Whether you are a small business owner or a self-employed individual, making sure you pay your employees or get paid for your work is of the utmost importance at the end of the day.

Good payment software makes the job much easier and safer.

Equally, the constant rise of online shopping calls for a reliable and easy-to-use payment solution (whether to transfer money to your family, friends, or request loans conveniently).

For that reason, I did the heavy lifting and tried out some of the most used payment software available on Google (the ones that offer a free trial or a free plan). While testing the tools, I mostly focused on:

- Payment processing time,

- Fees,

- Country availability,

- Currencies available,

- Payment methods,

- Transfer limits, and

- Notable features, including pros and cons for each app.

After taking a closer look at all the listed features, I picked out 9 most popular and reliable payment apps on the market.

Let’s see what I found out about those apps.

Table of Contents

PayPal — best online payment system

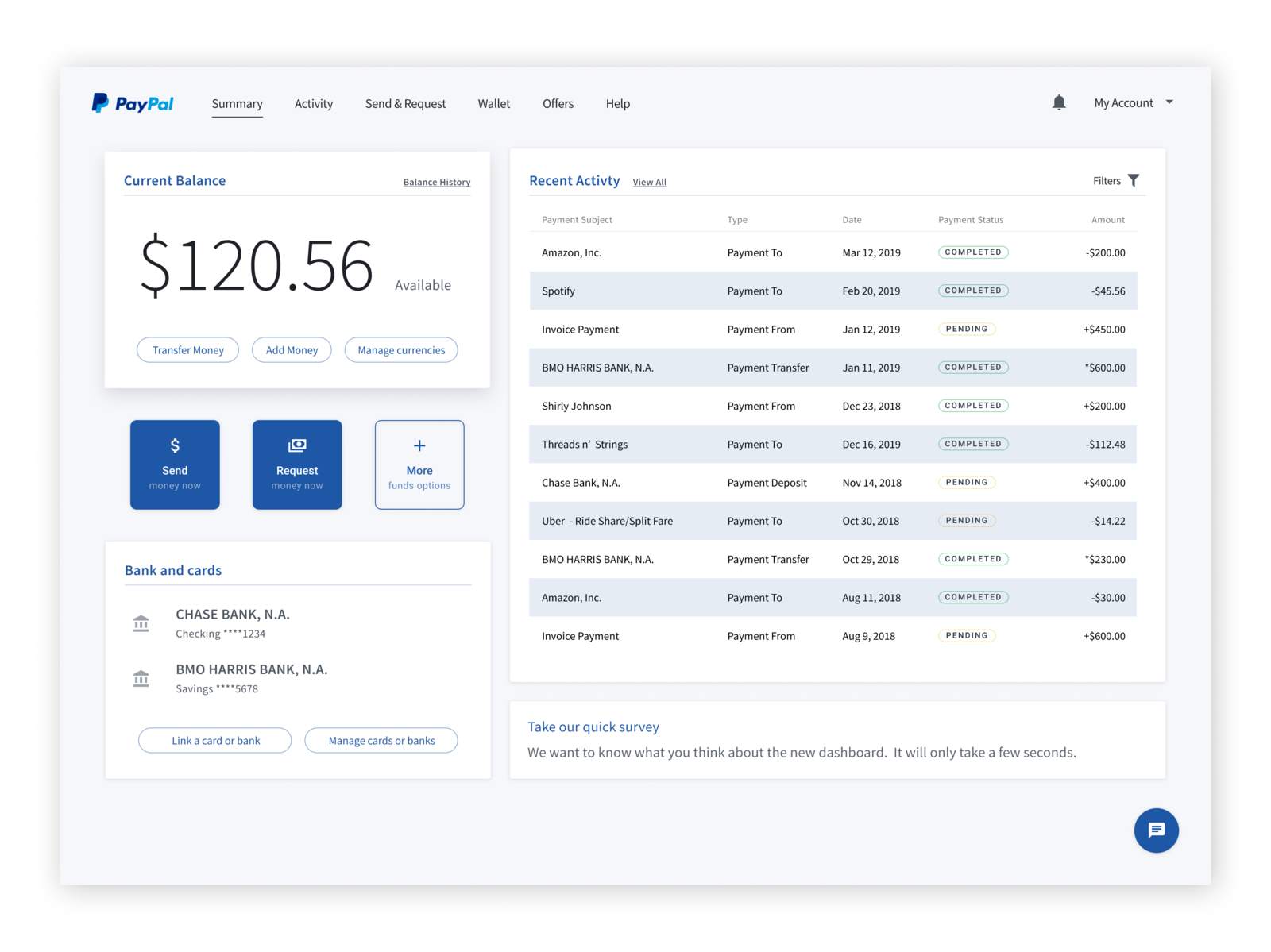

PayPal is an online payment system with over 200 million users. This payment platform allows you to shop, pay, and get paid from almost anywhere — either for personal or business needs.

Probably one of my favorite PayPal functionalities is One Touch. With One Touch, you can enjoy a seamless checkout experience and make purchases on websites that accept PayPal as a payment method. Additionally, PayPal offers insurance for different transactions, the ability to transfer money to friends with ease, or even request loans, making it a versatile payment platform.

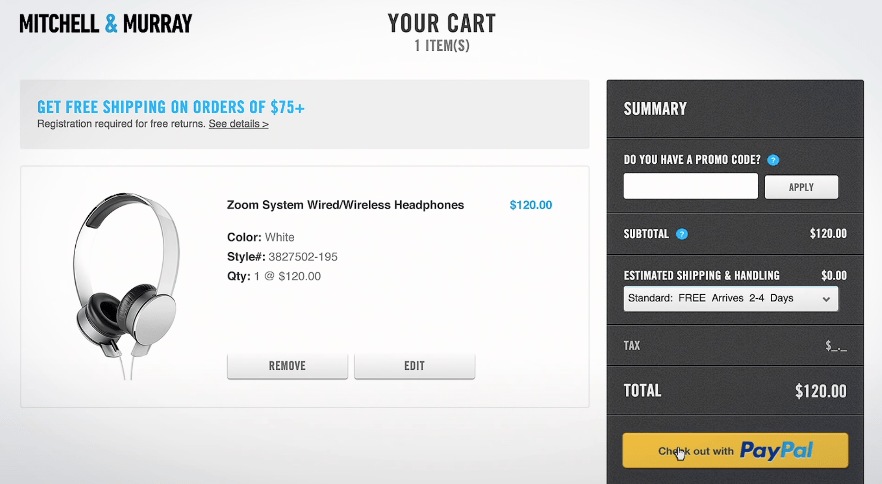

When you want to buy something online, if the store accepts PayPal, you’ll see the Check out with PayPal button. After you click on it, you will automatically be transferred to your PayPal account with your payment summary and your PayPal balance. Click Continue, and that’s all. No entering passwords or credit card details. Just make sure you have funds on your PayPal balance and that the online store you’re trying to make a purchase from accepts PayPal.

I’m an avid online shopper, and PayPal’s hassle-free payment method makes my life easier on a daily basis.

Key information about PayPal

Take a look at the following section to find out everything there is to know about money transfer via PayPal.

PayPal payment processing time:

Usually 3–5 business days.

PayPal fees:

Buying with PayPal (online or in-store) — free.

Receiving personal transactions — no fee (when no currency conversion is involved).

Sending domestic personal transactions

| Payment method | Sender market/region | Rate |

| PayPal Balance or Bank account | AD, HR, IS, MC* | No fee (if funded in EEA in EUR/SEK) |

| Any other market, where available | No fee (when no currency conversion is involved) | |

| Cards | AD, HR, IS, MC | No fee (if funded in EEA in EUR/SEK) |

| Any other market, where available | 3.4% + fixed fee |

*Take a look at the PayPal Market/Region list to find your country, where applicable.

Sending international personal transactions

| Payment method | Sender market/region | Recipient market/region | Rate |

| PayPal Balance or Bank account | AD, HR, IS, MC | Canada, Europe I, Europe II, Northern Europe, US | 1.99 EUR |

| Any other market | 3.99 EUR | ||

| AL, BA, MK, MD, ME, UA | Canada, Europe I, Europe II, Northern Europe, US | 1.99 EUR | |

| Any other market | 3.99 EUR | ||

| NZ | Any market | 6.99 NZD | |

| Any other market, where available | Any market | 4.99 USD | |

| Cards | AD, HR, IS, MC | Canada, Europe I, Europe II, Northern Europe, US | 1.99 EUR |

| Any other market | 3.99 EUR | ||

| AL, BA, MK, MD, ME, UA | Canada, Europe I, Europe II, Northern Europe, US | 1.99 EUR + 3.4% + fixed fee | |

| Any other market | 3.99 EUR + 3.4% + fixed fee | ||

| NZ | Any market | 6.99 NZD + 3.4% + fixed fee | |

| Any other market/region where available | Any market | 4.99 USD + 3.4% + fixed fee |

For more details about the PayPal consumer fees, visit the PayPal Consumer Fee page.

PayPal country availability:

Available in more than 200 countries.

PayPal supported currencies:

Available in 25 currencies.

PayPal payment methods:

- Instant balance transfer,

- Instant bank transfer,

- PayPal Credit,

- Instant card payment, and

- eCheque.

PayPal transfer limit:

- Regular users — $4,000,

- Verified users — $10,000 in a single payment, and

- Users with a linked bank account — $25,000 per transaction.

PayPal pros:

- Integrates with other platforms and websites,

- Offers a safe way of making payments online without exposing credit card details, and

- Offers the option to receive payments using an email address only.

PayPal cons:

- Hefty transaction fees, and

- Not so favorable exchange rates as those offered by other apps on this list.

PayPal is the best fit for:

Freelancers, businesses of any size, merchants.

PayPal pricing:

No monthly fees or set-up costs.

PayPal platforms supported:

Web, Mac, Linux, Windows, iOS, Android

What’s new with PayPal

In June 2022, PayPal announced a new feature called PayPal Pay Monthly. This feature allows US consumers to make a purchase between $199 and $10,000 and break their total cost up into monthly installments (over a 6-24 month period).

Payoneer — best for cross-border business payments

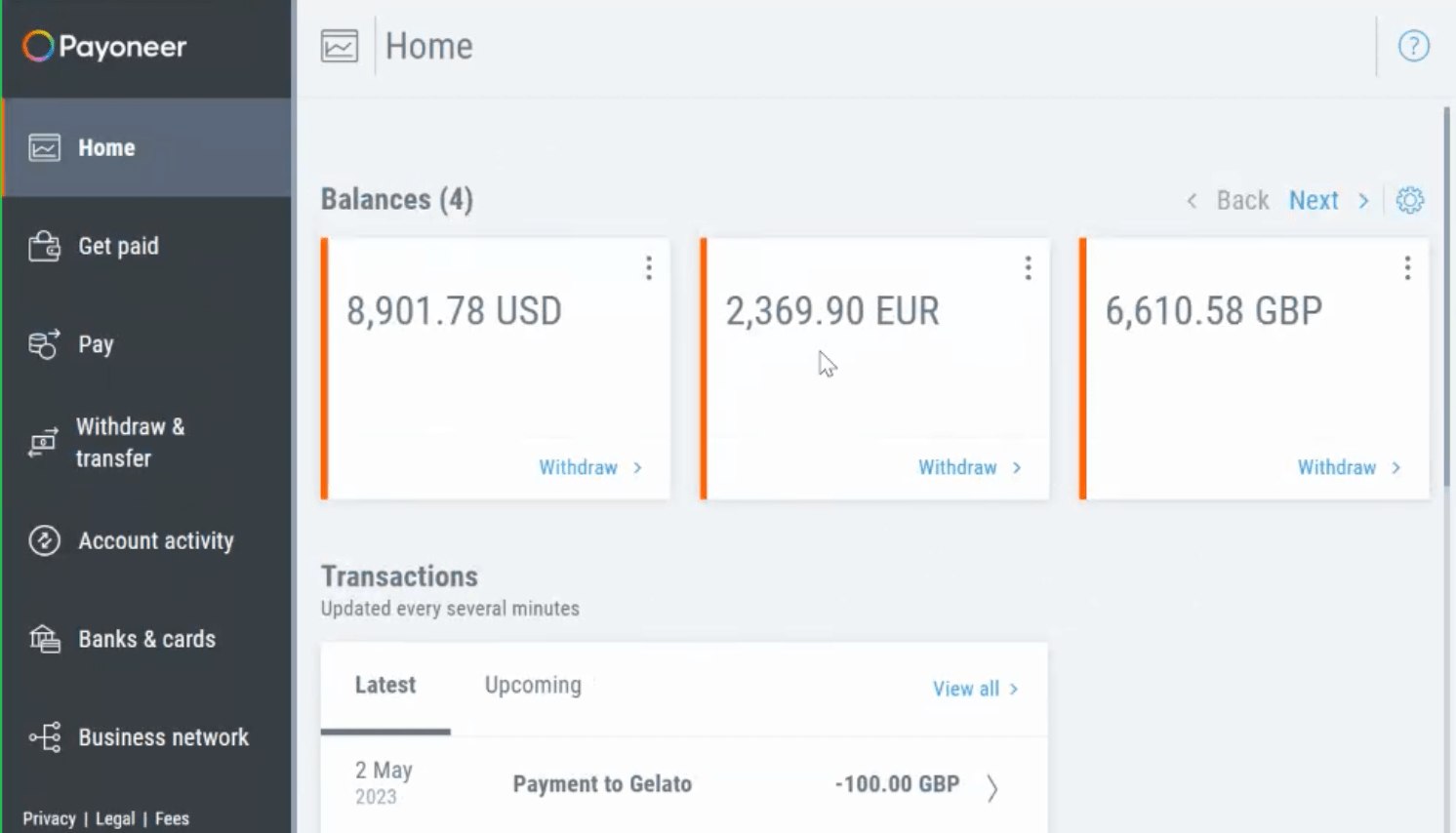

Payoneer is one of the more popular money transfer apps with more than 4 million users.

This payment solution lets its users receive and request online payments from clients, family, or friends in a couple of clicks, as well as track their account balance and entire transaction history.

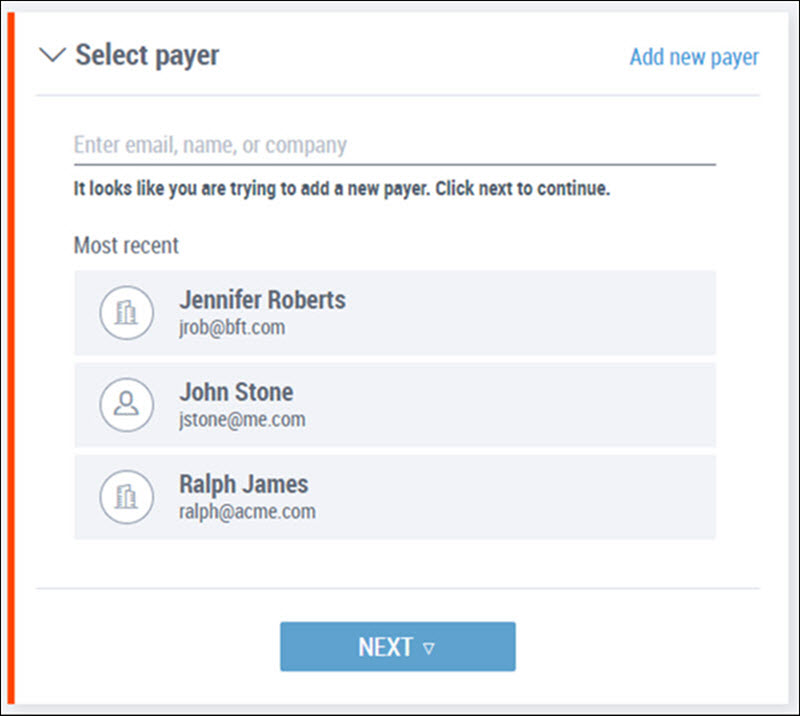

As a freelancer, you can make great use of Payoneer. Using the option Request payments, you can receive money by sending your client a payment request — right from your Payoneer account. All you need to do is fill out some payment details and submit the request.

The client receives an email with instructions on how to make a payment, and you can even attach an invoice together with your request.

I like the simplicity of this app. As a Payoneer user myself for years, I can admit it’s probably the most convenient and effective way to send or receive payments globally. I also like the ability to withdraw funds from my Payoneer account to my local bank account. This option comes in handy in case you don’t own a Payoneer card (and don’t want to pay a yearly fee for owning one).

Key information about Payoneer

Take a look at the following section to find out everything there is to know about money transfer via Payoneer.

Payoneer payment processing time:

Up to 5 business days, depending on the payment method used (applies to both sending and receiving payments).

Payoneer fees:

Getting paid

| Payment method | Fees |

|---|---|

| By another Payoneer customer | Free |

| Payoneer receiving accounts | Up to 1% |

| Credit cards | 3% |

| ACH bank debits | 1% (US only) |

Paying and using funds

| Payment method | Fees |

|---|---|

| To another Payoneer customer | Free |

| If the recipient is not a Payoneer customer | Up to 3% |

| USD to USD payments | $1.50 |

| EUR to EUR payments | €1.50 |

| GBP to GBP payments | £1.50 |

Payoneer card*

| Payment method | Fees |

|---|---|

| Moving funds between Payoneer balances | 0.5% of amount to transfer |

| Withdrawing funds to a bank account | Up to 3% of transactions |

*Annual account fee for a Payoneer card is $29.95

Payoneer country availability:

Available in 200+ countries.

Payoneer supported currencies:

Available in USD, EUR, GBP, CAD, AUD, JPY, and CNH.

Payoneer payment methods:

- Bank-debit ACH,

- Local bank transfers, and

- Credit/debit card payments.

Payoneer transfer limit:

| Transfer options | Transfer limits |

|---|---|

| Minimum per payment | 50 USD/GBP/EUR |

| Send daily | 25K USD/GBP/EUR |

| Receive daily | 25K USD/GBP/EUR |

| Send monthly | 50K USD/GBP/EUR |

| Receive monthly | 100K USD/GBP/EUR |

Still, each currency has limits, for instance, you can send $5,000 and €5,000 during the same 24 hours.

Payoneer pros:

- Free Payoneer-to-Payoneer transfers,

- Ability to convert funds from one balance or card to another balance or card, and

- Competitive exchange rates.

Payoneer cons:

- Expensive annual account fee, and

- Multiple mandatory verification processes.

Payoneer is the best fit for:

Entrepreneurs, freelancers, and small businesses.

Payoneer pricing:

Free to install and use.

Payoneer platforms supported:

Web, Mac, Linux, Windows, iOS, Android

What’s new with Payoneer

Payoneer partnered with Airbnb a decade ago. However, as of September 2023, hosts in additional countries can now get paid in their local currency.

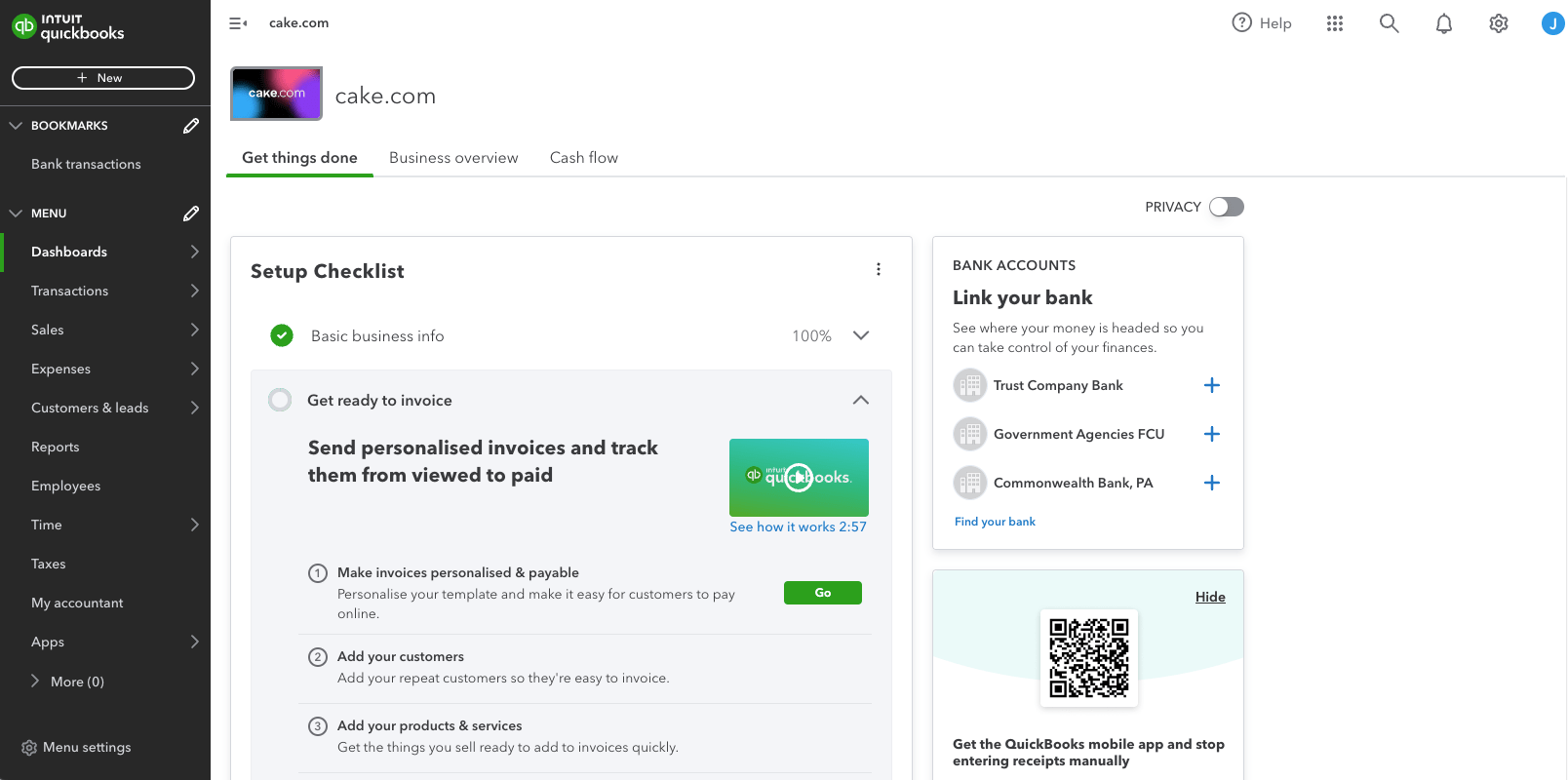

QuickBooks — best for accounting

QuickBooks is one of the most popular accounting solutions out there that can help you with:

- Receiving payments online,

- Sending out custom invoices,

- Scheduling recurring payments,

- Accepting payments, and

- Keeping a record of all changes made to the software.

As soon as you log into your account, you will see an overview of your QuickBooks account and sections aimed at transactions, invoices, payroll, expenses, etc.

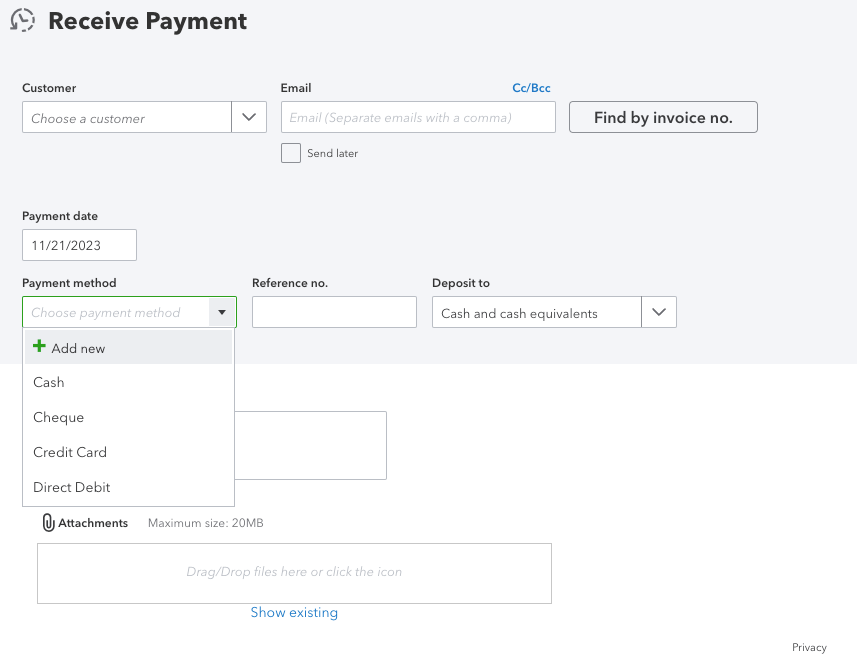

As for receiving payments from a customer in QuickBooks, the process seems very straightforward:

- First, select the customer you want to receive a payment from (or find it by invoice number, whichever way is easier for you),

- Enter a payment date,

- Choose the Payment method (whether you want to receive a payment by cash, cheque, credit card, or direct debit),

- Choose how you want to deposit the payment,

- Add attachments if necessary, and

- Click Save and close.

What I really like about receiving payments in QuickBooks is that the app adds flexibility to the way you want to get paid — you can set up custom payment schedules, track multiple invoices, inform your customers about your preferred payment method, and more.

What’s more, I find it useful that I can add and review bank transactions using QuickBooks. The Transactions tab on my dashboard allows me to connect my credit cards with QuickBooks, and QuickBooks then automatically imports my transactions.

Key information about QuickBooks

Take a look at the following section to find out everything there is to know about money transfer via QuickBooks.

QuickBooks payment processing time:

- Credit card payments — within 2 business days (up to 5 business days for your first few deposits), and

- ACH, PayPal, Venmo — the next day if processed before 3 p.m. (within 5 business days if you are brand new to QuickBooks).

QuickBooks fees:

| Payment method | Fees |

|---|---|

| Cards and digital wallets (invoices or quick requests paid using Visa, Mastercard, Discover, American Express, Apple Pay, PayPal, and Venmo) | 2.99% |

| ACH bank payments (invoices paid using electronic funds transfer) | 1% |

| Card reader (in-person payments with a card reader including Visa, Mastercard, Discover, American Express, Apple Pay, Google Pay, and Samsung Pay) | 2.5% |

| Keyed-in-cards (payments processed by manually entering a customer’s card info) | 3.5% |

QuickBooks country availability:

Available in more than 170 countries around the world.

QuickBooks supported currencies:

Available in 150+ currencies.

QuickBooks payment methods:

- Credit Card,

- Debit Card,

- ACH Bank Transfer,

- PayPal, and

- Venmo.

QuickBooks transfer limit:

Depends on your banking and processing history (i.e., the amount of money transferred within your account in the last 30 days). Apart from that, you are allowed to accept one ACH payment of up to $49,999.

QuickBooks pros:

- Cloud-based software, hence no need for downloads,

- Offers an easy and intuitive finance monitoring, and

- Uses numerous payment methods such as credit cards, PayPal, ACH, etc.

QuickBooks cons:

- Does not integrate with other business systems, and

- Offers plans with limited users.

💡Clockify Pro Tip

Apart from its role as a payment processor, QuickBooks online mainly serves as an effective automated accounting software — for more tools like QuickBooks, check our list of best accounting tools:

QuickBooks is the best fit for:

Small businesses.

QuickBooks pricing:

| Type of plan and availability | Pricing |

|---|---|

| Free plan ❌ | ❌ |

| Free trial ✅ | 30-day trial |

| Cheapest paid plan | $17/month |

QuickBooks platforms supported:

Web, Mac, Linux, Windows, iOS, Android

What’s new with QuickBooks

As of 2023, customers are now able to leave you and your employees a tip (5%, 10%, or 15%) on the invoice in QuickBooks Online.

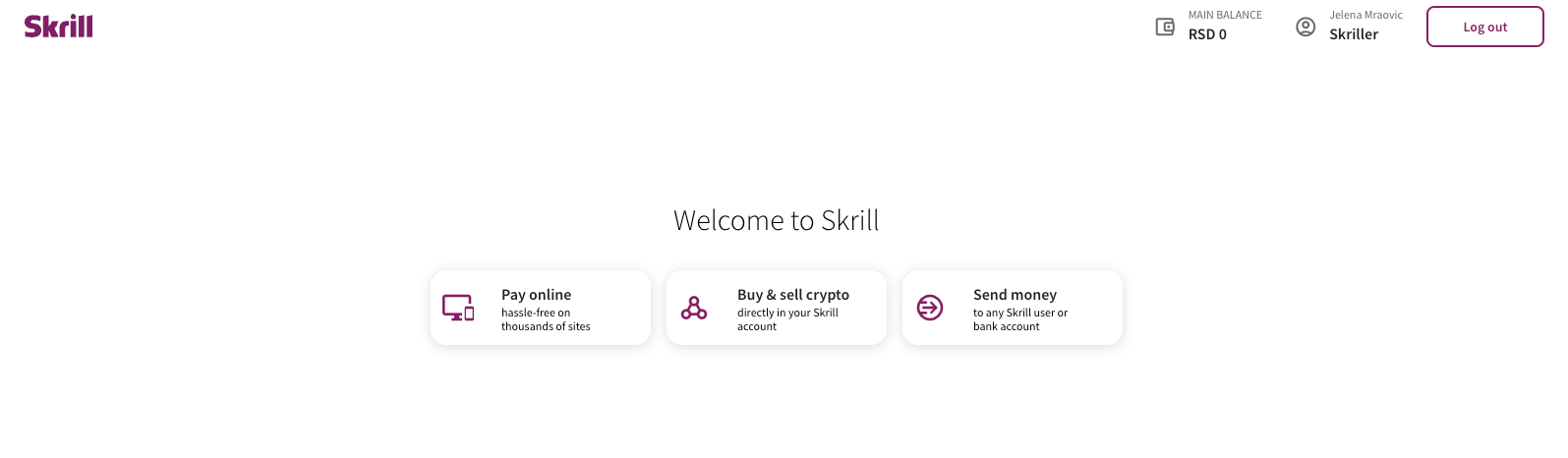

Skrill — best for fast and easy money transfer

Skrill is an online payment processor that allows users to send and receive international money transfers at a low cost. Apart from allowing its users to send and receive money around the world, Skrill can be a great ally in buying and selling over 40 cryptocurrencies, including Bitcoin, Ethereum, Cardano, etc.

Since Skrill is known as being one of the world’s most reliable methods for money transfer, I’ve decided to test its features to see for myself.

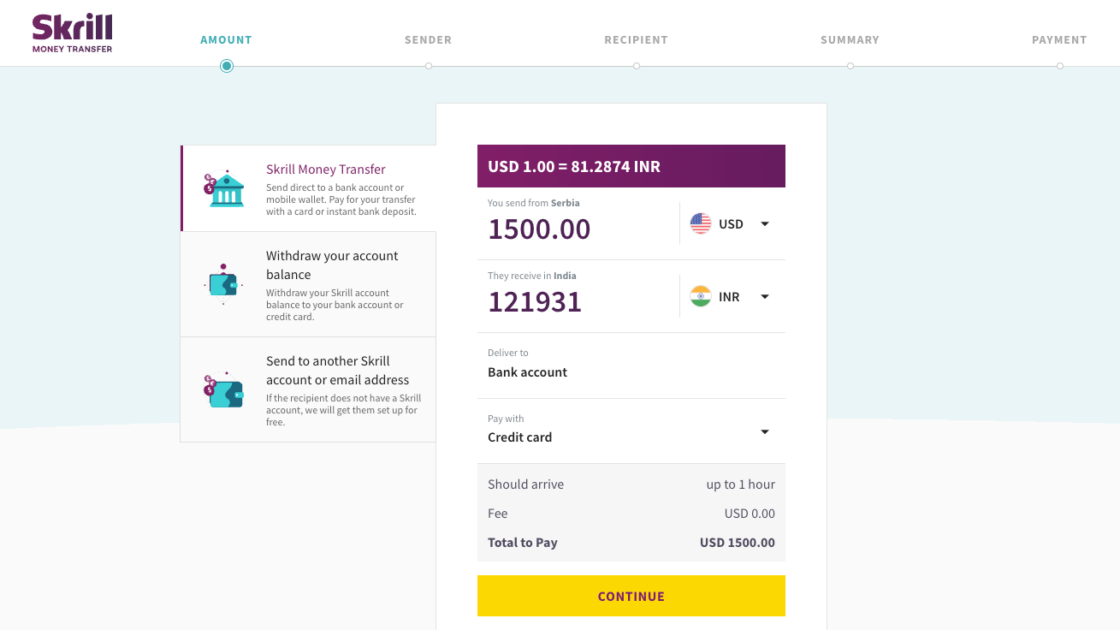

While testing out the app, I came to the conclusion that sending money via Skrill is child’s play. Transferring money using Skrill can be done to:

- A bank account,

- A mobile wallet,

- A mobile number, or

- An email address.

I also found sending money to a bank account very straightforward. All you need to do is follow the steps as shown below — choose the amount you want to transfer, fill out the necessary sender and recipient information, make sure you check everything before sending, click Send, and voila. As simple as that.

Key information about Skrill

Take a look at the following section to find out everything there is to know about money transfer via Skrill.

Skrill payment processing time:

Up to 3 days (depending on several factors, such as the payment method and the country you’re transferring money to).

An instant transfer is possible only with Skrill-to-Skrill transactions.

Skrill fees:

Skrill doesn’t charge anything when it comes to receiving the money — however, you might be charged a currency conversion fee of 3.99%, which is the Skrill’s exchange rate.

As for transferring money via Skrill, the following fees apply:

| Transfer options | Fees |

|---|---|

| International transfer, sending money by bank transfer | Free (charges may apply in case of currency conversion) |

| International transfer, sending money by debit card, Paysafecash, Bank transfer via Sofort/Klarna | Up to 1% |

| International transfer, sending money by credit card | Up to 2.99% |

| International transfer in the same send-and-receive currency per transaction | Up to 4.99% |

| International transfer exchange rate mark-up per transaction | Up to 4.99% |

| Domestic transfer per transaction | Up to 2% |

| Skrill to Skrill | 2.99% and a minimum fee of EUR 0.50 applies |

Skrill country availability:

Skrill is available in 200+ countries around the world.

Skrill supported currencies:

Available in 40 different currencies.

Skrill payment methods:

- Bank transfer,

- Credit card,

- Debit card,

- Paysafecash,

- Sofort, and

- Digital eWallet.

Skrill transfer limit:

- Minimum: $10 (or the equivalent amount),

- Maximum: $10,000 (or the equivalent amount).

Skrill pros:

- Very easy and intuitive money transfer,

- Offers a prepaid card that connects to your Skrill account so that you can withdraw money from an ATM, and

- Works across devices — you can access it through web or mobile apps.

Skrill cons:

- Many verification demands (submitting a picture, driver’s license, utility bill, and similar).

Skrill is the best fit for:

Small companies, large enterprises, self use, freelancers, etc.

Skrill pricing:

Free for personal use as long as you log in or make a transaction at least every 6 months. If not, €5.00 (or equivalent) will be deducted monthly from your account.

Completely free for business accounts.

Skrill platforms supported:

Web, Mac, Linux, Windows, iOS, Android

What’s new with Skrill

As of 2023, Skrill users can place bets on their favorite sports and manage their betting funds. Sports enthusiasts can now use Skrill to bet on football, basketball, baseball, tennis, boxing, motorsport, and eSports.

Remitly — best for expats sending money to their home countries

Remitly is a great payment solution for expats and immigrants who frequently send money back home to their loved ones.

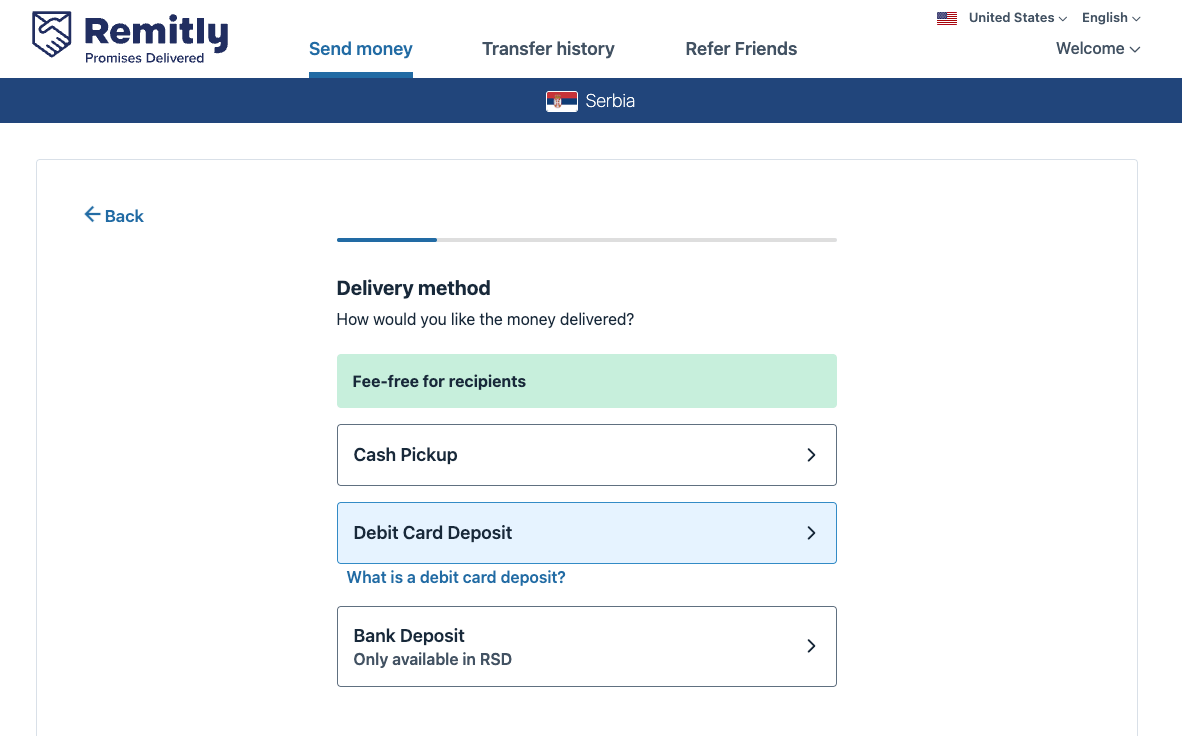

Furthermore, Remitly offers its users to receive money via:

- Cash pickup,

- Bank deposit, and

- Debit card deposit.

As for registration, it’s rather a simple and straightforward process. The homepage is easily navigated and user-friendly.

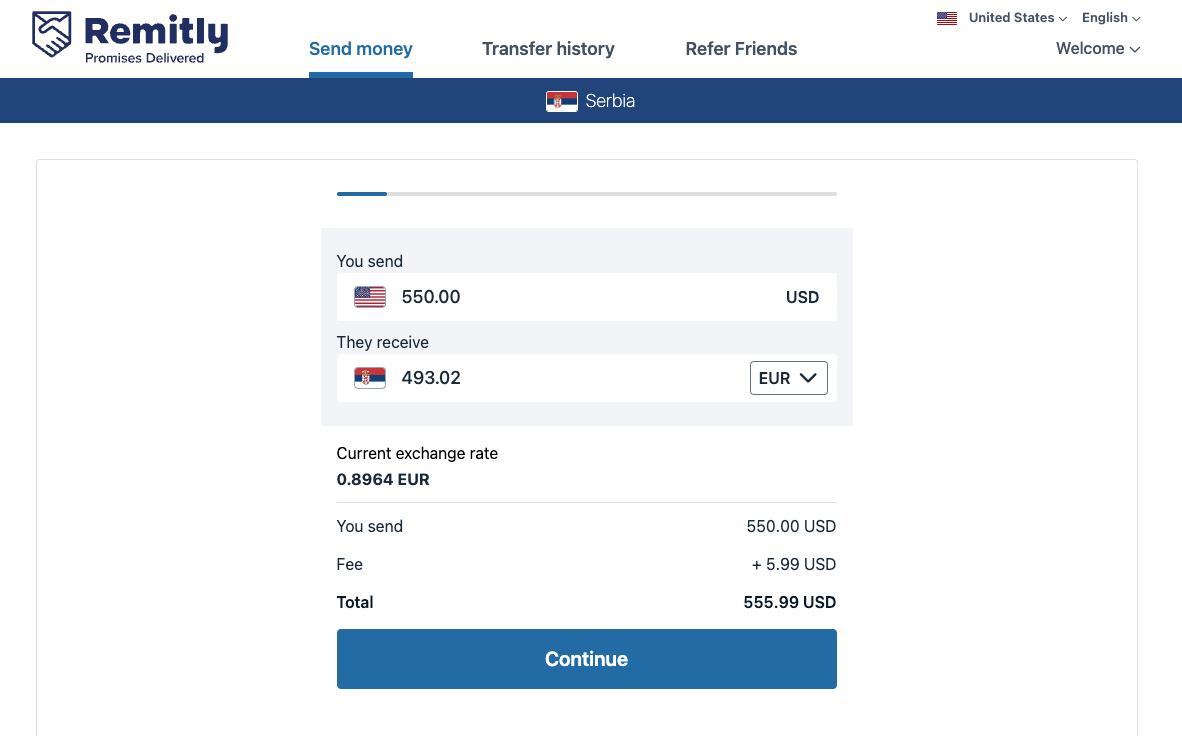

When you want to send money, all you need to do is click on the Send money tab and choose the country where you want to send money to. After you’ve entered the amount of money you want to send, the app instantly shows you the current exchange rate applied, which I find quite informative.

Up next is where you need to choose how your recipients will receive the money. After you choose your preferred delivery method, you’ll be asked to give the recipient’s phone number so that they get a text message that they received funds. This option is another thing about this app that I find very useful — as recipients can find out about their upcoming funds on the go.

After that, you just need to fill in necessary details about the recipient, and their funds are on the way.

Key information about Remitly

Take a look at the following section to find out everything there is to know about money transfer via Remitly.

Remitly payment processing time:

There is no exact time. The payment processing time depends on the country you are sending money to and your chosen delivery method. The user can see the processing time after they’ve entered the necessary details in the Transfers section.

Remitly fees:

Recipients don’t pay any fees, while the sender pays fees after choosing preferable sending options, such as delivery method, recipient’s country, and payment method. The sender is able to see the applicable fees and exchange rate in the Transfer summary later on.

Remitly country availability:

Remitly allows its users to transfer money to 170+ countries.

Remitly supported currencies:

Available in 100+ currencies.

Remitly payment methods:

- Credit card, or

- Bank account.

Remitly transfer limit:

The amount of money your recipient can receive depends on the recipient country and delivery location.

Remitly pros:

- Very easy and intuitive money transfer,

- Offers an affordable exchange rate, and

- Recipients can get their money delivered to their doorstep (home delivery).

Remitly cons:

- Doesn’t offer transparent processing payment time.

Remitly is the best fit for:

Expats and immigrants sending money to their families globally.

Remitly pricing:

Remitly is free to install.

Remitly platforms supported:

Web, Mac, Linux, Windows, iOS, Android

What’s new with Remitly

In October 2023, Remitly partnered with Mastercard to provide users with wider choices in sending and receiving money.

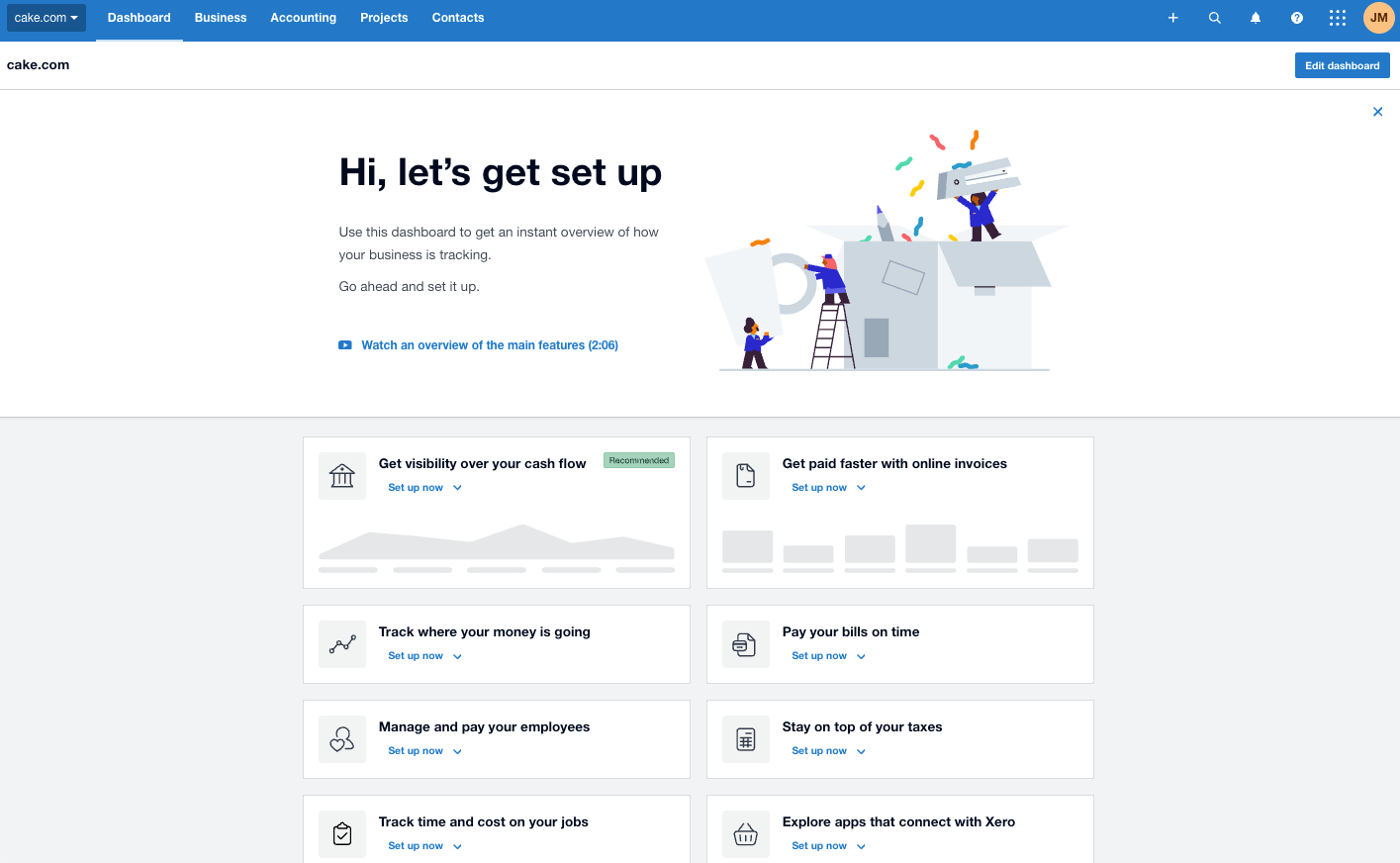

Xero — best for sending out customer invoices

Xero is essentially an accounting software, but it also allows you to accept payments indirectly — by connecting the software with popular payment processors such as PayPal and Stripe.

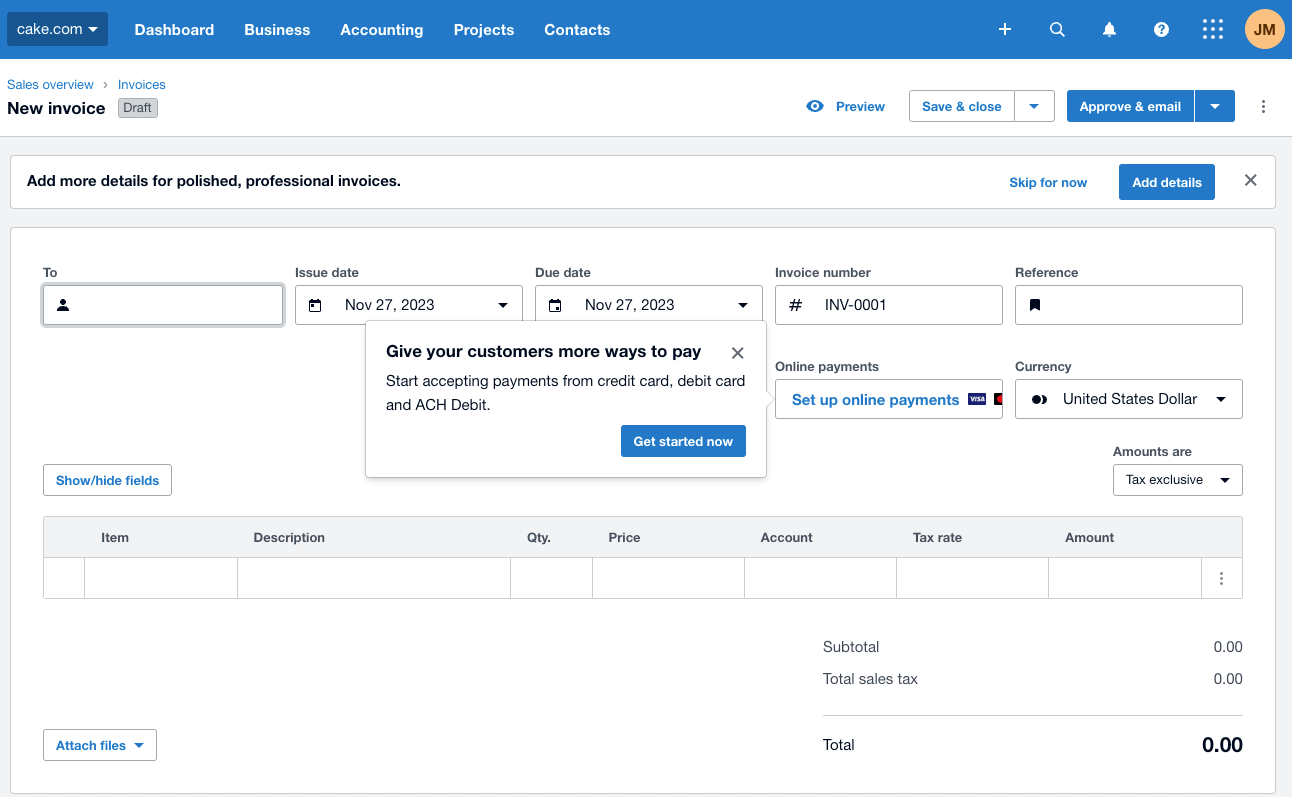

What I found useful while testing out the app was its invoicing feature. Xero lets you approve or create invoices for your customers, offering you two invoicing options — classic and new.

If you wish to manually enter all the info, you may choose the Classic invoicing feature. Opting for New invoicing, on the other hand, will fill out most of the info automatically — as it represents a simpler and faster invoicing option.

I prefer the New invoicing option as it speeds up your workflow while generating professional invoices. You may choose the way your customers can pay you, either by credit card, debit card, or ACH debit.

Moreover, Xero lets you save your invoice as a draft so that you don’t lose your work. Then, after you’ve finished filling it out, you click on Approve & email, and the invoice automatically gets delivered to your client’s email address.

You can also attach a file directly from your computer or any other device (laptop, mobile, etc.), add a description line if necessary, add a tax rate, and other information.

💡Clockify Pro Tip

Take a look at our carefully selected list of the best invoicing tools that you can use free of charge:

Key information about Xero

Take a look at the following section to find out everything there is to know about money transfer via Xero.

Xero payment processing time:

Usually 2–10 business days.

Xero fees:

Between 2% and 4% of an invoice value.

Xero country availability:

Available globally.

Xero supported currencies:

Available in 150+ currencies.

Xero payment methods:

- Credit cards,

- Debit cards, and

- Bank account.

Xero transfer limit:

Depends on the Xero plan you’re using, but usually up to 2,000 transactions per month.

Xero pros:

- Offers creating, editing, and sending invoices on the go, using a mobile app, and

- It’s a cloud-based app accessible from any browser or device.

Xero cons:

- Not as intuitive and easily navigated compared to other apps on the list, and

- Limited number of invoices if you choose the Early plan, which is the most affordable one.

Xero is the best fit for:

Small businesses.

Xero pricing:

| Type of plan and availability | Pricing |

|---|---|

| Free plan ❌ | ❌ |

| Free trial ✅ | 30-day trial |

| Cheapest paid plan | $15/month |

Xero platforms supported:

Web, Mac, Linux, Windows, iOS, Android

What’s new with Xero

In November 2023, Xero introduced E-invoicing, helping users reduce manual data entry and create automated invoices.

Wise — best for avoiding border-crossing fees

Wise is an international transfer service that lets you carry out transactions by matching your transfers and taking a small commission fee. There are no border-crossing fees for international transfers because the money doesn’t travel internationally — it just travels from one Wise account to another.

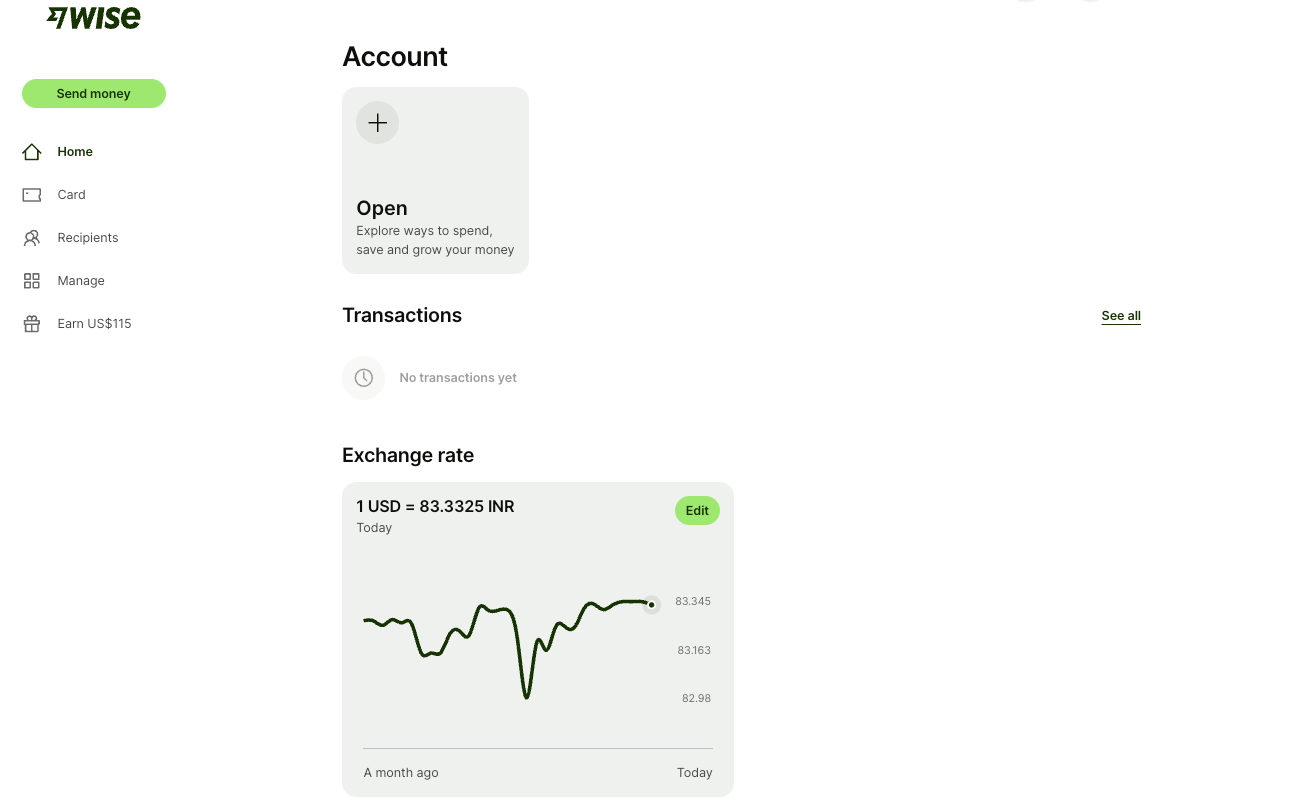

Once you’ve registered, you get to see the applicable exchange rate for a current day, along with the option to add people’s account details to start sending money instantly. You’ll see this option in the Recipient tab on the left side of the dashboard.

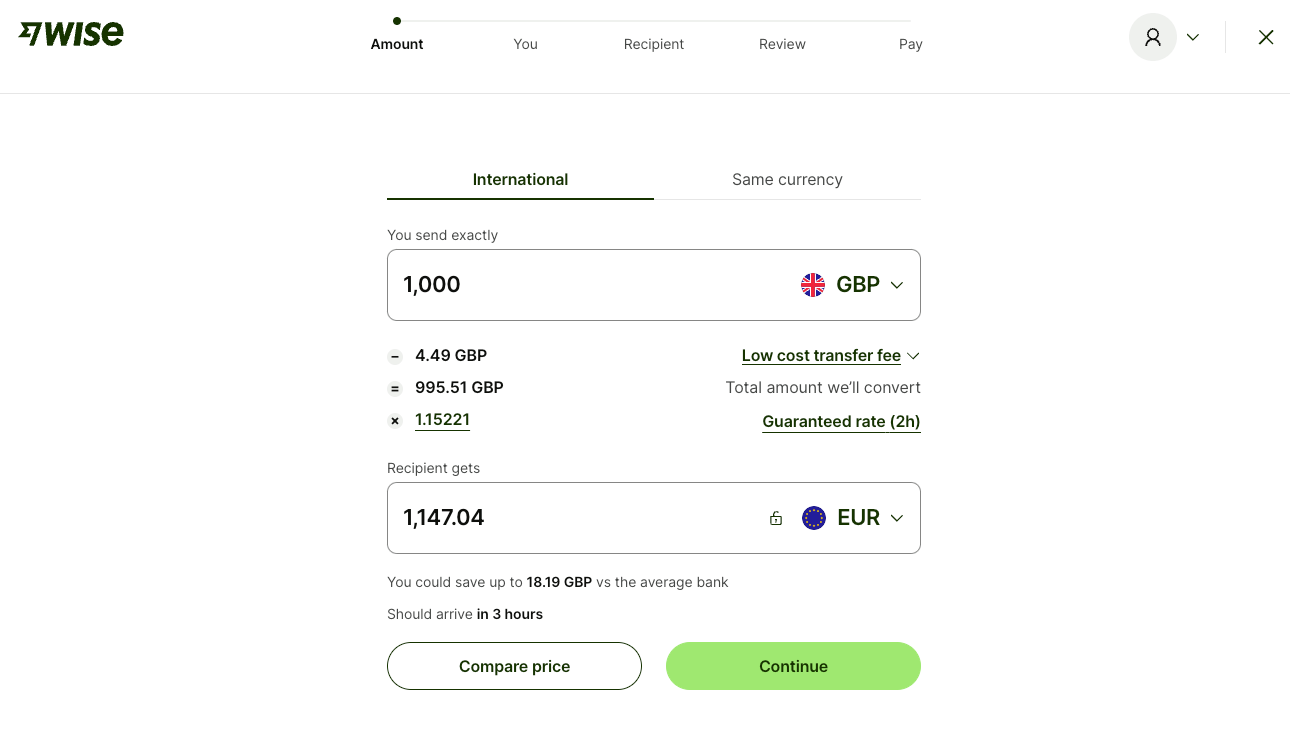

When you click the Send money button, you can choose between transferring money internationally or using the same currency.

Wise uses a calculator that tells you the amount of fees and exchange rate that will apply to your transfer upfront.

The thing I like most about Wise is that the app shows you an estimate of how long it will take to send funds to your recipients and a transparent exchange rate that applies to you at the moment of payment. Just make sure you enter all the information about your transfer first to get an accurate estimate. From then on, the sending process is rather simple and straightforward.

Key information about Wise

Take a look at the following section to find out everything there is to know about money transfer via Wise.

Wise payment processing time:

Depends on the currencies, countries, amounts, and payment methods involved. It could take a few seconds to 5 business days. For instance, if you choose to pay by card, the transfer happens instantly, while making a Swift payment may take 2 to 5 business days.

Wise fees:

Wise has a fixed fee starting from 0.43% of the transferred amount. Additional fees, however, depend on the countries, currencies, and amounts involved. You can calculate your specific Wise fees on their Fees and Pricing page. Also, keep in mind that if you decide to order a card, you will be charged $9.

Wise country availability:

Available in 65 countries around the world.

Wise supported currencies:

The thing about Wise is that you cannot send and receive the same currency (the currency exchange process is mandatory), and you can only receive your country’s official currency (for example, you can only receive Canadian Dollars in Canada). For more details, visit the web page concerning Wise currency information.

Wise payment methods:

- Bank transfer,

- Debit card,

- Credit card (Visa, Mastercard, and some Maestro cards),

- PISP (Payment Initiation Service Provider),

- SWIFT,

- Apple Pay, and

- Google Pay.

Wise transfer limit:

The transfer limit depends on currencies, amounts, and payment methods. In general terms, the limitations are:

- ACH transactions — $15,000/day,

- Debit/credit card transactions — $2,000/day or $8,000/week, and

- Wire transfer — $1 million.

Wise pros:

- Uses mid-market or “real” exchange rate,

- No fees when sending money in the same currency using Wise-to-Wise transactions, and

- User-friendly interface.

Wise cons:

- No door-to-door cash delivery, and

- Offers high transfer fees compared to other apps on the list.

Wise is the best fit for:

Small businesses and freelancers.

Wise pricing:

The app is free to install.

Wise platforms supported:

Web, Mac, Linux, Windows, iOS, Android

What’s new with Wise

In March 2023, Wise made a huge change to its design — transforming from its blue color palette to a fresh green look.

Western Union — best for international transactions

Western Union is a money transfer company that offers online payment and on-site payouts in over 500,000 worldwide locations.

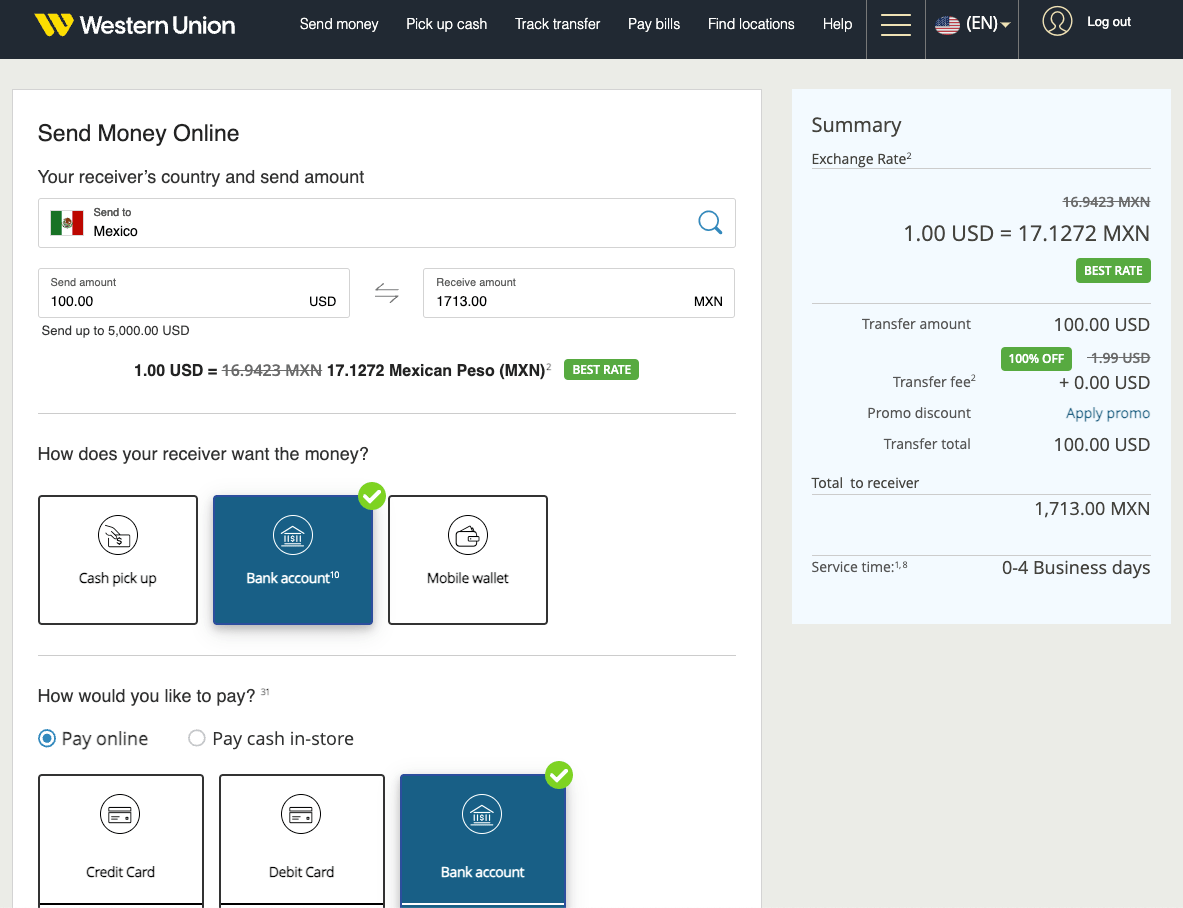

What I like about the app is its easy-to-understand interface and a variety of options for receiving and sending funds. If you would like to send money abroad via Western Union, you can:

- Pay online (using a credit, debit card, or bank account), or

- Pay cash in-store (you receive a tracking number called MTCN valid for 24 hours, which enables you to pay in cash at a Western Union agent location).

Furthermore, recipients may receive money in the following ways:

- Cash pickup,

- Bank account, or

- Mobile wallet.

What’s even better, as soon as you pick your preferred payment method, the app transparently shows you the transfer fee, exchange rate, and approximate service time. I think this is highly valuable information since not all money apps show such information as transparently as Western Union.

You may even apply promo/reward points that you can collect and use to reduce transfer fees on future transfers. For each transfer you make, and with each $1 you get 1 My WU point.

Key information about Western Union

Take a look at the following section to find out everything there is to know about money transfer via Western Union.

Western Union payment processing time:

Usually between 0–4 business days. The payment processing time depends on the payment method you choose. You can always track your transfer, whether you’re the sender or the receiver.

Western Union fees:

Depending on the countries involved, bank fees, the transaction amount, agent location, and the payment method used. Here is the Western union fee calculator that you’ll find useful when determining a transaction fee.

Western Union country availability:

Available in 200+ countries.

Western Union supported currencies:

Available in 30+ currencies.

Western Union payment methods:

- Cash pickup,

- Bank transfer,

- Credit card,

- Debit card,

- Mobile wallet, and

- Pay cash in-store.

Western Union transfer limit:

Depends on your transaction history, and whether you’re making a domestic or international transfer. If you conduct a payment at an agent station — there is no limit to how much you can send. However, the amount you can receive is usually limited — and it depends on the agent’s station location.

Western Union pros:

- Very easy to use,

- Quick transfers of funds, and

- Numerous agent locations across the globe when you select the “Pay cash in-store” method.

Western Union cons:

- Fees and rates can be subject to change without any prior notice, as written in their legal disclaimers and important information section.

Western Union is the best fit for:

Travelers, people who send money to their families abroad, business people making global transactions.

Western Union pricing:

The app is free to install.

Western Union platforms supported:

Web, Mac, Linux, Windows, iOS, Android

What’s new with Western Union

Announced in February 2023, Western Union extended their agreement with Regions Bank for 5 more years. This allows consumers to use Western Union’s money transfer and expedited bill pay services at any of Regions Bank’s locations in the US.

FreshBooks — best for expense-tracking

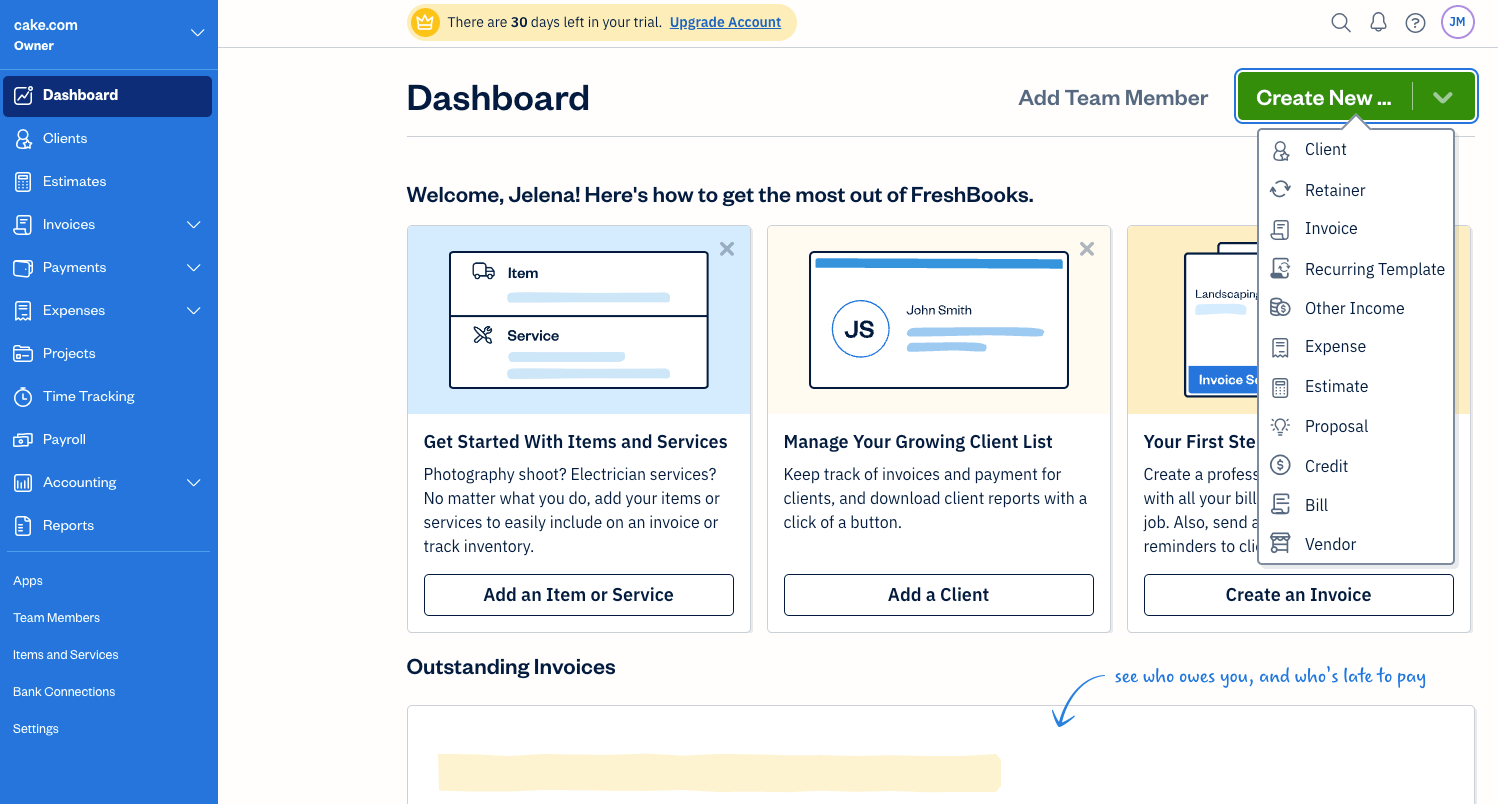

FreshBooks is a cloud-based accounting and bookkeeping software. It’s a versatile tool designed for personal use, businesses with employees, freelancers, and contractors.

As soon as you log into the app, you can see a plethora of functionalities, including:

- Invoicing,

- Tracking business expenses,

- Time tracking,

- Payments,

- Estimates, etc.

If you are interested in improving your cash flow and staying on top of your spendings, then the FreshBooks’ expense tracker can be of service. This all-in-one app allows you to track your spendings, import your expenses from your bank or credit card, or get your expenses ready for tax time.

What I find useful about FreshBooks is that you can create an expense manually or upload receipts, which FreshBooks automatically recognizes and shows you potential matches with existing expense transactions.

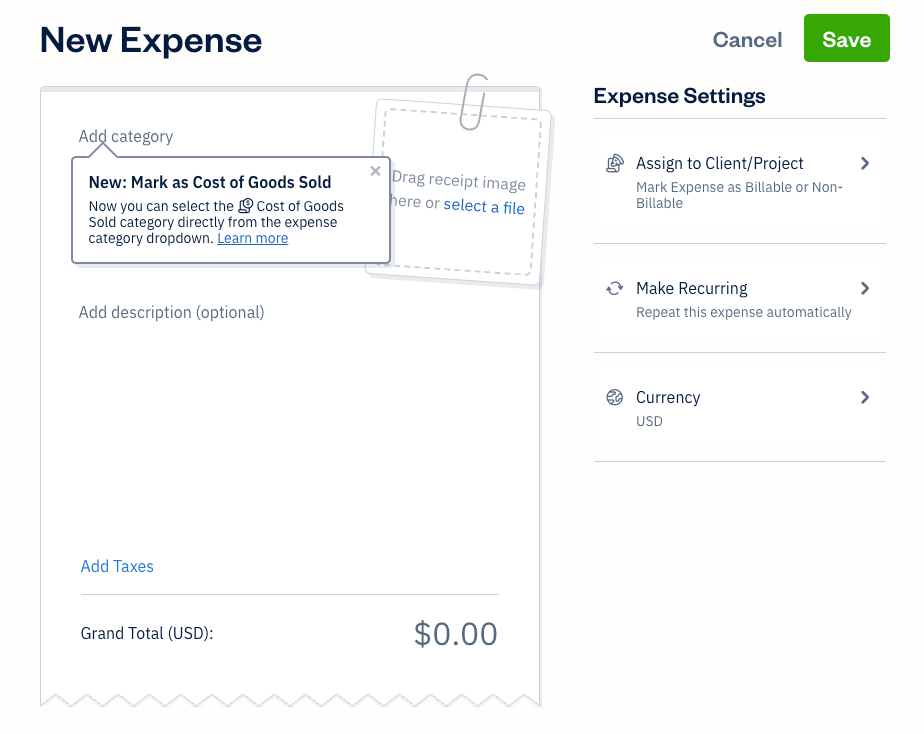

Furthermore, I find creating expenses manually pretty straightforward:

- Add an expense to a category,

- Assign it to either a client or a project,

- Choose a currency,

- Apply taxes, and

- Click Save.

You can also make it recurring, if you want.

💡Clockify Pro Tip

If you want to learn more about expense tracking and why it is important, read the following blog post on the matter:

Key information about FreshBooks

Take a look at the following section to find out everything there is to know about money transfer via FreshBooks.

FreshBooks payment processing time:

Payments take up to 3 business days (for credit cards), or up to 5 business days for bank transfer. Still, first transactions take between 5 to 7 business days to process.

FreshBooks fees:

Online payments are done through WePay, Stripe, Barclaycard, and PayPal.

Online Payments via WePay applicable to Canada and the US

| Payment Card Types | Transaction Fee | Advanced Payments Fee |

|---|---|---|

| Visa Credit, Debit Cards and Prepaid Cards | 2.9% + $0.30 | 3.5% + $0.30 |

| Discover Credit and Prepaid Debit Cards | 2.9% + $0.30 | 3.5% + $0.30 |

| MasterCard Credit, Debit and Prepaid Cards | 2.9% + $0.30 | 3.5% + $0.30 |

| American Express Credit and Prepaid Debit Cards | 3.5% + $0.30 | 3.5% + $0.30 |

*The Chargeback fee is $15.

The transaction fee for businesses in the US (ACH payment type) is 1%.

Online Payments via Stripe

| Country/Region | Payment Type | Transaction Fee |

|---|---|---|

| Canada | Pre-Authorized Debit (PAD) | 1% + $0.40 per transaction |

| Europe | Single Euro Payments Area (SEPA) | 1% + €0.25 per transaction |

| United States (US) | Bank Transfer (ACH) | 1% |

| United Kingdom (UK) | Bankers’ Automated Clearing System (BACS) | 1% + 20p per transaction |

*To see transaction fees for other applicable countries, check out the Stripe transaction fees page.

Online Payments via Barclaycard for businesses in the UK only

| Payment method | Fees |

|---|---|

| Consumer cards | 1% + 15p per transaction |

| Commercial cards | 1.9% + 15p per transaction |

| International cards | 2.9% + 10p per transaction |

*Only applicable to Visa and Mastercard holders.

Online Payments via PayPal for businesses in Canada and the US

| Country | Domestic Fee | International Fee |

|---|---|---|

| Canada | 2.9% + $0.30 | 3.7% + $0.30 for USD3.9% + $0.30 for international (outside of Canada and US) |

| United States (US) | 3.49% + $0.30 for PayPal accounts2.9% + $0.30 for credit and debit cards | 3.7% + $0.30 for CAD3.9% + $0.30 for international (outside of Canada and US) |

*To see the translation fees via PayPal for other applicable countries, visit the PayPal transaction fees website page.

FreshBooks country availability:

Available in over 160+ countries.

FreshBooks supported currencies:

FreshBooks offers a multi-currency option.

FreshBooks payment methods:

- ACH,

- Credit cards,

- Stripe, and

- PayPal.

FreshBooks transfer limit:

Depending on the plan you choose, you can send invoices to:

- 5 billable clients,

- 10 billable clients, or

- Unlimited number of billable clients.

FreshBooks pros:

- Integrates with 100+ apps such as Toggl, Todoist, Calendly, and others,

- Creating invoices is fast and easy, and

- Offers separate paid plans for freelancers, self-employed, or businesses.

FreshBooks cons:

- Uses a third-party app to process payments.

FreshBooks is the best fit for:

Freelancers and small businesses.

FreshBooks pricing:

| Type of plan and availability | Pricing |

|---|---|

| Free plan ❌ | ❌ |

| Free trial ✅ | 30-day trial |

| Cheapest paid plan | $17/month |

FreshBooks platforms supported:

Web, Mac, Linux, Windows, iOS, Android

What’s new with FreshBooks

As of October 2023, users are now able to see a full breakdown of their income by either transaction type or account on the Profit and Loss report page.

💡Clockify Pro Tip

Learn about profit and loss statements to find out if your business is doing well (or bad) here:

What is the safest payment app?

As you can see, there are many money transfer apps you can choose from. Everybody wants to send and receive money safely and securely.

But, as you probably already know, the web is full of scammers just waiting for an opportunity to commit fraud.

Even though the apps listed in this text all seem safe to use, you must still exercise caution and read your terms and conditions of use written in the agreements carefully. For extra peace of mind, always choose apps that offer an extra layer of security to secure your online account, such as multi-factor authentication (MFA). Apps that use multi-factor authentication require users to provide extra information when accessing their accounts such as one-time codes sent to their mobile device, biometrics using fingerprints or face recognition, tokens, and similar.

Most of the apps from this list use some type of MFA, such as PayPal’s 2-step verification via text message, Payoneer’s face recognition, and others.

How to choose a money transfer app?

When it comes to choosing an app to send money, make sure you take into account:

- Transaction fees — how much it charges for each transaction,

- Processing time — how much time it needs to process payments,

- Country availability — whether you can receive/send payments in your country,

- Currency support — whether you can receive/send payments in your currency,

- Payment methods — whether it supports your preferred payment methods, and

- Transfer limit — how much money you can receive/send at once.

Typically, the buyer or the client sending the money pays for the payment processor’s services and fees, not the receiver.

But, considering that the buyer or client will likely be looking for the most affordable option, make sure you do consider the transaction fees before suggesting a payment option (a more affordable solution will also increase your chances of getting paid properly).

Bonus app: Keep track of your earnings with Clockify

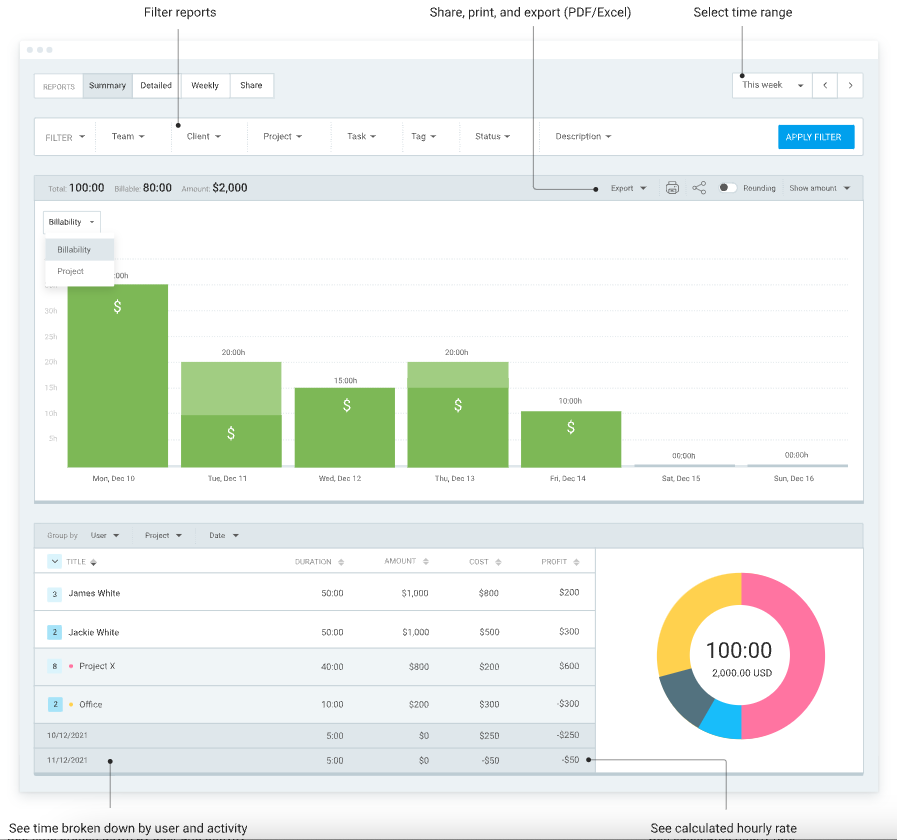

Before you request payment from your client using a money app, you’ll first need to make sure you know exactly how much money you’ve earned. For this purpose, Clockify is an effective, time tracking, time billing, and invoice-making solution.

As a very intuitive and easy-to-use time tracking software, Clockify can be your great ally together with a payment processor of your choice.

With Clockify, you’ll be able to:

- Add your hourly rates,

- Track the time you spend on tasks and projects, and

- Have your exact earnings calculated automatically in Reports.

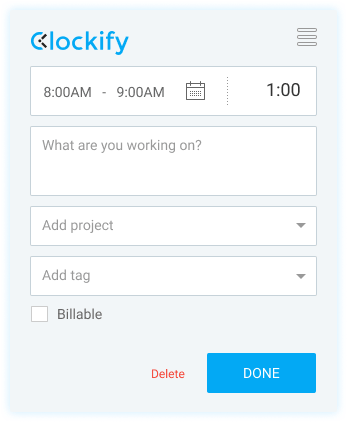

The procedure is rather simple — after you’ve set hourly rates, choose whether a time entry is billable or not, mark a task or project you are working on, and select Done.

Later on, you’ll be able to save these time entries in Reports as links and send them out to your clients, so they can track your project progress in real time, as well as the amount of money they’re due so far.

What makes my life easier is the ability to generate custom invoices for my clients based on my tracked time. What’s more, I find the option to mark entries as ‘invoiced’ particularly useful, as it happened to me in the past that I double billed my clients on a few occasions.

💡Clockify Pro Tip

Tired of creating invoices from scratch? Make use of the Clockify’s ready-made invoice templates for freelancers here:

Clockify country availability:

Download and use Clockify wherever you are.

Clockify supported currencies:

Admin roles in Clockify can define multiple currencies on their employee workspaces as well as assign a currency of choice to a client. This way, you define which currency will appear in the billable and cost amounts in reports.

Clockify pros:

- Offers ready-made invoicing templates as well as the option to create custom invoices from scratch,

- Can be paired up with other productivity tools, and

- Offers different ways of tracking time, either via tracker or timesheets.

Clockify cons:

- Lacks a payment processing system.

Clockify is the best fit for:

Freelancers, businesses of any size.

Clockify pricing:

| Type of plan and availability | Pricing |

|---|---|

| Free plan ❌ | ❌ |

| Free trial ✅ | 7-day trial for all PRO features, no credit card required |

| Cheapest paid plan | $3.99/month/user (if billed annually) |

Clockify platforms supported:

Web, Mac, Linux, Windows, iOS, Android

What’s new with Clockify

Some of the news and updates about Clockify in the last few months of 2023 include:

- December 2023 — UX improvements (no more “Load more” button to load projects and tags),

- November 2023 — Forecasting (chart data has been updated based on project estimate reset), and others, and

- October 2023 — ClickUp integration updates (users can now track time using a timer that is added to the task list view on ClickUp v3.0).

The best payment apps speed up your money transfers

Electronic payments have become a go-to solution for millions of people around the world whenever they want a quick, safe way to pay for nearly anything.

The best money transfer apps should consider aspects like cost, transfer speed, and international presence. We did our best to carefully test and describe the features of some of the most popular payment apps and provided links to the websites of the corresponding apps so that you may learn more about them. We hope you’ll find the information provided useful when searching for the best money transfer app that suits your needs.

No matter which payment method you opt for, don’t forget to record your work hours, send timesheets, or invoice your customers.