Mississippi Labor Laws Guide

Ultimate Mississippi labor laws guide: minimum wage, overtime, break, leave, hiring, termination, and miscellaneous labor laws.

| Mississippi Labor Laws FAQ | |

| Mississippi minimum wage | $7.25 |

| Mississippi overtime laws | 1.5 times rate for over 40 hours per week $10.875 for minimum wage workers |

| Mississippi break laws | None required |

Mississippi wage laws

The minimum wage requirement is different for non-tipped and tipped employees. Certain occupations are exempt from this requirement, and we’ll cover all instances in the following segments.

Employees who work up to 40 hours per week are paid at least the minimum wage, while employees who work over 40 hours a week get paid at a higher rate.

This is regulated by the Fair Labor Standards Act — and the state of Mississippi follows the federal minimum wage regulation.

Let’s examine what Mississippi employees are entitled to in terms of fair and adequate compensation for their work on an hourly basis.

| Mississippi Minimum Wage Laws | ||

| Regular minimum wage | Tipped minimum wage | Subminimum wage |

| $7.25 | $2.13 | $7.25 |

Mississippi minimum wage

Mississippi doesn’t have state laws determining minimum wages for its employees. Therefore, the federal law stands — i.e., the minimum wage has to be at least $7.25 per hour worked.

The minimum wage for Mississippi employees will increase correspondingly when the federal minimum wage rises.

It’s important to mention that it is illegal for employers to offer a lower hourly rate to all employees who are non-exempt from the rule.

However, there are some exemptions and exceptions to the minimum wage rule — for example, for tipped occupations.

Read the following segments to ensure you are fully aware of which situations and positions are exempt from the minimum wage rule, whether you’re an employer or an employee.

Tipped minimum wage in Mississippi

Certain professions, especially those in the hospitality industry, are commonly and closely tied to tips.

According to the Internal Revenue Service (IRS), a tipped minimum wage refers to certain sums of money that customers give tipped employees as recognition for their service and attitude.

Employees must regularly receive such gratuities (mostly in cash) to count as tipped employees — e.g., servers, bartenders, waiters, delivery people, etc.

The minimum wage for tipped employees in Mississippi is $2.13 per hour.

However, the tipped minimum wage rate is applicable only if the sum of the basis ($2.13) and the earned tips amounts to at least $7.25 (regular minimum wage). If the sum is lower, the law states it is up to their employers to make up the difference.

The state of Mississippi follows federal wage rules, and under the FLSA, tip pooling is permitted and may even be required by an employer.

This practice would mean redistributing all the tips collected during one shift among all the employees, even those who don’t regularly receive cash gratuities (chefs, assistant chefs, prep cooks, line cooks, dishwashers, etc.).

Exemptions to the minimum wage in Mississippi

Just as tipped employees are exempt from the minimum wage requirement, there are other instances of exempt occupations.

Since Mississippi has no wage laws, the FLSA specifies certain occupations as exempt from the minimum wage requirements.

Let’s now look at some occupations considered exempt from the standard minimum wage requirements in Mississippi:

- Bona fide executive, administrative, and professional employees, provided they earn at least $1,128 per week and are paid on a salary basis,

- Outside salespeople (provided they earn at least $1,128per week),

- Minors and younger workers (under the age of 20),

- Farmworkers,

- Seasonal workers,

- Employees working in domestic service, in or about a private home,

- Employees working as babysitters in the employer’s home,

- Employees working as companions of an elderly, sick, or convalescing person,

- Employees working in newspaper delivery,

- Full-time students, and

- Employees with disabilities.

🎓 Federal Minimum Wage and Overtime Exemptions List

Subminimum wage in Mississippi

We have already mentioned that the state of Mississippi does not have its own minimum wage laws. This implies that the state doesn’t address any subminimum wage requirements, so the federal rules apply again.

Subminimum wage usually applies to the following categories of employees:

- Minors,

- Employees with disabilities,

- Apprentices,

- Trainees,

- Learners,

- Student learners, and

- Student workers.

The term “minors” refers to young workers who are under the age of 18.

Because of the federal law application, Mississippi employers aren’t allowed to pay an hourly rate lower than the standard hourly rate to any of the abovementioned employees.

This means that subminimum and minimum wages are the same in Mississippi based on the federal minimum wage of $7.25 per hour.

However, federal law allows employers to pay youth employees under 20 years of age a minimum wage of $4.25 per hour for the first 90 calendar days of employment.

Mississippi payment laws

Now, let’s examine the state requirements for Mississippi employers regarding the frequency of payments.

Under Mississippi law, employers are required to provide payment once every 2 weeks or twice a month.

So, the payroll periods operate on a semi-monthly basis or a bi-weekly basis.

In other words, employers must compensate their employees no later than 14 days after a certain pay period ends. This rule does not cover private employers and therefore applies only to:

- Public labor or public service corporations, and

- Employers engaged in manufacturing who employ at least 50 employees.

🎓 Semi-Monthly vs. Bi-Weekly Payroll Explained

Wage deductions in Mississippi

Mississippi employers are required to provide an itemized statement of deductions for each pay period.

However, the state doesn’t have any other specific laws regarding deductions. That means there are no restrictions on employers deducting any amounts from their employees’ paychecks for the following reasons:

- Cash shortages,

- Lost or stolen property,

- Damage to property,

- Required uniforms,

- Required tools, and

- Any other items necessary for employees to perform their jobs.

The federal law also states that employers can make deductions for the above reasons only if said deductions don’t cause an employee to earn less than the federal minimum wage in a certain payroll period.

Mississippi overtime laws

According to federal and Mississippi state law, any number of hours exceeding 40 per week counts as overtime. Employees who work at least 40 hours per week are considered full-time employees.

Non-exempt employees who work more than 40 hours per week are entitled to 1.5 times their regular hourly rate.

For minimum wage employees (who earn $7.25 per hour), that currently translates to $10.875 per hour and is applicable to all non-exempt employees.

Some exemptions exist when it comes to overtime regulations. If an employee is exempt from overtime rules, the employer isn’t required to compensate them at a 1.5 rate.

The following section deals with exemptions from overtime, so you can check if you or your employees are eligible for overtime compensation in Mississippi.

🎓 Track Mississippi overtime with Clockify

Overtime exemptions for white-collar employees in Mississippi

According to the federal overtime rules, which the state of Mississippi abides by, specific categories of employees aren’t protected by the overtime law.

One type of exempt employee is “white-collar employees” paid on a salary. Examples of white-collar employees include individuals who work in government, academia, business, accounting, executive management, public relations, healthcare, and more.

To be exempt from the minimum wage and overtime requirements, “white-collar employees” must pass 3 tests:

- They must be paid a salary,

- They must have a specified weekly salary level, and

- They must perform executive, administrative, or professional duties.

Moreover, these employees must be compensated at a standard salary level, which is at least $1,128 per week.

The federal law also specifies another group of exempt employees, known as “highly compensated employees.” These employees earn at least $151,164 per year on a salaried basis.

The $1,128 standard salary threshold will increase on July 1, 2027, and every 3 years after that to keep up with inflation rates.

Mississippi overtime restrictions for specific occupations

Regarding overtime exemptions, federal law expands its restrictions to some other, more specific occupations.

The above-mentioned list of exemptions to the minimum wage applies to overtime as well, so here are some employee categories that are exempt from overtime:

- White-collar employees (bona fide executives, administrators, and professionals, provided they earn at least $1,128 per week),

- Outside salespeople (provided they earn at least $1,128 per week),

- Computer employees who earn at least $27.63 per hour,

- Minors and young workers,

- Agricultural and farm workers,

- Seasonal workers,

- Employees working in domestic service, in or about a private home,

- Employees working as babysitters in the employer’s home,

- Employees working as companions of an elderly, sick, or convalescing person,

- Employees working in newspaper delivery,

- Full-time and vocational students,

- Employees in certain non-profit and educational organizations, provided they have a certificate from the Department of Labor (their employees can be paid starting from 85% of the applicable minimum wage rate),

- Independent contractors (because they are not considered legal employees),

- Transportation workers,

- Any live-in employees (such as housekeepers), and

- Employees of motion picture theaters.

Mississippi break laws

Employers in the state of Mississippi aren’t legally required to provide a meal or a rest break to their employees.

However, employers can choose to offer both meal and rest breaks. In those cases, federal rules apply. Therefore, if an employer does offer either type of break, the law states that:

- Meal breaks lasting up to 20 minutes must be paid,

- Meal breaks lasting over 30 minutes can be either paid or unpaid, according to the employer's preference, and

- Rest breaks lasting up to 20 minutes must be paid.

It’s important to note that federal law distinguishes between the break periods mentioned above and compensable waiting or on-call times.

On-call times are when employees remain at their workplace while waiting for a “call” to get back to work (e.g., customer support agents).

Breastfeeding laws in Mississippi

In the State of Mississippi, breastfeeding mothers enjoy both federal and state protections while working.

According to Mississippi’s breastfeeding law, employers must give mothers a reasonable break to pump milk at work.

Moreover, breastfeeding mothers are protected by the federal PUMP Act, which requires employers to provide a room for pumping milk that meets the following conditions:

- The room must be private,

- The room must be shielded from view and free from intrusion, and

- The room cannot be used as a bathroom.

Breastfeeding mothers can exercise these rights for up to 1 year after the child’s birth.

Mississippi leave requirements

The law regulates leave requirements in Mississippi — it specifies which types of leave Mississippi employers are required to offer and provide, and what happens in terms of compensation during an employee’s leave.

The main question is the reason for the leave — why is an employee asking for a leave of absence? The law clearly regulates that employees shouldn’t suffer any negative consequences upon their return to work for the required types of leave.

Below are the State of Mississippi’s rules and regulations regarding required and non-required leave.

| TYPES OF LEAVES |

| ✅ REQUIRED LEAVE |

|

Family and medical leave — The Family and Medical Leave Act (FMLA) states that all employees are eligible to use 12 weeks of unpaid, job-protected work absence in one year for many household and medical-related reasons. The reasons include the following:

To be eligible, an employee must work for the employer for at least a year and at least 1,250 work hours (in 1 year). Note that this is applicable only to employers with over 50 employees. Additionally, Congress amended the FMLA in 2008 to protect the families of the Armed Services. Since then, employers have also been required to provide up to 26 weeks of unpaid leave if an employee needs to take care of a member of the Armed Forces who:

This is applicable only if said member is the employee’s spouse, parent, child, or next of kin. |

| ❌ NON-REQUIRED LEAVE |

|

Sick leave — Under Mississippi state law, private sector employers aren’t required to offer paid or unpaid sick days. However, if an employer decides to provide sick leave as part of the employment, they must abide by those rules. |

| ✅ REQUIRED LEAVE |

|

Holiday leave — Public sector employers in Mississippi are legally required to offer paid or unpaid leave for any public holiday and related celebrations. On the other hand, private employers aren’t required to offer this type of leave. |

| ✅ REQUIRED LEAVE |

|

Jury duty leave — Under Mississippi law, if an employee is summoned to perform jury duty, employers must allow them to be absent from work during that time. Moreover, the law states that employers cannot terminate or penalize an employee for accepting jury duty or force the employee to use annual, vacation, or sick leave for this matter. |

| ❌ NON-REQUIRED LEAVE |

|

Vacation leave — Employers aren’t required to provide vacation leave. As we have mentioned, employers who choose to offer this type of leave can include certain benefits, but all the details of the agreement between the 2 parties must be stated in the signed employment contract. |

| ❌ NON-REQUIRED LEAVE |

|

Voting time leave — Mississippi employers aren’t legally required to offer paid or unpaid leave for the sole purpose of voting. |

| ✅ REQUIRED LEAVE |

|

Military leave — This type of leave is regulated on a federal level by the Uniformed Services Employment and Reemployment Act. The act states that all employees in the US must be granted a leave of absence to serve in one of the following:

Upon returning to work, employees must be entitled to the same pay increases and other benefits as if they had been present at work the whole time. |

| ❌ NON-REQUIRED LEAVE |

|

Bereavement leave — Employers in Mississippi aren’t legally required to offer any paid or unpaid bereavement leave. If they choose to offer such a leave, the general practice is to offer 3-5 days for the death of an immediate family member and 1-2 days for the death of a close friend. |

| ✅ REQUIRED LEAVE |

|

Crime victim leave — If an employee in Mississippi is a victim of a crime, their employer is required to offer paid or unpaid leave. Apart from responding to a subpoena and participating in a criminal proceeding, the leave applies to the preparation period before said proceeding. Moreover, such employees cannot be discriminated against or treated differently upon their return to work. |

Child labor laws in Mississippi

Child labor laws apply to the employment of individuals under 18. We’ll use the term “minors” to refer to employees of this age category.

Let’s first mention the lower employment threshold — children under 14 years of age are not allowed to be employed in the State of Mississippi.

The primary purpose of both federal and Mississippi child labor laws is to prevent the exploitation of minors. Additionally, such laws help children prioritize education, while their employment only enhances their academic and life experience.

To be legally employed in Mississippi, children under 16 who want to work in specific industries must obtain an Employment Certificate and submit it to their employer.

This mandated document is also known as the Work Permit and applies to work in:

- Mills,

- Canneries,

- Workshops, and

- Factories.

To acquire this certificate, the school must be contacted. The school administrator or a guidance counselor will then determine if the minor in question meets the employment criteria. If they do, the certificate will be issued.

Apart from working in the above-mentioned positions, there are other relevant limitations in the state of Mississippi, which can be seen in the following categories:

- Restrictions on working hours,

- Restrictions on nightwork, and

- Restrictions on specific occupations.

While different rules and regulations apply to different age groups of minors, one thing still applies to all age groups — they are forbidden to work in any hazardous positions, according to federal law.

Next, let’s look at some other rules stated in Mississippi child labor laws.

Specific labor laws for minors in Mississippi

The state of Mississippi enforces different rules for different age groups:

- 14 and 15 years of age, and

- 16 and 17 years of age.

There are also some restrictions on child labor in specific industries.

For example, all minors are prohibited from working with explosives and radioactive substances — we’ll cover the details of prohibited occupations for minors in the state of Mississippi in the upcoming segments.

Let’s start with some restrictions on the maximum number of work hours and night work for minors’ employment.

The maximum number of work hours for minors in Mississippi

The work hours restrictions for minors are regulated differently based on whether school is in session or not. Also, there are different nightwork restrictions based on age groups.

Here’s a table of work hours for minors in Mississippi:

| Age group | School IS in session | School is NOT in session | Night work restrictions |

| 14 and 15 years of age | No work during school hours, Maximum of 3 hours per day, and Maximum of 18 hours per week. |

Maximum of 8 hours per day, Maximum of 40 hours per week, and Maximum of 44 hours per week if employed in a factory, mill, cannery, or workshop. |

Prohibited from working between 7 p.m. and 6 a.m. if employed in a mill, factory, workshop, or cannery, and Prohibited from working between 7 p.m. and 7 a.m. if employed elsewhere, except from June 1 to Labor Day, when they can work until 9 p.m. |

| 16 and 17 years of age | No work during school hours, Maximum of 3 hours per day, and Maximum of 18 hours per week. |

There are no work time restrictions when school is not in session. | There are no night work restrictions. |

Prohibited occupations for minors in Mississippi

We’ve previously mentioned that minors are prohibited from working in hazardous positions.

Now, let’s see what is considered hazardous in Mississippi.

Here’s the list of hazardous occupations for minors, including some that are considered so on a federal level and not just the state level:

- Manufacturing and storing explosives,

- Mining,

- Logging work,

- Sawmill work,

- Forest fire prevention work,

- Packing or processing meat and poultry,

- Wrecking operations,

- Demolition operations,

- Working with power-driven machinery,

- Exposure to radiation and ionizing substances,

- Roofing operations,

- Excavation operations,

- Work with balers and compactors, and

- Driving and working as outside helpers on motor vehicles.

🎓 U.S. Department of Labor, Child Labor Laws

Hiring laws in Mississippi

When it comes to the hiring and selection processes of Mississippi employers, the first thing to mention is that they’re prohibited from making such decisions based on discrimination.

The main discrimination reasons include the following categories:

- Race,

- Color,

- Age,

- Gender,

- Gender-related identity,

- Religion,

- National origin,

- Pregnancy,

- Genetic information (including family medical history),

- Physical/mental disability,

- Child/spousal support withholding, and

- Military or veteran status.

Employees who suspect they were discriminated against should file a formal complaint, as such behavior is prohibited.

Termination laws in Mississippi

Like most other states in the US, Mississippi also implements an “employment-at-will” regulation and policy.

Here’s what at-will employment means for both employers and employees.

- Employers can terminate their employees’ work engagement anytime, for any reason, or perhaps for no reason at all, and

- Employees are free to leave a job for any or no reason, without legal consequences.

Final paycheck in Mississippi

Employers in Mississippi are legally required to provide a final paycheck to everyone whose employment was terminated for any reason. The paycheck must include all the wages and benefits.

However, there are no state laws and regulations regarding the due date for the final paycheck.

For this reason, federal law requires employers to pay their employees’ final paychecks on the next scheduled payday.

Discrimination laws in Mississippi

Discrimination in the workplace isn’t only unethical but also illegal — and this is something applicable on a federal level.

Employees in Mississippi are protected from employment discrimination by the following acts:

- Title VII of the Civil Rights Act forbids race, color, religion, sex, or national origin discrimination.

- Americans with Disabilities Act (ADA) protects individuals with disabilities in many areas of life.

- Sections 501 and 505 of the Rehabilitation Act of 1973 forbid discrimination based on disabilities in the federal sector and regulate governing remedies in this case.

- Age Discrimination in Employment Act (ADEA) protects employees who are over the age of 40.

- The Equal Pay Act of 1963 (EPA) forbids wage discrimination based on sex.

Apart from these regulations, which are relevant on a federal level, there’s an additional anti-discrimination regulation in Mississippi based on the following employee status — smoking or off-duty tobacco use.

Occupational safety in Mississippi

Both federal and Mississippi state laws require employers to provide optimal conditions for a safe and healthy working environment. On a federal level, this is regulated by the Occupational Safety and Health Act (OSHA), passed by Congress in 1970.

OSHA clearly states that employers are required to continually inspect safety conditions for flaws and irregularities and work on improving them.

Every employer should reduce and further try to eliminate the possibility of workplace injuries, illnesses, and fatalities.

So, what are employers required to provide to ensure adequate workplace health and safety conditions?

For starters, all employees need proper training and education immediately upon their employment.

Moreover, to comply with all the regulations, employers must conduct educational and advisory activities to ensure safe and healthy working conditions.

There’s another thing employers must do to create optimal working conditions — the premises must be free from any recognized hazards that may cause harm.

Employers should regularly undertake safety demonstrations concerning health matters.

OSHA inspectors, also known as compliance safety and health officers, are responsible for effectively enforcing safety and health requirements.

Their inspections can happen with or without probable cause for some of the following:

- Regular scheduling,

- Reports of imminent danger,

- Worker complaints,

- Referrals from other agencies,

- Targeted inspections (aimed at specific high-hazard industries), and

- Reports of fatalities.

In Mississippi, the Mississippi Field Federal Safety and Health Councils regulate the enforcement of occupational safety and health standards in public and private sector workplaces.

Miscellaneous Mississippi labor laws

Those were the most important and common categories of labor laws that apply to all or some Mississippi employees.

Here’s what else is specifically regulated by the rule of law in Mississippi:

- Whistleblower protection laws,

- Background check laws,

- COBRA laws, and

- Record-keeping laws.

Let’s start with the first in line.

Whistleblower protection laws

The main purpose of Mississippi whistleblower protection laws is to ensure that employees can exercise all of their legal rights without negative repercussions.

The term “whistleblower” refers to employees who have inside knowledge of illegal practices or a safety hazard in the workplace.

Whistleblowers must be able to report such instances and continue being employed.

Some of the reasons why employees cannot be discriminated against or treated differently include the following:

- Exercising their First Amendment rights,

- Reporting an alleged violation of law,

- Opposing or complaining about discrimination in the workplace,

- Exercising their OSHA (Occupational Safety and Health) rights, and

- Opposing or participating in an investigation of discrimination.

Moreover, under Mississippi law, a whistleblower is protected from retaliatory actions in the workplace for “blowing the whistle.” Some of these actions include:

- Wrongful performance evaluations,

- Demotion,

- Salary reduction,

- Denial of promotion,

- Suspension,

- Dismissal, and

- Employment cancellation.

For a whistleblower complaint to be valid, the action against the employee must be based on their reporting an issue to the governing body.

Background check laws

Background checks are allowed by all employers (but not required) and are subject to the federal Fair Credit Reporting Act.

This act regulates the collection, accuracy, and distribution of information in the Consumer Financial Protection Bureau — in fact, all employers must ensure they are following those requirements.

Only certain positions require background checks for Mississippi employees and applicants, including:

- School employees,

- Any employees working with children in any capacity,

- Any employees who carry a weapon as part of their duty,

- Key employees of liquor retailers,

- Any employees working in gaming establishments, and

- Any employees providing direct patient care or services.

COBRA laws

According to the Consolidated Omnibus Budget Reconciliation Act (COBRA), employees are allowed to retain health care insurance and benefits after their employment is terminated.

Federal regulations also state that the law can be applied to employers with over 20 employees and that coverage can be extended for up to 30 months. That’s the reason why many states have their version of this law, better known as the “mini-COBRA” regulation.

Mini-COBRA applies to small businesses with 2–19 employees and is enforced in Mississippi.

Therefore, the state’s mini-COBRA ensures 12 months of continuation coverage if an employer has fewer than 20 employees.

Record-keeping laws

Employers whose businesses operate in Mississippi follow FLSA rules and are, therefore, required to keep the records of all their employees for at least 3 years.

So, if you’re wondering what types and categories of information such records should consist of, here’s the full list:

- Full name,

- Social security number,

- Occupation of the employee,

- Date of birth,

- Home address,

- Gender,

- Regular hourly rate of pay,

- The basis on which wages are paid,

- Total daily or weekly net wages and deductions,

- Total gross daily or weekly wages,

- Date of each payment, and

- Records of leaves, notices, and policies under the Family and Medical Act.

Some other record-keeping laws may also apply. So, here are the additional records Mississippi employers are required to keep:

- All employment records, including the deductions from wages — for 2 years,

- Records of all job-related injuries and illnesses under OSHA — for 5 years, and

- Specifically dangerous instances under OSHA (e.g., covering toxic substance exposure) — for 30 years.

Frequently asked questions about labor laws in Mississippi

To make this guide as comprehensive as possible, we’ve included an FAQ section where we’ll answer the most common questions about labor laws in Mississippi.

What are the labor laws in the State of Mississippi?

Mississippi uses both federal and state laws to regulate employment and labor. Here are some of the most important laws you must abide by in Mississippi:

- Fair Labor Standards Act (FLSA),

- Mississippi Employment Protection Act,

- Title VII of the Civil Rights Act,

- Family and Medical Leave Act (FMLA),

- The Equal Pay Act of 1963 (EPA),

- Consolidated Omnibus Budget Reconciliation Act (COBRA), and

- Mississippi Employment Fairness Act.

How long does an employer have to pay you after termination in Mississippi?

Employers aren’t required to pay their employees immediately after employment termination. They can pay the remaining wages and benefits to employees by the next scheduled payday.

Does Mississippi have to pay overtime after 40 hours?

Yes, employers in Mississippi are required to pay employees who work more than 40 hours per week an overtime rate of 1.5 times their regular pay rate.

What is considered wrongful termination in Mississippi?

Although Mississippi is an “at-will employment” state, employers can still commit wrongful termination if they terminate the employees’ contract for discriminatory reasons.

Is there maternity leave in Mississippi?

Yes, mothers in Mississippi are covered by the Family and Medical Leave Act, which allows them to take up to 12 weeks of unpaid leave to care for a newborn child unless they’re exempt.

Need a simple time clock for employees?

Clockify allows you to track time, attendance, and costs with just a few clicks — for FREE.

Your team can track work time personally via the web or mobile app, or you can set up a time clock kiosk from which employees can clock in and out.

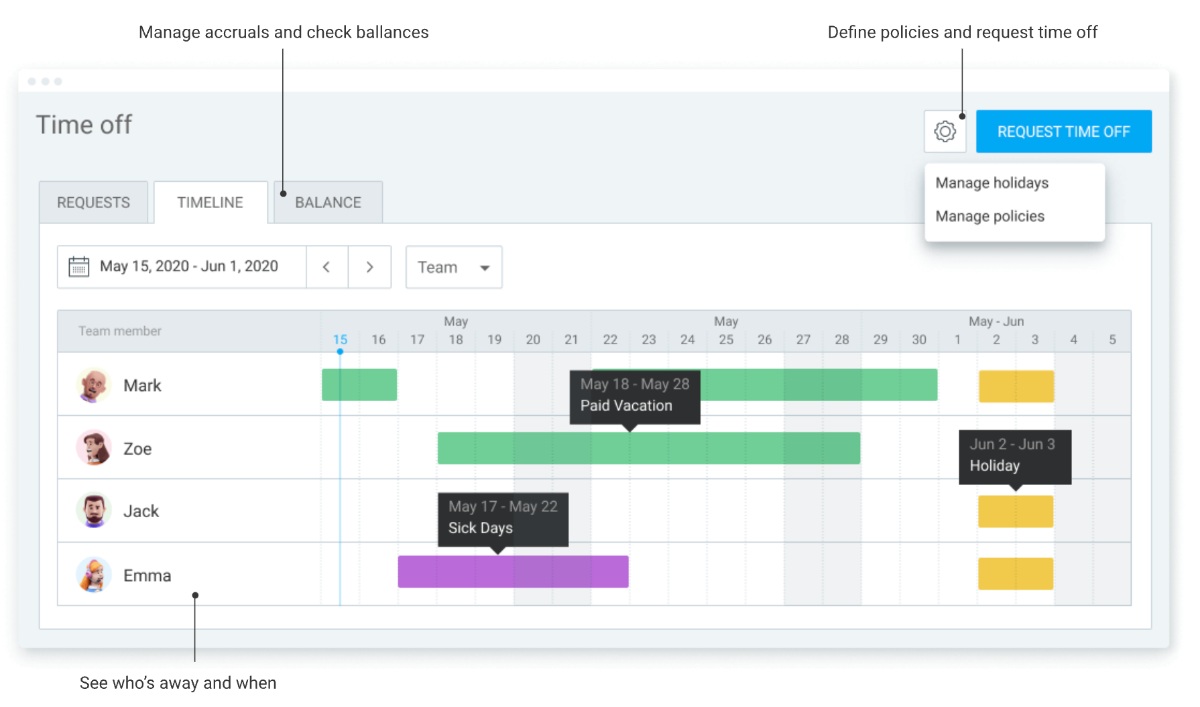

In addition, Clockify also has a time off feature, which your employees can use to take time off for holidays or any other type of leave. This way, you can always know who’s available and easily manage leave requests.

Later, you can approve timesheets and time off, schedule shifts, run time card reports, and export everything for payroll (PDF, Excel, CSV, link, or send to QuickBooks).

Conclusion/Disclaimer

We hope this Mississippi labor law guide has been helpful. Once again, we remind you to pay attention to the links we have provided, as most of them will lead you to the official websites and other relevant information.

Please note that this guide was written in Q2 2025, so any changes in the labor laws that were included later than that may not be included in this Mississippi labor laws guide.

We strongly advise you to consult with the appropriate institutions or certified representatives before acting on any legal matters.

Clockify is not responsible for any losses or risks incurred should this guide be used without further guidance from legal or tax advisors.