Hawaii Labor Laws Guide

| Hawaii Labor Laws FAQ | |

| Hawaii minimum wage | $14 |

| Hawaii overtime | 1.5 times the regular wage for any time worked over 40 hours/week ($21 for minimum wage workers) |

| Hawaii breaks | 30-minute meal breaks for every 7.5 hours worked a day |

The State of Hawaii mostly has its own laws concerning labor, but in some cases will follow federal regulations instead.

In this Hawaii labor law guide, we’ll be looking at the following areas:

- Wages, overtime, and breaks,

- Child labor laws,

- Hiring and termination laws,

- Occupational safety laws,

- Leave requirements, and

- Miscellaneous labor laws.

Hawaii wage laws

With regards to wages, Hawaii has the following laws, regulations, and limitations.

| HAWAII MINIMUM WAGE | ||

| Regular minimum wage | Tipped minimum wage | Subminimum wage |

| $14 | $21 | Training wage $4.25 Student wage $11.90 |

Hawaii minimum wage

Hawaii minimum wage

As of January 2025, the Hawaii minimum wage is $14 per hourfor non-exempt employees.

Tipped minimum wage in Hawaii

The current tipped Hawaii minimum wage can be no less than $21 per hourwhen wagesand tips combine ($14 minimum wage + $7 tips = $21 tipped minimum wage per hour). This applies to occupations where employees can regularly earn more than $20 a month on tips.

Additionally, the employer can’t take any tips or gratuities the employee earns with proof via a receipt or another deposit — unless state or federal law requires it.

Subminimum wage in Hawaii (training/student minimum wage)

As of June 16, 2021, the subminimum wage for the disabled no longer exists, and such employees must be paid at least the state minimum. Under federal law, any new employee under 20 years old can be paid a training wage of $4.25 for the first 90 days of their employment.

The student minimum wage must be no less than 85% of the regular minimum wage for up to 20 hours of work per week. With the current minimum wage, that equals $11.90 per hour.

Exceptions to the minimum wage in Hawaii

Based on both federal and state law, employees in the following sectors aren’t required to be paid the minimum wage:

- Agriculture,

- United States Government,

- Executive and administrative,

- Computer systems analysts, programmers, software engineers, etc.,

- Domestic service,

- Child welfare homes and shelters,

- Ship or vessel work,

- Seasonal youth camp staff sponsored by nonprofit organizations,

- Outside commission-paid sales,

- Employees earning $2,000 per month or more,

- Fishing, fish processing, propagation, harvesting, and cultivating, etc.

🎓 Full list of minimum wage exemptions

Under the Fair Labor Standards Act (FLSA), if an employee is subject to both the state and federal minimum wage laws, the employee is entitled to the higher minimum wage rate.

Hawaii payment laws

In accordance with Hawaii law, employers are required to pay wages to their employees on set days, at least twice per month.

The payouts should happen on the same days each month, predetermined by the employer.

Hawaii overtime laws

The FLSA regulates overtime in Hawaii — any time worked over 40 weekly hours is considered overtime.

In accordance with this, employers are required to pay their employees 1.5 times their regular wage for any overtime work.

Overtime exceptions and exemptions in Hawaii

The following are employees who are exempt from overtime pay under federal law:

- Executive, administrative, and professional employees who are paid on a salary basis and earn at least $1,128 per week,

- Highly compensated employees who earn at least $151,164 per year,

- Outside sales representatives,

- Amusement and recreational employees,

- Some agricultural employees of small farms or family-owned farms,

- Employees of certain small local newspapers,

- Some babysitters or companions for the elderly,

- Seamen on vessels other than American vessels, and others,

- Executive positions (full-time management of 2 or more employees),

- Professional workers (work requiring advanced education: artists, certified teachers, IT professionals),

- Outside salespeople, and others.

🎓 Track Hawaii Overtime with Clockify

Hawaii break laws

Let’s now focus on Hawaii laws governing break times — and the exceptions to these laws.

Meal breaks in Hawaii

Hawaii has no state regulation concerning breaks for regular employees. The only mention is in relation to employed 14 or 15-year-old minors, who are eligible for a 30-minute break for every 5 consecutive hours worked.

However, under federal law, a lunch break lasting 30 minutes or more doesn’t have to be paid, while a rest period lasting 20 minutes or less should be paid.

Hawaii’s official government website states that employees can contact the US Department of Labor for more information on federal break laws.

Hawaii breastfeeding laws

According to the official Guide to the Rights of Breastfeeding Employees, lactation breaks are mandatory for businesses with more than 50 employees and are provided in the following way:

- Employees get a designated nursing room (other than a bathroom),

- The lactation break time duration is per the employer’s decision (and within reasonable boundaries), and should be available for up to 1 year after the child’s birth,

- Employers must post a notice in an accessible place to keep the employees informed of their rights and obligations concerning breastfeeding, and

- The employee should have full privacy from coworkers and the public and be free from intrusion.

The only exception to this regulation is if the employer has fewer than 20 employees.

If the employer can prove that finding proper accommodations poses financial, structural, or other difficulties to the business, they’re exempt from providing a separate room.

Hawaii leave requirements

Now we’ll look at both required and non-required leaves in the state of Hawaii.

Hawaii required leave

Let’s take a look at all the possibilities concerning required leave in Hawaii.

Sick leave

In regard to sick leave in Hawaii, state law says that employers aren’t obligated to provide paid leave. Should an employer choose to offer such benefits, they should be in line with the company's established policies.

However, employers may be obligated to provide paid sick leave in situations where the Family and Medical Leave Act or other laws take priority.

Holiday leave (public employers)

Eligible state-employed employees are required to take days off on state-recognized holidays, which are 13 holidays per year in the state of Hawaii (14 days during the election year).

These are official holidays in Hawaii:

- New Year’s Day,

- Dr. Martin Luther King Jr. Day,

- Washington-Lincoln Day (Presidents’ Day),

- Prince Jonah Kuhio Kalaniana’ole Day,

- Good Friday,

- Memorial Day,

- King Kamehameha I Day,

- Independence Day,

- Statehood Day,

- Labor Day,

- Veterans Day,

- Thanksgiving Day, and

- Christmas Day.

Family leave

Unlike with sick leave, Hawaii Family Leave Law states that any employer with 100 or more employees who work in the State of Hawaii is required to give paid or unpaid family leave if the person has been employed for at least 6 months. Under Family Leave Law in Hawaii, you may use up to 10 days of your accrued and available sick leave per year, unless a collective bargaining agreement provides for more than 10 days.

Moreover, under the Federal Family and Medical Leave Act, which also applies, they may be eligible for up to 12 weeks of family leave for the following:

- Birth and care of a newborn child (both parents eligible),

- Employee’s care of a child, partner, or family member with a serious health condition,

- Employee suffering from a serious health condition, making them unable to perform their job, and

- Qualifying Exigency Leave — where the employee’s partner, parent, or child is a military member called to active duty or already serving.

An employee can qualify for both Hawaii Family Leave and Federal Family and Medical Leave, and they can run concurrently.

Jury duty leave

While employers are required to allow employees time off to serve on a jury, they aren’t required to pay for an employee’s leave for jury duty summons.

At the same time, they aren’t allowed to penalize or otherwise punish the employee for that time off.

Any fee the employee receives from the state for their jury duty summons can’t be counted as wages.

Voting time leave

Under Hawaii law, an employer is required to provide employees with 2 hours of paid time off for voting, between the opening and closing of ballots (from 7 a.m. to 6 p.m.).

There’s a caveat — if an employee works from 9 a.m. to 5 p.m., they can vote when the ballots open, so the employer isn’t required to provide the 2 hours off.

Domestic violence or sexual assault leave

Any employee who is a victim of domestic abuse, sexual assault, or stalking is protected under Act 206 of Hawaii, regardless of how much time they’ve worked in a company. This applies to all employers with 1 or more employees.

Employers with under 50 employees are required to provide 5 days of unpaid leave, while employers with 50 or more employees must allow up to 30 days of unpaid leave. The leave is given for:

- Medical attention for recovering from physical or psychological injuries,

- Counseling to recover from physical or psychological injuries,

- Working with protection services, or

- Participating in legal action (criminal and civil proceedings).

Emergency response leave

An employer is required to provide up to 30 days of disaster leave to a state employee for their services and response to the American Red Cross.

To be eligible for disaster leave, the disaster must be a level 3 or higher, declared as such by the US President, and declared a state of emergency by the Governor.

Similarly, employees called to active duty to aid with disaster relief efforts are entitled to 15 days of military leave (as long as they’re eligible for paid military leave).

Organ and bone donation leave

Under Hawaii law, an employer is required to provide up to 7 days of paid leave for employees donating bone marrow and up to 30 days for organ donation.

Military leave

An employer is required to approve military leave for employees who are part of the National Guard.

Like all other states in the US, Hawaii acknowledges the federal Uniformed Services Employment and Reemployment Rights Act (USERRA), which requires employers to allow employees to return to their jobs after military service.

Hawaii non-required leave

The following is all information concerning non-required leave.

Bereavement leave

An employer isn’t required to give employees bereavement leave, nor time off for attending a funeral.

If an employer chooses to offer this benefit, it should comply with an established company policy.

Vacation leave

In regard to paid vacation leave in Hawaii, state law says that employers aren’t obligated to provide it.

Should an employer choose to offer such benefits, they should be provided per the company’s established policies.

Holiday leave (private employers)

In the case of private employers, there’s no legal obligation to provide paid leave or pay employees premium pay for working holidays (unless it becomes overtime).

Child labor laws in Hawaii

When it comes to the employment of minors under the Hawaii Child Labor Law, the rules are as follows:

- No child aged 14 or under is allowed to work,

- Minors under the age of 18 are required to have a work permit,

- Minors aged 16 and 17 are allowed to work, but not in hazardous jobs,

- During the school year, no minor under 16 years of age can work longer than 3 hours a day when school is in session, and 8 hours on non-school days, and

- No minor under 16 years of age can work before 6 a.m. and after 9.30 p.m. on school days. On non-school days, they can work until 11 p.m.

When it comes to child labor, the State of Hawaii considers any person under the age of 18 a minor. Every employer needs to obtain a written work permit in order to employ minors.

Labor laws for minors aged 14 and 15

Minors aged 14 and 15 are allowed to work very limited hours.

For instance, they aren’t allowed to work before 7 a.m. and after 7 p.m. when school is in session. But on non-school days, they’re allowed to work between 6 a.m. and 9 p.m.

They’re also not allowed to work more than 3 hours on a school day or 8 hours when school isn’t in session.

They can work up to 18 hours on weeks when school is in session, or up to 40 hours when school isn’t in session.

They aren’t allowed to work more than 6 days a week, and require a 30-minute break for every 5 consecutive hours worked.

Labor laws for minors aged 16 and 17

With employed minors aged 16 and 17, there are no restrictions on work hours.

However, they also require an Age Certificate, issued by the Hawaii Department of Labor.

Prohibited occupations for minors

The Hawaii Child Labor Law strictly prohibits certain employment for minors.

Generally, any occupation deemed by the United States Secretary of Labor to be hazardous for the minor’s health, welfare, safety, and morals.

🎓 Prohibited occupations according to FLSA

Some of the more specific prohibited occupations specific to Hawaii:

- Minors under 15 can’t work on pineapple harvesting machines or be in the truck attached to one such machine, and

- Minors under 10 aren’t allowed to use any harvesting equipment in coffee harvesting, nor should they carry loads over 15 pounds in weight.

There’s a very thorough and detailed document concerning Child Labor Laws in Hawaii, and we advise you to consult the documentation for further specifics for each age bracket.

Hiring laws in Hawaii

Hiring laws in Hawaii follow the same federal regulations as in the rest of the US (and as described in the next section below).

The only addition specific to Hawaii is that an employer isn’t allowed to discriminate against a candidate who is a member of a volunteer emergency responder team or currently absent from the National Guard.

Termination laws in Hawaii

Hawaii is a state that follows employment-at-will. This means that employees working under contract can be terminated for any reason at any moment.

The only caveat is that termination can’t be considered legal if it’s due to discrimination or retaliation against an employee.

Final paycheck in Hawaii

As stipulated by Hawaii law, an employer who discharges an employee is required to pay all final wages to such employee at the time of discharge or no later than the next working day. If an employee quits or resigns, the employer must pay final wages to such employee by the next payday.

Further information concerning hiring and termination processes can be found in the discrimination laws section below.

Discrimination laws in Hawaii

Hawaii follows a strict regulation prohibiting employment and termination discrimination on multiple grounds.

The Equal Employment Opportunity Commission prohibits discrimination based on:

- Biological sex,

- Race and national origin,

- Age (applies to individuals between 40 and 70 years of age),

- Pregnancy, child or spousal support withholding,

- Sexual orientation,

- Gender and gender identity,

- Religion,

- AIDS/HIV status, and

- Disability (mental, physical).

The State of Hawaii also prohibits any discrimination and wrongful termination based on an employee’s membership in a volunteer emergency responder organization or the National Guard.

Occupational safety in Hawaii

Hawaii doesn’t follow the federal OSHA, but instead has 2 programs within its own Hawaii Occupational Safety and Health Division (HIOSH):

- Occupational Safety and Health, and

- Boiler and Elevator Safety.

Hawaii is one of the 26 jurisdictions approved to form its state safety and health program.

As such, HIOSH mainly follows the federal guidelines with some adjustments:

- Employees need certificates of fitness for blasters and pyrotechnics specialists, hoisting machine operators, and safety and health professionals,

- Increased workplace inspections for high-hazard industries, and

- HIOSH provides free on-site consultations to identify workplace hazards and evaluations.

Miscellaneous Hawaii labor laws

In this final section, we’ll go through some of the additional labor laws that are of public interest.

Whistleblower protection laws

According to the Hawaii State Legislature, an employer can’t terminate an employee’s contract, threaten them, discriminate against them, or affect their wages if they are:

- About to report (to an employer’s supervisor or public body) a violation that has occurred or is believed will occur, either verbally or in writing — unless the employee knows or believes that the report is false, and

- Expected to take part in an investigation or hearing held by a public body in connection with a violation at the workplace.

Background check laws

Hawaii is among many US states that follow the “Ban-the-Box” legislation. It’s also one of 14 states that extend this legislation to private businesses.

According to this law, an employer isn’t allowed to ask about or investigate an applicant’s criminal history before offering them the job.

The only exception to this rule is in cases where the criminal record bears a “rational relationship to the duties and responsibilities of the position”. This express inquiry is allowed for occupations at schools, security, and financial and insurance institutions.

However, employers should keep in mind that:

- Criminal background checks fall under anti-discriminationlaw, and they can’t put candidates with criminal records at a disadvantage,

- If using third-party software to conduct a background check, employers need to look into Fair Credit Reporting Act (FCRA) compliance requirements, like a written permission from the candidate, and a document assuring the third party that the information gathered won’t be misused, and

- In Hawaii, only felony convictions from the last 7 years and misdemeanor convictions from the last 5 years can have their application rejected by the employer; any older felony or conviction can’t be counted while considering an application.

Drug and alcohol testing laws

The State of Hawaii gives employers full freedom to conduct drug and alcohol testing at their discretion. However, the few regulations that do exist include:

- Only blood and urine collection are allowed for testing purposes, and

- Employers must use either the Hawaii Department of Health laboratories or those certified by the Substance Abuse and Mental Health Services Administration.

In summary, employers can test for both recreational and medical marijuana, drug and alcohol, and 11-panel screening (marijuana, cocaine, amphetamines, opiates, phencyclidine, methadone, alcohol, benzodiazepines, barbiturates, propoxyphene, and methaqualone).

Employer use of social media regulations

In Hawaii, according to the Uniform Employee and Student Online Privacy Protection Act, an employer can’t:

- Ask an employee to disclose their login information for their personal account,

- Ask an employee to disclose the contents of their personal social media account, unless it was voluntarily shared by the employee,

- Alter the settings or login information of the employee to make the content of the account accessible to others,

- Try to actively gain access to an employee’s personal account by observing the employee logging in, etc.

The following actions are allowed:

- Accessing an employee’s publicly available information on social media,

- Formulating a policy concerning the use of electronic devices provided for employees for business purposes,

- Asking an employee to share specific content if it’s part of a legal proceeding or investigation, and

- Asking an employee to share specific content if it concerns investigating threats to safety (harassment, threats of workplace violence, threats to the safety of the employer’s information technology or communication, or threats to employer property).

COBRA laws

The State of Hawaii follows the Federal Consolidated Omnibus Budget Reconciliation Act (COBRA), which applies only to companies with 20 or more employees.

Aside from COBRA, the Hawaii Prepaid Health Care Act provides health care coverage for employees for non-work-related illnesses or injuries. Employees who aren’t eligible for this health care program include:

- Employees who work fewer than 20 hours per week,

- Federal, State, and County workers,

- Seasonal agricultural workers,

- Commission-based salespersons in insurance or real estate,

- Employees in domestic work, and

- Employees under 21 working for their parents.

Expense reimbursement laws

Hawaii has no law regulating travel and other work-related reimbursements.

Record-keeping laws

When it comes to record-keeping, Hawaii follows the guidelines laid out by the FLSA.

Records kept for 1 year

According to the Equal Employment Opportunity Commission, employers are obligated to keep all records relating to employment for at least 1 year from the date of termination.

Employers should also keep copies of every employee’s I-9 form for at least 1 year.

The paperwork includes:

- Employee’s full name,

- Their Social Security number,

- Date hired, rehired, or returned to work,

- Date employment ended and the reason(s) for separation from work,

- Amount of remuneration paid in each calendar quarter,

- Amount of remuneration paid each pay period, including the value of any remuneration in a form other than cash,

- Amount and date of any special payment, such as a bonus, gift, or prize, and

- Place in which services were performed.

Records kept for 2 years

Any documents relating to basic employment and earnings, such as wages, timecards/timesheets, billing records, and any bonuses or deductions from pay.

Records kept for 3 years

Any documents concerning payroll records, agreements, bargaining agreements, sales and purchase records.

Records kept for over 4 years

This documentation should include:

- Records of job-related injuries are kept for 5 years.

- Records of annual reports for benefit plans are kept for 6 years.

- Records of toxic substance exposure are kept for 30 years.

🎓 Hawaii Records Retention and Disposition Schedules

Frequently asked questions about Hawaii labor laws

If we haven’t answered some of your specific questions about working laws in the state of Hawaii, here’s an additional section with extra information.

Are there labor laws in Hawaii?

Yes. As in any other state in the US, Hawaii also has its laws and regulations regarding labor laws concerning minimum wage, overtime, break time, time off, etc.

How long can you work without a break in Hawaii?

There’s no state law requiring employers to provide their employees with rest or lunch breaks for adult employees. However, minors should get a 30-minute break for every 5 consecutive hours worked.

What is the minimum wage in Hawaii?

The minimum wage in Hawaii is $14 per hour for non-exempt employees.

What does McDonald’s pay in Hawaii?

According to the latest Indeed findings, here are some popular jobs at McDonald’s in different parts of Hawaii:

- Crew Member (Honolulu, HI) — $16 to $20.36 per hour,

- Crew Member (Wahiawā, HI) — $16.50 to $21 per hour,

- Crew Member (Kaneohe, HI) — $17 to $21.64 per hour, etc.

How many hours is full-time in Hawaii?

There’s no definition on how many hours a week or month a full-time or part-time employee has to work to earn such employment statuses. Still, if you work at least 20 hours per week, your employer must provide you with certain benefits under the Hawaii Prepaid Health Care Law.

🎓 Part-time vs. Full-time Employment: Understanding the Difference

Is Hawaii a final pay state?

Yes. If you’ve been discharged, your employer is required to pay all final wages to you at the time of discharge or no later than the next working day. Moreover, if you quit or resign, the employer must pay final wages to you by the next payday.

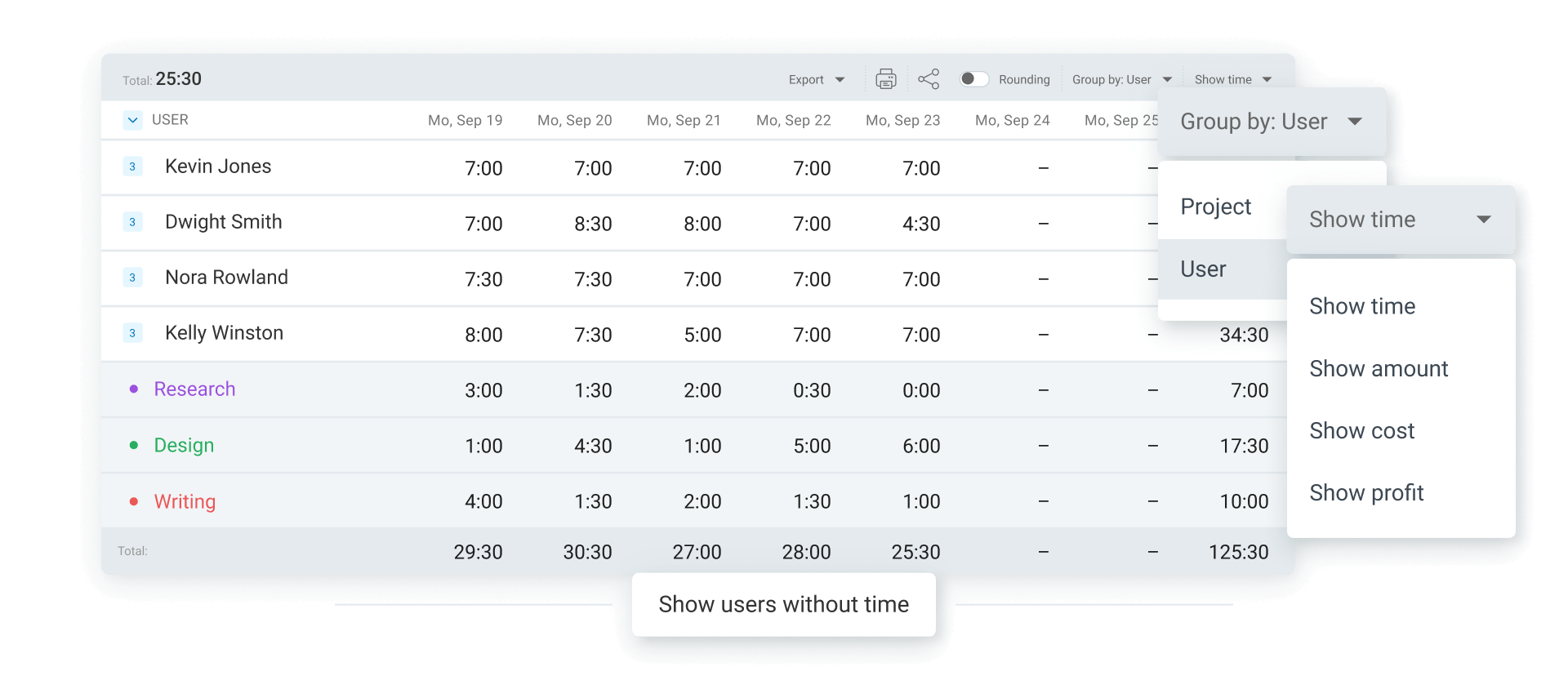

Use Clockify to stay compliant with Hawaii labor laws

To stay compliant with all the said laws and regulations regarding labor laws in Hawaii, opt for a simple tool you can rely on.

For that purpose, Clockify is an all-in-one tool that can make all your business operations a breeze.

For instance, Clockify can help you comply with overtime regulations. One powerful feature in Clockify calculates overtime hours automatically, helping you compensate your employees in accordance with Hawaii overtime laws.

How does it work?

Simply let Clockify generate detailed reports that show insights into:

- Each employee’s start time and end time,

- Total hours worked by an employee or the whole team,

- Employees’ break time, and more.

Thanks to these insights, you can always compensate your employees properly and stay in compliance with the overtime regulations.

Conclusion/Disclaimer

We hope this Hawaii labor law guide has been helpful. We once again remind you to pay attention to the links we’ve provided, as most of them will lead you to the official government websites and other relevant information.

Please note that this guide was written in Q2 2025, so any changes in the labor laws that were included later than that may not be included in this Hawaii labor laws guide.

We strongly advise you to consult with the appropriate institutions and/or certified representatives before acting on any legal matters.

Clockify isn’t responsible for any losses or risks incurred if this guide is used without further guidance from legal or tax advisors.