Delaware Labor Laws Guide

| Delaware Labor Laws FAQ | |

| Delaware minimum wage | $15.00 |

| Delaware overtime | 1.5 times the regular wage for any time worked over 40 hours/week ($22.50 for minimum wage workers) |

| Delaware breaks | 30 minute meal breaks for every 7.5 hours worked a day |

Governed by state laws, Delaware is a US state that values autonomy and well-compensated labor. However, in some cases, it does follow federal regulations, as there are no state laws in specific instances.

In this Delaware labor law guide, we’ll be looking at the following areas:

- Wages, overtime, and breaks,

- Child labor laws,

- Hiring and termination laws,

- Occupational safety laws,

- Leave requirements,

- Miscellaneous labor laws, and

- General questions regarding Delaware labor laws.

Delaware wage laws

Regarding wages, Delaware has the following laws, regulations, and limitations in place.

| DELAWARE MINIMUM WAGE | ||

| Regular minimum wage | Tipped minimum wage | Subminimum wage |

| $15.00 | $2.23 | $7.25 |

Delaware minimum wage in 2025

In recent years, Delaware’s minimum wage has increased on January 1 as a way to combat inflation and rising prices.

As of January 1, 2025, the minimum wage in the state of Delaware rests at $15.00 per hour for all full-time employees. However, there are exceptions to the rule, which we’ll get into in the following paragraphs.

Tipped minimum wage in Delaware

The current tipped Delaware minimum wage amounts to no less than $2.23 per hour for occupations where employees can regularly earn more than $30 per month in tips.

Additionally, any tips or gratuities the employee earns, provided with proof via a receipt or other documentation, cannot be taken by the employer unless state or federal law requires it.

Exceptions to the minimum wage in Delaware

Employees in the following sectors aren’t required to be paid the minimum wage:

- Agriculture,

- Domestic service,

- United States Government,

- Sales,

- Bona fide executives, administrators, and professionals who earn at least $1,128 per week,

- Fishing and fish processing,

- Volunteering,

- Non-profit junior camp counseling, and

- Department of Corrections programs for inmates.

Additionally, following FLSA, employers in Delaware aren’t required to pay minimum wage to:

- New employees under 20 years of age, due to their lack of work experience. They can pay employees a training wage of $4.25 per hour, but only for the first 90 days of their employment.

- Full-time students employed in a part-time occupation. They are eligible for 85% of Delaware minimum wage for part-time work (no more than 20 hours a week).

Delaware payment laws

Under the Delaware Office of Labor Law, employers are required to pay their employees wages on a set schedule, at least once per month.

Payouts should happen within 7 days from the closing of the pay period during which the wages were earned. And if the payday falls on a non-working day, the payment must be made on the workday before it.

Delaware overtime laws

Overtime in Delaware is regulated by the Fair Labor Standards Act (FLSA).

According to the FLSA, any time over 40 weekly hours worked is considered overtime.

In accordance with this, employers are required to pay their employees 1.5 times their regular wage for any overtime work.

🎓 Track Delaware overtime with Clockify

Overtime exceptions and exemptions in Delaware

The exceptions and exemptions for overtime in Delaware are the same as in all the other states regulated by the FLSA.

According to federal law, the following are groups of employees considered exempt from overtime protection:

- Highly compensated employees who make more than $151,164 per year,

- Executive, administrative, and professional employees who make a salary of at least $1,128 per week,

- Computer professionals who earn at least $27.63 per hour, and

- Outside salespeople.

Delaware break laws

According to Delaware state law, employers must providea 30-minute meal break for every 7.5 hours of work per day.

The break should be used after the first 2 hours worked and before the last 2 hours worked.

Working minors are eligible for a 30-minute break for every 5 hours worked.

Exceptions to break laws in Delaware

Limitations to meal breaks can be imposed if:

- There’s only one employee available for a particular duty,

- The employees need to be ready to respond to emergencies and unexpected tasks, or

- The occupations in question are those where a break during specific times could affect public safety.

Delaware breastfeeding laws

According to Delaware’s Pregnant Workers Fairness Act, effective July 6, 2023, lactation breaks are mandatory and provided in the following way:

- Employees get a designated nursing room (other than a bathroom).

- The lactation break time duration is per the employer’s decision (and within reasonable boundaries), and should be available for up to 1 year after the child’s birth.

- The nursing break time should be compensated, and not considered leave.

- The employee should have full privacy from coworkers and the public and be free from intrusion.

Delaware leave requirements

Regarding required and non-required leave, Delaware has no specific regulations, which allows employers to set their own terms and benefits.

In other words, each company or occupation will have its own rules, so we advise employees to inform themselves during the application process.

| TYPES OF LEAVES |

| ✅ REQUIRED LEAVE |

|

Sick leave — As of 2025, in regards to sick leave in Delaware, state law says that employers aren’t obligated to provide paid leave. However, as of January 1, 2026, most businesses with 10 or more employees will be required to offer sick leave under a statewide law. Currently, if an employer chooses to offer such benefits, they should align with the company’s established policies. Additionally, employers may be obligated to provide paid sick leave in situations where the Family and Medical Leave Act or other laws take priority. |

| ✅ REQUIRED LEAVE |

|

Jury duty leave — In Delaware, both public and state employees are allowed to take a leave of absence to appear for jury duty. However, employers aren’t required to pay for such leave. At the same time, they’re not allowed to penalize or otherwise punish the employee for that time off. Additionally, any fee the employee receives from the state for their jury duty summons cannot be counted as wages. |

| ✅ REQUIRED LEAVE |

|

Voting time leave — According to Delaware Statute, House Bill No. 225, employers are required to provide up to 2 hours of paid time off to vote for employees who:

Additionally, employers cannot prevent employees from using their accrued time off for voting if the voting takes more than 2 hours due to crowding or other issues that might arise on voting day. |

| ✅ REQUIRED LEAVE |

|

Domestic violence or sexual assault leave — Employers are required by the Delaware Domestic Violence, Sexual Violence and Stalking Policy to provide a safe environment and reasonable accommodations for the victims (unless it poses complications for the normal functioning of the business). Additionally, victims of domestic violence are eligible to use various forms of leave, including paid sick leave, annual leave, or unpaid leave, for treatment, counseling, mental break, or any other needs. |

| ✅ REQUIRED LEAVE |

|

Organ and bone marrow donation leave — For state employees, teachers, and school employees, employers are required to give up to 30 days of paid leave for organ donation, and up to 7 days for bone marrow donation. |

| ✅ REQUIRED LEAVE |

|

Military leave — An employer is required to approve military leave for the duration of their tour, and up to 90 days after the termination of the tour. Like all other states in the US, Delaware acknowledges the federal Uniformed Services Employment and Reemployment Rights Act (USERRA), which requires employers to allow employees to return to their jobs after military service. |

| ❌ NON-REQUIRED LEAVE |

|

Bereavement leave — An employer isn’t required to give employees bereavement leave, nor time off for attending a funeral. If an employer chooses to offer that benefit, it should comply with an established company policy. |

| ❌ NON-REQUIRED LEAVE |

|

Vacation leave — In regards to paid vacation leave in Delaware, state law says that employers aren’t obligated to provide paid leave. Should an employer choose to offer such benefits, they should be in line with the established policies of the company. Here are some other considerations:

|

| ❌ NON-REQUIRED LEAVE |

|

Holiday leave — In case of private employers, there’s no legal obligation to provide paid leave, nor to pay them premium pay for working holidays (unless it becomes overtime). On the other hand, public office employees and educators in public schools are required to have off days on state-recognized holidays. |

| ❌ NON-REQUIRED LEAVE |

|

Emergency response leave — An employer isn’t obligated to provide paid leave for employees who are volunteer emergency responders. However, they’re also not allowed to retaliate or take disciplinary action against their employees for responding to a Governor-declared state of emergency or getting injured during it. |

Child labor laws in Delaware

When it comes to the employment of minors, the rules are as follows:

- No child aged 14 or under is allowed to work.

- Minors under the age of 18 are required to have a work permit.

- Minors aged 16 and 17 are allowed to work, but not in hazardous jobs.

- During the school year, no minor under 16 years of age can work longer than 3 hours a day when school is in session, and 8 hours on non-school days.

- No minor under 16 years of age can work before 6 a.m. and after 9.30 p.m. on school days. On non-school days, they can work until 11 p.m.

- When school is out (or if the minor isn’t enrolled in any school), no minor under 16 years of age can work before 6 a.m. and after 11 p.m. on school days. They can work 8 hours a day for a total of 40 hours a week.

When it comes to child labor, the State of Delaware follows the Child Labor Act and considers any person under the age of 18 a minor.

Every employer needs to obtain a written work permit in order to employ minors.

Delaware work permit exceptions for minors

Employers in Delaware aren’t required to have work permits for employed minors if:

- The work falls under industrial education provided by the State of Delaware or the United States, approved by a school board or other appropriate public authority.

- The work is non-hazardous and falls under probationary work by the Family Court.

- The work performed is in or about their private home or on a farm.

- The work is performed in a business owned by a parent or a legal guardian.

- The work consists of delivering newspapers.

- The minor performing hazardous work has graduated on said hazardous work by an accredited school.

- The work consists of non-hazardous tasks in any facility focusing on canning or preserving perishable fruits and vegetables.

With these being the general guidelines, let’s take a look at specific limitations surrounding youth employment.

Labor laws for minors aged 14 and 15

Minors aged 14 and 15 are allowed to work a very limited number of hours.

They aren’t allowed to work before 7 a.m. and after 7 p.m. when school is in session. But, from June 1 through Labor Day, they’re allowed to work until 9 p.m.

They’re also not allowed to work for more than 4 hours on a school day or 8 hours when school isn’t in session.

Minors aged 14 and 15 can work up to 18 hours on weeks when school is in session, or up to 40 hours when school isn’t in session.

They aren’t allowed to work more than 6 days a week, and they require a 30-minute break for every 5 consecutive hours worked.

Labor laws for minors aged 16 and 17

Employed minors aged 16 and 17 cannot spend more than 12 hours per day on school and work hours combined.

They’re obligated to have at least 8 hours of leisure time (non-work and non-school) every day (24 hours), and require a 30-minute break for every consecutive 5 hours worked.

Prohibited occupations for minors

The Delaware Child Labor Law strictly prohibits specific jobs for minors. Generally, any occupation deemed by the United States Secretary of Labor to be hazardous for the minor’s health, welfare, safety, and morals.

🎓 Prohibited occupations for Delaware minors

More specific prohibited occupations specific to Delaware include:

- Docks, wharves, and marinas that accommodate the sale or service of pleasure boats,

- Railroads,

- Distilleries, or any alcoholic beverage manufacturer,

- Manufacturing of dangerous or toxic chemicals,

- Occupations requiring the handling of electrical wires,

- Employment at a telephone or messenger company requiring them to distribute, collect, or transmit goods or messages in any town with a population over 20.000 people.

Note that none of these occupation restrictions apply to a minor enrolled in an apprenticeship or a work and study program where employment is considered vital to graduation, as long as it’s supervised by the appropriate accredited authority.

Hiring laws in Delaware

Hiring laws in Delaware follow the same federal regulations as in the rest of the US (and described in the next section below).

The only addition specific to Delaware (and other similar states) is that the employer is prohibited from discriminating against a candidate who is a member of a volunteer emergency responder team.

Termination laws in Delaware

Delaware is a state that follows the employment-at-will doctrine. This means that employees, whether they have a written contract or not, can be terminated at any time for any reason.

The only caveat is that the termination cannot be considered legal if it’s due to discrimination or retaliation against an employee.

Final paycheck in Delaware

As stipulated by the Delaware Department of Labor, employers are required to pay all final wages to employees by the next payday, regardless of the cause of termination.

Further information concerning hiring and termination processes can be found in the “Discrimination laws” section below.

Discrimination laws in Delaware

Delaware follows a strict regulation prohibiting employment and termination discrimination on multiple grounds.

The Equal Employment Opportunity Commission prohibits discrimination based on:

- Biological sex,

- Race and national origin,

- Age (applies to individuals between 40 and 70 years of age),

- Pregnancy, child, or spousal support withholding,

- Sexual orientation,

- Gender and gender identity,

- Religion,

- AIDS/HIV status, or

- Disability (mental, physical).

The State of Delaware also prohibits any discrimination and wrongful termination based on an employee’s membership in a volunteer emergency responder organization.

Occupational safety in Delaware

Regarding workplace safety, Delaware has no state-regulated occupational safety and health program; instead, it follows the federal Occupational Safety and Health Act (OSHA).

However, Delaware has a Department of Labor’s OSHA Consultation Office, which provides free consultations and hazard assessments for small businesses (with fewer than 250 employees per facility and fewer than 500 employees per company).

Miscellaneous Delaware labor laws

In this final section, we’ll go through some of the additional labor laws that are of public interest, including:

- Whistleblower protection laws,

- Background check laws,

- Employer use of social media regulations,

- Employee monitoring law,

- Drug and alcohol testing laws,

- Sexual harassment training laws,

- COBRA laws,

- Expense reimbursement laws, and

- Record-keeping laws.

Whistleblower protection laws

The Delaware Whistleblowers’ Protection Act states that no employer is allowed to fire, threaten, or discriminate against an employee if they:

- Are about to report (to an employer’s supervisor or public body) a violation that has occurred or is believed to occur, either verbally or in writing — unless the employee knows or believes that the report is false.

- Are expected to take part in an investigation or hearing held by a public body in connection with a violation at the workplace.

- Are about to report an infraction or a noncompliance to either an employer’s supervisor or a public body.

- Refuse to commit or assist in a violation at the workplace.

Background check laws

With background checks, Delaware proves to be most strictest when it comes to occupations in the health department, caregiving, and similar positions.

In short, the Department of Health and Social Services (DHSS) should conduct a comprehensive criminal background check on candidates, including fingerprinting and requesting criminal history information from the State Bureau of Identification (SBI) and the Federal Bureau of Investigation (FBI).

Drug and alcohol testing laws

The State of Delaware Law also allows employers to request drug testing.

The State of Delaware has also made background checking more easily accessible through a single portal that aggregates all available information on a potential candidate — the Background Check Center (BCC).

However, for occupations other than the health department and caregiving, employers are not allowed to conduct or request background checks until the first interview has been completed.

Employer use of social media regulations

Delaware is one of several states in the US that regulates an employer’s access to employees’ personal social media accounts.

According to this regulation, an employer isn’t allowed to:

- Ask an employee to disclose the username and password to their personal social media account.

- Access an employee’s personal social media account in the presence of said employee.

- Use the employee’s personal social media account and available information as a condition for employment.

- Add themselves (or another person) to the employee’s list of contacts on their personal social media account.

- Change the settings on an employee’s social media account to allow a third party to be able to view their account.

The only exceptions in these regulations are the following:

- An employee is being investigated for a violation or misconduct.

- The device used for the social media account, or the service itself, is paid for in full or in part by the employer, and used for business purposes.

- The network used to access the social media account belongs to the employer, in which case the employer is allowed to monitor, review, or block the employee from accessing it.

The Employee monitoring law

According to the Delaware Office of Labor Law, an employer isn’t allowed to intercept or monitor any phone calls, Internet traffic, or electronic correspondences of their employees, without:

- Providing a daily notice every time employees access the network or use electronic and phone services, and

- Providing a one-time notice of monitoring to the employee, in writing, and requesting that they read and sign the notice if they agree.

In short, monitoring employees’ electronic activity and correspondence without their knowledge isn’t allowed.

NOTE: These rules do not apply if:

- Law enforcement or a public body is investigating an employee due to a violation or infraction,

- Online activity monitoring is part of the company’s daily tasks, like measuring the volume of email correspondences, or

- Online activity, phone calls, and email correspondence are monitored for the purpose of protecting and maintaining the computer system.

Drug and alcohol testing laws

The State of Delaware has no comprehensive guidelines for drug and alcohol testing, allowing employers to conduct them at their discretion. However, the few regulations that do exist include:

- School bus drivers and candidates applying to work at nursing homes and other caregiving institutions must go through drug testing.

- Registered medical marijuana users are protected by the state Medical Marijuana Act from being persecuted, discriminated against during hiring, or terminated due to their use of the substance. The same employees do need a valid registry identification card, and can possess no more than 6 ounces of medical marijuana.

Sexual harassment training laws

The State of Delaware requires every employer with 50 or more employees to provide sexual harassment prevention training to all employees within 1 year of hiring.

After that, all employees are required to undergo training again every 2 years.

COBRA laws

Delaware follows the Federal Consolidated Omnibus Budget Reconciliation Act (COBRA), but also has its own regulation, known as the “mini-COBRA.”

Since COBRA applies only to companies with 20 or more employees, small businesses are left without a regulation of their own.

Mini-COBRA provides this aid to business owners with 20 or fewer employees.

Through it, former employees can continue to use health coverage provided by their former employer for up to 9 months after termination.

Expense reimbursement laws

The State of Delaware doesn’t require employers to reimburse employees for travel expenses; however, employers should compensate employees for the time spent traveling.

In case an employer does not reimburse travel expenses, employees can file a claim with the IRS to treat it as a deduction.

The only exception to this law is injured employees. An employer’s insurance company is required to pay for travel expenses at the rate of $0.40 per mile.

Record-keeping laws

When it comes to record-keeping, Delaware follows the guidelines laid out by the FLSA.

Records kept for 1 year

According to the Equal Employment Opportunity Commission, employers are obligated to keep all records relating to employment for at least 1 year from the date of termination. Employers should also keep copies of every employee’s I-9 form for at least 1 year.

The paperwork includes:

- Employee’s full name and Social Security number,

- Date hired, rehired, or returned to work,

- Date employment ended and the reason(s) for separation from work,

- Amount of remuneration paid in each calendar quarter,

- Amount of remuneration paid each pay period, including the value of any remuneration in a form other than cash,

- Amount and date of any special payment, such as a bonus, gift, or prize, and

- Place in which services were performed.

Records kept for 2 years

Any documents relating to basic employment and earnings, such as wages, timecards/timesheets, billing records, and any bonuses or deductions from pay.

Records kept for 3 years

Any documents concerning payroll records, agreements, bargaining agreements, sales, and purchase records.

Records kept for over 4 years

Some records are required to be kept for more than 4 years:

- Records of job-related injuries are kept for 5 years.

- Records of annual reports for benefit plans are kept for 6 years.

- Records of toxic substance exposure are kept for 30 years.

While some of these timeframes may sound strange, the reason behind record-keeping for so long is simple: Employers may need these documents when filing claims or sending records to the IRS.

Frequently asked questions regarding Delaware labor laws

Just in case there’s something left unsaid, we’ve prepared a section to answer some burning questions you might have regarding labor laws and regulations in Delaware.

Let’s jump right in!

What is considered wrongful termination in Delaware?

As Delaware is an “at-will” state, wrongful termination occurs when there’s an illegal breach of contract or due to a wrongful act that stems from violating company policies.

Such cases are usually reported as a consequence of discriminatory practices, proven nepotism, or violating some of the miscellaneous laws we’ve mentioned earlier, such as whistleblowing.

What is the WARN Act in Delaware?

The Worker Adjustment and Retraining Notification (WARN) Act is a federal law that prevents employers from executing massive layoffs or closing a business suddenly without prior notice to their employees.

Essentially, if an employer has more than 100 employees, they’re required by federal law to notify their workers at least 60 days before the layoffs or closing.

How many hours do I have to work to get a 15-minute break?

Delaware state law requires employers to provide a 30-minute meal break for every 7.5 hours of work per day. However, no clause states that an additional 15-minute break is required.

On the other hand, general practice is to offer an additional break if the workload is physical and demanding. However, such breaks are often unpaid.

Need a simple time clock for employees?

Try Clockify — a simple and powerful software that allows you to track:

- Time,

- Attendance, and

- Costs.

Best of all? It’s free!

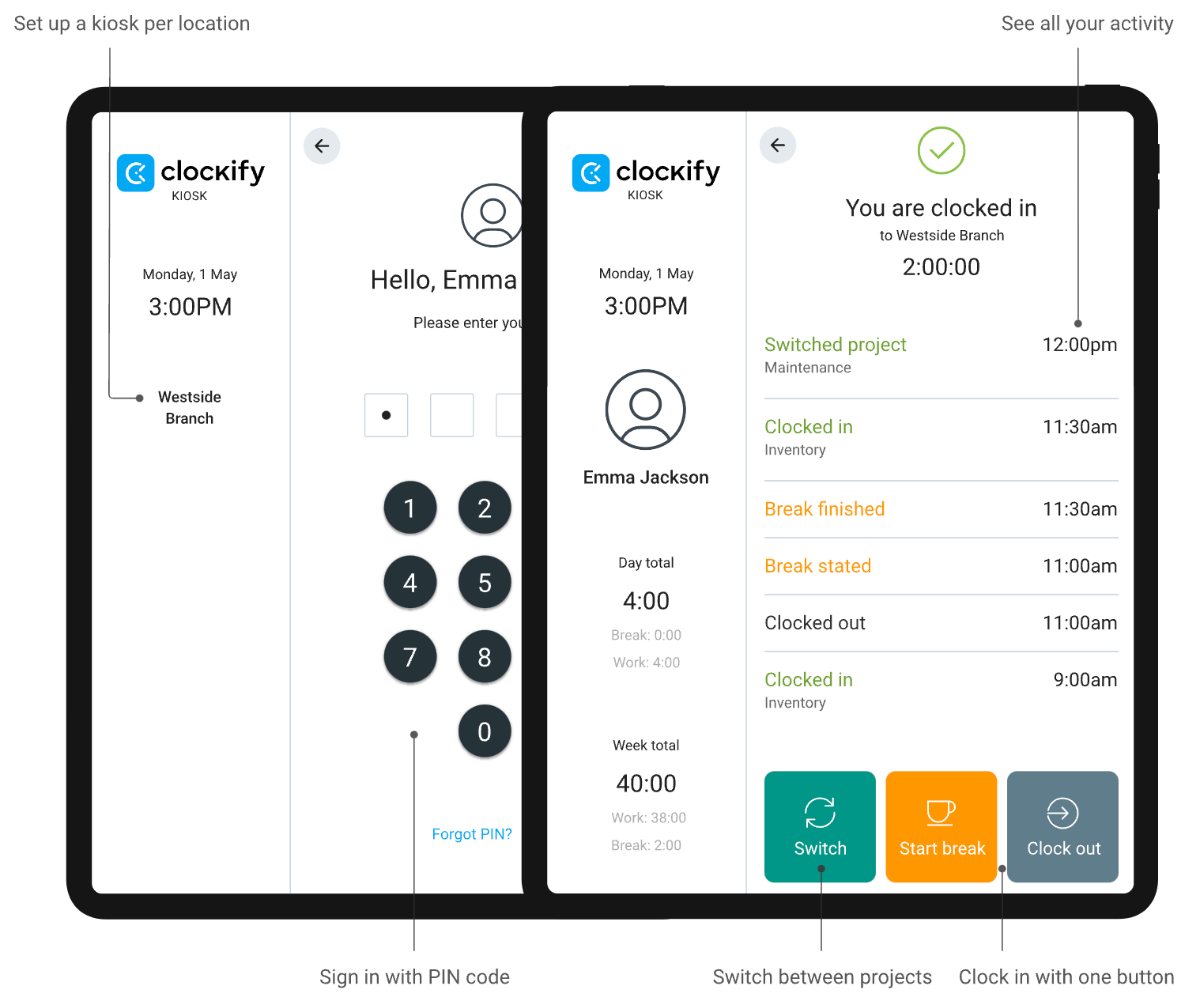

You can track work time using the mobile app, desktop app, or the web version, and you can even set up a time clock kiosk from which you can clock in and out.

The kiosk feature can be easily set up on a tablet or mobile device, allowing employees to clock in and out using their PIN code.

With Kiosk, you can precisely track employees’ work hours, breaks, and other activities.

Later, you can approve timesheets and time off, schedule shifts, run time card reports, and export everything for payroll (PDF, Excel, CSV, link, or send to QuickBooks).

Conclusion/Disclaimer

We hope this Delaware labor law guide has been helpful. We advise you to make sure you’ve paid attention to the links we’ve provided, as most of them will lead you to the official government websites and other relevant information.

Please note that this guide was written in June 2025, so any changes in the labor laws that were included later than that may not be included in this Delaware labor laws guide.

We strongly advise you to consult with the appropriate institutions and/or certified representatives before acting on any legal matters.

Clockify is not responsible for any losses or risks incurred should this guide be used without further guidance from legal or tax advisors.