Many people looking for their first job, or considering going from hourly to salary employment (or vice versa), often wonder – is salary or hourly better?

To help you make the best choice for your future career, here are the most important and most prevalent pros and cons of both salary and hourly jobs, according to experienced professionals from the salary vs hourly Reddit pages, as well as according to some basic definitions, rules, and regulations.

Salaried vs hourly employees – the basic definitions

What is a salary?

According to the legal definition, salary is a fixed regular payment, typically paid on a monthly or bi-weekly basis.

It’s usually expressed as an annual sum, based on the average number of hours the employer estimates the employee will work during the coming year.

According to salaried employees rules, the minimum pay for salaried employees per week is $455.

In addition, standard salaried employees’ hours usually amount to 40 hours per week.

However, in case the standard salaried employees’ hours are less than 40 hours per week within a company, the average hourly compensation rate of the employees must still be no less than $27.63 per hour.

Unless additional rules apply, salaried employees are always paid the same annual amount, no matter the number of hours and the amount of effort they put into their jobs, and they are also typically not paid overtime.

For more information and interesting insights into the standard number of working hours for salaried employees, check out our guide to Standard working hours by country and industry in 2019.

What is hourly pay?

According to the definition, employees who are paid by the hour, and based on the number of hours they put into their work, are hourly employees.

The hourly rate of hourly employees varies according to:

- their choice of profession

- level of experience

- level of education

- other similar factors

However, there are minimum wage rates which vary from state to state, as well as from country to country – by law, the employer cannot pay the hourly employees less than that.

Unlike salaried employees, hourly employees are always paid according to the number of hours and effort they put into their jobs.

Unless additional rules apply, they are also typically paid overtime.

💡 Clockify pro tip

Looking to set your optimal hourly rate if you’re a freelancer? Check out our Hourly Rate Calculator that helps you determine and calculate your ideal hourly rate based on industry, location, and other factors. For a statistical overview of average hourly rates per industry, check out our guide on the Average freelance & consulting hourly rates in 2019.

What is a wage?

When it comes to the wage vs salary vs hourly conundrum, the difference isn’t quite as big – the main distinction is the time period covered.

In gist, a wage is a fixed regular payment, usually calculated on a daily or weekly basis, instead of an annual basis.

But, it’s also usually based on the number of hours put into that work, making it the same as hourly pay.

A small, semantic difference, however, is that “wages” are usually associated with manual labor, while “hourly pay” is used for a wider scope of professionals.

Exempt vs non-exempt employees – the basic definitions

The question of being exempt or nonexempt is linked to overtime pay – in gist:

- Non-exempt employees receive overtime pay

- Exempt employees don’t receive overtime pay

Most employees who are covered by the Fair Standards Labor Act (FLSA) are non-exempt, although there are other elements that determine whether an employee is exempt or not:

☑️ The type of business they do

☑️ The wages they receive

☑️ The type of employment (hourly or salaried workers)

What are exempt employees?

Exempt employees may work overtime but are not entitled to be paid overtime.

This is because their average hourly rate is higher than the minimum hourly wage of $27.63 ($455/week or $23,600/year).

Apart from overtime pay, these employees are also exempt from minimum wage, and other rights and protections non-exempt employees enjoy according to FLSA rules and regulations.

Exempt employees are typically:

- executives

- supervisors

- sales workers

However, other professionals can be exempt as well.

They are all also typically salaried exempt employees.

However, certain hourly positions can be exempt, such as those working in the Railroad, Truck driving, and Movie Theater industries:

The benefits of exempt employees include always being able to calculate your annual and monthly pay (as well as count on a fixed amount) – considering that your pay doesn’t fluctuate due to overtime or losing an hour or two at work.

What are non-exempt employees?

Non-exempt employees are entitled to be paid a 1.5-times overtime fee for working overtime, considering their average hourly rate is lower than $27.63 ($455/week or $23,600/year).

They are also typically hourly employees, and they enjoy the benefits a minimum wage position brings, as well as other FLSA rights and protections.

However, salaried employees can also be non-exempt, provided that they meet the overtime, minimum wage, record keeping, and other FLSA rules.

💡 Clockify pro tip

Want to calculate your overtime earnings really quick, every time? Use Clockify for free so you can define your hourly rates, track overtime hours, and then have them automatically multiplied by 1.5 times your hourly rate.

The benefits of non-exempt employees include being compensated for the time worked, and not the jobs they complete as a result – they get paid for all hours worked, not just those that fall under the standard 40 hours per week.

—

Now that you understand the basics of hourly, salary, exempt, and non-exempt employees, let’s see how hourly pay and salaried positions really stack up against each other:

Fixed salary advantages and disadvantages

FIXED SALARY PROS

More predictability overall

✅ You’ll be working fixed working hours – for example, from 9-to-5, or from 6-to-10, depending on the working hours of your company. You also won’t have to bring your workload home.

✅ You’ll get a guaranteed amount that doesn’t depend on the time you’ve clocked in – if you work only 35 hours one week you still get paid the same as the weeks you clock in 40 hours.

✅ There’ll be a fewer chance that you’ll get an unpaid leave for a day, due to a lack of work.

✅ Considering that your pay is a fixed amount, you’ll always be able to count on your weekly/monthly/yearly income – making it easier to plan for the future.

More flexibility when it comes to your schedule (with equal pay)

✅ You can go run quick errands in the middle of the day, without a reduction in pay for that day. You may, however, need to work longer that day, or come in earlier tomorrow, to make up for the lost time – but, this isn’t a rule.

✅ On the other hand, when you work extra hours during one week, you may be encouraged to work less in a future week, to even the number of hours out. For example, people on a salary may work an extra 10 hours on busy weeks, but may be encouraged to clock in 10 hours less than the norm on slower weeks.

✅ Depending on the company, people generally may not mind if you go home earlier on a slow day.

✅ If you finish your work earlier than the deadline, it’s possible for you to get the afternoon off.

More benefits

✅ You have a fixed number of vacation days per year. This number depends on the company you’re employed in, but it’s usually correlative to the time you’ve spent working so far – according to the Bureau of Labor Statistics, most people get 5-9 days of PTO in their first year, which builds up to 20-24 days for 15+ years of service. In any case, it’s important that you properly track the time spent on vacations to aid company records.

✅ You have a fixed number of sick days per year, as well as a number of health care benefits. You also have proper health insurance that helps you cover for that time.

Better chances of a higher overall income

✅ FLSA regulations don’t permit pay deductions from exempt salaried employees covered by the FLSA.

✅ You’re likely to get paid for any day the company is unexpectedly closed (like on a heavy snow day).

✅ If you arrive to work, but then have to leave 2 hours in because you’re not feeling well, you’ll still get paid for that day the same.

✅ Some rare companies even offer overtime pay for salaried employees who work past a fixed number of hours – for example, some companies count overtime after 42 or 44 of hours worked per week, after which employees get paid overtime.

✅ Depending on the company, you may occasionally get a bonus to your paycheck, anything from 2.5% to 15% added to your regular salary basis – this includes milestone bonuses, referral bonuses, and year-end bonuses.

✅ As previously mentioned, you are guaranteed some paid vacation time, unlike hourly employees.

✅ You always have national holidays off – and you’re still paid regularly for this time.

FIXED SALARY CONS

No overtime pay (no matter how much you work)

❌ Unless you are a non-exempt salaried employee (which is a rarer position), you get no compensation for when you work overtime – even if the reality of your workweek is 80+ hours, you still get paid the same as the weeks you clock in 40 hours.

❌ If it’s a busy day, and a problem occurs at 5 p.m., you may need to stay in much longer to fix the problem – without pay.

❌ You may need to work on weekends or during the night to beat a deadline – again, without pay.

❌ If you’re making business phone calls or participating in conference calls from home, you can’t charge for it.

It’s more stressful

❌ Salary usually implies you have a minimum number of work hours per week, say 40h (and sometimes much more) – meaning you’ll likely have less free time than an hourly employee.

❌ Many salaried employees are often on-call the entire day, throughout the week, for the same pay – if the hourly employee isn’t available to work during that time.

❌ Salaried positions of supervisors and executives come with larger responsibilities and the obligation to carry out independent judgment in your work.

❌ You may have to work as long as an hourly employee, but, considering that your extra time isn’t reflected anywhere (least of all your paycheck), you’ll have to make the extra effort to stand out from an average worker and impress your bosses. Which leads to extra stress.

Less flexibility in some areas of your work

❌ You’ll likely bring work home after 5 p.m., but it’s a smaller chance you’ll be able to work from home during regular business hours.

❌ Officially, you have to stay in the office until quitting time at 5 p.m., even if you’ve already finished all your obligations for that day.

The benefits have restrictions

❌ Unless you reach certain benchmarks, no matter how hard you work on reaching them, you’ll get no bonus.

❌ Bonuses may be subject to extra taxes.

❌ The health benefits provided by your company may have restrictions that don’t suit you.

Hourly pay advantages and disadvantages

HOURLY PROS

You get paid how much you work (+ all overtime)

✅ If an employee works less, he or she gets paid less. If an employee works more, he or she gets paid more – both the employee and the company benefit from such an arrangement.

✅ Even if you have to work on late nights and weekends, you get paid for it, based on your predefined overtime hourly rate – all you have to do is track the time you spend on tasks and remember to submit your timesheets.

✅ An hourly arrangement encourages employees to put in an extra effort into their work – plus, if you have to work 80+ hours on some weeks, you’ll feel better at the thought that you’ll get extra pay for each hour.

✅ You’ll have more flexibility to charge your work – hourly employees may charge phone calls and meetings separately, whereas this kind of work falls within the 40 hours for a salaried worker.

You’ll get all the chance to earn extra money

✅ When you need more money and have the time and energy for it, you can usually lobby for extra hours or additional projects – and then get more pay as a result.

✅ Overtime pay is 1.5 times your regular pay – so overtime work brings more money than regular work.

✅ Some companies ask hourly employees to be on call and work during the holidays – for as much as double their usual hourly rate.

You still get some benefits

✅ The number of vacation and sick days may get accrued according to the number of hours you put in during a fixed time period.

✅ If you achieve full work status at your company, you get the same benefits as a salaried employee. Namely, if you work in a company with 50 hourly employees, and you work over 30 hours per week, health coverage laws state you’re eligible for health care insurance.

✅ Contractors can command the largest hourly rate – to completely make up for the benefits they don’t have.

Your work time is more flexible

✅ Even if you have a fixed number of working hours you need to have per week, you’re more flexible to spread you work across days in a way that suits you. Have the time and energy to work for 10 hours on Monday, but can only clock in 5 hours on Tuesday? No problem.

✅ You’ll have more freedom to work from home – you have to clock in your hours anyway and keep straightforward records of the work you’ve done, so it’s no problem if you do it from home.

HOURLY CONS

You only get paid how much you work

❌ You don’t get paid for the time you spend in doctor’s appointments in the middle of the working day. You may even need to take a couple of hours of PTO or a full vacation day off for this purpose.

❌ You are only paid for the specific hours you put into your work – if you work for 35 hours during one week, you get paid less.

Fewer benefits

❌ If a business is doing slow, you may not have to work for the usual 40 hours/week – and become ineligible for health care privileges if you work less than 30 hours/week.

❌ You’ll likely have to use some of your PTO for any day the company is unexpectedly closed (like on a snowy day).

You may have a smaller income

❌ If your company is having a slow week and ends up being closed for a day, you don’t get paid for that day.

❌ If you arrive to work, but then have to leave 2 hours in because you’re not feeling well, you won’t get paid for the remaining 6 hours of your daily norm.

Set daily work rates easily — with Clockify

Both the hourly pay and fixed salary have their pros and cons.

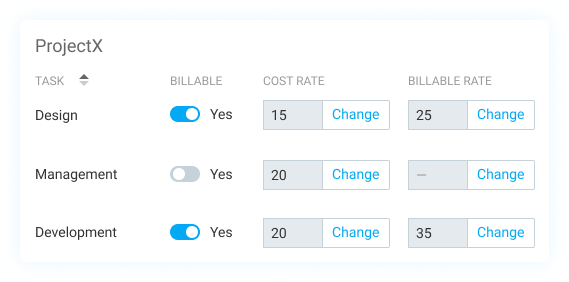

Whichever of the two you pick, Clockify lets you set hourly rates for yourself or others. You just need to:

- Go to Projects,

- Click on your project’s name,

- Select the Settings tab, and

- Set the billable rate for your project in the section titled Project billable rate.

All this useful information lets you calculate labor costs to see exactly how you or your team members contribute to the financial bottom line.

Every second of your work counts, so you don’t want to waste it on software with a steep learning curve.

On the other hand, a digital tool for setting pay rates helps you bring accuracy, clarity, and peace of mind.

Say goodbye to traditional timesheets and opt for a Clockify plan that’ll help you make the most out of your workday.