South Carolina Labor Laws Guide

Ultimate South Carolina labor laws guide: minimum wage, overtime, breaks, leave, hiring, termination, and miscellaneous labor laws.

| South Carolina Labor Laws FAQ | |

| South Carolina minimum wage | $7.25 |

| South Carolina overtime laws | 1.5 times the rate of regular pay after working 40 hours in a workweek ($14.50 per hour for minimum wage workers) |

| South Carolina break laws | Breaks not required by law |

South Carolina wage laws

Wage laws in South Carolina mostly rely on federal provisions, with one exception being wage rates for employees with disabilities.

For easier understanding, we’ve divided the South Carolina wage laws into the following subcategories:

- Minimum wage in South Carolina,

- Tipped minimum wage in South Carolina,

- Subminimum wage in South Carolina,

- Exceptions to the minimum wage in South Carolina, and

- South Carolina payment laws.

| MINIMUM WAGE IN SOUTH CAROLINA | ||

| Regular minimum wage | Tipped minimum wage | Subminimum wage |

| $7.25 | $2.13 | Training wage — $4.25 Student-learners — $6.16 |

South Carolina minimum wage

The state of South Carolina doesn’t have a state minimum wage law. Therefore, the federal minimum wage applies — as defined by the Fair Labor Standards Act (FLSA).

At the moment, the federal minimum wage for employees covered by the FLSA is $7.25 per hour.

Tipped minimum wage in South Carolina

Under US federal law, “tipped employees” are employees who regularly receive tips and earn at least 30$ a month in tips.

As South Carolina doesn’t have a state minimum wage law, tipped employees can be paid at the federal tipped minimum wage rate of $2.13 per hour.

The employer can pay the employee at this rate, as long as the direct wages combined with the tips amount to at least the federal minimum wage of $7.25. If this isn’t the case, the employer must cover the difference in pay.

Subminimum wage in South Carolina

Subminimum wage is any wage lower than the federal, state, or local minimum wage — whichever minimum wage rate applies to a given state.

Under FLSA laws, employers with special certificates could pay employees with disabilities a subminimum wage determined by a state agency and based on the employee’s output.

However, last year, South Carolina officials passed Senate Bill 533 to eliminate the subminimum wage for disabled employees.

One different type of subminimum wage is called a training wage. Under federal law, employers can pay this type of wage to employees under 20 during their first 90 days of employment.

The training wage rate in South Carolina is $4.25 per hour.

Lastly, we have the so-called Student-Learner Program, which allows employers to pay their employees who are full-time students at an 85% rate of the minimum wage requirement. This program puts the minimum wage rate for students at $6.16 per hour.

🎓 Track work hours and calculate hourly pay with Clockify

Exceptions to the minimum wage in South Carolina

As only the federal FLSA laws apply to South Carolina employees, here are some of the occupations that are exempt from minimum wage requirements under these laws:

- Farm workers,

- Seasonal workers,

- Newspaper deliverers,

- Casual babysitters,

- Elderly companions, and

- Executive, administrative, and professional employees whose wage exceeds $1,128 per week.

🎓 FLSA minimum wage exemptions

South Carolina payment laws

South Carolina doesn’t have any laws regulating the frequency at which employers must pay their employees.

However, employers must still establish regular paydays and inform employees of any changes in advance. The most common types of payrolls in the US are:

- Weekly,

- Bi-weekly,

- Semi-monthly, and

- Monthly.

South Carolina overtime laws

Regarding overtime provisions, South Carolina once again relies on the federal FLSA regulations.

According to these regulations, overtime is defined as all work exceeding 40 hours in a workweek.

The workweek is a regularly recurring period of 168 hours (split into 7 24-hour periods), which doesn’t necessarily correlate to usual time and weekdays.

All overtime work hours must be paid at the rate of 1.5 times the regular pay rate.

Overtime exceptions and exemptions in South Carolina

When it comes to overtime exemptions in South Carolina, some of them overlap with the minimum wage exemptions.

Here are the examples of occupations exempt from both the overtime and minimum wage requirements:

- Executive, administrative, and professional employees earning more than $1,128 per week,

- Farm workers,

- Seasonal workers,

- Babysitters,

- Seamen, and

- Newspaper delivery employees.

However, some professions are exempt from overtime provisions, such as:

- Commissioned employees,

- Computer professionals who earn at least $27.63 per hour,

- Airplane salespersons,

- Taxi drivers,

- Railroad employees, and

- Salespersons, mechanics, and partsmen in the automotive industry.

🎓 Track South Carolina overtime with Clockify

South Carolina break laws

No state or federal laws require South Carolina employers to provide meal breaks or rest periods during working hours.

However, if the employer does choose to provide breaks, they must follow these requirements:

- Rest periods lasting 20 minutes or less must be paid and calculated towards work hours, and

- Meal periods usually last longer than 20 minutes and can be unpaid if the employer releases the employee from all duties for their duration.

The federal law differentiates between rest periods up to 20 minutes (paid), compensable waiting time or on-call time (paid), and meal breaks over 20 minutes (unpaid).

South Carolina breastfeeding laws

Under the federal PUMP Act, South Carolina employers must provide additional break time for nursing mothers.

The employer must give the employee reasonable time and accommodation to express their breast milk.

In addition to more frequent breaks, employers must provide an adequate room for nursing mothers that satisfies the following requirements:

- The room’s shielded from view,

- The room’s free from public or coworker intrusion, and

- The room isn’t used as a bathroom.

The right to nursing breaks lasts up to 1 year after childbirth.

South Carolina leave requirements

Different US states have different rules when deciding whether a certain type of leave is required by law.

In this section of our South Carolina labor law guide, we’ll go over the required and non-required types of leave.

To make this easier to understand, we’ve broken down leave requirements in a table. So, below are the leave requirements according to South Carolina work laws.

| ✅ REQUIRED LEAVE |

|

Family and medical leave — Under the federal Family and Medical Leave Act (FMLA), some South Carolina employees are eligible for up to 12 weeks of unpaid leave in case of medical emergencies. Some situations that may qualify an employee for family and medical leave include:

As for the requirements the employees need to fulfill to be able to take the family and medical leave, federal law states that the employee must have worked for the same employer for at least:

Learn more about family and medical leave by reading the Family and Medical Leave Act FAQ. |

| ❌ NON-REQUIRED LEAVE |

|

Sick leave — No regulations require private South Carolina employers to provide sick leave to their employees unless the employer-employee contract states so. On the other hand, South Carolina public employees can accrue up to 15 annual days of sick leave. Up to 10 days of this leave can be used as family sick leave. |

| ✅ REQUIRED LEAVE |

|

Jury duty leave — Employers in South Carolina can’t threaten, discipline, or discharge an employee who chooses to attend jury duty. However, employers can ask their employees to use available vacation time to attend jury duty, and this time off doesn’t have to be paid. |

| ✅ REQUIRED LEAVE |

|

Witness leave — Private South Carolina employers may not prevent their employees from attending court cases for which they were subpoenaed. However, the employer doesn’t have to pay the employee for the duration of this absence. On the other hand, if a state employee has been subpoenaed to a litigation in which they don’t receive any personal gain, they’re entitled to paid leave. Additionally, the employee may retain any witness fee or travel expenses. |

| ❌ NON-REQUIRED LEAVE |

|

Bereavement leave — If this type of clause doesn’t exist in the employment contract, private employers in South Carolina aren’t required to provide bereavement leave to their employees. In most cases, if a clause exists, the general consensus is to offer 3-5 days for the death of an immediate family member and 1-2 days for the death of a close friend. However, state employees are allowed 3 days of paid bereavement leave following the death of an immediate family member. The employee must provide a statement to their supervisor containing the name of the deceased and the employee’s relationship to them. |

| ❌ NON-REQUIRED LEAVE |

|

Vacation and holiday leave — Private employees in South Carolina aren’t entitled to vacation or holiday leave unless otherwise stated in their contract. In contrast, full-time state employees receive accrued vacation leave at different rates, based on their workweek schedule and years of service:

|

| ✅ REQUIRED LEAVE |

|

Military leave — Under the federal Uniformed Services Employment and Reemployment Rights Act (USERRA), all members of the uniformed services are eligible for unpaid military leave. Employees can leave for deployment and be reinstated once they return. However, the following conditions must be met:

In addition to reinstatement, the employee is entitled to all the benefits and the level of seniority they held prior to the deployment. |

| ✅ REQUIRED LEAVE |

|

Bone marrow donation leave — Employees who work in establishments with 20 or more employees may be eligible for paid bone marrow donation leave. As a requirement, the employee must work an average of at least 20 hours per week, and the leave may not exceed 40 hours total — unless otherwise approved by the employer. The employer may also require that the employee provide verification by a physician regarding the purpose and length of the leave. |

| ❌ NON-REQUIRED LEAVE |

|

Voting time leave — South Carolina employers aren’t required to provide voting time off. Employees who live too far away from work to vote on time may be granted voting time leave. This leave can last a maximum of 2 hours and must be paid by the employer. |

| ✅ REQUIRED LEAVE |

|

Emergency response leave (state employees) — South Carolina state employees who are certified by the American Red Cross can take up to 10 calendar days per year of paid leave to participate in disaster relief. To do this, they must acquire the approval of their agency supervisor. |

| ✅ REQUIRED LEAVE |

|

Administrative leave (for state employees) — Employees who get hurt while performing their work duties must be placed on administrative leave instead of sick leave. This type of leave is paid but can’t exceed 180 calendar days. |

Child labor laws in South Carolina

When it comes to legal working hours for minors, South Carolina’s Office of Wages and Child Labor recognizes several age categories:

- Minors under 14,

- Minors aged 14 and 15, and

- Minors aged 16 and 17.

Minors under 14 years of age can’t be employed in non-agricultural occupations and can only work jobs not covered by the FLSA, such as newspaper delivery and acting.

South Carolina labor laws for minors aged 14 and 15

Minors aged 14 and 15 can work different hours depending on whether school is in session or not.

When school is in session:

- No work during school hours,

- No more than 3 work hours on a school day,

- No more than 18 hours in a school week, and

- Anytime from 7 a.m. to 7 p.m. on school days.

When school is notin session:

- Anytime from 7 a.m. to 9 p.m. while school is out of session,

- No more than 8 work hours on a non-school day, and

- No more than 40 hours in a non-school week.

South Carolina labor laws for minors aged 16 and 17

There are no particular restrictions on the work hours of minors aged 16 and 17. This means that minors of this age can work as many hours as they want in any occupation except for prohibited occupations.

Prohibited occupations for minors in South Carolina

The FLSA also regulates occupations prohibited to minors, which have been deemed too dangerous for minors under 18 years old to perform.

In South Carolina, some prohibited occupations for minors are the following:

- Working with explosives,

- Driving motor vehicles,

- Mining,

- Logging and sawmilling,

- Working in meat processing,

- Operating power-driven machinery,

- Working in excavation occupations,

- Manufacturing bricks and related products,

- Roofing, and

- Wrecking and demolition work.

🎓 FLSA Prohibited Occupations for Non-Agricultural Employees

Hiring laws in South Carolina

Under the South Carolina Human Affairs Law, job applicants have a right to a fair hiring process. As such, discrimination is prohibited on the basis of:

- Race or color,

- Religion,

- National origin,

- Sex,

- Age, and

- Disability.

These provisions prohibit South Carolina employers from refusing to hire or treat any job applicants or employees differently based on the above-mentioned characteristics.

The City of Columbia’s “Ban-the-Box” law

Across the US, many states have passed a “fair chance” hiring policy to give ex-offenders a better chance during the hiring process.

They did so by passing the so-called “Ban-the-Box” laws — which enable a fairer hiring process by:

- Prohibiting questions about the applicant’s criminal history during the initial job application, and

- Delaying background checks until later in the hiring process.

South Carolina doesn’t have such a “fair chance” hiring policy at the state level. However, the City of Columbia passed this type of law in 2014, which applies to all employees within city limits.

Specifically, this law prevents employers from asking about the applicant’s criminal history before a “conditional job offer.”

This offer can be rescinded after the criminal background check results.

🎓 City of Columbia Ban-the-Box law FAQ

Termination laws in South Carolina

South Carolina is one of many US states that use the “at-will employment” principle. This means that both the employer and the employee can terminate the employment contract at any time.

Additionally, neither party needs to provide a particular reason for the termination.

South Carolina at-will employment laws also apply to private business employees unless otherwise specified in their contract with the employer.

Final paycheck in South Carolina

Upon termination, employers must pay the employees their final paycheck within the following time period:

- Within 48 hours of the time of termination, and

- On or by the next regularly scheduled payday, without exceeding 30 days from the date of separation.

COBRA and South Carolina Mini-COBRA laws

South Carolina employees may be eligible for continued health insurance under the provisions of the federal Consolidated Omnibus Budget Reconciliation Act (COBRA).

This insurance is provided for employees who experience termination or are going through some other highly stressful life event, such as:

- A significant reduction in work hours,

- A divorce,

- A serious health issue that makes the employee unable to work, and

- A family member with serious health issues.

COBRA laws cover employers with 20 or more employees and may allow the continuation of health insurance for up to 36 months.

This insurance is usually priced at 102% of the original cost.

Smaller businesses (those with fewer than 20 employees) are covered by the South Carolina Mini-COBRA, which allows continued insurance for up to 6 months.

🎓 South Carolina Mini-COBRA law

Occupational safety in South Carolina

Workplace security standards and practices fall under the jurisdiction of the federal Occupational Safety and Health Administration (OSHA).

OSHA conducts workplace inspections to ensure all of its requirements are being followed.

All workplace injuries and fatalities should be reported to the South Carolina branch of OSHA.

Miscellaneous South Carolina labor laws

Lastly, we provide a brief overview of miscellaneous South Carolina labor laws that don’t strictly fit into the previously mentioned categories, including:

- Whistleblower protection laws,

- Background check laws,

- Drug and alcohol testing laws, and

- Record-keeping laws.

Whistleblower protection laws

South Carolina’s whistleblower laws provide a certain level of protection to all employees who report suspected or witnessed violations of state or federal laws.

These laws prohibit employers from discharging, threatening, or in any other way retaliating against a whistleblower.

However, employees must file the whistleblower report in good faith — otherwise, the protection doesn’t apply.

Background check laws

When conducting a background check, South Carolina employers must follow the regulations provided in the federal Fair Credit Reporting Act (FCRA).

Before collecting employee background data, employers need to provide written notice in advance.

As mentioned in the section on South Carolina’s “Ban-the-Box” law, employers can’t ask about the applicant's criminal history during the initial application.

However, some occupations where criminal background checks are required include the following:

- Child care center staff (including family and religious child care centers),

- Charter school personnel,

- Direct care providers,

- Police officers,

- Private investigators, and

- Firefighters.

Drug and alcohol testing laws

There are no laws in South Carolina that prohibit employers from testing their employees for the presence of drugs or alcohol.

Record-keeping laws

South Carolina Code requires that employers keep accurate and permanent employee records, including the following:

- Name,

- Address,

- Wages for each payday, and

- Deductions.

All employee records must be kept for at least 3 years in a place that is easily accessible in case of an inspection.

Frequently asked questions about labor laws in South Carolina

To make this guide as detailed as possible, we’ve included an FAQ section where we’ll answer the most common questions about South Carolina labor laws.

Are 15-minute breaks required by law in South Carolina?

No, there are no break requirements for employers in South Carolina. However, it’s up to the employer to choose whether to implement breaks under their own policies. If they do, they’re lawful and legal and, therefore, valid in the eyes of the court.

Is it illegal to not pay overtime in South Carolina?

Yes, it is. Federal law protects employees who work more than 40 hours per week, and employers are required to pay them 1.5 times their regular rate of pay for overtime hours.

What are my rights as an employee in South Carolina?

Employees in South Carolina are protected by both federal and state laws. Every employee has the right to a minimum wage, leaves, overtime pay, and more. Here are some of the most important South Carolina labor laws you should know about:

- Fair Labor Standards Act (FLSA),

- Family and Medical Leave Act (FMLA),

- Consolidated Omnibus Budget Reconciliation Act (COBRA),

- Fair Credit Reporting Act (FCRA), and

- South Carolina Human Affairs Law.

Is South Carolina a right-to-work state?

Yes, South Carolina is a right-to-work state. This means that employers can’t force employees to join union organizations or retaliate against employees who refuse to do so.

Need a simple time clock for employees? Try Clockify

Clockify allows you to track time, attendance, and costs for FREE with just a few clicks.

Your team can track work time personally via the web or mobile app, or you can set up a time clock kiosk from which employees can clock in and out.

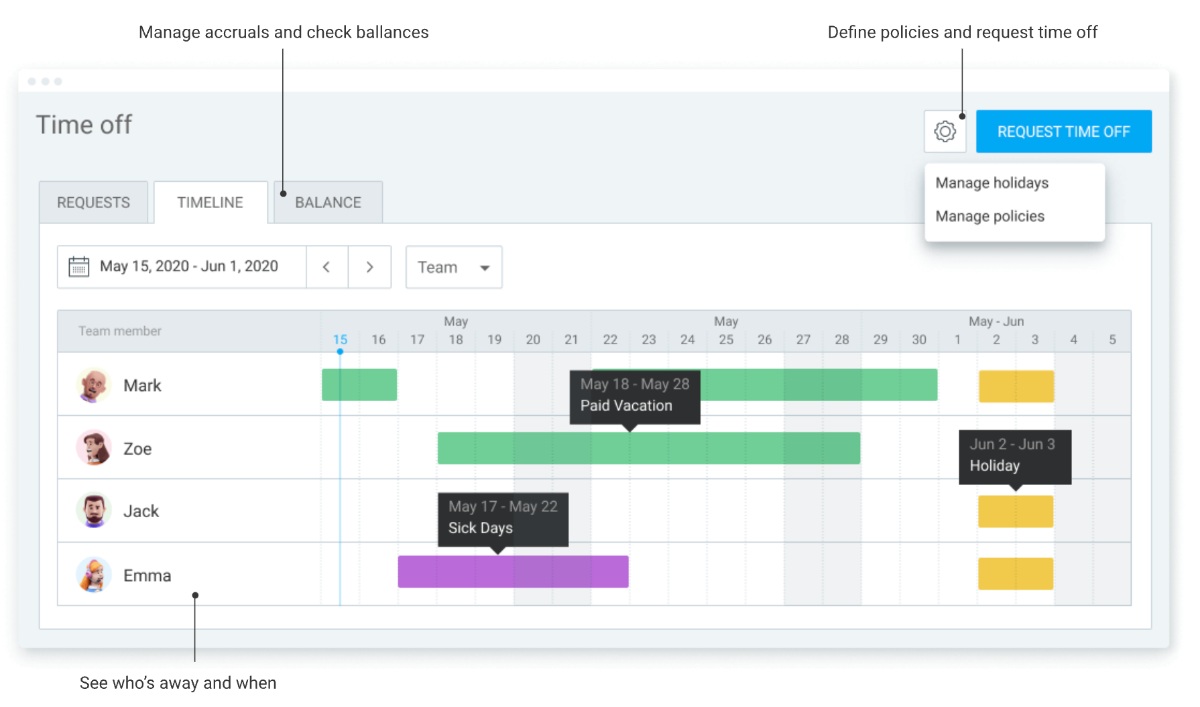

In addition, Clockify helps you stay compliant with South Carolina labor laws with its time off feature.

This feature lets you see when your employees are available and approve their leave requests.

You can also approve timesheets, schedule shifts, run time card reports, and export everything for payroll (PDF, Excel, CSV, link, or send to QuickBooks).

Conclusion/Disclaimer

We hope this South Carolina labor law guide has been helpful. We advise you to pay attention to the links we have provided, as most of them will lead you to the official government websites and other relevant information.

Please note that this guide was written in Q2 2025, so any changes in the labor laws that were included later than that may not be included in this South Carolina labor laws guide.

We strongly advise you to consult with the appropriate institutions or certified representatives before acting on any legal matters.

Clockify isn’t responsible for any losses or risks incurred should this guide be used without further guidance from legal or tax advisors.