Texas Labor Laws Guide

| Texas Labor Laws FAQ | |

| Texas minimum wage | $7.25 |

| Texas overtime | 1.5 X the regular wage for any time worked over 40 hours/week($10.87 for minimum wage workers) |

| Texas breaks | Breaks not required by law (see below for exceptions) |

Both federal and state laws apply concerning employment laws in the state of Texas.

In this Texas labor laws guide, we will be looking at the following areas:

- Wages, overtime, and breaks,

- Leave requirements,

- Child labor laws,

- Hiring and termination laws,

- Occupational safety laws, and

- Miscellaneous labor laws.

Texas wage laws

Since Texas doesn’t have state laws concerning wages — federal laws apply instead.

Thanks to the US Department of Labor (DOL), all employers in the US are liable for paying their employees at least the federal minimum wage — unless exempt. The same applies to Texas employers.

The following are wage regulations regarding:

- State minimum wage,

- Tipped hourly wage, and

- Subminimum wage in Texas.

| TEXAS MINIMUM WAGE | ||

| Regular minimum wage | Tipped minimum wage | Subminimum wage |

| $7.25 | $2.13 | Applies to a certain group of employees (see below) |

Texas minimum wage

We have already said that Texas adopted federal law concerning the minimum wage rate. Therefore, the minimum wage for non-exempt employees in Texas is $7.25 per hour of work.

Exceptions to the minimum wage in Texas

When it comes to exemptions from the minimum wage, federal and state laws overlap.

Under the Fair Labor Standards Act (FLSA), employees who are exempt from the minimum wage are:

- Executive, professional, and administrative employees paid on a salary basis and who earn not less than $1,128 a week,

- Computer employees who earn not less than $1,128 per week or $27.63 an hour,

- Highly compensated employees who earn $151,164 per year or more,

- Farm workers,

- Employees in fishing industries,

- Seasonal and recreational workers, etc.

🎓 More FLSA minimum wage exemptions

Meanwhile, Texas minimum wage exemptions include:

- Religious, educational, charitable, or nonprofit organization employees,

- Professionals, salespersons, or public officials,

- Domestic workers,

- Certain youths and students,

- Inmates who are employed while imprisoned in the institutional division of the Texas Department of Criminal Justice or local jails,

- Family members working for a family business (refers to the employer’s brother, sister, brother-in-law, sister-in-law, child, spouse, parent, son-in-law, daughter-in-law, ward, or person in loco parentis to the employee),

- Amusement and recreational establishment employees,

- Non-agricultural employers not liable for state unemployment contributions,

- Dairy farming and production of livestock, and

- Sheltered workshops for people with disabilities.

Tipped minimum wage in Texas

Any employee in the state of Texas who receives more than $20 in tips per month is considered a tipped employee under the federal law on minimum wages for tipped employees.

Tipped employees in Texas receive $2.13 per hour.

Since $2.13 per hour is below the federal minimum wage, tipped employees must make at least $7.25 per hour when the hourly wage and tips are combined.

If this isn’t the case, the employer is liable for making up the difference.

Subminimum wage allows employers to pay certain employees a wage that is less than the minimum wage.

Texas subminimum wage may be paid to persons who are:

- Patients or clients of the Texas Department of Mental Health and Mental Retardation,

- Mentally impaired, i.e., their productive capacity is weakened,

- Assistants in operating the facility as part of their therapy,

- Youths (children under age 18) entitled to $4.25/hour, and

- Trainees in a sheltered workshop or similar program.

Texas payment laws

When it comes to the frequency of wage payments, Texas employers must make payments to non-exempt employees at least twice per month on designated paydays.

If the employer fails to determine the payment days, paydays will automatically be the 1st and 15th days of each month.

At the same time, those employees who are exempt under the FLSA must be paid at least once a month.

Texas overtime laws

Non-exempt Texas employees are entitled to overtime pay at a rate of one and one-half (1.5) times the regular rate of pay for hours worked in excess of 40 in a seven-day workweek.

Overtime exceptions and exemptions in Texas

Contrary to the said regulations, exempt employees are not eligible for overtime.

The following are employees who are exempt from overtime pay under Texas law:

- Executive, administrative, professional, and computer employees,

- Outside sales representatives,

- Amusement and recreational employees,

- Some agricultural employees of small farms or family-owned farms,

- Employees of certain small local newspapers,

- Some babysitters or companions for the elderly,

- Seamen on vessels other than American vessels, and others.

Even though registered nurses paid on an hourly basis are entitled to overtime under federal law, a hospital may not demand a nurse to work mandatory overtime. Likewise, a nurse may refuse to work extra hours.

Still, in the event of a healthcare disaster, such as the outbreak of a contagious disease, said regulations don’t apply.

Fluctuating Workweek Method (FWW) in Texas

Even though federal law proposes that employees who earn a fixed salary are exempt from overtime, there is an exception to this rule.

Under the Fluctuating Workweek Method (FWW), certain employees who receive a fixed salary have the right to overtime pay of one-half (0.5) times their regular hourly rate.

However, having a fixed salary isn’t the only condition to qualify for overtime pay under FWW. Eligible employees must have a fluctuating workweek — hence the name of the workweek method — meaning they sometimes work more or less than 40 hours a week.

What’s more, such employees’ minimum hourly wage must equal $7.25 per hour.

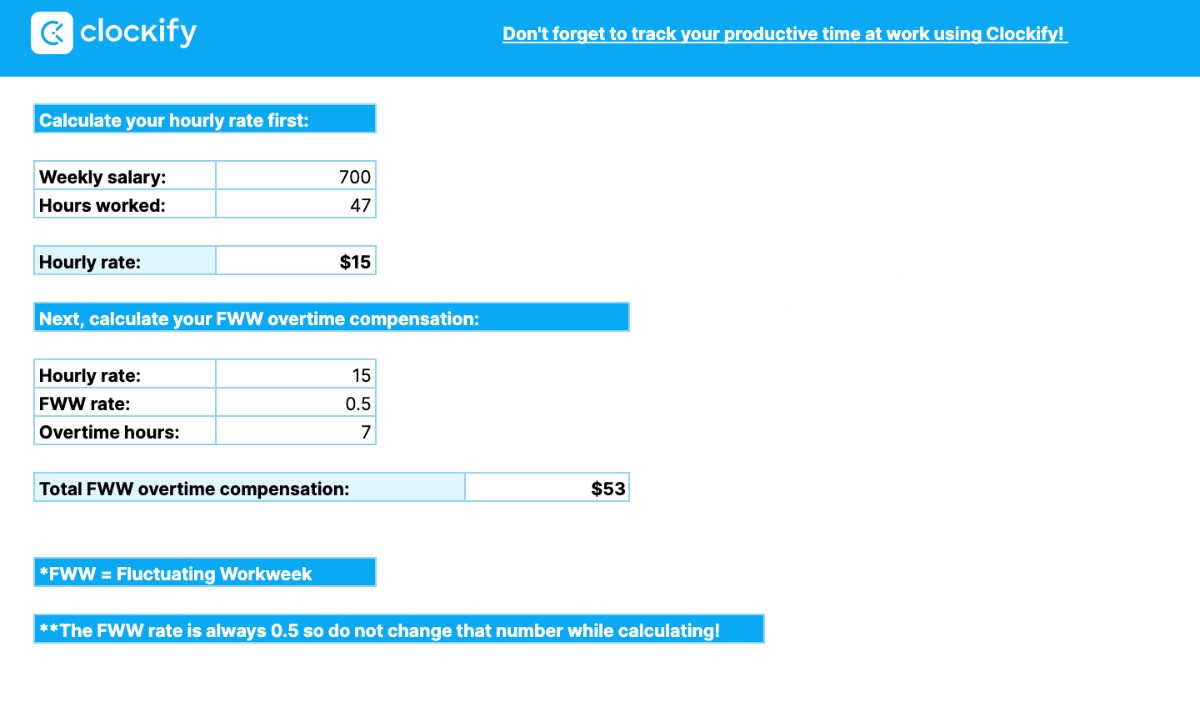

Take a look at the following example to see how the Fluctuating Workweek Method (FWW) works in practice:

An employee’s weekly income is, for instance, $1,050.

In the preceding week, the employee worked 48 hours.

To be able to calculate overtime hours, calculate the hourly rate first.

Simply divide the weekly salary by the number of hours worked for that week.

$1,050 / 48 = $22 per hour

Next, multiply the hourly rate by 0.5 for every overtime hour during a week.

$22 per hour x 0.5 = $11 for each overtime hour worked

Total overtime compensation goes as follows:

$11 x 8 overtime hours = $88

🎓 Fluctuating Workweek Calculator

🎓 How to Cope With Working Long Hours

Texas break laws

Neither federal nor state law obliges an employer to provide rest or meal breaks to its employees. Such benefits are left to the employer’s discretion.

Exceptions to break laws in Texas

When breaks are given, employers must comply with the following provisions on break and meal periods:

- Breaks lasting 20 minutes or less (such as a coffee break) must be paid,

- Meal breaks lasting 30 minutes or longer are not paid, and employees are fully relieved of their duties during that time, and

- If an employee must work during a meal break (e.g., call agents), such breaks are compensable.

Moreover, construction workers in Austin must be provided with a rest break of at least 10 minutes for every 4 hours worked.

However, employers are advised to offer breaks of any kind to their employees to foster a healthy and productive environment in the workplace.

🎓 Getting started with the Pomodoro technique

Texas breastfeeding laws in the workplace

Texas doesn’t have any state ordinances in terms of breastfeeding in the workplace.

For that reason, non-exempt breastfeeding employees are protected under federal law, which further states:

- Breastfeeding employees must have a “reasonable break time” to express milk each time they have a need to do so,

- Such breaks are available up to one year after the child’s birth,

- Breastfeeding employees must be provided with a separate room for the purpose of expressing milk — restrooms don’t qualify as such separate rooms, and

- Such breaks are not compensable.

Texas leave requirements

In the state of Texas, there are 2 types of leave days:

- Required leave, and

- Non-required leave.

Let’s discuss each type in more detail.

Texas required leave

The following are leave benefits that Texas employers must provide to their employees. Such benefits mostly refer to employees employed in public offices, including:

- Sick leave (public employers),

- Family and Medical Leave Act (FMLA),

- Parental leave for certain employees,

- Holiday leave (public employers),

- Vacation leave (public employers),

- Emergency leave (public employers),

- Military leave (public employers),

- Volunteering leave (public employers),

- Administrative leave (public employers),

- Voting leave (public employers),

- Jury duty leave,

- Organ or bone marrow donor leave (public employers), and

- Blood donor leave (public employers).

Sick leave (public employers)

State employees in Texas are eligible for paid sick leave. Such employees may start accruing sick leave on the first day of state employment.

Full-time employees may accrue 8 hours of sick leave for each month of employment. Contrarily, part-time employees accrue sick leave on a proportionate basis.

However, to start accruing days, eligible employees must have worked at least 20 hours per week for at least 4 and a half months.

Such leave is paid, and eligible employees may use it in the following circumstances:

- Sickness,

- Injury,

- Pregnancy,

- Confinement, and

- Caring for a sick immediate family member (spouse, child, or parent).

Still, if an employee wants to take more than 3 days of paid sick leave, they must obtain a doctor’s certificate stating the reason for the employee’s absence.

Moreover, parents who have children attending nursery school through 12th grade are eligible for an additional 8 hours of sick leave each year. They may use that time off to attend educational activities such as a classroom program, field trip, music or theater program, etc.

Family and Medical Leave Act (FMLA)

The Family and Medical Leave Act (FMLA) is a federal law that offers eligible employees up to 12 weeks of unpaid leave per year.

To qualify for FMLA, employees must have worked for their employer for at least 12 months (or 1,250 hours) in the last 12-month period.

Who can use the FMLA?

Eligible employees include:

- All state employees,

- Public and private elementary or secondary school employees, and

- Employees working in companies with 50 or more employees.

When to use the FMLA?

Reasons for taking time off under the FMLA include:

- Birth or care for a newborn child,

- Adopting or taking in a foster child,

- Caring for an immediate family member (child, spouse, or parent) due to a serious health condition, and

- The employee’s serious health condition.

However, under Texas law, the employee must first use all available paid vacation and sick leave before taking the FMLA leave of absence.

Parental leave for certain employees

Unlike the FMLA, state employees who have worked less than 12 months (or 1,250 hours in a 12-month period) are eligible to take parental leave. Such leave isn’t paid and must not exceed 12 weeks.

Yet, similarly to the FMLA leave, employees must first spend all available paid vacation and sick leave to be able to use the parental leave benefits.

Parental leave becomes valid on the date of birth of a natural child or the adoption or foster care placement — provided that the foster child is younger than 3 years of age.

Holiday leave (public employers)

Texas state employees, including temporary, part-time, and hourly employees, are entitled to a paid day off during a holiday.

Moreover, eligible employees may get a paid day off before or after a holiday — or on both days, provided that those days are workdays.

Still, employees don’t receive a leave of absence if:

- A holiday falls on a Saturday or Sunday, or

- The General Appropriations Act prohibits public offices from observing a holiday.

The following are national holidays in Texas when eligible employees get time off from work:

- New Year’s Day (January 1st),

- Martin Luther King, Jr. Day (third Monday in January),

- Presidents' Day (third Monday in February),

- Memorial Day (last Monday in May),

- Independence Day (fourth day of July),

- Labor Day (first Monday in September),

- Veterans Day (eleventh day of November),

- Thanksgiving Day (fourth Thursday in November), and

- Christmas Day (25th of December).

Next are state holidays of Texas when eligible employees get time off from work:

- Confederate Heroes Day (nineteenth day of January),

- Texas Independence Day (second day of March),

- San Jacinto Day (twenty-first day of April),

- Emancipation Day in Texas (nineteenth day of June),

- Lyndon Baines Johnson Day (twenty-seventh day of August),

- Friday after Thanksgiving Day,

- The twenty-fourth day of December, and

- The twenty-sixth day of December.

Finally, optional holidays in the state of Texas include:

- Rosh Hashanah,

- Yom Kippur, and

- Good Friday.

An employee may decide to give up a state holiday — provided that it doesn’t fall on a Saturday or Sunday and that the General Appropriations Act doesn’t prohibit from observing — and receive a paid day off on each day of an optional holiday.

However, a state employee must not give up the Friday after Thanksgiving or the 24th or 26th day of December.

Finally, state agencies and higher education institutions in Texas must have enough employees on duty during a state holiday.

Vacation leave (public employers)

Texas state employees (except for higher education employees, faculty members, and instructional employees employed less than 12 months) qualify for paid accrued vacation leave.

The following is the vacation leave accrual schedule concerning full-time employees*:

| Years of service | Hours accrued per month | Maximum hours carried forward from one fiscal year to the next |

| Less than 2 | 8 | 180 |

| 2 but less than 5 | 9 | 244 |

| 5 but less than 10 | 10 | 268 |

| 10 but less than 15 | 11 | 292 |

| 15 but less than 20 | 13 | 340 |

| 20 but less than 25 | 15 | 388 |

| 25 but less than 30 | 17 | 436 |

| 30 but less than 35 | 19 | 484 |

| 35 or more | 21 | 532 |

*Part-time employees accrue vacation leave on a proportionate basis.

Eligible employees may start accruing sick leave from the first day of state employment — but must be employed for 6 continuous months to be able to take days off.

Emergency leave (public employers)

Emergency leave is taken due to a death in the employee’s family.

State employees are entitled to paid time off in the event of the death of the employee’s spouse, parent, brother, sister, grandparent, grandchild, or child.

Military leave (public employers)

Eligible persons are entitled to a paid leave of absence of up to 15 days a year (from October 1st to September 30th) to serve in the military or authorized training.

Such persons include public officers or employees of Texas, a municipality, county, or another political subdivision who are members of:

- Texas military forces,

- Reserve components of the federal armed forces, or

- A state or federal urban search and rescue team.

In case of a disaster, said employees or officers are entitled to a paid leave of absence (up to 7 days in a year) and relief of duty for each day such person is called to active duty during the disaster.

Volunteering leave (public employers)

State employees who are volunteer firefighters, emergency medical services volunteers, or search and rescue volunteers are granted a paid leave of absence of up to 5 working days per year.

Such leave is taken in case of emergency training practices or to respond to emergencies such as fire, medical, or search and rescue.

Administrative leave (public employers)

Such leave may be granted to employees as a reward for outstanding performance at work.

Eligible employees receive up to 32 hours of paid absence a year.

Voting leave (public employers)

All state agencies are obliged to offer their employees sufficient time off with pay to vote in a national, state, or local election.

Jury duty leave

All employees must be excused from work to respond to a jury duty summons.

Yet, under Texas law, employers are not obligated to compensate for hours not worked because of performing jury duty.

Organ or bone marrow donor leave (public employers)

State employees who are volunteer organ or bone marrow donors receive the following benefits:

- Paid leave of absence of up to 5 working days per year for donating bone marrow, or

- Paid leave of absence of up to 30 working days for donating an organ/organs.

Blood donor leave (public employers)

Blood donors — applicable to state employees — are entitled to sufficient time off with pay to donate blood.

Yet, eligible employees must obtain approval from the supervisor before taking time off.

Such leave is limited to 4 times in a fiscal year.

Texas non-required leave

In the state of Texas, most leave benefits for private employees are left to the employer’s discretion.

When granted, leaves may be paid or unpaid.

Child labor laws in Texas

With regard to child labor provisions in Texas, employees under 18 years of age are covered.

However, under Texas law, minors under the age of 14 are not allowed to work (except when working for a business owned by a parent or legal custodian or as actors and performers).

Child labor laws in Texas offer minors a chance to earn money. At the same time, employers must make sure minors work in a hazard-free environment and don’t neglect school.

The following are child labor provisions in Texas regarding:

- Hour restrictions,

- Break periods, and

- Prohibited occupations.

Work time restrictions for Texas minors

In Texas, work-hour restrictions for minors only apply to those between the ages of 14 and 15 — state and federal laws overlap.

Time restrictions for minors aged 14 and 15 under Texas law include:

- May work no more than 8 hours a day and 48 hours a week,

- May not work before 5 a.m. and after 10 p.m. following a school day, and

- May not work after midnight on a non-school day.

Time restrictions for minors aged 14 and 15 under federal law:

- May not work during school hours,

- May work no more than 8 hours a day and 40 hours a week on non-school days,

- May work no more than 3 hours a day and 18 hours a week on school days, and

- May work between 7 a.m. and 7 p.m. during the school year (except between June 1st and Labor Day, when they may work 2 hours longer, from 7 a.m. to 9 p.m.).

Under Texas law, authorities may approve a hardship waiver if they determine that a child is in hardship. When approved, the child is no longer subject to hour limitations.

Breaks for Texas minors

As for rest or meal periods for Texas minors — neither state nor federal laws oblige an employer to provide minors with such breaks.

Prohibited occupations for Texas minors

In Texas, jobs that are considered forbidden and hazardous in child labor are divided into 2 groups:

- Prohibited occupations for 14 and 15-year-olds, and

- Prohibited occupations for 16 and 17-year-olds.

Prohibited occupations for 14 and 15-year-olds

Texas minors aged 14 or 15 are not allowed to be employed in the following occupations:

- Manufacturing, mining, or processing occupations,

- Operating or tending hoisting apparatus or any other power-driven machinery other than office machines,

- Operating motor vehicles,

- Warehousing and storage,

- Cooking and baking — including operating deep fryers, electric or gas ovens, etc.,

- Warehouse occupations (except for office and clerical work),

- Construction, etc.

Prohibited occupations for 16 and 17-year-olds

Furthermore, minors aged 16 and 17 in Texas are not allowed to work in the following occupations (except for the occupations marked with an asterisk (*), which apply to 16 and 17-year-olds employed as apprentices or student learners:

- Manufacturing or storing explosives,

- Operating motor vehicles,

- Coal mining,

- Logging and sawmill operations,

- *Operating or assisting to operate power-driven hoisting apparatus such as elevators, cranes, derricks, hoists, and high-lift trucks,

- *Operating or assisting to operate power-driven bakery machines,

- Manufacturing brick, tile, and kindred products,

- *Operating or assisting to operate power-driven woodworking, metal forming, punching, shearing, meat processing, or paper-products machines, balers, compactors, circular saws, band saws, guillotine shears, abrasive cutting discs, reciprocating saws, chain saws, and woodchippers, and

- *Roofing and excavation operations.

🎓 Extensive list of prohibited jobs for Texas minors

Texas hiring laws

It’s considered an unlawful employment practice if an employer, employment agency, labor organization, or training program fails or refuses to hire, limits, segregates, classifies, or discriminates in any other manner against an individual based on their:

- Race,

- Color,

- Disability,

- Religion,

- Sex,

- National origin, and

- Age (applies to individuals aged 40 and over).

Texas law against employment discrimination applies to private employers with 15 or more employees and all state and local governmental entities, regardless of their number of employees.

Moreover, Texas law protects employees from retaliation discrimination. Therefore, it’s considered an unlawful employment practice if an employer takes adverse action against an individual who files a workplace discrimination complaint or participates in the investigation of a discrimination complaint.

Right-to-work law in Texas

Texas is another right-to-work state. This means that an employee may not be denied or conditioned on employment based on their membership or non-membership in a labor union or organization.

Furthermore, no employer, officer, agent, representative, or member of a labor union may receive or demand fees from a non-union member as a condition for employment.

Under Texas law, “workers must be protected without regard to whether they are unionized; The right to work is the right to live.”

Texas termination laws

Texas employers may terminate their employees at any time and for any reason or no reason at all. This employment law is called employment-at-will.

Similarly, under this law, employees in Texas can quit their jobs at any time and for any reason or no reason at all.

However, there are exceptions to this rule. It’s considered “wrongful discharge” if an employer discharges an employee based on:

- Race, color, religion, gender, pregnancy, age, national origin, or disability,

- Veteran status,

- Sexual orientation,

- Filing a claim or bringing suspected wrongdoing to the attention regarding employment discrimination, OSHA standards, wages, etc.,

- Military duty,

- Jury duty,

- Voting, and

- Union membership.

Texas final paycheck

Based on Texas law, at the time of work separation, the employer must:

- Make a final wage payment within 6 calendar days if an employee has been discharged, or

- Make a final wage payment not later than the next regularly scheduled payday when an employee resigns.

Health insurance continuation in Texas

Even after employment termination, eligible employees and their dependents are still legally allowed to use health insurance under the Consolidated Omnibus Budget Reconciliation Act (COBRA).

COBRA is a federal law that covers employers with 20 or more employees and provides health insurance for 18 to 36 months following the work termination.

In addition, there is also a state insurance continuation under Texas law. So, if an employee or their dependent isn’t eligible for COBRA (or has exhausted their COBRA coverage), they are subject to their former employer’s health plan for another 9 months.

If they have exhausted their COBRA coverage, they are entitled to an additional 6 months of health insurance coverage.

Still, Texas insurance continuation only applies to group health benefit plans (this doesn’t include self-funded ERISA healthcare plans).

Occupational safety in Texas

The federal Occupational Safety and Health Act (OSHA) ensures that Texas employees work in a healthy and hazard-free working environment.

Thanks to OSHA’s safety standards and regulations, workplace accidents and tragedies are kept to a minimum.

Still, OSHA only applies to private employers and their employees.

Under OSHA, the hazards are grouped as follows:

- Biological hazards — Mold, pests, insects, etc.,

- Chemical and dust hazards — Pesticides, asbestos, etc.,

- Work organization hazards — Stress triggers (e.g., workplace violence, excessive workload, and similar),

- Safety hazards — Slips, trips, falls, etc.,

- Physical hazards — Noise, radiation, temperature extremes, etc., and

- Ergonomic hazards — Repetition, lifting, awkward postures, etc.

The Texas Occupational Safety and Health Consultation (OSHCON) program helps private employers recognize and eliminate workplace hazards and maintain a hazard-free working environment. Thanks to this program, fewer occupational injuries and illnesses are reported each year.

Miscellaneous Texas labor laws

We have decided to add a few more laws concerning labor and placed them in the miscellaneous section, including:

- Whistleblower laws, and

- Record keeping laws.

Let’s explore more.

Texas whistleblower laws

Whistleblower laws prohibit retaliation, such as pay cuts, dismissal, or any other adverse employment action, against an employee who “blows the whistle” — i.e., reports illegal activity to the authorities.

In the same manner, the Texas Whistleblower Act protects public employees who, in good faith, report a violation of law to an appropriate law enforcement authority (reporting a violation to a supervisor isn’t considered an appropriate law enforcement authority).

In case a public employee has been affected by an adverse employment action (wrongfully suspended, dismissed, etc.), such an employee has the right to sue a state or local governmental entity for:

- Injunctive relief,

- Actual damages,

- Court costs, and

- Reasonable attorneys fees.

In addition, a damaged employee is entitled to reinstatement to their former position and all wages and fringe benefits lost during the period of absence.

If a public employee believes that they have been discriminated against for being a whistleblower, such an employee must initiate their district’s grievance procedure within 90 days after the alleged incident.

A supervisor who takes an adverse employment action against a public employee may be liable for a civil penalty of up to $15,000.

Texas recordkeeping laws

Regarding the retention of personnel records in Texas, there are specified periods of time for different types of records that must be kept by each employer.

Said records include:

- Compensation records — Payroll and other compensation records together with unemployment tax records for at least 4 years.

- Family and Medical Leave (FMLA) records — Payroll, benefits, and leave-related documents for at least 3 years after the conclusion of the leave.

- I-9 records — For at least 3 years after the date of hire or 1 year after the date of separation, whichever is reached later.

- Hiring records — All hiring-related records for at least 1 year after the date of hire.

- Disability-related records (ADA) — For at least 1 year after the date the document was created or the personnel action was taken, whichever comes later.

- Benefit-related information (ERISA and HIPAA) — For at least 6 years after the date of document creation.

- Age-discrimination documentation (ADEA) — Payroll records for at least 3 years and documents concerning personnel actions for at least 1 year.

- OSHA records — For at least 5 years.

- Hazardous materials records — For at least 30 years after the date of employment separation.

- State discrimination laws — For at least 1 year after the date of separation.

- IRS payroll tax-related records — For at least 4 years following the period covered by records.

Moreover, under FLSA, records regarding non-exempt employees must be kept for at least 3 years — said records include:

- Name, address, birthday (if younger than 19), and sex,

- Occupation,

- Hours worked each day and week,

- Exact time and day of the week when the employee’s workweek begins,

- Basis on which the employee’s wages are paid (e.g., $12 per hour or $400 per week),

- Hourly pay rate,

- Total overtime earnings,

- Additions or deductions from the employee’s wages,

- Total wages paid each pay period, and

- Date of payment and the pay period.

Since federal recordkeeping laws require payroll records to be kept for at least 3 years, the state law requiring at least 4 years prevails.

In general, the law with the “stricter” or “more beneficial” provisions for the employee (in this case, the state law of Texas) will always overpower the one with the “weaker” or “less beneficial'' provisions (in this case, the federal law).

Frequently asked questions about Texas labor laws

In case we haven’t answered some of your questions about living and working in Texas, here’s an additional section with extra information.

What are the labor laws of Texas?

Labor laws in Texas (and any other state) regulate the rights and responsibilities of employees and employers in the workplace.

Labor laws in Texas may include (not limited to) laws regarding:

- Hourly wages and overtime hours (including exceptions),

- Payment laws,

- Leave requirements,

- Child labor,

- Hazardous jobs,

- Recordkeeping laws, and others.

By following such laws, employees can work safely and without discrimination, while businesses ensure smooth operation.

How many hours straight can you legally work in Texas without a break?

Neither federal nor Texas law obligates an employer to provide their employees with rest or meal periods during a work day. Still, if an employer provides a break lasting 20 minutes or less, such a break must be paid. Breaks that last more than 20 minutes don’t have to be paid.

Can you be fired without warning in Texas?

Yes. Since Texas is an at-will state, an employer can terminate an employment contract at any time and for any reason or no reason at all. However, no employee may be fired based on race, color, veteran status, sexual orientation, etc.

Is it illegal to not pay employees on time in Texas?

Texas employers are required to pay their employees on scheduled paydays at least twice a month. In case your employer owes you wages, you can file a wage claim within 180 days from the date you were supposed to be paid.

How many days straight can you legally work in Texas?

Workers in Texas (including 16 and 17-year-olds) can work an unlimited number of hours each day, 7 days a week. Still, retail workers must be provided at least 1 day off each week. Employers are required to pay overtime to non-exempt employees for working more than 40 hours per week.

What is the hourly law in Texas?

Since there’s no state law regarding hourly wages in Texas, employees must be paid the federal minimum wage, which is $7.25 for each hour worked.

What is the blacklist law in Texas?

The blacklist law in Texas states that it’s illegal for a person or entity to blacklist an employee who has been discharged to try to prevent them from getting a new job. This includes conspiring to blacklist or communicating with others to stop someone from obtaining employment. Penalties may include a fine, jail time, or both.

Use Clockify to stay compliant with Texas labor laws

Even though it may sound difficult to stay compliant with all the said laws and regulations, Clockify can definitely make the situation much easier.

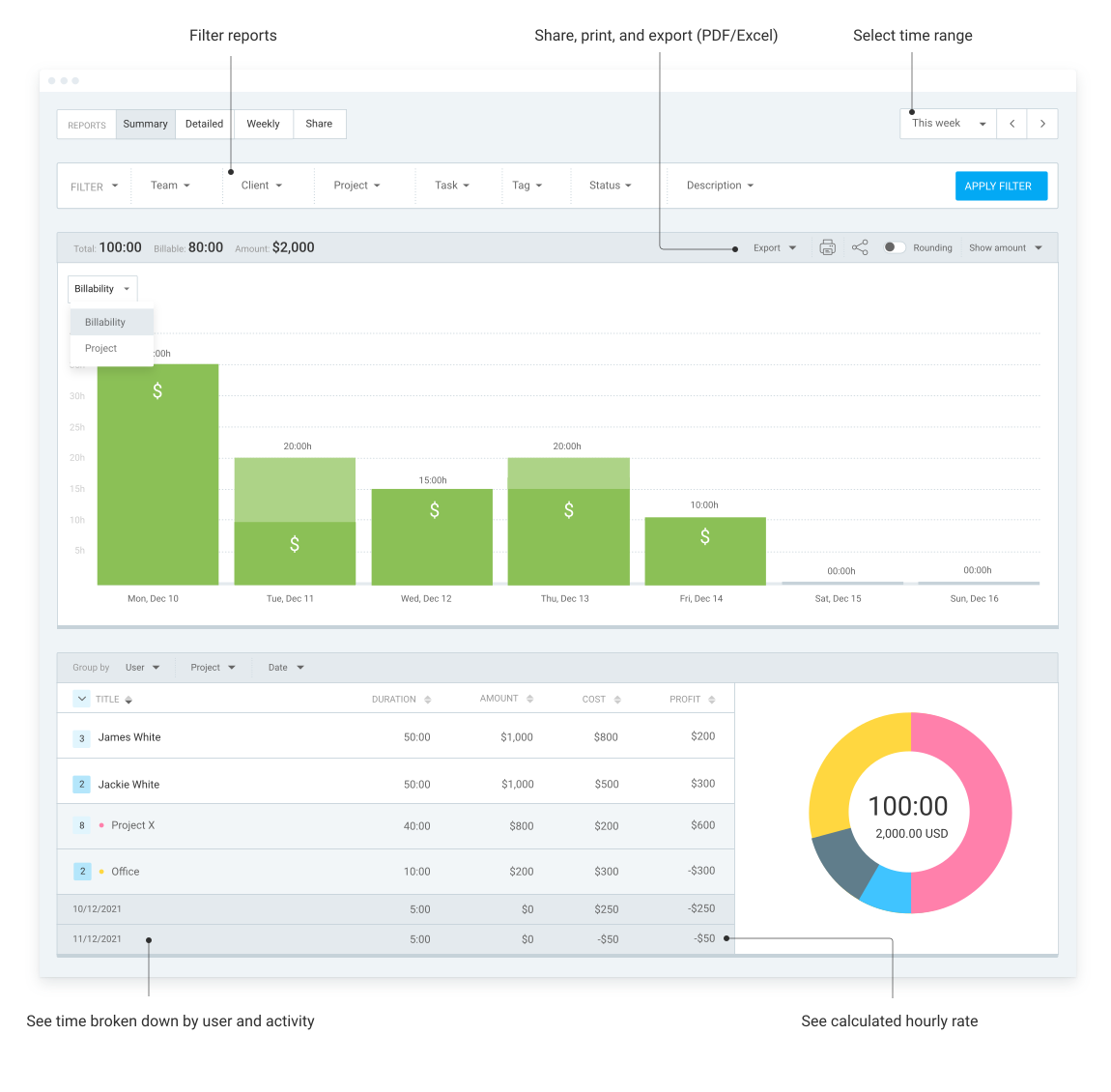

As a time tracking app in essence, Clockify serves as a great ally when it comes to:

- Tracking employee work hours — you and your employees can choose time tracking methods such as a timer, timesheets, or kiosk.

- Tracking overtime hours — Clockify can monitor when someone goes over 40 hours a week; you can also set up alerts or reminders.

- Logging break time — Texas doesn’t require breaks or meal periods, but if you decide to provide them, you need to keep track of them. Clockify allows your employees to log breaks manually or use tags like #paid or #unpaid breaks.

- Enabling rounding — Clockify allows you to set the rounding interval and how you wish to round time entries.

One of the best things about Clockify is its rich reporting capabilities. Reports in Clockify can help you stay compliant with labor laws, as they give you the data you need to monitor your employees and ensure everyone is paid fairly.

For instance, the summary report shows you the total hours worked by each employee in the organization for a specific period, together with billable amounts, cost, profit, and more.

Using reports in Clockify, Texas employers can ensure accurate records and fair labor practices at all times.

Conclusion/Disclaimer

We hope this Texas labor law guide has been helpful. We advise you to pay attention to the links we’ve provided, as most of them will lead you to the official government websites and other relevant information.

Please note that this guide was written in Q2 2025, so any changes in the labor laws that were included later than that may not be included in this Texas labor laws guide.

We strongly advise you to consult with the appropriate institutions and/or certified representatives before acting on any legal matters.

Clockify isn’t responsible for any losses or risks incurred if this guide is used without further guidance from legal or tax advisors.