The number of freelancers in the USA has been rapidly increasing since 2014 —according to the latest research, there are 59 million freelancers in the USA. People opt for freelance jobs due to their scheduling flexibility and additional income. Also, there are people whose primary sources of income come directly from freelancing. Freelancers have great benefits indeed, but one of the main predicaments is how to calculate billable hours.

Brick and mortar professions have human resource departments that handle their payments, invoices, and PTO time. When you are self-employed, managing payments can rock the boat. It’s oftentimes daunting and quite common for employers to be tardy when it comes to paying. According to research by the Freelance Union, 8 in 10 freelancers deal with payment issues.

In order to avoid this from happening, we’ve prepared some ethical strategies that can help you manage your payments and maximize billable hours as a freelancer.

What are billable and non-billable hours?

Freelancers, as opposed to full-time employees, have the freedom to organize their working time and leisure time how they desire. However, the downsides of working as a freelancer sometimes put perks in the shade. In many cases, these downsides such as unwanted downtime, unpaid vacations, pension, and insurance. But, considering that a lot of freelancers charge their time by the hour, what often worries them is how to increase the number of billable hours. Before we deep dive into maximizing billable hours, let’s make sure you understand what billable and non-billable hours stand for.

Billable hours

When you are self-employed, you don’t have a human resource department to rely on to do the administrative job for you. Instead, you manage your labor hours, vacation, and billable hours by yourself.

Billable hours are the number of hours worked for which a freelancer bills the client. In order to calculate your billable hours correctly, you need to be very meticulous and rigorous — but remain ethical — otherwise, you will end up working for free or fired if you commit fraud.

For instance, in the case of a language tutor, the activities that constitute billable hours are exclusively teaching. In contrast, an attorney’s billable hours include meetings with clients, any form of correspondence with the clients including phone calls or emails, and working on the actual matter for a client.

Non-billable hours

The number of hours that a freelancer works but doesn’t bill the client is referred to as non-billable hours. Non-billable hours include the additional hours that were spent to get the work done but cannot be ethically billed.

For instance, freelance language tutors spend additional hours preparing for the class and providing extra material for which they are not paid. In the attorney’s case, non-billable hours include meetings with coworkers, answering calls and emails that are not directly related to the client, thinking and making strategies.

According to one research, a significant number of freelancers work additional hours so as to meet milestones. For instance, a software developer, from the same research, states that he works 10% more than he charges, around 50 hours a week. One of the reasons why this happens is due to the constant innovation of technologies that is oftentimes hard to keep up with. Thus, developers spend extra hours running tests and trying new things to deliver results and finish the work.

The additional activities like acquiring new skills, obtaining certifications, administrative work, etc. refer to non-billable hours that multiple freelancers spend doing their job but cannot bill.

Who works billable hours?

Freelancers make up a majority of workers who work billable hours — they refer to the people who are self-employed rather than working for someone else full-time, i.e., a company. A lot of freelancers work in customer service, IT sector, writing, education, accounting, etc.

However, there are a few other types of professionals that work billable hours besides freelancers. The calculation of billable hours, amongst others, applies to legal professionals, whether they be freelancers or work full-time for a company. This practice was introduced in the 1960s with the invention of the computer mainly to keep records of billable hours and put an end to unethical billing practices.

Professions that use billable hours when conducting work have a hard job making judgments about which activities constitute as ethically or practically billable. In the following section of this blog post, you can find how to calculate your billable hours easily but also maximize them, in a professional and ethical manner.

Strategies for maximizing billable hours and remaining ethical

We’ve prepared six useful strategies you might adapt to increase your billability yet remain sincere to clients. Therefore, if you are facing delayed payments or even nonpayments, here are some strategies that will help you get the most out of projects you do get paid for (or simply avoid wasting time on the wrong projects).

Avoid job scams

Perhaps this is the initial step you need to check off your to-do list. Do some research on the company you were hired by as a freelancer, see if they have an official website or social media presence. Moreover, look for reviews on legit job review websites, or try to reach out to employees in the company you are applying for.

Furthermore, there are companies that are legit but have a reputation for being late payers or even non-payers. Do your research and agree on payment terms with your clients in advance to have control over your cash flow. Avoiding fraudulent business proposals will save you from wasting your time and working for free.

Provide proof of your work hours

Provide your clients with a clear and transparent description of your billable hours. Vague descriptions such as “testing” or “doing research” can do more harm than good. Some clients will look for a needle in a haystack to dispute your invoices, delay payments, or don’t pay at all. Thus, write a thorough description of each billable activity, track your billable time to avoid misunderstandings, and build trust with your clients. This brings us to our next point.

Track your billable time

To better understand how you can maximize your billable hours, you’ll need to track and calculate them first. When you think about it, calculating billable hours seems like a walk in the park — you multiply your labor hours by your hourly rate. However, freelancers often manage multiple projects for several clients at once and charge differently for each. To prevent confusion and nonpayments, a freelancer should choose a reliable method for calculating billable hours. This is where technology comes in handy since you are not going to write everything down on paper (hopefully).

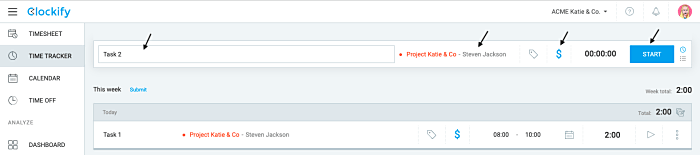

With that said, you can choose a time tracking tool such as Clockify by CAKE.com, to track billable hours with ease. Simply, set your billable rate and start tracking your billable hours whenever you work on a project, as shown in Screenshot 1: Tracking billable hours. Make sure the dollar sign is checked (or disabled for non-billable activities).

Screenshot 1: Tracking billable hours

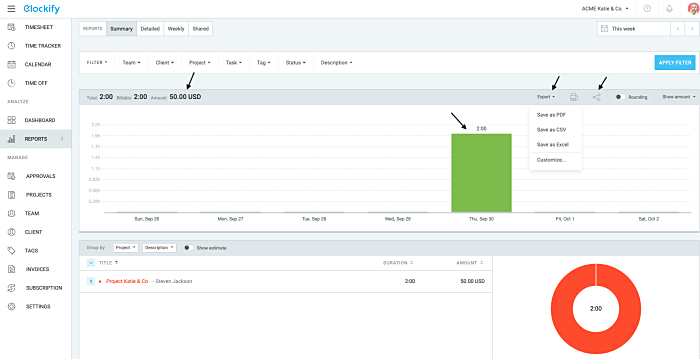

In order to see and analyze your tracked billable hours (and compare them to your non-billable time), go to the Reports section where Clockify automatically includes billable hours in your earnings as shown in Screenshot 2: Reporting. You can also export your report as a pdf or Excel file, or even send an URL link to your client, whatever suits you best.

Screenshot 2: Reporting

Only when you start keeping a record of your time, can you see how you spend your time while working, and how you can organize your day to spend more time on billable activities.

Take caution when creating invoices

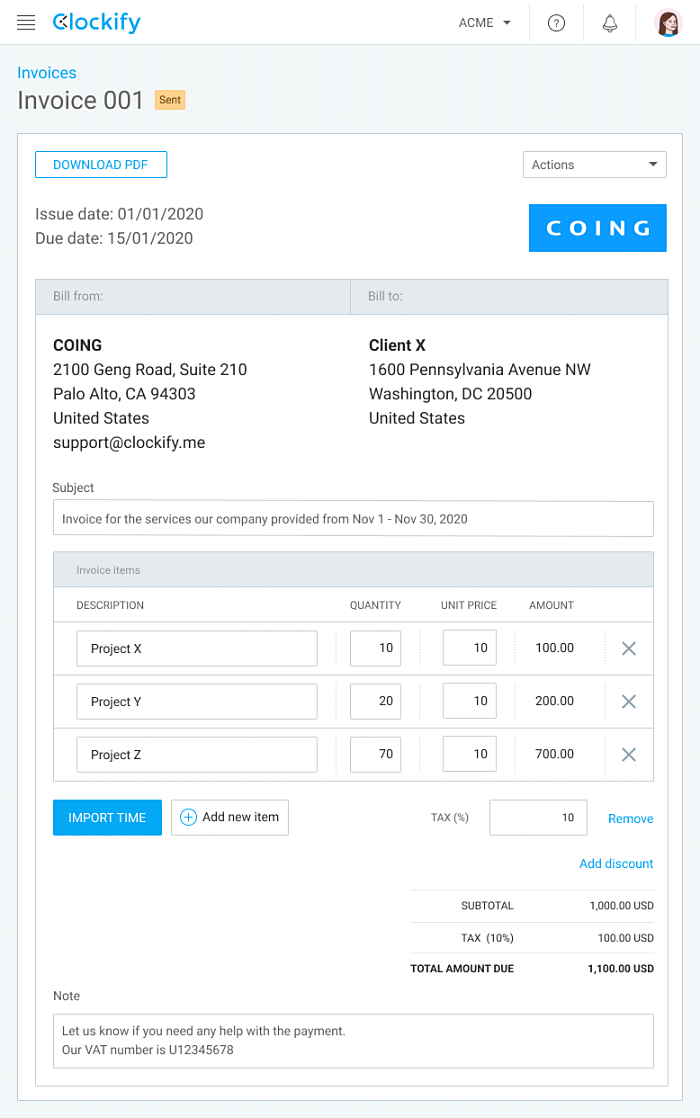

Are you sure you’re always diligent when including billable time in client invoices? Maybe you’re not billing for everything you should, simply because you’re not including all billable entries in your invoices. To avoid this, you can use an app that will create invoices for you.

For example, you can also use Clockify for this purpose to create invoices based on the billable time you’ve just tracked.

Simply, enable invoicing in the settings section, enter your company address in the section below, and start creating invoices.

The best thing about managing invoices this way is that you can automatically populate your invoice by importing your tracked billable time. When your invoice is ready, you can download it and save it in pdf format to be easily shareable with your clients.

Screenshot 3: Invoice example

Using a tool such as Clockify by CAKE.com, you can avoid missing a billable entry or two, and forgetting to bill for something you are supposed to.

Adjust your approach to your profession

When looking for ways to maximize your earnings, always adjust your approach to your profession. Take legal professionals, as an example. Legal work includes a vast number of activities that cannot be practically or ethically billed. A lawyer can’t bill the client hours spent on meetings, administrative work, or committee work. For instance, if a lawyer bills the client seven hours, it means he or she will spend up to twelve hours in the office.

Due to the billable nature of their job, they suffer from burnout, lack of private life, and social isolation. Additionally, billing fraud is common and can result in serious consequences for the legal professionals who try it.

To avoid this from happening, legal professionals can do the following:

✅ Provide your clients with transparent and detailed invoices by tracking your billable time.

✅ Communicate with your clients frequently and have clear policies regarding rates.

✅ Delegate non-billable tasks such as administrative work to legal assistants or secretaries.

✅ Use a billable hour chart to prepare time entries for invoicing more accurately and avoid padding hours since it’s unethical. So, if you worked for less than an hour on client-related things and don’t know how to properly bill them — this method will come in handy.

| Time increment | Minutes |

| 0.1 | 1-6 minutes |

| 0.2 | 7-12 minutes |

| 0.3 | 13-18 minutes |

| 0.4 | 19-24 minutes |

| 0.5 | 25-30 minutes |

| 0.6 | 31-36 minutes |

| 0.7 | 37-42 minutes |

| 0.8 | 43-48 minutes |

| 0.9 | 49-54 minutes |

| 1.0 | 55-60 minutes |

This chart is used to easily calculate chunks of an hour worked. It is based on increments of 1/10th of an hour. For instance, if you worked for 20 minutes at a rate of $180 per hour, look at the chart to find the time increment. In your case, that would be 0.4.

In order to calculate your billable time, multiply the time increment by your hourly rate. So, 0.4 x $180 = $72. You should bill $72 to your client.

To make your life even easier, we’ve prepared a free billable hour calculator for you.

🔽 Download the Billable hour calculator

Treat yourself as a brand

As a freelancer, you need to treat yourself as a brand, establishment, and as a result, others will do so too. This will indirectly maximize your billable hours — because it will increase the chances you’ll be paid. Therefore, be professional.

Don’t write sloppy emails, and try to reply to your emails as soon as possible (if time differences allow so). According to Jon Younger, the coauthor of Agile Talent, you should send invoices weekly or each time you finish the job since it is “a signal that you consider your time valuable.” In the case of complex projects that can last up to a few months, he suggests milestone payments or payments in chunks. Younger says: “You don’t want to work for three months on a project only to have the client say, ‘I hate it. And I will only pay you for 50%.”

Additionally, don’t agree to work on something without receiving a contract with the project’s scope, visible payment terms, and conditions. Read the contract carefully to avoid any fraud or misunderstanding later on.

Present yourself as a professional who delivers consistent and quality work yet respects honest and transparent communication.

Conclusion

Whether you are a freelancer or work in an industry that requires billable hours, choose a strategy that suits you best and integrate it into your work routine. Sure, there are activities you simply cannot bill, but using the strategies from this article may help you acquire new management skills and utilize your time a bit efficiently.

Moreover, maintaining an open and truthful billing practice will earn you status as a valued professional and attract quality clients in return.

✉️ Have you ever dealt with delayed or even non-payments as a freelancer yourself? How did you bill your clients in the end? Write to us at blogfeedback@clockify.me for a chance to be featured in this or future articles.