Late Invoice Statistics You Should Know (2025 Edition)

Frequent overdue invoices aren’t just a nuisance — they cause significant financial strain on businesses. In fact, 1 in 4 bankruptcies happens because of late invoice payments.

Read on for more fascinating late invoice statistics, with tips on how to handle late payments so they don’t harm your business.

What is a late invoice?

A late invoice is a payment request document that’s past due. In other words, every invoice issued to a customer that remains unpaid after the payment deadline is considered late.

What percentage of invoices are paid late?

As per the Atradius 2024 report on US B2B payment practices, half of US invoices are currently overdue.

The responses from the businesses surveyed also showed that 42% of invoices were paid on time. The remaining 8% include bad debts, which are debts that are unlikely to be paid — typically because the customer has gone bankrupt.

Late invoice payments and small businesses

Small businesses are usually the most affected by late invoice payments. Their day-to-day operations aren’t exactly smooth sailing, and their capital is quite limited — especially when they’re just starting out.

What’s more, small businesses make up the majority of US businesses. Namely, a staggering 99.9% of all companies in the US are classified as small businesses, with 45.9% of the US workforce being small business employees.

🎓 Small Business Statistics for 2025

Now, let’s see how frequently small businesses deal with late invoices.

Small businesses are usually paid 8 days late

According to Small Business Insight research, US small businesses, on average, receive payment 8.2 days after the agreed-upon deadline.

Naturally, with their money captured in unpaid invoices, small businesses have lower prospects for growth and risk increased employee turnover. This is especially the case if the lack of cash flow impacts the compensation or career growth opportunities.

14% of small to medium-sized businesses spend 5 or more hours per week chasing late payments

As a finance manager, you likely waste too much time just following up on outstanding invoices. In fact, some 5% of UK small to medium-sized businesses (SMBs) spend over 10 hours dealing with past-due invoices, according to QuickBooks research on the impact of late payments. An additional 9% spend 5–10 hours per week chasing payments.

The rest devote less (or no) time to asking for payment:

- 20% of SMBs spend 1–4 hours asking for payment,

- 27% of SMBs spend less than 1 hour asking for payment, and

- 38% of SMBs don’t spend any time following up on past due invoices.

This may not sound like a lot, but just 1 hour per working day wasted chasing payments amounts to 260 hours per year.

🎓 How to Take Back Control of Your Time

38% of small businesses fail because of financial challenges

Running out of capital is among the top reasons small businesses fail within their first year of operation. In fact, as Forbes statistics show, 38% of US small businesses fail due to financial challenges.

Small businesses that rely less on digital tools experience overdue payments more frequently

The 2025 Small Business Late Payments Report by QuickBooks found a correlation between digital adoption and timely invoice payments. Namely, the results showed that the more a business embraced technology, the less likely it was to experience late payments.

Here’s a detailed breakdown of the rates of digital adoption for businesses that frequently deal with late payments versus those that experience fewer outstanding invoices.

| Type of technology adopted | Rate of digital adoption for businesses that experience outstanding invoices more frequently | Rate of digital adoption for businesses that experience outstanding invoices less frequently |

| E-commerce | 15% | 20% |

| AI | 16% | 20% |

| Cloud services | 30% | 43% |

| Email marketing | 33% | 43% |

| Accounting software | 36% | 56% |

| Business websites | 40% | 63% |

| Social media | 41% | 69% |

As you can see, the results show 4–28% higher digital adoption rates for businesses less affected by late invoice payments. Simply put, if you use the right digital tools, you could save your business a lot of money.

Global statistics for invoice late payment practices

Late payment practice isn’t confined to a geographical location. So, let’s examine the status of overdue invoices across countries and regions.

37% of B2B invoices in Australia are paid on time

A 2025 Atradius report on B2B payment practices uncovered that:

- Only 37% of the surveyed Australian businesses had their invoices paid on time,

- A whopping 52% of invoices were overdue, and

- As many as 11% of outstanding invoices constituted bad debts.

The same Australian businesses noted the following reasons their customers fail to pay on time:

- 42% due to customers’ cash flow issues,

- 36% due to customers’ payment process delay, and

- 27% due to disputes over invoices.

What’s interesting is that as many as 33% of the survey respondents cited invoicing their customers late as another major reason for delayed payments. This means that companies can prevent many late payments simply by issuing invoices on time.

62% of small businesses in the UK aren’t being paid on time

As the Payment and cash flow review report by the UK Department for Business and Trade highlights, UK large businesses report that 25.2% of their invoices aren’t paid on time.

Small UK businesses don't have it any easier. According to the 2025 Small Business Late Payments Report, 62% of small businesses in the UK deal with overdue invoices.

With over 5.45 million small businesses in the UK, this translates to more than 3 million companies that regularly struggle to receive payment for their services on time.

With such a poor payment culture, it‘s not surprising that as many as 50,000 small businesses in the UK close every year due to untimely customer payments.

47% of EU businesses reported having issues due to late customer payments

A 2024 report by the European Commission revealed that 47% of EU businesses reported experiencing problems because of outstanding invoices. That’s the highest increase in the past 5 years — from 43% in 2019.

This practice impacts European businesses to the extent that 25% of all bankruptcies are caused by late invoices.

To minimize such occurrences, in 2023, the European Commission proposed a regulation that would limit the maximum payment term to 30 days.

—

Other regions, particularly parts of Latin America and Asia, have already introduced e-invoicing mandates. The first country to introduce mandatory digital invoicing was Mexico, back in 2011.

The consequences of late invoice payments

Late-paying customers not only negatively impact their clients’ financial performance but can also leave their footprint on a business’s resignation rate.

Let’s take a look at all the potential consequences of late invoice payments up close.

Consequence #1: Financial hardships and an increased number of loans

One of the greatest constraints to small and medium-sized businesses’ growth are insufficient financial resources, according to the World Bank.

Late or unpaid invoices only add fuel to the fire in such uncertain times — especially considering the high percentage of bad debt. For example, a Creditsafe report revealed that 32% of businesses lose between 5% and 30% of their annual revenue due to bad debt.

To stay afloat and ensure sufficient working capital, companies typically need to either overhaul their entire business strategy or secure business loans.

As the Xero report on small business late payments and borrowing shows, the majority of businesses opt for a loan. By analyzing the connection between late payments and an increased number of business loans, the researchers discovered that small businesses borrowed more funds whenever invoices were paid late.

The same Xero report analyzed data from the US, Australia, New Zealand, the UK, and Canada over 5 consecutive years. The researchers found that small businesses affected by late invoice payments collectively borrowed $4,418 billion.

Consequence #2: Operational issues

Usually, it’s only a matter of time before the lack of funds triggered by late payments begins to threaten day-to-day operations.

If a business relies solely on external payments, invoices that aren’t cleared on time may result in insufficient working capital. This, in turn, impacts everything — from standard procedures, such as running payroll and meeting supply demands, to unexpected matters, such as emergency repairs or equipment failures.

Consequence #3: Difficulty hiring skilled workers

Waiting for outstanding invoices to be paid takes its toll on a business’s cash flow. The financial shortfall naturally prevents companies from hiring new employees. As a result, remaining workers are left to handle extra workload — leading to overworked employees and potentially even an increased resignation rate.

Cash flow issues also make it difficult to offer attractive compensation and bonuses. This often deters skilled workers from applying for the job.

The above-mentioned QuickBooks 2025 report discovered that companies experiencing significant payment delays are 1.3 times more likely to face challenges hiring skilled workers. This challenge is even greater for businesses with longer payment terms — 1.6 times to be exact.

🎓 Career Burnout and Its Effect on Health

Tips on how to get paid faster

Although the late invoice statistics may not exactly inspire hope, you can take measures to speed up the process of getting paid, effectively minimizing outstanding payments.

Here are 5.

#1: Apply discounts and incentives

Interestingly, consumer psychology research has indicated time and time again that saving money increases the feeling of happiness — making customers more likely to purchase discounted products.

Yet, discounts and incentives can work even long beyond the selling point, when you’re just looking to get paid on time.

Offering a discount for early payments motivates your clients to pay ahead of schedule and places you ahead of your competitors — especially if they don’t provide such a reward.

For example, you can offer a 2% discount for invoices paid within the first 10 days, or provide additional support or services as incentives.

Yet, keep in mind that incentivizing prompt payment can also impact your own finances. Some customers may even misuse this system, so it’s best first to determine exactly how frequently you deal with late payments.

If it happens frequently, receiving less money for your product may be better than not getting paid at all.

#2: Use invoicing software

Processing invoices manually takes too much time and effort. It’s easy to overlook including all relevant information. If you omit crucial details like the payment due date, you most likely won’t get paid on time.

On the other hand, invoicing software prompts you to include everything a proper invoice needs. It also saves your team time, allowing them to focus on higher-value tasks.

For that, you can try Clockify by CAKE.com — a powerful time tracking and invoicing tool. In Clockify, you can dispatch an invoice immediately after you’re finished tracking your tasks.

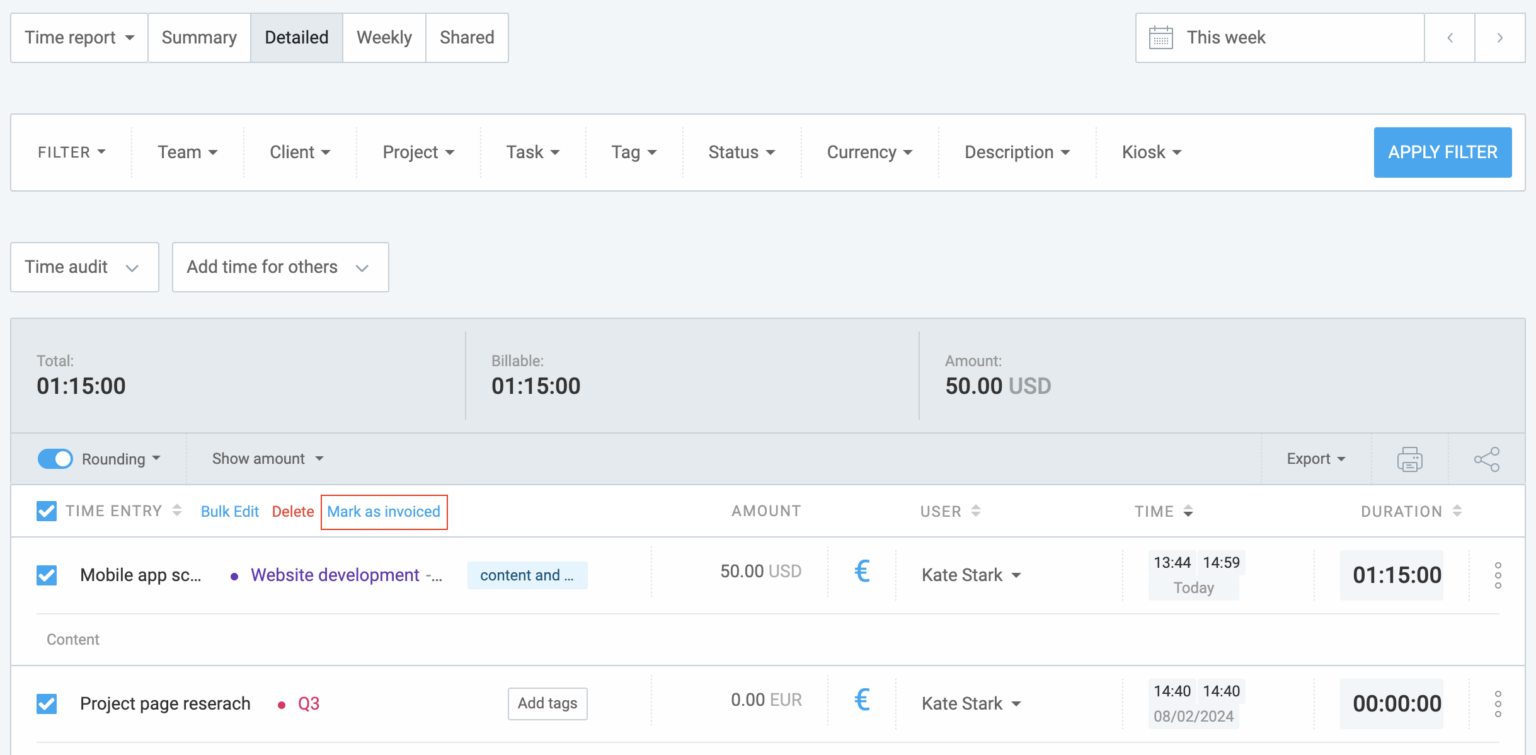

Then, simply head to the Detailed report section and mark your tracked entry as invoiced as soon as you send the invoice.

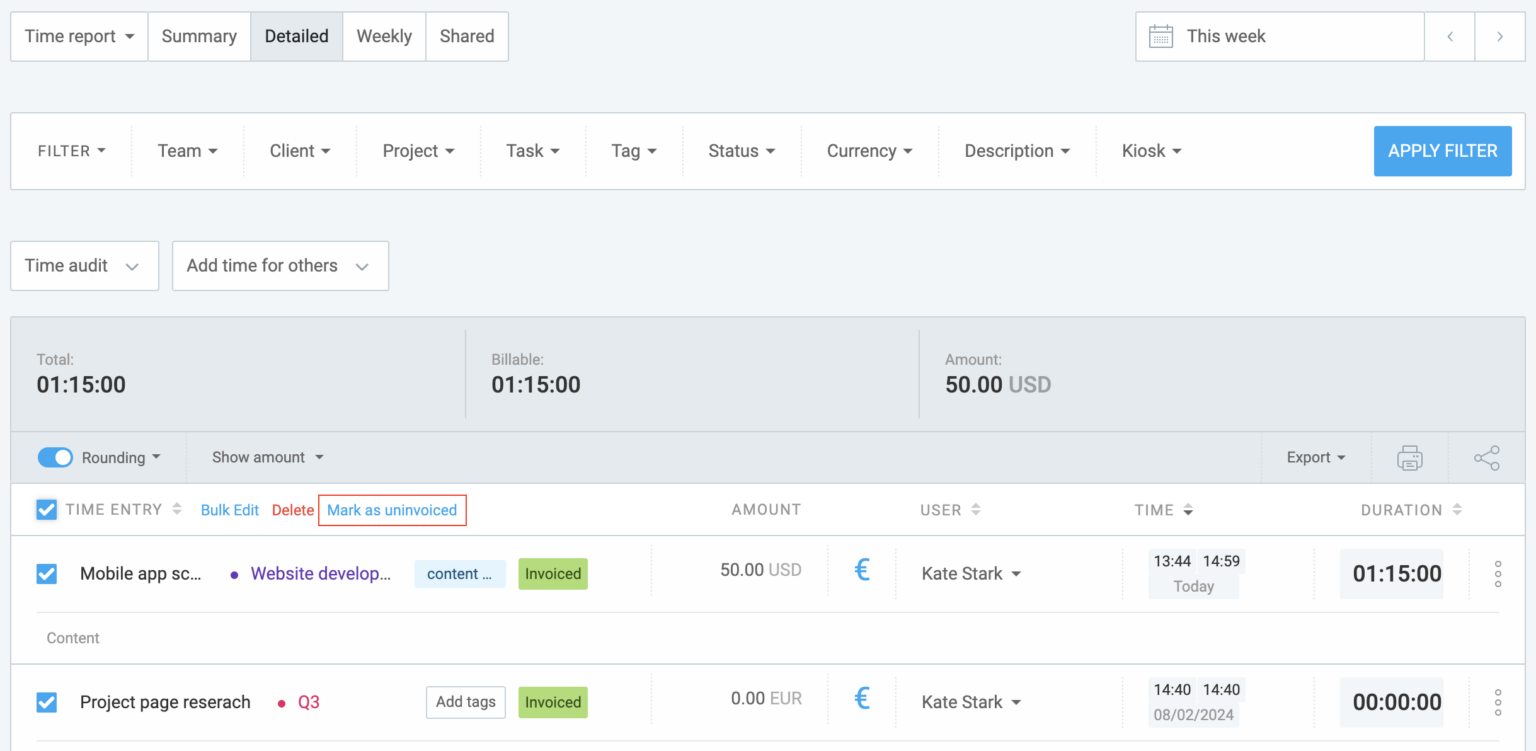

Immediately after, you’ll see a green Invoiced tag appear next to your time entry.

This way, you’ll always have a visual cue to inform you whether your customers failed to pay on time or you simply forgot to issue the invoice.

🎓 10 Best Free Invoicing Software for Error-Free Accounting

#3: Send payment reminders

Many business owners are reluctant to ask for payments, which is one of the reasons for the high percentage of unpaid invoices. As many as 42% of Australian SMB owners reported feeling uncomfortable chasing payments for outstanding invoices. The reasons they cited include:

- Fear of coming off as rude, and

- Fear of upsetting the customer.

However, there are effective ways of reminding customers that their payment is due without damaging your relationship with them. You can do this by asking for payment politely via email.

Yet, matters can become complicated when you have too many outstanding invoices. If you rely on manual processes for managing invoices, it’s difficult to keep track of which customers are late with their payments. Thus, you can’t be sure what payments to chase first.

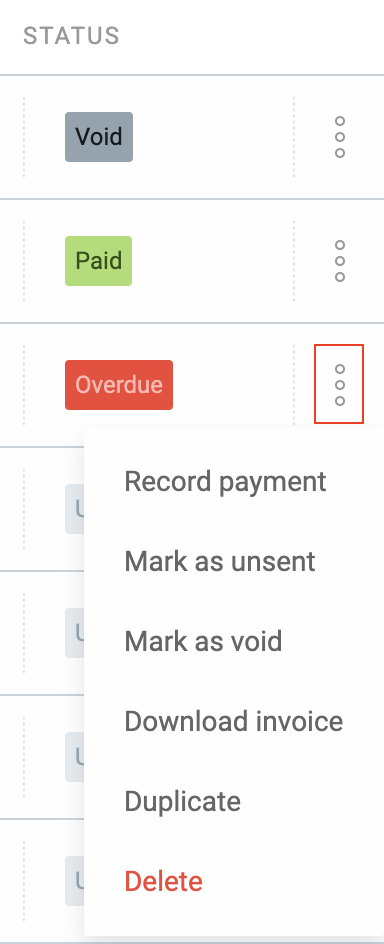

Using Clockify for invoicing means you can mark each invoice as paid as soon as the payment has been cleared. This also helps you get a precise overview of all the late invoices.

As soon as you notice an Overdue invoice status, you’ll know it’s time to send your client a quick reminder that they have a debt to settle.

This way, you’ll likely speed up the payment process and reduce the waiting time — especially if the invoice due date simply slipped your client’s mind.

🎓 How to Ask for Payment Politely and Professionally (+ Templates)

#4: Offer a variety of payment methods

If possible, give your clients multiple payment options.

Not offering a client’s preferred payment method can slow down the money transfer process. In some cases, it can even make it impossible for your client to pay. So, think about providing your clients with greater flexibility.

Accept traditional payment options, including credit and debit cards, as well as bank transfers. In addition, consider introducing digital wallets and wire transfers.

This way, you’ll safeguard your business from outstanding payments caused by money transfer issues. This also helps you stand out from the competition that doesn’t provide enough payment options.

#5: Include late payment fees

Rewards may serve as a motivational drive for the majority of people. However, in some cases, nothing except charging extra will help you get paid on time.

Yet, to enforce late fees, you must be upfront and very specific about your late payment policies from the start.

First, lay out the payment terms and conditions before you close the deal with the customer. Also, remember to include a section on your late fees policy in the invoice.

A typical late fee in the US is 1-2%. However, keep in mind that certain US state laws limit the late invoice payment interest. So, make sure you’re familiar with your state’s regulations.

The future of invoicing

Invoicing has evolved tremendously over the last couple of decades with the goal of reducing the number of late payments — and it hasn’t stopped there.

If you’re wondering what the future holds, here are some of the most prominent invoicing trend predictions for 2026 and beyond.

#1: More businesses ditching paper invoicing

We’ve already witnessed a major shift toward digital invoicing. However, we can’t say paper invoicing is completely gone. While the EU has proposed electronic invoicing mandates, it appears that the US has no such plans.

Curiously, about half of the US invoices are still printed on paper. However, we can expect more digital adoption when it comes to invoicing in the near future.

#2: Increasing reliance on AI

Evidently, AI-powered solutions are becoming increasingly popular. As this technology becomes increasingly refined, we can expect it to be used more widely.

According to the State of ePayables 2025 report, only about 44% of surveyed accounts payable (AP) teams rely on AI. However, 75% of respondents expect to adopt AI to some extent within the next year.

#3: Mobile invoicing

Sending invoices via mobile phones is expected to become the standard. This is no surprise, considering that more global internet traffic comes from mobile devices than computers.

In fact, data from 2024 shows that 58.7% of traffic comes from mobile devices, as opposed to 41.3% from desktop computers. This percentage is projected to rise even more (in favor of mobile devices) in the future.

FAQs about late invoices

Outstanding invoices can still cause confusion, so you may have some questions about them. Take a look at some of the most frequently asked questions we’ve answered below.

How late can an invoice be issued and remain valid in the United States?

The US law doesn’t have a specific limit on how late you can send an invoice for it to be valid. However, keep in mind that the later you issue the invoice, the later you get paid.

Also, the statute of limitations on debt in the US is 6 years. This means that you have 6 years to collect payment from customers starting from the payment due date. After that period expires, you can no longer take legal measures to demand payment.

How to write a past due invoice email?

Your late payment invoice email should be short and to the point. Be direct and firm while still remaining polite and professional. Make sure to include relevant details like:

- Amount to be paid,

- Invoice number,

- Date the invoice was sent, and

- When the invoice was due.

If you’re having trouble crafting such an email, you can rely on payment request email templates.

What is the average late fee for invoices?

There isn’t one typical average late fee that works for all businesses.

Companies typically charge either a flat rate fee (such as $10 or $100) or a specific percentage (1% or 5%) of the total invoice amount.

The amount, however, depends on a variety of factors — including different business policies, industry standards, and sometimes even laws and regulations valid in the state where a business operates.

🎓 Free Invoice Templates for Freelancers

Why do people pay invoices late?

Some of the most common reasons clients fail to make timely payments include:

- Financial constraints,

- Confusing payment terms, and

- Disagreement regarding the quality of goods/services provided.

However, if you want to know for sure what’s behind your client’s invoice late payment, you can always ask them directly.

Eliminate delayed payments with Clockify by CAKE.com

Even the best finance manager in the world can’t always avoid outstanding invoices. However, too many late payments make it difficult to predict cash flow accurately.

As a result, you’re faced with financial planning issues, such as establishing a budget and determining product/service pricing.

To reduce the number of such incidents, streamline your invoicing process with a time tracking and invoicing tool like Clockify.

Clockify by CAKE.com allows you to store all the necessary details regarding your services in one place. Then, as the moment to collect payment arrives, all it takes is a couple of seconds to select all the details you want to include in your invoice and send it off.

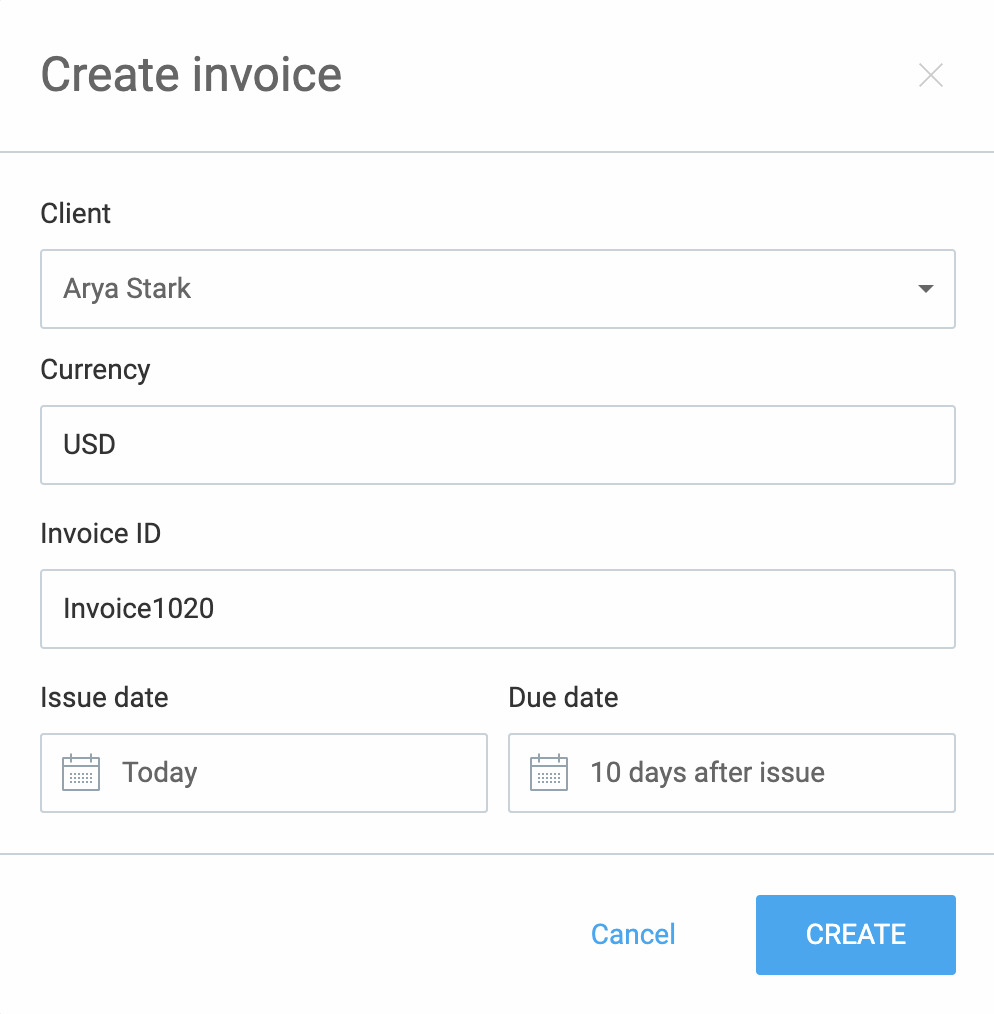

To create an invoice in Clockify, all you need to do is:

- Go to the Invoices section,

- Click Create invoice,

- Select your Client, Currency, Issue, and Due dates, and

- Click Create.

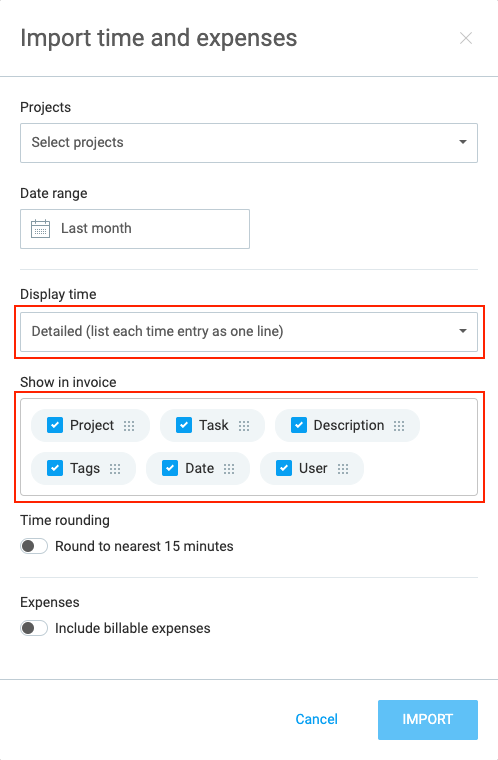

You can also decide whether you’d like to add items to your invoice manually or automatically import the time you’ve tracked.

Clockify’s invoicing feature also lets you add a discount to each invoice. This can serve as an extra motivational boost for your customers should you decide to incentivize early payments.

This way, you increase your chances of receiving payments on time, effectively speeding up cash flow. But you also minimize the risks of omitting important information when creating an invoice.