Maryland Labor Laws Guide

Ultimate Maryland labor law guide: minimum wage, overtime, break, leave, hiring, termination, and miscellaneous labor laws.

| Maryland Labor Laws FAQ | |

| Maryland minimum wage | $15.00 |

| Maryland overtime | 1.5 times the regular wage for any time worked over 40 hours/week |

| Maryland breaks | Specified shift breaks for retail workers; 30-minute breaks for every 5 consecutive hours worked (for employed minors) |

Maryland wage laws

The following table represents the current 2025 laws in Maryland regarding wages:

| MARYLAND MINIMUM WAGE | ||

| Regular minimum wage | Tipped minimum wage | Subminimum wage |

| $15.00 | $3.63 | $4.25 |

Maryland minimum wage

In 2025, the State of Maryland has a minimum wage requirement of $15.00 per hour. This rule applies to all businesses, no matter how many employees they have.

Some Maryland counties, however, have different hourly minimum wages.

In Montgomery County, starting from July 1, 2025, the minimum wages are the following:

- $15.50 per hour for small businesses with 10 or fewer employees,

- $16.00 per hour for businesses with 11–50 employees,

- $17.65 per hour for businesses with 51 employees or more, and

- $4.00 per hour for employees who receive tips.

From July 1, 2024, to June 30, 2025, the minimum wage in Prince George’s County will be $17.10 per hour. In addition, the minimum wage in Howard County will be $16.00 perhour from January 1, 2025.

Tipped minimum wage in Maryland

Tipped employees are individuals working in an industry where they regularly and customarily receive tips up to $30 per month.

In Maryland, the current tipped minimum wage is $3.63 per hour. However, tipped employees must receive at least the minimum wage (tipped minimum wage + tips) for each hour worked. If they don’t, the employer has to make up the difference.

Subminimum wage in Maryland

Under federal law, employers can pay employees under 20 years of age a subminimum wage of $4.25 for the first 90 calendar days of their employment.

Employers are allowed to pay employees under 18 a subminimum wage equal to 85% of the minimum wage, which amounts to $12.75 per hour in Maryland.

In addition, the FLSA allows employers to pay other specific subminimum wage rates to certain types of employees, such as workers with disabilities and student learners.

Exemptions to the minimum wage in Maryland

The following are the exemptions to the minimum wage in Maryland:

- Direct family members of the employer,

- Some agricultural branches,

- Executives, administrative, and professional employees,

- Minors under 16 who work fewer than 20 hours per week,

- Establishments selling food and drinks on the premises (restaurants and cafes) that earn less than $400,000 per year,

- Employees who work as trainees in public school programs,

- Outside salespersons and commissioned employees,

- Volunteers for charities, educational and religious institutions, and nonprofits,

- Drive-in theaters, and

- Facilities involved with the canning, freezing, and packing of fruits, vegetables, seafood, or poultry.

Under the Fair Labor Standards Act (FLSA), if an employee is subject to both the state and federal minimum wage laws — the employee is entitled to the higher minimum wage rate.

For example, if the state minimum wage is less than $7.25 per hour, employees protected by the FLSA must earn a minimum salary of at least $7.25 per hour.

Maryland payment laws

According to the Maryland Department of Labor Law, employers are required to pay wages at least once every 2 weeks or twice a month.

Payouts should happen on the same days each month, predetermined by the employer.

Executive, professional, and administrative employees are exceptions to this law and can be paid less frequently.

Secure Maryland Wage Act

In June 2021, the State of Maryland passed the Secure Maryland Wage Act, which raises the minimum wage of employees working in “heightened security interest locations.”

According to this act, Baltimore-Washington International Thurgood Marshall Airport and Pennsylvania Station are considered “heightened security interest locations,” and their employees will be paid $16.00 per hour from January 1, 2025.

Moreover, starting from January 1, 2026, employers are required to pay employees a regular wage of $16.00 per hour and a supplement benefit rate of at least $1.00 per hour.

The Secure Maryland Wage Act covers employees who perform work at locations of heightened security interest and are non-exempt under the FLSA.

The law was passed to address the high turnover in these specific positions, attract and retain experienced workers, and improve workers’ rights in Maryland.

Similar laws exist at Los Angeles International Airport, John F. Kennedy Airport, and LaGuardia International Airport.

Maryland Living Wage Law

Maryland’s Living Wage Law requires private businesses that do contract work with the state government to pay their employees a living wage. This hourly rate is usually above minimum wage to address the rising costs of living standards.

The Living Wage Law applies to all businesses that:

- Have a contract or a subcontract with the State of Maryland, and

- Provide services to the state of $100,000 or more.

To be eligible for a living wage, an individual employee should spend at least 50% of their work time on the given project. Simply put, State of Maryland employees who aren’t involved in that project are not eligible.

Companies covered by this law offer maintenance and information technology services and are NOT suppliers, construction companies, or architecture-related companies or agencies.

Lastly, living wage rates differ based on the county where the services are being performed and are divided into 2 tiers:

- Tier 1 — Anne Arundel County, Baltimore City, Baltimore, Howard, Montgomery, and Prince George’s Counties, and

- Tier 2 — all other counties.

The minimum living wage for Tier 1 counties is $16.63 per hour (except for Montgomery County, where it is $17.60), and the minimum living wage for Tier 2 counties is $15.00 per hour.

Due to increases in the Maryland minimum wage rate that exceed the Living Wage rate, employees in Tier 2 should be aware of the current minimum wage rates and planned increases in the future.

Maryland overtime laws

The FLSA regulates overtime in Maryland — according to the FLSA, any work time over 40 hours per week is considered overtime.

Under this rule, employers must pay their employees 1.5 times their regular wage for overtime work hours, which equals $18.75 per hour.

However, it’s essential to note that employees who work more than 8 hours per day aren’t considered overtime eligible.

In Maryland, only employees who work more than 40 hours per week are qualified for overtime pay.

🎓 Free Employee Overtime Tracker

Overtime exceptions and exemptions in Maryland

When it comes to overtime, there are certain exceptions and exemptions in the State of Maryland.

Exceptions mean that certain employees are eligible for overtime, but the rules differ from the regular ones. The following are the exceptions to overtime rules:

- Bowling establishments and institutions providing on-premise care whose workers work over 48 hours per week, and

- Workers in agriculture who work more than 60 hours per week.

On the other hand, overtime exemptions are situations where overtime rules do not apply. The following are the exemptions from overtime rules:

- Executive positions (full-time management of 2 or more employees),

- Administrative work (business operations, management, administrative training),

- Professional work (requiring advanced education: artists, certified teachers, IT professionals),

- Salespeople and commissioned employees,

- Taxi drivers,

- Trainees who are part of a public school program, and

- Volunteers for charities and other non-profit organizations.

🎓 Maryland Department of Labor Website

Maryland break laws

In this section, we’ll look at Maryland’s break laws and the exceptions to these laws.

Maryland work breaks (meals and rest)

Maryland has no state regulation concerning breaks for regular employees.

The only mention of work breaks concerns employed minors, eligible for a 30-minute break for every 5 consecutive hours worked.

However, following federal law on break time, Maryland employers can provide their employees with short or long breaks:

- Short breaks last 5 to 20 minutes and are included in the total sum of work hours during the week. Employees get paid for this time as it was spent working.

- Long breaks last at least 30 minutes, and employers aren’t required to pay for this time.

Moreover, when providing meal breaks to employees, employers must abide by 2 rules:

- If an employee works during mealtime (e.g., eating at their desk while working or grabbing a quick bite while commuting from one on-site location to another, etc.), they need to be paid because their mealtime is still spent working.

- If an employee can have a meal break during which they don’t perform work and can spend that time as they see fit, it counts as a meal break, but it doesn’t have to be paid.

Although breaks are not mandatory by state or federal law, many employers choose to include them in a collective bargaining agreement.

Healthy Retail Employee Act

The Maryland Department of Labor has been enforcing a law concerning break times in retail stores since March 2011.

According to the Healthy Retail Employee Act, an employer is required to provide (un)paid breaks to employees if they own a retail establishment that:

- Primarily sells goods to customers on-premises (via a physical store, not an online one),

- Has 50 or more retail employees, and

- Has been open and operational for 20 or more calendar weeks.

The breaks are distributed in the following ways:

- If an employee works less than 4 consecutive hours, no break is required,

- If an employee works between 4 and 6 consecutive hours, a 15-minute break is required,

- If an employee works more than 6 consecutive hours, a 30-minute break is required, and

- If an employee works more than 8 consecutive hours, a 30-minute break is required, with an additional 15 minutes for every new 4 consecutive hours.

Maryland breastfeeding laws

The State of Maryland does not regulate breaks for breastfeeding mothers in the workplace specifically. That means the federal laws apply, so the FLSA protects mothers who are non-exempt (hourly) employees.

Within the federal law, here’s what breastfeeding rules entail (for up to 1 year after the child’s birth):

- Employees get a designated private nursing room, which is free from public and coworker intrusion and not used as a bathroom,

- The duration of the lactation break is per the employer’s decision (and within reasonable boundaries), and

- Employers must post a notice in an accessible place to inform employees of their rights and obligations concerning breastfeeding.

The only exception to this regulation is if the employer has fewer than 50 employees.

Moreover, if the employer can prove that finding proper accommodations poses financial, structural, or other difficulties to the business, they’re exempt from providing a separate room.

Maryland leave requirements

Luckily for many employees, the state of Maryland follows both the federal leave laws and has its own state regulations titled The Maryland Healthy Working Families Act, related to leave laws.

In other words, employers are obliged to follow the regulations that bring the most benefits to their employees.

Let’s look at each type of leave — required and non-required — and observe what Maryland has to offer.

🎓 Maryland Department of Labor Website

| TYPES OF LEAVES |

| ✅ REQUIRED LEAVE |

|

Sick and family leave — Employers in the State of Maryland are required to provide sick and safe leave to employees. Employers can award this leave to employees at the beginning of the year or let employees earn it during their work time. Non-exempt employees can earn 1 hour of sick or family leave for every 30 hours worked. This way, they can accrue up to 40 hours of sick leave per year. Employees can take sick leave to:

Employers with 15 or more employees are required to provide paid sick leave, while employers with 14 or fewer employees are not required to pay for the sick leave. In addition, employees in Maryland are also covered by the Family and Medical Leave Act (FMLA), which they can use if they meet the following requirements:

NOTE: On March 30, 2022, the Maryland House of Delegates passed a bill establishing the so-called Time to Care Act. If successful, it will take effect on July 1, 2025, when eligible employees will be entitled to 12 weeks of partially paid sick leave and up to 24 weeks of paid leave for new parents. |

| ❌ NON-REQUIRED LEAVE |

|

Bereavement leave — State employers with 15 or more employees must provide paid bereavement leave. However, employees can only use earned leave (accrued days) for these instances. This means that employees accumulate leave days throughout their work time, which they can later use for bereavement purposes. Employees can use up to 3 days of leave for the death of an immediate family member (parents, child, or spouse) instead of using 3 days of the 5 days of sick leave. |

| ✅ REQUIRED LEAVE |

|

Jury duty leave — According to Maryland law, employees summoned for jury duty are protected by law. Employers aren’t allowed to coerce, intimidate, or threaten to discharge an employee for performing their jury duty. Moreover, if the employee’s jury service lasts more than 4 hours, employers cannot schedule work shifts that begin:

Employers are also prohibited from requiring employees to use their annual, sick, or vacation leave for jury service. |

| ❌ NON-REQUIRED LEAVE |

|

Vacation time — In Maryland, state law states employers are not obligated to provide paid vacation leave. Should an employer choose to offer such benefits, they must align with the company’s established policies. |

| ✅ REQUIRED LEAVE |

|

Voting time leave — Maryland Election Law from 2019 states that employers are required to provide employees who are registered voters 2 hours of paid voting time off. Employees must provide proof of voting on a form predetermined by the State Board. |

| ✅ REQUIRED LEAVE |

|

Domestic violence or sexual assault leave — The already mentioned Maryland Healthy Working Family Act also covers employees who have been victims of domestic abuse themselves or their immediate family members. Employers should provide earned sick leave after an employee or their family member has suffered domestic, sexual violence, or stalking. The leave is used for:

|

| ❌ NON-REQUIRED LEAVE |

|

Holiday leave — Private employers are not required to provide paid or unpaid holiday leave for employees, while individuals employed with the state have the right to 11 paid holidays per year. |

| ✅ REQUIRED LEAVE |

|

Emergency response leave — Employers aren’t allowed to discharge, demote, take pay cuts, or otherwise retaliate against employees who are members of:

These employees are entitled to adequate time off in response to emergency events declared by the Governor. This leave counts up to 30 days in a 12-month period, but under 2 conditions:

|

| ✅ REQUIRED LEAVE |

|

Organ and bone donation leave — Employees who are organ or bone marrow donors are entitled to leave. The leave counts up to 30 days for organ donation and up to 7 days for bone marrow donation. |

| ✅ REQUIRED LEAVE |

|

Military leave — Maryland military leave law requires that employers provide 15 days of paid leave (while other days of leave are unpaid) for employees who are members of a reserve unit of the armed forces or organized militia. This leave can be used for either deployment or military training. Likewise, Maryland also recognizes Deployment Leave for the family of the armed forces members. In businesses with 50 or more employees, if an employee has worked full-time or part-time for at least 1,250 hours in the past 12 months, they are entitled to a day off work on the day of their immediate family member’s deployment. |

Child labor laws in Maryland

When it comes to employing minors, all minors under 18 must have a signed and approved work permit issued by the Maryland Department of Labor.

Moreover, all minors are entitled to a 30-minute break after 5 consecutive hours of work.

Labor laws for minors aged 14 and 15

No minor under 14 is allowed to work in the state of Maryland. However, minors aged between 14 and 15 can and must have a valid working permit to be employed.

Their work hours are limited to the following conditions:

- When school is in session — a maximum of 3 hours per day and 18 hours per week, and

- When school is not in session — a maximum of 8 hours per day and 40 hours per week.

Moreover, minors can work only between 7:00 a.m. and 7:00 p.m. — except from June 1 until Labor Day, when they can work until 9:00 p.m.

Labor laws for minors aged 16 and 17

Regarding minors aged 16 and 17, the work restrictions are less strict.

The main rule states they can spend a maximum of 12 hours per day at school and work combined. For their health and safety, they must have at least 8 consecutive hours of rest per 24 hours, during which they will not have school or work.

Also, a 30-minute break is required after working for 5 consecutive hours.

Prohibited occupations for minors in Maryland

All minors in Maryland have the same prohibited occupations, with no distinction regarding age — these include:

- Working in or about plants or manufacturing related to explosives or items with explosive components,

- Working in logging, mining, or any occupation with power-driven machinery (metalwork, wood processing, etc.),

- Operating lifts, elevators, and other hoisting apparatuses,

- Cleaning, oiling, or any other form of machinery maintenance,

- Working around blast furnaces,

- Working at docks or piers,

- Working at railroads,

- Driving motor vehicles,

- Working in roofing or excavation occupations,

- Erection and repair of electrical wires or components, and

- Working in distilleries (e.g., manufacturing, packaging, or bottling alcoholic beverages).

🎓 Full list of prohibited occupations for minors in Maryland

Maryland child labor law exemptions

Child labor laws allow for exemptions in cases where some occupations are not considered employment.

These activities are performed outside a school day and do not involve any hazardous work. Some examples include the following:

- Minors employed by family members or relatives, as long as the minor is not 15 or under and doing work in mining or manufacturing,

- Minors caddying on a golf course,

- Minors manufacturing evergreen wreaths in or about a home.

- Minors working on newspaper delivery,

- Minors working on an instructional sailboat as an instructor,

- Minors working as performers or entertainers (TV, radio, online, etc) — as long as the agency employing them provides all the vital information on hours worked and wages, and

- Minors working as counselors or assistant counselors in certified Youth Camps.

NOTE: Employers are subject to both federal and state laws. Although Maryland child labor laws are less strict than the federal ones, employers covered by the FLSA should also follow federal regulations.

Hiring laws in Maryland

Hiring laws in Maryland follow the same federal regulations as in the rest of the US.

In addition, the state also follows the Job Applicant Fairness Act, which prohibits employers from asking applicants for their credit reports to decide whether to hire, discharge, or change their pay rate.

Termination laws in Maryland

Maryland is a state that follows employment-at-will. This means that Maryland employees working under contract can be terminated (or resign on their own) for any reason at any moment.

The only caveat is that termination is considered illegal if it’s based on discrimination or retaliation against an employee.

Final paycheck in Maryland

As stipulated by the Maryland Department of Labor, employers are required to pay all final wages to the State of Maryland employees by the next payday, regardless of the cause of termination.

Discrimination laws in Maryland

With regards to discrimination, the State of Maryland Commission on Civil Rights regulates that every applicant and employee in Maryland is granted protection in the workplace from discrimination based on:

- Race,

- Color,

- Religion,

- Nationality,

- Sex,

- Age,

- Marital status,

- Sexual orientation,

- Gender identity,

- Genetic information, and

- Disability.

This means that the employers cannot:

- Discriminate on these bases when recruiting, hiring, making contracts for applicants, discharging, etc.,

- Deny membership on these bases for apprenticeship programs,

- Ask discriminatory questions during a job application, or circulate information that could affect potential employment, and

- Publish job advertisements with discriminatory information/conditions.

This anti-discrimination law applies only to employers with 15 or more employees.

Still, complaints against harassment or discrimination can be filed regardless of the number of employees.

Occupational safety in Maryland

Maryland follows the federal Occupational Safety and Health Act (OSHA) and also has its own law, titled Maryland Occupational Safety and Health (MOSH).

Aside from specific programs, MOSH offers the following services specifically tailored to the needs of businesses in Maryland:

- Consulting and on-site inspections,

- Providing educational programs and outreach,

- Setting and enforcing standards, and

- Working with businesses to continually improve workplace safety and health.

Miscellaneous Maryland labor laws

In this final section, we’ll go through some of the additional labor laws that are of public interest, including:

- Right-to-work laws,

- Whistleblower protection laws,

- Background check laws,

- Employer use of social media regulations,

- Employee monitoring laws,

- Drug and alcohol testing laws,

- Sexual harassment training laws,

- COBRA laws,

- Expense reimbursement laws, and

- Record-keeping laws.

Right-to-work laws

Maryland has no legislation regarding right-to-work laws.

However, one section of their Labor and Employment law states that no employer can force an employee to:

- Become or remain a member of a labor organization,

- Resign from a labor organization, or

- Resign from their job or role if they’re a part of or wish to join a labor organization.

So, while there’s no formal right-to-work law, a regulation protects employees from being manipulated through (or for) labor union membership.

Whistleblower protection laws

Regarding whistleblower protection, the State of Maryland uses its own Maryland Whistleblower Law, differentiating between public and private employees.

For the public sector, an employer isn’t allowed to fire, threaten, or discriminate against an employee if they report:

- A violation of the law,

- A substantial and specific danger to public health and safety,

- Mismanagement of state funds,

- Gross mismanagement,

- Gross waste of money, or

- Abuse of authority.

While the public sector guidelines are relatively straightforward, it’s important to note that the State of Maryland takes whistleblower laws seriously.

Therefore, different laws apply depending on the following:

- The industry in which an employee works,

- The gravity of misconduct being reported, and

- The type of misconduct being reported.

In short, reporting health safety concerns as a nurse falls under different rules than reporting safety concerns as a project manager.

Background check laws

Maryland is among the many US states that follow the Ban the Box legislation.

According to this law, an employer is not allowed to ask about or investigate an applicant’s criminal history until the first in-person interview.

The law applies to any business with 15 or more employees and to any type of employment (seasonal, contractual, temporary), not just full-time employment.

The only exception to this rule is in cases where the criminal record bears a rational relationship to the duties and responsibilities of the position. This includes occupations in the following sectors:

- Schools,

- Security, and

- Financial and insurance institutions.

Employer use of social media regulations

Regarding employee privacy in the workplace, Maryland has the Username and Password Privacy Protection Law.

Under this law, an employer cannot ask employees to provide their usernames and passwords for their private social media accounts for any reason.

However, the employer is allowed to:

- Ask an employee for login credentials to any work-related, non-personal accounts that provide access to the employer’s internal computer,

- Ask for an investigation of an employee’s work-related computer based on receipts of information about unauthorized downloads, financial data, or similar misconduct that could jeopardize business operations, and

- Ask for an investigation of an employee’s work-related computer to ensure compliance with financial and security laws.

The employee monitoring law

The State of Maryland allows employers to conduct phone call surveillance in cases essential for the job being performed (such as customer service calls).

Employers are generally prohibited from recording or tapping into employees’ personal calls or in-person conversations.

The exception to this rule is if all conversation participants have given permission.

Drug and alcohol testing laws

The State of Maryland recognizes several regulations concerning alcohol and drug testing in the workplace:

- While recreational use of marijuana is decriminalized, it’s still illegal in Maryland. Therefore, an employer is allowed to discipline an employee who is also a medical marijuana patient if they test positive in the workplace.

- Bodily samples such as blood, urine, hair, and saliva are allowed, but not breath — especially for breath alcohol testing.

- Employers are allowed to test for any controlled dangerous substance as long as the samples are collected and processed by a licensed laboratory, and the reasons for the testing are justified.

- Employers must use either the licensed laboratories or those certified by the Substance Abuse and Mental Health Services Administration.

🎓 Maryland’s drug and alcohol testing

Sexual harassment training laws

According to Maryland’s anti-harassment training laws, all public employees should undergo 2 hours of sexual harassment prevention training within 6 months of employment.

After the first training, employees should take another 2-hour session every 2 years.

COBRA laws

Maryland follows the Federal Consolidated Omnibus Budget Reconciliation Act (COBRA) but also has its own regulation called the Maryland Continuation Coverage (MCC).

Since COBRA applies only to companies with 20 or more employees, small businesses are left without a regulation of their own.

MCC provides this aid to business owners with 19 or fewer employees.

We strongly advise looking into the official document comparing COBRA and MCC for extensive information on prolonged health insurance after termination. The table provided gives specific information on eligibility, availability, and types of coverage provided by both plans.

Although the main difference between the 2 acts is which type of employers they cover, you should also consider other differences, such as different time limits, payment amounts, and health benefits.

Expense reimbursement laws

Maryland’s Department of Budget and Management states that public employees are entitled to reimbursement for “meal and incidental expenses.”

Each year, new rates are calculated and published on the official website.

Reimbursements include:

- Meal allowances,

- Porter fees and hotel tips, and

- Transportation tips.

Record-keeping laws

According to the Maryland Department of Labor, each employer should keep, in or about the place of employment, for 3 years after termination, the following records on each employee:

- Name,

- Address,

- Race,

- Gender,

- Occupation,

- Rate of pay and the amount of each pay period, and

- Daily and weekly work hours.

Frequently asked questions about labor laws in Maryland

To make this guide as comprehensive as possible, we’ve included an FAQ section that answers the most common questions about Maryland laws.

Is it illegal to work 8 hours without a break in Maryland?

No, it’s not illegal. However, if the employee works in retail and is covered by the Healthy Retail Employee Act, they’re entitled to certain work breaks. Moreover, if the employee is a minor, they’re also guaranteed a break during work.

Can you be fired without cause in Maryland?

Yes, you can. Maryland follows the “at-will” doctrine, which allows both employers and employees to terminate the employment relationship at any time and without any specific reason. However, the termination cannot be a result of retaliation or discrimination.

What are the pay laws for termination in Maryland?

If an employee is terminated from their contract, the employer has to pay the remaining employee’s wages by the next scheduled payday.

Is there a pay transparency law in Maryland?

Yes, there’s a Maryland pay transparency law. The law is named Equal Pay for Equal Work – Wage Range Transparency and became effective on October 1, 2024. Under this law, job postings must include wage ranges and benefits.

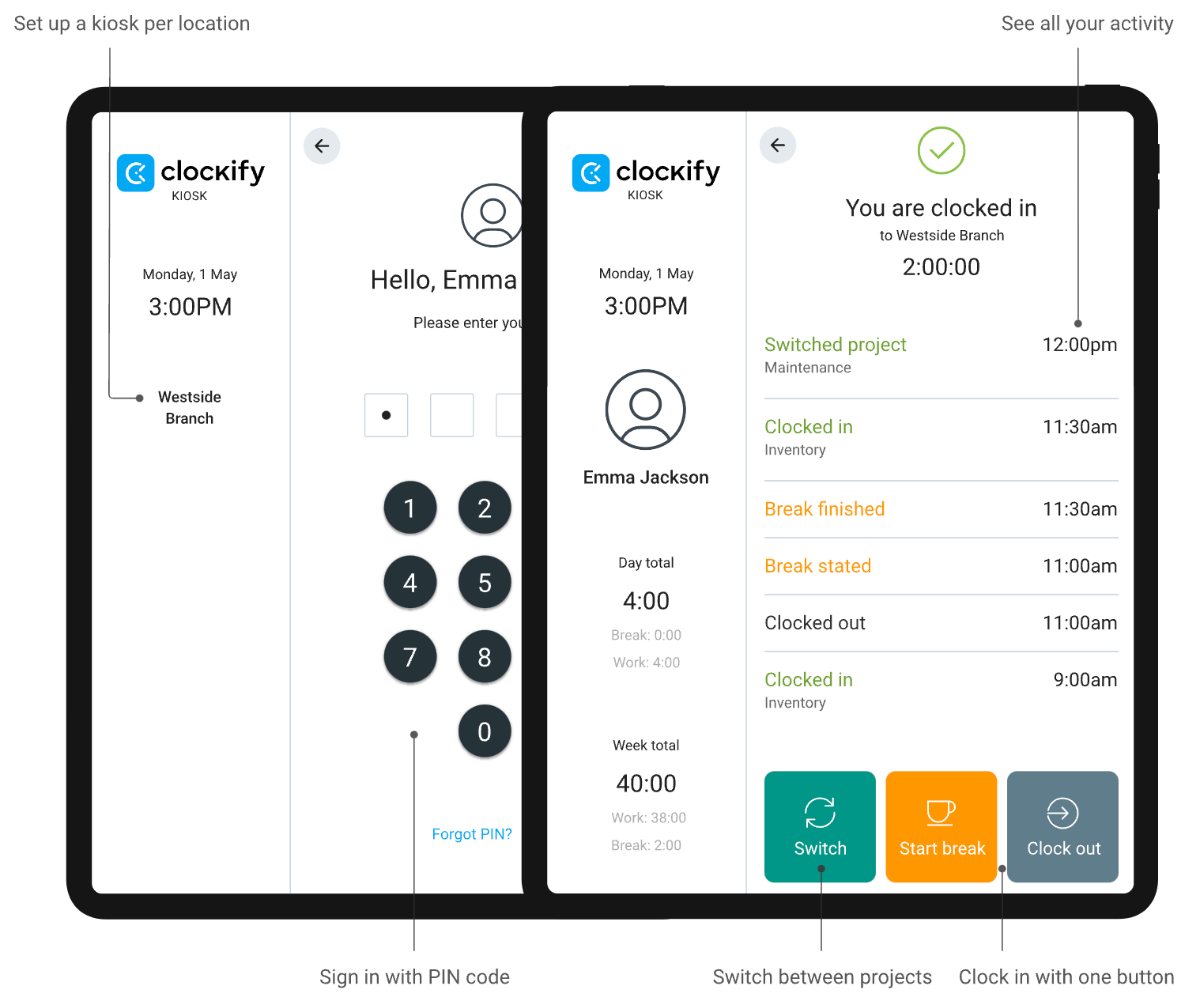

Need a simple time clock for employees? Try Clockify

Clockify allows you to track time, attendance, and costs with just a few clicks for FREE.

Your team can track work time personally via the web or mobile app, or you can set up a time clock kiosk from which employees can clock in and out.

The kiosk feature in Clockify allows your employees to clock in and out using a unique PIN code.

Employees can then track their work time and breaks and switch between different projects.

Later, you can use Clockify to approve timesheets and time off, schedule shifts, run time card reports, and export everything for payroll (PDF, Excel, link, CSV, or send to QuickBooks).

Conclusion/Disclaimer

We hope this Maryland labor law guide has been helpful. Please ensure you have paid attention to our links, as most of them will lead you to the official government websites and other relevant information.

Please note that this guide was written in Q2 2025, so any changes in the labor laws that were included later than that may not be included in this Maryland labor laws guide.

We strongly advise you to consult with the appropriate institutions or certified representatives before acting on any legal matters.

Clockify is not responsible for any losses or risks incurred should this guide be used without further guidance from legal or tax advisors.