Georgia Labor Laws Guide

Ultimate Georgia labor law guide: minimum wage, overtime, break, leave, hiring, termination, and miscellaneous labor laws.

| Georgia Labor Laws FAQ | |

| Georgia minimum wage | $5.15 or $7.25 |

| Georgia overtime | 1.5 times the regular wage for any time worked over 40 hours/week ($7.72 or $10.87 for minimum wage workers) |

| Georgia breaks | Breaks not required by law |

Georgia wage laws

With regard to wage laws in Georgia, state and federal laws overlap.

The following are the regulations concerning the minimum wage, the tipped hourly wage, and the youth minimum wage in Georgia.

| GEORGIA MINIMUM WAGE | ||

| Regular minimum wage | Tipped minimum wage | Subminimum wage |

| $5.15 or $7.25 | $2.13 | $4.25 |

What is the minimum wage in Georgia in 2025?

The state minimum wage for Georgia workers is $5.15 per hour. This rule applies to employers who employ 6 or more employees.

However, the state minimum is lower than the federal minimum wage of $7.25. Therefore, the Georgia state minimum does not apply to employees eligible for the federal minimum wage.

Thus, the federal minimum of $7.25 applies to:

- Employers who have 5 employees or fewer,

- Employers who have sales of $40,000.00 per year or less,

- Employers who employ domestic workers,

- Farm owners, sharecroppers, or land renters,

- Tipped or gratuity employees,

- High school or college students,

- Newspaper carriers, and

- Employees who work in nonprofit child-care institutions or facilities serving children or mentally disabled adults who also reside within the institutions.

Under the Fair Labor Standards Act (FLSA), if an employee is subject to both the state and federal minimum wage laws, the employee is entitled to the higher minimum wage rate — in this case, the federal minimum wage of $7.25 per hour.

Exceptions to the minimum wage in Georgia

The FLSA proposes that certain employees are exempt from minimum wage.

The following is the list of some employee categories that are exempt from minimum wage regulations (together with specific requirements):

- Executive workers who are paid on a salary basis and earn at least $1,128 per week,

- Administrative workers who are paid on a salary basis and earn at least $1,128 per week,

- Learned and creative professionals paid on a salary basis who earn at least $1,128 per week,

- Highly compensated employees who earn $151,164 or more a year,

- Outside sales employees — there is no minimum salary requirement for such employees,

- Babysitters,

- Companions for older people,

- Workers with disabilities,

- Tipped employees, and

- Minors.

What is the minimum wage for tipped employees in Georgia in 2025?

The FLSA considers employees who regularly earn at least $30 per month from tips as tipped employees.

As stated above, tipped employees in Georgia are exempt from the state minimum wage of $5.15 per hour. Therefore, federal regulations apply to these employees, amounting to $2.13 per hour.

However, a tipped worker’s hourly earnings must equal or exceed the federal minimum of $7.25. If a tipped employee earns less than $7.25 per hour, the employer must make up the difference.

What is the youth minimum wage in Georgia in 2025?

According to federal law, employers in Georgia can pay employees under 20 years of age a subminimum wage of $4.25 per hour for the first 90 consecutive calendar days of employment.

After that period (or if the employee turns 20), the employee is entitled to the federal minimum of $7.25.

However, full-time students are entitled to 85% of the minimum wage provided that they work in retail, agriculture, or colleges and universities.

Employers are required to obtain a working certificate if they wish to employ a full-time student. Moreover, there are certain work hours restrictions employers have to abide by:

- No more than 20 work hours per week (8 hours a day) when school is in session, and

- No more than 40 work hours per week when school is not in session.

Once a student graduates or leaves school, they are entitled to the federal minimum wage.

Additionally, the state of Georgia enacted a bill, which is to be entitled to Title 34 of the Official Code, that aims to phase out subminimum wages to people with disabilities. In other words, no employer shall utilize the state minimum wage directories to pay individuals with disabilities less than the federal minimum wage.

Georgia payment laws

The majority of employees in Georgia are paid semi-monthly or twice a month.

Still, this rule does not apply to wage workers in the farming, sawmill, and turpentine industries who are employed at stipulated salaries. Such workers are paid monthly or even yearly.

Georgia overtime laws

Since Georgia has no state labor laws specific to overtime pay, the federal provisions apply instead.

Unless exempt, employees who work more than 40 hours per week are entitled to overtime pay at one and a half times their regular pay rate.

The FLSA does not require overtime pay for work on weekends, holidays, or any other regular days of rest.

🎓 Track Georgia overtime with Clockify

Overtime exceptions and exemptions in Georgia

According to the U.S. Department of Labor's latest overtime law that came into force on January 1, 2025, the standard salary threshold for exempt employees will increase from $884 to $1,128 per week.

Moreover, the annual salary for highly compensated employees will go up from $132,964 to $151,164.

The thresholds will further go up every 3 years to keep up with the employee earnings.

Still, the FLSA exempts the following employees from overtime pay:

- Executive employees who earn a salary and make at least $1,128 per week,

- Administrative employees who earn a salary and make at least $1,128 per week,

- Learned and creative professionals who receive a salary of at least $1,128 per week,

- Highly compensated employees who make more than $151,164 a year,

- Computer employees who work on a salary basis and earn at least $27.63 per hour,

- Railroad workers,

- Taxicab drivers,

- Airline workers, and

- Outside sales employees.

The exemptions do not apply to “blue-collar” workers (agriculture, manufacturing, construction, etc.), police officers, firefighters, paramedics, rescue workers, and similar community workers.

Also, said overtime rules do not apply to employees with varying schedules, i.e., the Fluctuating Workweek Method (FWW).

Finally, the FLSA does not limit the number of overtime hours a week as long as the employee is at least 16 years of age.

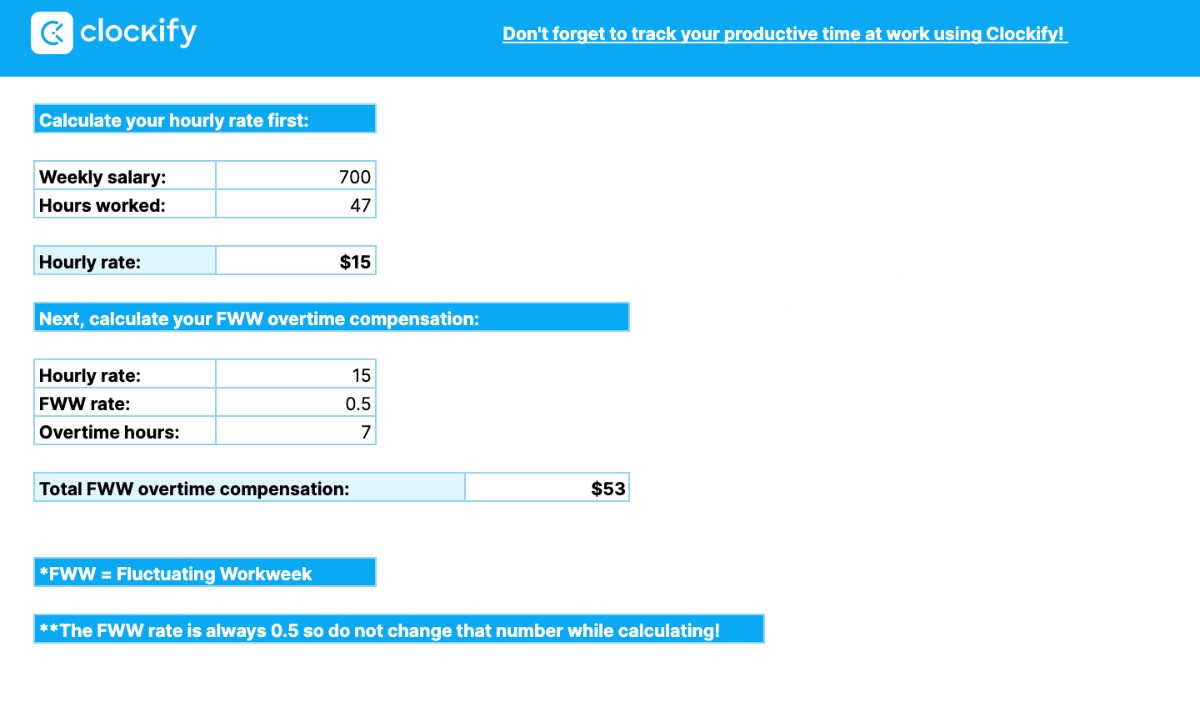

Fluctuating Workweek Method (FWW) in Georgia

Georgia is one of the many states that offers its salaried workers an alternative work schedule: the Fluctuating Workweek Method, also known as Chinese overtime.

This work schedule allows salaried employees to receive an overtime premium of one-half (0.5) times their regular hourly pay.

The emphasis is on salaried workers whose workweek fluctuates from time to time. If a salaried worker sometimes works 35 or 40 hours a week and receives the same salary, their workweek is fluctuating.

But, if they worked 46 hours the preceding week, they are entitled to overtime pay of one-half times their regular hourly pay rate for each extra hour worked.

Let’s calculate overtime compensation for such a week. To do so, we need to calculate the hourly pay first.

Suppose an employee's weekly income is $900 a week, and the employee worked 46 hours the preceding week.

$900 / 46 = $20 per hour

Therefore, the overtime compensation per hour in this case is →

$20 per hour x 0.5 = $10 for each overtime hour worked

Total overtime compensation during that week →

$10 x 6 overtime hours = $60

🎓 Fluctuating Workweek Calculator

Georgia break laws

Under federal and Georgia law, employers are not liable for providing their employees with breaks or meal periods.

Nonetheless, employers are encouraged to offer breaks to their employees to promote a healthy work-life balance and attract top talent. In general, most employers offer anywhere from 5 to 20 minutes breaks for meals and rest.

Georgia breastfeeding laws

According to Georgia law, breastfeeding mothers are allowed to breastfeed their babies at any location where they are allowed to be.

In addition, the federal law known as the PUMP Act requires employers to provide nursing employees reasonable break time to express breast milk.

Such employees must also get a separate room where they can express breast milk. The room must meet the following criteria:

- It must be shielded from view,

- It must be free from intrusion, and

- It must not be used as a bathroom.

The PUMP Act covers nursing employees for up to 1 year after the child’s birth.

Georgia leave requirements

According to federal law, an employer is not obliged to pay for any time not worked. However, most employers provide their employees time off — whether paid or unpaid. You’ll also see that regulations for public and private employers differ in some cases.

In the state of Georgia, there are 2 types of leave days:

- Required leave, and

- Non-required leave.

Check out the table below to learn more.

| TYPES OF LEAVES |

| ✅ REQUIRED LEAVE |

|

Sick leave (public employers) — under Georgia’s sick leave law, full-time public employees are entitled to 15 days (3 weeks) of sick leave. However, employees can’t earn more than 3 weeks of sick leave per year. They can also only save up to 90 days (720 hours) of sick leave since anything over 90 days is forfeited. |

| ❌ NON-REQUIRED LEAVE |

|

Sick leave (private employers) — a private employer is not required to provide their employees with paid or unpaid sick leave. However, if an employer decides to include sick leave in the employment contract, they must abide by it. |

| ✅ REQUIRED LEAVE |

|

Holiday leave (public employers) — state employers must grant their employees 12 paid holidays within a year. All state offices must be closed during these holidays. If an employee must work on a state holiday for any reason, they must be granted another day off. If a holiday falls on a rest day, it shall be observed on a specifically defined day. However, if an employer chooses to offer free time for any additional holidays besides the ones approved by the government, they do so under their own policies, which they have to abide by. |

| ❌ NON-REQUIRED LEAVE |

|

Holiday leave (private employer) — a private employer does not need to provide employees with holiday leave — paid or unpaid. Also, an employer can require employees to work on a holiday without receiving any premium pay whatsoever. Nonetheless, if holiday leave is included as part of the employment contract, employers must respect it. |

| ✅ REQUIRED LEAVE |

|

Annual leave — employees in Georgia are entitled to annual leave, which they can use for vacation or any other occasion to take time off. Accrual of paid leave increases with the years of service, and employees get:

Bear in mind that employees can only accrue 45 days (360 hours) of annual leave since anything above is forfeited. |

| ✅ REQUIRED LEAVE |

|

Family and Medical Leave (FMLA) — the Family and Medical Leave Act is a federal law that offers eligible employees an unpaid leave of absence of up to 12 workweeks annually. This leave of absence can be used in the case of a serious disease or illness of an employee or their family member, for the birth and care of a newborn baby, etc. In Georgia, eligible employees need to have been employed by the state for at least 12 months (or 1,250 hours) to qualify for FMLA benefits. |

| ❌ NON-REQUIRED LEAVE |

|

Bereavement leave — this type of leave is taken when there has been a death within a family. There’s no explicit law regarding bereavement leave in Georgia. Thus, it depends on the company’s policies and rules. |

| ✅ REQUIRED LEAVE |

|

Jury leave — jury duty is a civic responsibility for all citizens in Georgia. Therefore, employers in Georgia are required to grant employees time off (paid or unpaid) to attend jury duty. |

| ✅ REQUIRED LEAVE |

|

Voting leave — every employee in the state of Georgia must be permitted to vote in any municipal, county, state, or similar election. On that account, an employer must grant 2 hours of time off — paid or unpaid — to any employee who wishes to vote on the day of the election. |

| ✅ REQUIRED LEAVE |

|

Military leave — An employee who leaves a job position to perform military service, federal or state, is entitled to paid or unpaid leave of up to 5 years. Also, an employee can receive leave benefits to attend training of up to 6 months within a 4-year period. |

Child labor laws in Georgia

Georgia’s child labor laws protect minors from physical, moral, or emotional hazards. In fact, Georgia has both state and federal labor laws regulating the working conditions of minors, depending on their age. The same goes for any US state — if the state laws benefit an individual more than the federal ones, the state laws will apply.

Work time restrictions for minors in Georgia

In Georgia, work time restrictions for minors are divided into groups according to their age and are regulated by both state and federal law.

Federal work time restrictions for youth 14–15 years of age:

- May work no more than 3 hours on a school day,

- Cannot work for more than 8 hours on a non-school day,

- Can work up to 18 hours during a school week when school is in session,

- Can work up to 40 hours during a school week when school is not in session,

- No work during school hours, and

- No work before 7 a.m. and after 7 p.m. (except between June 1 and Labor Day — in this case, no work after 9 p.m.).

Georgia work time restrictions for minors under the age of 16:

- May work for 4 hours on a school day,

- May work for 8 hours on a non-school day,

- May work a maximum of 40 hours per week,

- No work before 6 a.m.,

- No work after 9 p.m., and

- No work during school hours unless they have completed senior high school or have been excused by a county or independent school system board of education.

As of January 1, 2025, there are no federal or state work hour restrictions for minors aged 16 and 17.

Employment of minors 12 and 13 years of age and younger

A minor aged at least 12 but less than 16 years of age must obtain an employment certificate issued by the school administration or a parent/legal guardian to be able to work.

Moreover, minors under 12 years of age are not allowed to work in any gainful occupation and receive a regular hourly wage. However, they can work junior jobs such as cutting the lawn, shoveling snow for neighbors, helping around the house for an allowance, and similar.

Breaks for Georgia minors

In Georgia, minors between the ages of 9 and 16 are entitled to a 1-hour meal break or a 30-minute meal break and an additional 30 minutes for rest or recreation. They may not work longer than 5 hours a day.

Minors older than 16 are entitled to the same breaks without the working-hour restrictions. However, they are entitled to 3 hours of tutoring if tutoring is required.

Prohibited occupations for Georgia minors

Minors under the age of 16 years cannot work in occupations connected with:

- Power-driven machinery,

- Butchering,

- Scaffolding,

- Loading and unloading goods, or

- Any other occupation that may cause temporary or permanent injuries and illnesses.

Working near alcoholic beverages

Minors under 18 years of age aren’t allowed to serve, sell, dispense, or take orders for any alcoholic beverages.

However, minors under 18 years of age are allowed to work in supermarkets, convenience stores, or drugstores, considering that the alcoholic beverages bought there are consumed off the premises.

Time of inspection and pertinent records

The Commissioner of Labor or the Commissioner’s designee may enter and inspect the premises reasonably when minors are employed.

In addition, employers who employ minors must keep necessary work certificates and pertinent records at the premises for the duration of the worker’s employment. Pertinent records refer to records that evidence the working hours of an employed minor.

Effective July 1, 2015, work permits are no longer required for youth aged 16 and older, with the exception of minors in entertainment.

Penalties for employers

Anyone who violates any of the child labor provisions stated above will be guilty of a misdemeanor.

If an employer is convicted, they can be fined up to $1,000, sentenced to 12 months in prison, or both for each violation.

In addition, employers can also be penalized by getting a written citation or a suspended employer certificate.

Georgia hiring laws

Georgia uses both federal and state laws to ensure equal hiring opportunities for all individuals. The following are some of the most critical federal and state laws that Georgian employers should comply with during recruitment.

Federal employment-related laws

Employers in Georgia must comply with federal laws enforced by the Equal Employment Opportunity Commission (EEOC) to avoid workplace discrimination.

With regard to hiring new employees, the following acts apply:

- The Age Discrimination in Employment Act of 1967 (ADEA) protects people 40 years of age and older. Under this act, failing or refusing to hire a job applicant because of age is considered unlawful. It is illegal to limit, segregate, or classify in any way that can deprive a job applicant of employment opportunities.

- The Genetic Information Nondiscrimination Act of 2008 (GINA) protects job applicants from discrimination based on genetic information. The term “genetic information” denotes information about a person’s health and well-being. It is unlawful to limit, segregate, or deprive any job applicant of employment opportunities because of genetic information.

- Title VII of the Civil Rights Act of 1964 is a federal anti-discrimination law for employment. It makes it unlawful for employers to deprive someone of employment opportunities because of their race, color, religion, national origin, or sex.

State employment-related laws

The most prominent state laws refer to employee background checks. To ensure that employers make a sound hiring decision, they hire third parties to conduct background checks on job applicants.

The following laws help prevent employers from discriminating against future employees based on their criminal history:

- OCGA § 35-3-34 — the Georgia Crime Information Center is a third party authorized to provide private individuals and businesses with criminal history records of a job applicant in question. To do so, private individuals or companies must submit the fingerprints of such an individual or a signed consent form from that person. However, the center shall not disclose records of arrests or charges that did not result in a conviction. Under this statute, if an employer makes an employment decision that negatively affects the job applicant or employee, that employer will be guilty of a misdemeanor.

- Ban the Box — a policy that protects applicants with criminal records from discrimination during hiring processes. It increases job opportunities for people with criminal records within state employment offices. It bans the employer from asking questions about the job applicant’s criminal record during the initial stage of the hiring process.

- Expungements — individuals with a criminal record can still apply for certain jobs and licenses without disclosing their records. They can apply to the Georgia Bureau of Investigation’s Georgia Crime Information Center for record restriction.

Right to work law in Georgia

A “right-to-work” state is a state where employees have the right to choose whether or not to join a labor union. Under this law, no one can require an employee to join a labor union to get or keep a job. Georgia adopted a right-to-work statute in 1947.

Any labor organization, labor union, employer, corporation, or association in Georgia is not allowed to:

- Force an employee to join or refrain from joining any labor organization as a condition of employment,

- Force an employee to strike or refrain from striking to get employment,

- Require any payment, fee, or other sum of money as a condition of employment, and

- Deduct from employees’ wages or other earnings to pay a labor organization.

Any individual violating this law’s provision shall be guilty of a misdemeanor.

Georgia termination laws

Georgia is another “employment-at-will” state. This means an employer has the right to terminate employment at any time for any reason — provided that it is not based on discrimination, retaliation, or similar. Also, an employee may leave their job anytime for any reason without any losses, damages, penalties, or similar.

However, under Georgia employment law, an employer may not discharge an employee if their earnings are subject to garnishment (e.g., unpaid taxes, overdue child support, student loans, and similar).

Georgia final paycheck

Since Georgia does not regulate when an employer must make the final payment to the employee, federal law applies instead.

Under federal law, employers are not required to give former employees their last paycheck at the time of employment termination. Therefore, employers may give the final paycheck on the next scheduled payday.

🎓 Department of Labor's Wage and Hour Division

Health insurance continuation in Georgia (COBRA)

Under the State Continuation law in Georgia, or mini-COBRA, small business workers (19 or fewer employees) are guaranteed a 90-day coverage package in case of job termination. The main difference between this act and federal COBRA law is that there is no 2% administration fee.

Moreover, the federal Consolidated Omnibus Budget Reconciliation Act (COBRA) provides covered employees and their families with extended health benefits for another 18 to 36 months in some circumstances. These circumstances include events such as:

- Job loss,

- Transition between jobs,

- Death,

- Divorce, and

- Other life occasions.

On that account, eligible employees can extend their health coverage for another 18 to 36 months. However, this act only applies to businesses with more than 20 employees.

Occupational safety in Georgia

For the sake of the welfare and safety of the workers, the Occupational Safety and Health Administration (OSHA) steps in. The OSHA Act is a federal law that covers most private employers and their workers. It sets standards and ensures employees work in a safe and healthful environment.

Under OSHA, the hazards are grouped as follows:

- Biological hazards — Mold, pests, insects, etc.,

- Chemical and dust hazards — Pesticides, asbestos, etc.,

- Work organization hazards — Things that cause stress,

- Safety hazards — Slips, trips, falls, etc.,

- Physical hazards — Noise, radiation, temperature extremes, etc., and

- Ergonomic hazards — Repetition, lifting, awkward postures, etc.

The authorities are entitled to enter and inspect the premises during working hours to ensure that OSHA standards are followed as stated in this act. If an employer fails to obey the rules, a civil penalty of not more than $70,000 but not less than $5,000 for each violation may be imposed.

🎓 OSHA Penalties for Employers │ OSHA Offices in Georgia

Miscellaneous Georgia labor laws

Certain labor laws don’t belong to any specific group above, so we have placed them in the miscellaneous section.

The most significant include:

- Whistleblower laws, and

- Recordkeeping laws.

Georgia Whistleblower Protection Act

When it comes to whistleblower protection, under Georgia law, a public employer (or any local or regional governmental entity receiving funds from the state of Georgia) is obliged to investigate complaints or information from a public employee that contains any fraudulent behavior, abuse at work, or waste under the supervision of such employer.

Furthermore, the employer is not allowed to disclose the identity of the public employee who “blew the whistle” unless the employer thinks it is necessary during the investigation. In that case, the employee must be notified in writing at least 7 days before disclosure of information.

No employer is allowed to prevent a public employee from disclosing a violation or take any forbidden action, like retaliation, against such an employee for disclosing the public interest.

If a public employee experiences any type of discrimination, the court may order:

- Placing the employee in the same position before the retaliation or in a similar position,

- Granting fringe benefits to the employee (e.g., vacation pay, personal use of a company-owned vehicle, pension plan, etc.), and

- Paying compensation for lost wages, attorney's fees, benefits, etc.

Georgia recordkeeping laws

Georgia recordkeeping laws prescribe that each employing unit must maintain the following records:

- Name,

- Social Security number,

- The date on which the employee was hired and where the services were performed,

- Employee’s residential address,

- Wages paid for services performed, together with dates of payment,

- Traveling reimbursements or other business expenses, together with the dates of payment,

- Working hours,

- Dates of pay periods,

- Total amount of wages paid in each quarter for the services provided,

- Earnings by pay periods, and

- Leave days.

The employing unit should keep the above-mentioned records for a period of up to 4 years.

Frequently asked questions about labor laws in Georgia

To make this guide as comprehensive as possible, we have included an FAQ section where we answer the most common questions about labor and employment laws in Georgia.

What are the labor laws in Georgia?

The state of Georgia uses federal and state laws to regulate employment. Here are some of the most important labor and employment laws in Georgia:

- Child labor laws,

- The Consolidated Omnibus Budget Reconciliation Act (COBRA),

- Title VII of the Civil Rights Act of 1964,

- Fair Labor Standards Act (FLSA),

- Family and Medical Leave Act (FMLA), and

- The Georgia Department of Labor rules.

Are 15-minute breaks required by law in Georgia?

No, they are not. No state or federal law requires employers to provide breaks. Nonetheless, if an employer chooses to offer their employees short breaks of up to 20 minutes, they are considered compensable.

How long can you work without a break in Georgia?

In Georgia, there is no limit on how many hours an employee can work throughout the day, as no state or federal law regulates this matter.

Is working 32 hours considered full-time in Georgia?

Yes, it is. According to Georgia law, employees who work at least 30 hours per week are considered full-time employees.

Is Georgia an at-will employment state?

Yes, Georgia is an “at-will employment” state. This means that under Georgia’s at-will employment law, both employees and employers can terminate the employment contract without any specific reason and at any time they want to do so.

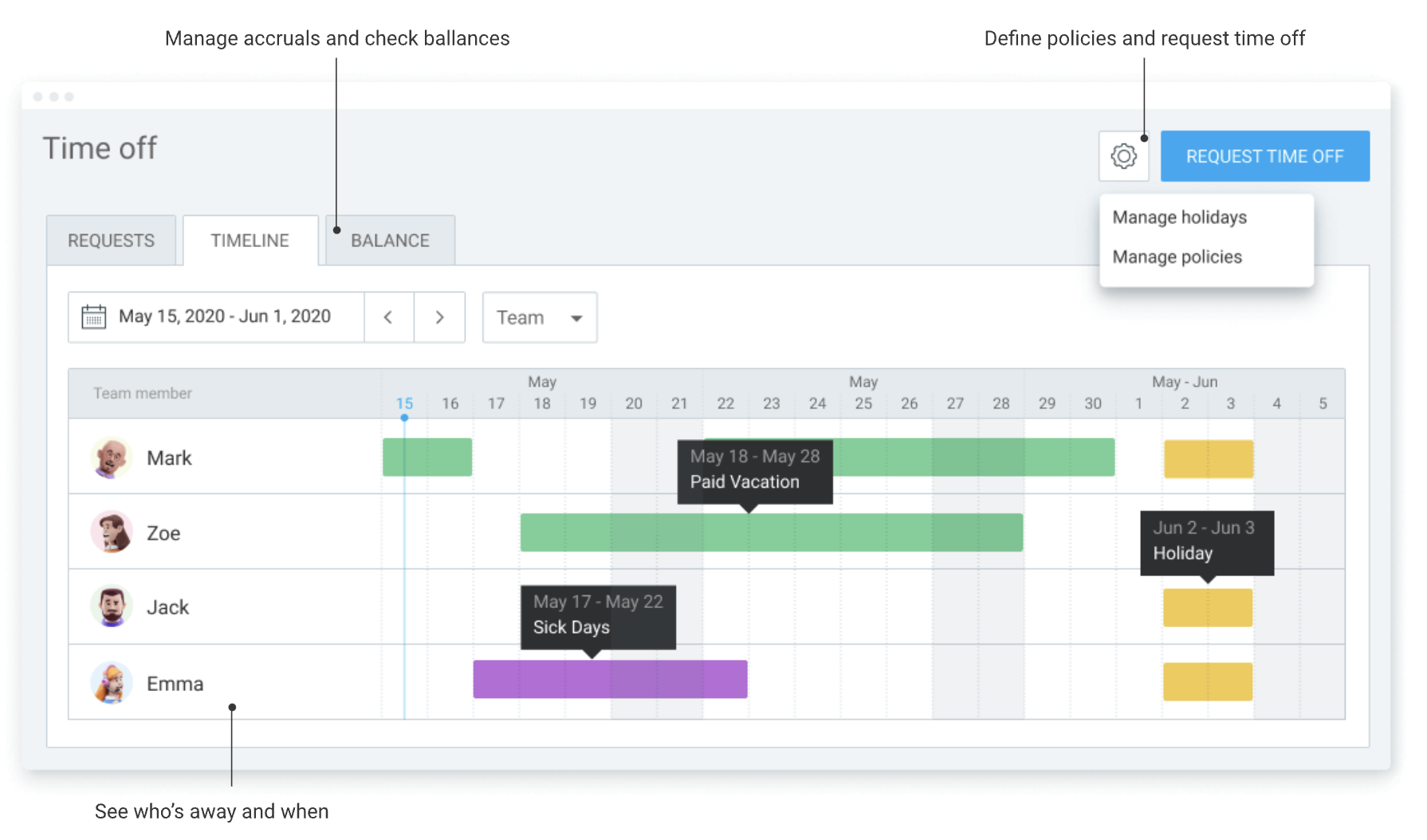

Need a simple time clock for employees?

Clockify is a simple-to-use software that allows you to track time, attendance, and costs with just a few clicks.

Your team can track work time personally via the web or mobile app, or you can set up a time clock kiosk from which employees can clock in and out.

With the time-off feature, you can easily track your employees’ days off and see who is away and when.

Moreover, you can see what type of leave they use, such as paid, sick, or holiday leave.

Your employees can also check their time-off balance and see how many leave days they have used and how many they have left.

Clockify also lets you approve timesheets and time off, schedule shifts, run time card reports, and export everything when needed for payroll (PDF, Excel, link, or send to QuickBooks).

Conclusion/Disclaimer

We hope this Georgia labor law guide has been helpful. Please pay attention to the links we have provided, as most of them will lead you to the official government websites and other relevant information.

Please note that this guide was written in Q2 2025, so any changes in the labor laws that were included later than that may not be part of this Georgia labor laws guide.

We strongly advise you to consult with the appropriate institutions or certified representatives before acting on any legal matters.

Clockify is not responsible for any losses or risks incurred should this guide be used without further guidance from legal or tax advisors.