Remote work is far from a new phenomenon. Yet, questions regarding telework expenses never cease to arise.

From who covers the costs associated with working from home to whether remote employees receive lower salary — remote work seems to bring to light a great number of doubts.

If you’ve been offered to become part of a fully virtual team, you may also be wondering:

- Who pays for the Internet?

- Who pays for the laptop/desktop computer?

- Who equips the remote home office with furniture?

- Who pays for a coworking space?

- Do the remote employees get paid less?

These are all vital questions to ask about full-time remote work and its expenses — and this blog post will answer them all.

Table of Contents

Who pays for remote work expenses?

In gist — the answer to the question of remote work expenses depends on different factors.

Some companies offer more to their remote workers, some offer less, and some even require the workers to cover their own costs and expenses.

Others provide their remote employees with access to a company computer (one they’ll most likely have to return when they move to a new job, of course).

Some companies even provide reimbursements for the costs of a remote office.

In the following section, we’ll explore what may be included in your company’s remote work policy based on some of the most common remote work reimbursement questions.

Who pays for the work equipment — policies, laws, and regulations

In short, the question of who provides reimbursements for work equipment (your Internet, laptop, software) when you work remotely mainly depends on:

- The state or country where a business operates,

- The state or country an employee works in, and

- Company policies.

Namely, certain companies have introduced different remote work policies that clearly state who’s responsible for remote work equipment reimbursements.

However, apart from different internal regulations, governments can pass different acts regulating remote work expenses.

In the US, for example, it is considered legal if employers don’t pay for their remote employees’ work equipment. Yet, according to the FLSA’s ‘free and clear’ regulation, employers need to reimburse their workers for work-related expenses if these costs sink their employees’ income below the federal minimum wage — $7.25.

In case employee expenses do not reduce their wages below the legal minimum — they’re not entitled to receive reimbursement according to the federal law.

Yet, some US states (such as California and New York, for example) have introduced regulations that mandate employers to provide reimbursements to employees for necessary work-related expenses, such as internet bills, equipment, etc.

However, it’s important to keep in mind that work-from-anywhere arrangements get further complicated when employees work at a location different from the one in which their company operates. In this case, the question of who covers the work equipment may depend on the regulations valid in the employee’s state or country of residence.

💡 Clockify Pro Tip

Since the policies and laws regarding remote work expenses and reimbursements may differ based on the state, make sure to check out the regulations valid in your state of residence:

Who pays for the internet connection?

Similarly to other remote work equipment, the question of responsibility for covering the costs of internet connection mostly depends on the:

- Employer’s or business location,

- Employee’s working location,

- Laws regulating remote work expenses, and

- Individual companies’ policies.

Yet, according to Buffer’s State of Remote Work Report 2023, which surveyed 3,000 remote workers worldwide, only 28% of remote employees report that their company covers their internet connection expenses.

Who pays for your laptop/desktop computer?

When it comes to the equipment necessary for remote work, employers more often than not provide their employees with their personal laptops, desktop computers, and even cell phones if the job requires it — e.g., sales positions, software developers, etc.

In fact, according to the previously mentioned Buffer research, 64% of surveyed remote workers report their employers covering the hardware expenses.

This probably has a lot to do with the fact that it’s in your employers’ interest that you have a reliable, secure, and fast machine to carry out your work on.

Also, working from your personal computer could pose a significant cybersecurity risk, so it’s only logical that employers provide their remote workers with work devices to ramp up security measures and prevent data breaches.

Who pays for the software you use?

Since you’ll probably need a number of business-specific and more general tools to help you carry out your work while working remotely — your employer will likely pay for your work software.

Depending on your position, you may need different types of tools to collaborate with your teammates and complete your personal tasks:

- If you’re a designer, you’ll likely need the Adobe Creative Cloud package, or a similar package — this includes Adobe Photoshop, Adobe Illustrator, and Adobe Animate or their alternatives.

- If you’re a programmer, you’ll likely need a great editor system and database tools, among other tools.

- If you work in sales, you’ll likely need an efficient power dialer and marketing intelligence tool.

- You’ll likely need a strong audio and video conferencing system for daily meetings and other arrangements, considering that you can’t meet with your clients and colleagues face-to-face on a regular basis. Alternatively, you can use a chat or communication app such as Pumble for those purposes.

- You’ll probably also need a time tracking software that records the time you spend working, to make sure you document your work time correctly.

- You’ll likely also need project management tools or some similar software that helps you track project progress and collaborate with your other remote colleagues.

- If your company is offering certain resources, such as supplying you with a laptop, you’ll probably already have these tools installed. Some of them will even be free, to begin with.

Who pays for additional equipment?

The question of covering the costs of additional equipment, such as printers, scanners, cell phones, etc., may depend on the industry you work in and how crucial this equipment is for your work.

You’ll likely be given a cell phone if you work in sales or any other position requiring frequent phone calls.

Printers and scanners, on the other hand, may not be crucial for many positions, so you’ll probably not be very likely to get them.

Regarding multiple monitors, some types of professionals are more likely to get them than others. For example, if you’re a designer or programmer, your second monitor will be just as important for your work as the first one — accordingly, your chances that you’ll get one will significantly increase.

Who pays for the remote office?

Again, it is legal if your employer chooses not to equip your home office, but they may need to make sure your personal office is comfortable and safe.

Namely, according to the Occupational Safety and Health Act (OSHA), US employers are not mandated to provide workstations to their employees. Still, OSHA’s General Duty Clause mandates the employers to keep the said workstations void of all hazards — and this includes “ergonomic hazards.”

Some companies may even cover the costs of a stand-up desk or similar equipment meant to increase their employees’ productivity.

Others may also implement an ergonomic program to make sure you’re aware of proper conduct in terms of ergonomics — yet, you’ll be the one to cover the expenses.

Again, it all depends on your company’s remote work policy.

Who pays for a coworking space?

Based on the earlier mentioned Buffer research, only 22% of surveyed remote workers state that their employers pay for their coworking space membership.

This could be due to the fact that the average cost of a coworking space in the US ranges from $161 to $561 per month, depending on the type of desk you want.

Who pays for travel expenses?

If you need to travel for your business, your company will most likely cover your travel costs.

Even though you might be free of a daily commute to work, when you go on a business trip, your company will probably provide for:

- Your flight (if you have to fly in),

- Hotel expenses,

- Meals, and

- Other types of transportation you need.

However, there may be restrictions on the amount you can spend on each item. For example, you may be restricted to only spending $20 on each meal to qualify for full reimbursement of your meals.

Additional FAQs about remote work expenses

If you’re still in two minds about remote work expenses, perhaps the following responses to some of the additional frequently asked questions could be helpful.

What’s the difference between remote workers and freelancers, in terms of expenses?

Most freelancers are remote workers, but not all remote workers are freelancers.

The term “remote worker” is often tied to someone who’s employed in a company full-time. Most frequently, they enjoy flexible working hours. However, they are expected to meet a certain norm (e.g., 8 hours per day) and track the time they spend on work tasks.

As mentioned above, full-time employed remote workers may or may not get reimbursement for their work-related expenses, depending on a variety of factors, such as their employer’s policies, location, etc.

On the other hand, the term “freelancer” is often tied to someone who’s hired to work on one (or more) short-term projects. Usually, they have the liberty of setting their own work hours.

On top of managing their own work schedule, freelancers cover their own remote work expenses (i.e., write them off as taxes), too.

💡 Clockify Pro Tip

If you work as a freelancer and struggle to make the most of your working hours, perhaps you could benefit from carefully picked tips for organizing your time:

What is the California telecommuting law?

In 2021, the state of California enacted a Statewide Telework Policy directed at government employees. This document leaves it up to the state departments to establish their remote work policies while following the statewide policy provisions.

One of the provisions states that government employees working remotely can use their own equipment with department approval. In other cases — departments are responsible for covering the costs of work equipment.

Yet, when it comes to private remote workers, California has not enacted a specific regulation directed solely at them. So, the question of private industry remote workers’ expenses falls under other state labor regulations.

Namely, according to California’s Labor Code Section 2802, employers are mandated to give reimbursement to their employees (regardless of their work setting) for equipment expenses.

Furthermore, based on the California Occupational Safety and Health Act, employers are required to make sure their employees are working in safe and healthy surroundings — no matter whether they’re remote or office-based.

Do remote workers get paid less?

According to the before-mentioned Buffer research, 70% of surveyed remote workers aren’t paid less than their office-based counterparts.

As a matter of fact, teleworkers actually receive higher salaries than their colleagues working from the office.

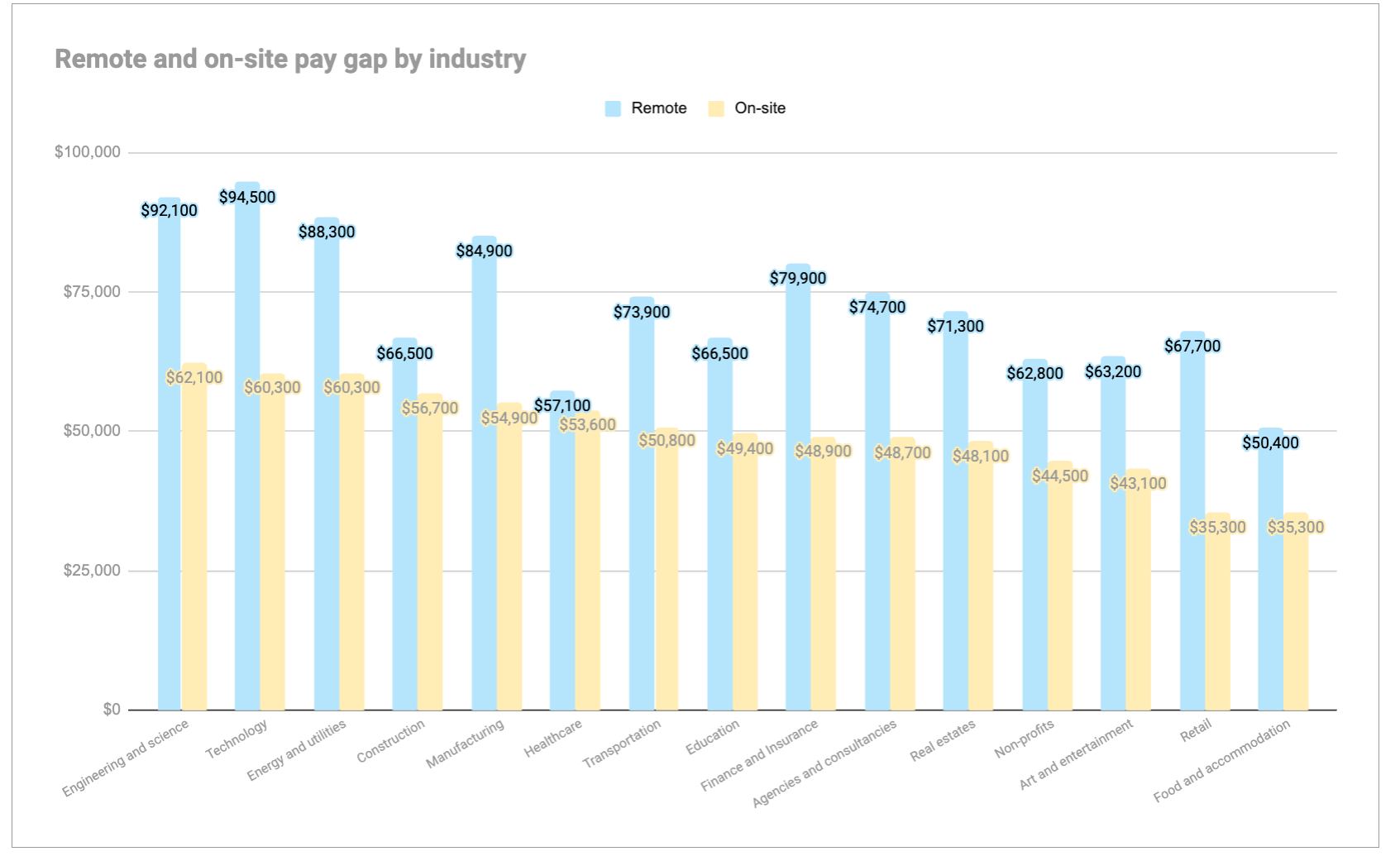

Namely, Payscale’s 2023 State of Remote Work Report finds a significant discrepancy between remote and on-site workers’ salaries within the same industries.

So, for example, while an on-site employee working in retail earns a median pay of $35,300, their colleague working from home earns almost twice as much — $67,700, to be exact.

However, the Payscale’s researchers point out that the discrepancy between on-site and remote workers does not mirror a case of discrimination. In fact, it actually brings to light the fact that highly paid employees are more likely to work from home — possibly based on the nature of their positions.

What are the key factors that determine remote work salaries/paychecks?

The factors that will determine your final paycheck largely depend on:

- The company you’re working for — some may expect you to take a pay cut for your remote role, and some simply won’t,

- The industry of work — since salaries widely range depending on the industry you’re employed in, your field will likely impact your paycheck, too, and

- Your location — companies often define your yearly salaries based on the costs of living in your country or city.

Yet, no matter what the remote work policy or your geolocation prescribes, research by Owl Labs states that as much as 62% of employees would take a pay cut of 10% to be able to work remotely. On top of helping them achieve a better work-life balance, remote work arrangements improve employees’ overall well-being, so their preference for telecommuting should not come as a surprise.

In fact, as the Owl Labs research shows, 29% of remote workers would expect a salary increase if they weren’t able to work from home anymore.

In any case, your remote work salary is most frequently determined by a variety of factors. So, even though a large percentage of remote workers would go along with a change in their salaries, that still doesn’t mean their remote work environment would actually impact their final paycheck.

How much can you save by working remotely?

As a remote worker, you can save quite a lot of resources on a yearly basis. Namely, according to research, Americans spend as much as $8,466 on commutes per year. They also spend extra money on professional wardrobe ($925), as well as restaurant lunches and branded coffee ($1,040).

That’s more than $10,000 you save by working remotely per year, right there.

Now, if you are a remote employee working in retail, and your yearly salary is around $67K, you can quickly save up quite a sum just due to your remote work arrangement.

Even if you’ve taken a 10% pay cut to work remotely, you’d still make more than your on-site-based peers.

For example, if you take a $6,770 pay cut but save $10,000 on various expenses, you’ll still earn $25K more.

Will you still have work benefits if you work away from the office?

Most remote workers have the same benefits even if they work away from the office.

In fact, remote employees most frequently get paid time off and sick leave. However, they may take fewer sick days — after all, commuting for 1 hour while sick is much less convenient than working from home while sick. It’s a matter of choice more than need.

Some remote employees even get unlimited paid time off — which entails a flexible number of days per year you can use for your vacations.

Yet, research by Gusto has found that remote employees take 5.5% less time off on average than their office-based team members, despite having the same benefits.

Namely, remote workers sometimes feel their lack of physical presence at the office makes taking time off uncalled for. In other words, remote employees may feel unequal compared to their colleagues coming into the office, even though they receive the same benefits.

💡 Clockify Pro Tip

Going too long without a vacation can seriously hamper your productivity, mental health, and overall well-being. Read more about how to avoid falling prey to a silent enemy called career burnout:

What do you need for a telecommuting office setup?

Here’s the remote working equipment that each remote office needs:

- Proper furniture — no matter where you work remotely, you’ll need a desk, chair, and related furniture required for your job,

- Hardware for working remotely — this includes a mobile phone, a laptop/desktop computer, a second monitor, a printer, and every related technology you need to complete your assignments, and

- Software for working remotely — this includes tools you need to use to carry out your main line of work, as well as the tools you use to communicate and collaborate with your team.

What is a home office stipend?

A home office stipend is the amount a company reimburses for the expenses of setting up a remote home office. Interestingly, a home office stipend may cover more than just furniture — it will likely include your hardware and software.

In fact, you may be in a position to arrange a home office stipend that covers the costs of:

- Your work equipment,

- Your employee insurance,

- Renting your home office (if applicable),

- Your Internet, and

- Cell or home phone.

But coming up with the exact figure for your stipend may be difficult — since the price of software and hardware you’ll need may even depend on your job position and industry.

You may also receive a mobile stipend that covers work-related calls you make from your home, based on the Bring Your Own Device (BYOD) policy. This mobile stipend usually falls somewhere between $30 and $50 per month or $430 per year.

An Oxford Economics survey has shown that 89% of companies provide at least a partial mobile stipend to cover phone expenses for their BYOD employees. What’s more, 58% cover at least a connectivity stipend — which also includes device purchases.

However, if you do get a home office stipend, you’ll always need to document your bills. Just keep in mind that if your arrangement says you’ll get reimbursed for business calls, you may not be reimbursed for electricity bills.

Anyhow, if you have a great case about why working from home would benefit the business, you’ll be more likely to make arrangements for a home office stipend.

What is a home office tax deduction? And is working from home tax deductible?

Before 2018, if you used your home office strictly for business, you were in a position to deduct at least a portion of your home expenses for taxes.

For example, if the size of your home office is 300 square feet (roughly 28m2), the IRS would provide you with a $5 deduction for each square foot. This may build up to as much as $1,500 you’d be able to deduct for taxes on your home office space.

However, as of 2018 and until 2025, the home office tax deduction law is no longer applicable for people working remotely for companies — only for small-business owners and self-employed, i.e., freelancers.

So, you can no longer deduct home office expenses for taxes.

How do I convince my employer to pay for a coworking space?

If you work from a remote part of the globe, your employer may be more willing to cover the costs of a suitable coworking space.

If you want to make the case for your company covering your coworking expenses, there are elements that may tip the scale in your favor. Explain to your employer that a coworking space would help you:

- Avoid the distractions of working from your home or a coffee shop,

- Always have a reliable internet connection,

- Maximize your productivity,

- Install a dedicated business address for your company in the said coworking space, and

- Have a professional place to attend video conferences and video calls with clients.

Alternatively, you may need a coworking space to test out a new market in a new state or city. If your company sent you to a new city to test out the waters for your business without opening full-fledged offices, you’ll likely have all coworking expenses covered.

💡 Clockify Pro Tip

Even if you don’t regularly work from a coworking space, that still doesn’t mean you couldn’t work faster, smarter and better. Find out how:

Stay on top of your remote work expenses with the right tool

As evident, the question of who covers the expenses of remote work — the employer or the employee depends on a variety of factors.

Yet, to stay on top of them, you’ll need to keep a detailed record of all your costs — especially if your employer intends to reimburse you for your remote work expenses.

With a time and expense tracking app such as Clockify, you can create separate expense categories for different remote work costs, include receipts, and send them off to your employer for approval or as Expense Reports.