Are you good with money, or does it just slip through your fingers?

Do you control your finances, or do they control you?

You don’t have to answer out loud — if you choose at least one of the latter options, just keep reading.

In this article, you’ll learn what expense tracking is and a tool you can use to rein in your finances — both personal and business.

What is expense tracking?

Expense tracking is a budgeting method that involves recording all expenditures over a specific period to avoid spending beyond your means.

Business owners and managers track expenses to learn where and how they spend their money. In fact, detailed expense tracking can:

- Keep you focused on your financial goals,

- Reveal spending issues on time,

- Make business forecasting easier, and

- Help you solve problems on time.

5 Reasons why you should track your expenses

Meticulous cost tracking brings a wide range of benefits. With a firm grip on your expenses, you can:

- Take control of your finances so you manage your money instead of the other way around,

- Focus on your financial goals like getting out of debt, saving for a house, or investing in a business,

- Spot spending issues such as unnecessary monthly subscriptions and eating out more often than you can afford,

- Make better business forecasts by always knowing the profitability of each client and project, and

- Stick to your budget by cutting out impulse spending and managing money more consciously.

By tracking your spending, you’ll see any financial problems a mile away and resolve them on time.

How to track expenses?

To balance the books and stay on budget, you need to develop an efficient expense tracking system.

Naturally, there’s no single correct method for tracking expenses — many people and organizations adopt different approaches.

So, we’ve carefully selected 5 universal steps you can take to improve your expense tracking right now.

Step #1: Categorize your expenses

When you categorize your expenditures, you get a better grasp of your finances. Therefore, you may use a seemingly old-fashioned but effective method — envelope budgeting.

This method helps you see how much money you’re spending in each major category, including:

- Food,

- Utilities,

- Office supplies,

- Entertainment, etc.

When you carefully make budget estimates for each category, put them into an actual envelope.

This way, you’ll always know the expenses tied to different aspects of your life and avoid overspending. You can also use this method to build up your savings account — if there’s some money left over in one of the envelopes, you can add it to your savings.

Of course, the envelope method is only suitable for tracking personal expenses. It’s not the most convenient solution for business costs.

For business expenses, modern and reliable software solutions like Clockify are a better option.

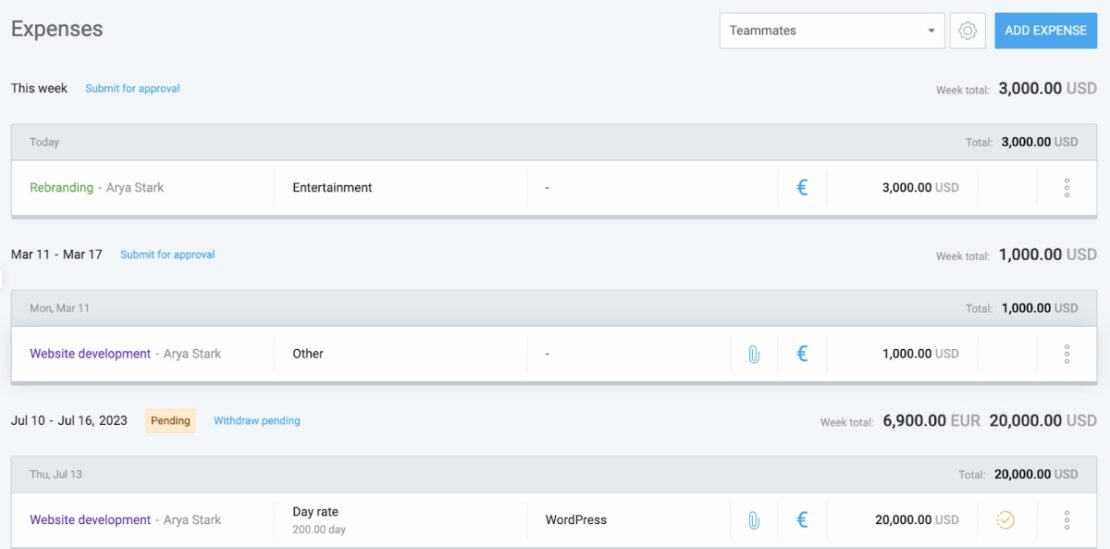

You can use Clockify to manage all kinds of business costs — from your employees’ daily and hourly rates, to mileage, business lunches, and overtime.

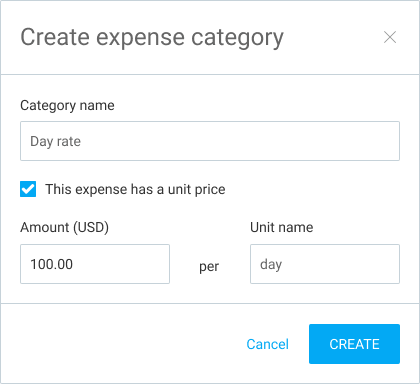

You can create custom expense categories for everything, allowing you to track costs as precisely as you want. To create a new expense category, you only need to:

- Choose Expenses from the left sidebar,

- Go to Settings,

- Click Add category,

- Enter the category name and any other information, and

- Click Create.

Precise cost categories give you valuable insights into how your company or team spends money and the profitability of your work.

Step #2: Track your expenses regularly

Ideally, you should track your expenses in real time. Make tracking expenses a regular habit to avoid forgetting an expenditure and disrupting cost analysis down the line.

With that being said, you can set daily or weekly reminders to build better budgeting habits and never overlook an expense again.

For business owners and managers, regular expense tracking is tough because of the sheer volume of costs. If you did it manually, you’d spend an eternity on employee billable hours alone.

Luckily, you can use time and billing software to simplify the process.

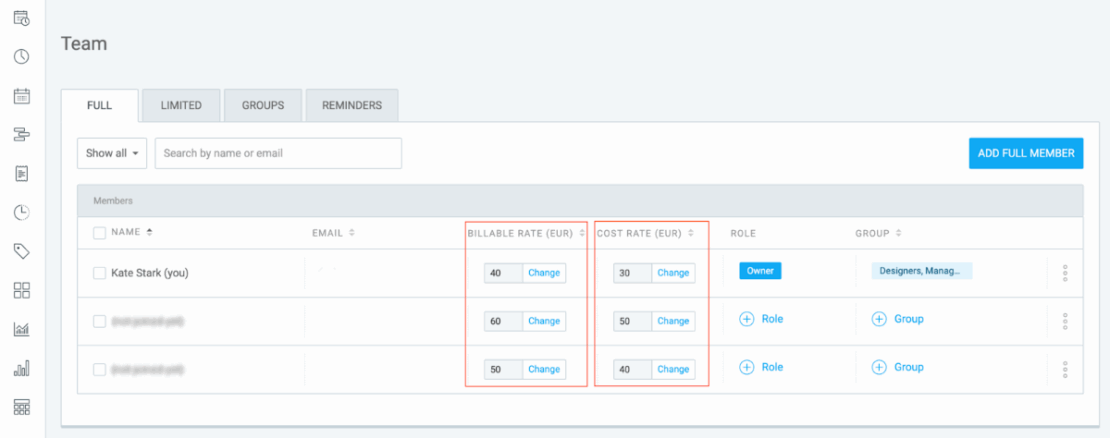

For example, Clockify can track billable hours for you automatically. As a manager, all you need to do is set the billable rates for each employee in the Team section.

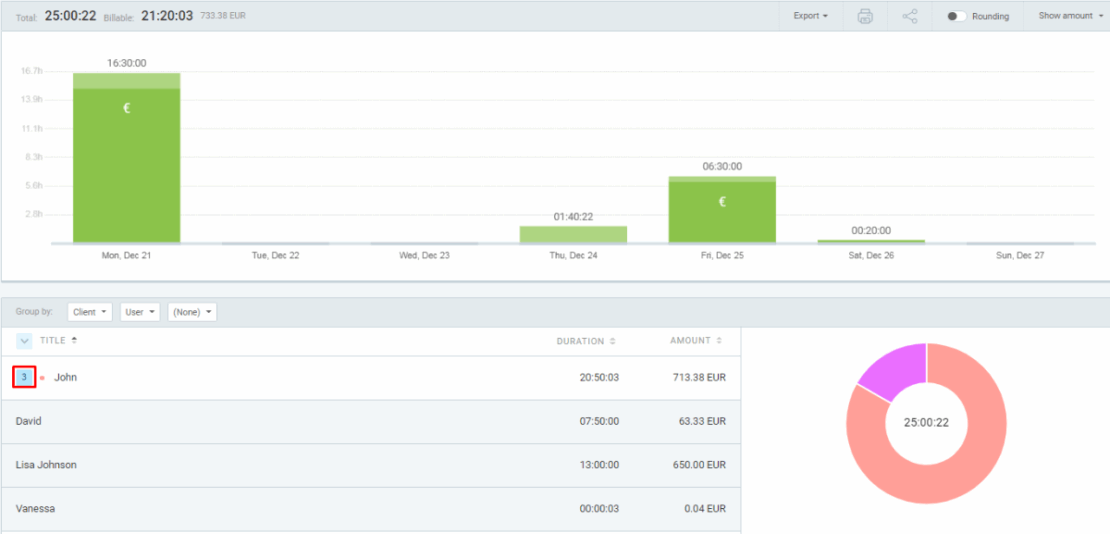

As your employees track their time in Clockify, the platform will automatically calculate billables for everyone.

Based on this data, Clockify generates visual reports that provide valuable insights in real time.

In the summary report, you can compare your employees’ billable rates to the profitability of their assigned tasks and projects.

As a result, you’ll always know if costs on a specific project are getting out of hand.

Step #3: Keep a thorough paper trail

By this, we don’t mean you should pile up dozens of papers in your drawers. You just need to gather all the financial documents and other valuable papers lying around the house in one place.

Then, get some folders and organize them by categories such as:

- Receipts,

- Tax records,

- Certificates,

- Warranties,

- Policies, etc.

For additional security and peace of mind, consider making digital backups on cloud platforms.

Small businesses must have a workable record-keeping system to organize their invoices, bank statements, payroll records, and other business-related expenditures. In most jurisdictions, governments require businesses to keep accurate records for tax and compliance purposes.

No matter what method you opt for, categorizing and storing your valuable papers is essential for tracking your expenses. You never know when you’ll need the receipt from a recent purchase or a similar expense.

💡 CLOCKIFY PRO TIP

Struggling to understand how federal taxes work? Use our free federal paycheck calculator to estimate taxes more accurately:

Step #4: Keep a monthly expense report

Now that you’ve recorded your expenses (by hand or digitally), it’s wise to review them monthly. This way, you can see where your money went and change your spending habits if necessary.

If you prefer more traditional record-keeping, you can track and write everything down by hand. However, budgeting apps that automate a lot of that work are more practical.

Track project costs with Clockify

For instance, Clockify generates reports based on your tracked time and expenses automatically, and you can export them in popular formats like PDF, CSV, and Excel.

This makes it easier to analyze balance sheets, cash flow, profit, or potential losses at the end of each month. That way, you’ll have a firm grasp of your equity, assets, and liabilities, and be prepared for unexpected expenses.

💡 CLOCKIFY PRO TIP

Struggling to keep track of monthly expenses? Check out this article for practical tips and templates:

Step #5: Find a suitable tool for expense tracking

There’s no one perfect way to record your expenses.

Some people are comfortable with a simple expense ledger or check register, where they record purchases by hand. Others prefer feature-rich budgeting apps for tracking money on the go. Find your “style” and what works best for you — the choice is all yours.

Of course, modern software tools make cost tracking quicker, easier, and more precise, especially for business owners.

How to track project expenses

Now that we’ve covered a few ways to track expenses more accurately, let’s dive into how freelancers and permanent employees working from home can track expenses on specific projects.

As a freelancer

Freelancers are responsible for their taxes and for setting aside money for health insurance and an IRA. Together with regular living costs and business expenses, all this can become difficult to manage.

That’s why freelancers should:

- Separate business and private accounts, allowing you to charge for each type of expense separately and easily calculate tax deductions later on, and

- Consult a tax accountant to give you professional tax advice.

To help you track all freelancing expenses, we’ve created a template sheet where you can enter various types of costs:

⬇️ Download the Project expenses for freelancers template in Excel

⬇️ Download the Project expenses for freelancers template in Google Sheets

As a permanent employee working from home

Unlike freelancers, remote employees working for a single company usually manage fewer expenses. Typically, costs like health insurance and taxes are automatically deducted from their wages.

However, they may still have professional expenses to track and report, such as bills for company phones or other costs that their firms might reimburse.

To track such costs easily, here’s a template for permanent employees working from home:

⬇️ Download the Project expenses for permanent employees template in Excel

⬇️ Download the Project expenses for permanent employees template in Google Sheets

Track expenses easily with Clockify

Clockify lets you easily track and record your employees’ unit-based expenses, such as:

- Hours,

- Mileage,

- Days,

- Project-related costs,

- Fixed fees,

- Overtime pay, and

- Other quantifiable costs.

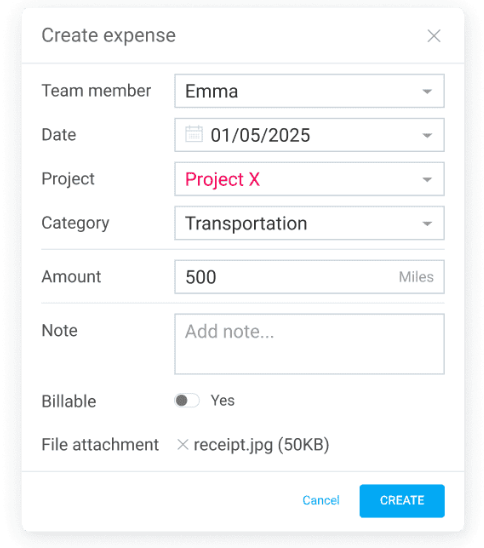

You can quickly create an expense, organize it by expense category, and associate it with the related project. If you need to explain the cost in more detail, you can also add a note — like below:

Additionally, you can attach receipts for accounting purposes in various file formats (.png, .pdf, etc.), up to a 5 MB file size.

Recording expenses in Clockify is an extra feature available in the Pro and Enterprise plans. Take a look at the different plans that Clockify offers and get the one that suits you the most.

For maximum value, Clockify is also available at a discounted price as part of the CAKE.com Bundle — where you get 3 productivity apps for the price of one.