of their occurrence and will be handled confidentially. It’s also illegal for employers to retaliate against employees who have filed a complaint under the Alaska Human Rights Law.

The process of reporting discrimination consists of 3 stages:

- The complaint itself — drafting, notarizing, and filing,

- The investigation by the Commission staff, and

- The conciliation — if substantial evidence is found.

🎓 Find out more about filing a complaint

Occupational safety in Alaska

Occupational safety laws protect employees in the workplace. The Alaska Occupational Safety and Health (AKOSH) section of the law regulates this area in Alaska. Employers are required to provide necessary training and education to reduce occupational injuries, illnesses, and fatalities.

The law requires that a safety representative be responsible for conducting internal inspections of safety and health standards. Representatives also file complaints about potential threats.

In the state of Alaska, employees are permitted to report any issues directly to the Alaska Department of Labor and Workforce Development and request an external inspection.

Considering that it is their legal right, employees must not be penalized for it.

Miscellaneous Alaska labor laws

So far, we’ve covered the most essential aspects and categories regarding Alaska labor laws. Now, let’s mention other regulations that may be applicable, including:

- Whistleblower protection laws,

- Background check laws,

- Credit and investigative check laws,

- Arrest and conviction check laws,

- Employer use of social media regulations,

- Drug and alcohol testing laws,

- Consolidated Omnibus Budget Reconciliation Act (COBRA) laws, and

- Record-keeping laws.

Whistleblower protection laws

The term “whistleblower” refers to employees who expose certain information or activities they consider illegal, illicit, unsafe, or immoral.

Under the Alaska Whistleblower Act, such employees are protected and must not suffer any negative consequences for practicing their civil rights.

Background check laws

Employers in Alaska are allowed to perform background checks and are subject to the Federal Fair Credit Reporting Act. This law regulates the collection, accuracy, and distribution of information by the Consumer Financial Protection Bureau.

Here’s the list of professions that require background checks:

- School bus drivers,

- Teachers,

- Ambulatory surgical center employees,

- Foster home employees,

- Hospital employees,

- Home health agency employees,

- Hospice employees,

- Care facility employees,

- Free-standing birth center employees,

- Child placement agency employees, and

- Assisted living home employees.

Credit and investigative check laws

The state of Alaska neither requires nor prohibits credit and investigative checks. This means that the employer can conduct such checks based on their judgment and the type of position in question.

Arrest and conviction check laws

The same principle (as above) applies to arrest and conviction checks — any employer can decide at any time to conduct these types of checks on their current or potential employees.

Employer use of social media regulations

When it comes to employees’ personal social media accounts, the Alaska Legislature imposes several restrictions on what employers can do.

It is forbidden for employers to request the following:

- Disclose any username, password, or other authentication method,

- Provide access to a personal account,

- Change the settings of their personal accounts, and

- Add a person to the list of contacts associated with the personal account.

Drug and alcohol testing laws

Employers in Alaska aren’t required to conduct drug and alcohol testing — but such checks aren’t forbidden by law.

The law only regulates certain conditions in the event of a lawsuit to protect employers from wrongful termination claims.

If they suspect that an employee is using controlled substances at work, it means they are directly posing threats to workplace safety — and, therefore, violating occupational safety and health regulations.

COBRA laws

This group of laws refers to the continuation of employees’ medical coverage expenses, even after the termination of employment.

The coverage continues for up to 18 months after the termination date in Alaska and is regulated by the Consolidated Omnibus Budget Reconciliation Act (COBRA).

The law doesn’t apply if the termination happened due to gross misconduct.

It’s also important to mention that the level of coverage may differ during that period.

Record-keeping laws

According to the Alaska Department of Labor and Workforce Development, employers must keep accurate records of their employees.

While there is no standard or universal form of such records, there are regulations that dictate what data must be included in those records.

Here’s what the law considers to be basic records — the accurate information about all the employees that must be kept for 3 years:

- Full name and social security number,

- Address,

- Occupation,

- Birth date if the employee is under 19,

- Gender,

- Beginning and ending dates of the regular pay period,

- The total number of hours worked per day,

- The total number of hours worked per week,

- The basis of employee wages (per hour, per week, per month, or per piece of work),

- The regular rate of pay,

- Total of both straight-time and overtime hours an employee worked,

- Total daily or weekly straight-time earnings,

- Total weekly overtime earnings,

- All additions to or deductions from the wages, including federal income tax deductions, Federal Insurance Contributions Act (FICA) deductions, Alaska ESC deductions, if applicable, board and lodging costs, advances on pay, and other authorized deductions,

- Total gross and net wages paid per pay period, and

- Exact dates of payment for each pay period.

Aside from basic records, there are specific ones on which the wage computations are based. They include any time cards and other timekeeping records. Those should be retained for 2 years and must be open for inspection by the Department’s representatives.

Some other wage-related records within this category are:

- Wage rate tables,

- Time and work schedules,

- Piece work tickets, and

- Records of additions and deductions.

Frequently asked questions about Alaska labor laws

This article provides comprehensive information about state employment in Alaska. However, we’ve created this section to address some frequently asked questions on this topic.

Does Alaska have labor laws?

Yes, in addition to federal law, the state of Alaska has several state acts that regulate employment, some of which are:

- Alaska Wage and Hour Act,

- Alaska Family Leave Act,

- Alaska Child Labor Laws,

- Alaska Whistleblower Act, and

- Alaska Occupational Safety and Health.

How soon after termination does an employer need to pay you?

If an employer terminates your employment, they must pay you everything owed within 3 working days. If you decide to quit, an employer will pay you on the next payday, provided it is at least 3 working days away from your last working day.

Are breaks required by law in Alaska?

No, employers in Alaska aren’t legally required to provide breaks to employees over the age of 18. However, if an employer decides to include breaks for employees, they must compensate employees for breaks of up to 20 minutes.

Is overtime over 8 hours a day or 40 hours a week in Alaska?

In Alaska, employees who work more than 8 hours a day or 40 hours a week are entitled to overtime compensation.

What is the minimum wage in Alaska?

The minimum hourly wage in Alaska for tipped and non-tipped employees is $11.91. The minimum wage increases annually due to inflation and will always be at least $1 higher than the federal minimum wage.

What is the highest-paying job in Alaska?

According to the U.S. Bureau of Labor Statistics, the highest-paying job in Alaska is that of a surgeon, with an annual earnings of $407,300. Here’s a list of the top 5 highest-earning professions in the state of Alaska:

- Surgeons — $407,300 annually,

- General internal medicine physicians — $402,000 annually,

- Obstetricians and gynecologists — $306,700 annually,

- Physicians — $284,240 annually, and

- Family medicine physicians — $273,740 annually.

Is Alaska a right-to-work state?

No, Alaska is not a right-to-work state. As a result, employees may be required to join a union and pay union dues.

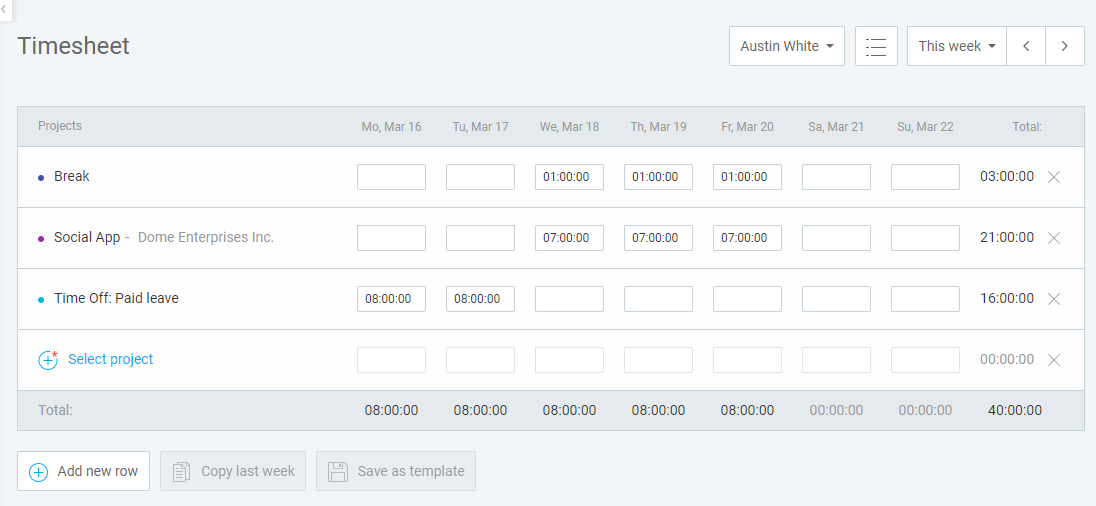

Need a simple time clock for employees? Try a time tracker

Clockify allows you to track time, attendance, and costs with just a few clicks, all for free.

Your team can track work time via the web or mobile app, or you can set up a time clock kiosk from which employees can clock in and out.

Later, you can approve timesheets and time off, schedule shifts, run time card reports, and export all data for payroll (in PDF, Excel, CSV, or as a link, or send it to QuickBooks).

If you’re hiring in Alaska, you’re required to keep records of all your employees for at least 3 years.

With Clockify’s timesheet feature, you can do this stress-free and never worry about missing important data.

Your employees simply write down their time entries in a timesheet, and you can later see how they spent their work hours!

Conclusion/Disclaimer

We hope this Alaska labor law guide has been helpful. We advise you to pay attention to the links we have provided, as most of them will lead you to the official government websites and other relevant information.

Please note that this guide was written in Q1 of 2025, so any changes in the labor laws that were included later than that may not be included in this Alaska labor laws guide.

We strongly advise you to consult with the appropriate institution and certified representatives before acting on any legal matters.

Clockify isn’t responsible for any losses or risks incurred should this guide be used without further guidance from legal or tax advisors.