New Mexico Labor Laws Guide

Ultimate New Mexico labor law guide: minimum wage, overtime, break, leave, hiring, termination, and miscellaneous labor laws.

| New Mexico Labor Laws FAQ | |

| New Mexico minimum wage | $11.50 (except for Santa Fe County — $12.10 and Las Cruces — $10.50) |

| New Mexico overtime laws | 1.5 times the minimum wage for any time worked over 40 hours/week ($17.25 for minimum wage workers, $18.15 in Santa Fe County, $15.75 in Las Cruces) |

| New Mexico break laws | Breaks not required by law |

Table of contents

New Mexico wage laws

We’ll first deal with the laws and regulations regarding minimum, tipped, and subminimum wages in New Mexico.

| NEW MEXICO MINIMUM WAGE | ||

| Regular minimum wage | Tipped minimum wage | Subminimum wage |

| $11.50 (except for Santa Fe County — $12.10, and Las Cruces — $10.50) |

$2.80 (except for Albuquerque and Las Cruces — $6.30, and Santa Fe County — $3.62) |

50% of the standard wage Regular minimum wage — $5.75 Santa Fe County — $6.05 Las Cruces — $5.25 |

New Mexico minimum wage

The term minimum wage refers to the lowest hourly rate employees can be compensated for their work.

On a federal level, wages are regulated by the Fair Labor Standards Act (FLSA) — but each state has the right to make the state minimum wage higher than the federal minimum wage of $7.25.This is the case with New Mexico.

New Mexico’s current minimum wage is $11.50 — with two exceptions:

- Santa Fe County, where minimum wage employees earn $12.10 per hour, and

- Las Cruces, where the minimum wage is $10.50 per hour.

The increase to the minimum wage in New Mexico is announced and will go into effect on January 1, 2023. The new regular minimum wage will be $12.

There are some exemptions and exceptions to the minimum wage requirement — for example, for tipped occupations.

Let’s see what else is relevant in terms of fair compensation for New Mexico employees.

Tipped minimum wage in New Mexico

According to federal law and the Internal Revenue Service (IRS), tips are optional payments freely provided by customers to employees.

Tips are closely tied with certain professions, especially in the hospitality industry. To provide a couple of examples — people often leave tips to servers and bartenders, as a recognition for their service.

Tipped employees in New Mexico are employees who regularly receive such gratuities.

Under New Mexico regulations, the tipped minimum wage is $2.80.

This rate is applicable only if the sum of the basis ($2.80) and the earned tips amounts to at least $11.50 (i.e. the regular minimum wage).

If the sum is lower, New Mexico employers must pay the difference.

The tipped minimum wage increase is also announced and will be $3, starting from January 2023.

There’s a common practice related to tips — tip pooling (or tip sharing).

The practice refers to all tipped employees sharing a portion of their tips in order for a part to be distributed to employees who usually don’t receive tips, such as:

- Cooks,

- Line cooks,

- Prep-cooks, and

- Dishwashers.

New Mexico employers can require employees to participate in tip pools, as New Mexico law doesn’t address the matter — meaning that the federal law applies.

Even if an employer doesn’t require tip pooling, employees can enter into agreements about this among themselves.

Cash wage for tipped employees in Albuquerque, Las Cruces, and Santa Fe County

There is another set of rules regarding tipped employees in Albuquerque, Las Cruces, and Santa Fe County.

Employers can compensate employees in cash wages at a different rate — again, provided that the total of the cash wage and tips is at least the same as the local minimum wage.

The cash wage hourly rates are:

- $6.30 in Albuquerque and Las Cruces

- $3.62 in Santa Fe County

Exceptions to the minimum wage in New Mexico

Certain job profiles are exempt from the law regarding minimum wage in New Mexico (e.g. employees working in agriculture).

The following is the list of other professions to which minimum wage requirements don’t apply in New Mexico:

- White collar employees (bona fide executives, administrative workers, and professionals)

- Outside salespeople, provided they are compensated on a commission basis, by piecework, or flat rate schedules

- Individuals who work on a voluntary basis for educational, charitable, religious, or nonprofit organizations

- G.I. bill trainees while under training

- Seasonal employees of employers who have a valid certificate issued by the Labor Relations Division of the Workforce Solutions Department

- Employees working in agriculture

- Employees engaged in handling, drying, packaging, processing, freezing, or canning of any agricultural and horticultural commodity in its unmanufactured state

- Employees of charitable, religious, and nonprofit organizations who reside on the premises

Subminimum wage in New Mexico

The minimum wage for certain categories of workers — such as apprentices and employees with disabilities in New Mexico — is commonly known as the subminimum wage.

The term “subminimum” implies that employers are allowed to pay such employees a lower hourly wage. In New Mexico, it must be at least 50% of the standard minimum wage.

The number translates to a requirement of at least $5.75 per hour, or $6.05 in Santa Fe County, while it’s $5.25 in Las Cruces.

There are several categories of employees who can be paid at a lower rate:

- Apprentices

- Learners

- Employees with disabilities — provided the employer has obtained a special certification for that purpose

Unlike in many other US states, employees who are trainees, student learners, and student workers are still entitled to at least the standard minimum hourly rate — i.e. they are NOT paid the subminimum wage.

New Mexico payment laws

When it comes to pay frequency in New Mexico, employers are required by law to provide regular compensation for their employees on a semi-monthly basis.

This means that every 2 weeks are considered a payroll period.

The only exceptions to the semi-monthly pay period are monthly payday requirements for:

- Executive personnel

- Administrative personnel

- Professional personnel

It is also legal for an employee to have a different payroll period — provided that both employers and employees agree on these different terms, in writing.

Track employee payroll with ClockifyNew Mexico overtime laws

Regulations established by the Fair Labor Standards Act define a working week as any seven consecutive working days.

During this period, employees who work up to 40 hours are compensated for their work at an hourly rate of at least a minimum wage, as defined by the New Mexico constitution.

Any number of hours exceeding 40 counts as overtime and must be compensated at a higher hourly rate.

Non-exempt employees who do exceed that number of work hours are entitled to 1.5 times their regular pay rate.

In other words, the overtime hourly rate for minimum wage employees is $17.25 per hour, except for those employed in Santa Fe County and Las Cruces.

As Santa Fe's standard rate is higher, the overtime rate in this county of New Mexico is $18.15 for minimum wage employees. For Las Cruces, the standard rate is lower, so the overtime rate translates to $15.75.

Track New Mexico overtime with ClockifyOvertime exceptions and exemptions for white collar employees in New Mexico

Following the federal requirements on the overtime exemptions, 4 main categories of employees are not protected by the law, as they fit into the larger category of white collar occupations.

When it comes to overtime, provided they earn at least $684 per week, white collar employees do not have to be paid at a 1.5 rate for working over 40 hours per week.

White collar employees are the ones working in any of the following categories:

- Administration — people who perform non-manual work related to business operations, management policies, or administrative training (provided that no more than 20% of their time is spent on activities unrelated to the position) — this category includes accountants, HR team members, market research analysts, etc.

- Executives — business, general, and executive managers who directly manage at least 2 employees

- Professionals — people whose position calls for advanced knowledge and extensive education, such as software analysts or software engineers (the category also includes artists, certified teachers, and other creative work requiring talent, invention, or imagination)

- Outside sales — outside sales representatives who visit potential and existing customers at their premises (New Mexico has an additional requirement for the category of outside salespeople — only the ones compensated on a commission basis, by piecework, or flat rate schedules are exempt from the overtime requirement)

New Mexico overtime exemptions for specific occupations

Besides the federal government exemptions, the state enforces overtime restrictions on some other, more specific occupations.

Overtime and minimum wage exemptions are almost the same — at least — but there is one additional category for overtime exemptions.

So, here’s the full list of occupations exempt from overtime pay rates in New Mexico:

- Any and all individuals working for the United States, the state, and a political subdivision of the state

- Individuals who work on a voluntary basis for educational, charitable, religious, or nonprofit organizations

- G.I. bill trainees while under training

- Seasonal employees of employers who have a valid certificate issued by the Labor Relations Division of the Workforce Solutions Department

- Employees working in agriculture

- Employees engaged in handling, drying, packaging, processing, freezing, or canning of any agricultural and horticultural commodity in its unmanufactured state

- Employees of charitable, religious, and nonprofit organizations who reside on the premises

New Mexico break laws

Employers in New Mexico are legally not required to provide any type of breaks.

There is only one required type of break in New Mexico, but it applies only to breastfeeding mothers. It is called a lactating break, and we will elaborate on it in one of the following sections.

Exceptions to break laws in New Mexico

Employers can choose to create a company policy that offers both meal and rest breaks to their employees, even though it’s not required by the law.

The length of breaks determines whether that period is compensable or not, if an employer does offer meal and/or rest breaks. The rules are as follows:

- 5 to 20 minutes — compensable

- 30+ minutes — not compensable

Breastfeeding laws in New Mexico

All working mothers who gave birth recently and are still lactating and breastfeeding are entitled to take a break for this purpose.

In New Mexico, the same as on the federal level, employers are obligated to provide adequate conditions for such female employees.

This type of break can be either paid or unpaid, as predetermined by the company regulations and policy.

By “adequate conditions”, the law refers to employers providing a room or location with a door that can’t be a bathroom stall.

Employers must provide such a location in the nearest possible proximity to the working environment.

New Mexico leave requirements

The law clearly regulates which types of leave employers are required to provide, with no negative consequences for an employee upon their return to work.

There are 2 broad categories of leave of absence — required and non-required, according to the US Department of Labor.

However, the types of leave included in the 2 categories are not predetermined by the federal law, as each state regulates them differently.

Here’s how New Mexico observes required and non-required leave.

Track employee time off with ClockifyNew Mexico required leave

While employers do have to offer and provide some types of required leave to all their employees, they don’t have to compensate them for that period.

But, some company policies will nevertheless offer paid required leave.

Here’s the list of all types of leave that employers in New Mexico are required to offer by law:

- Family and medical leave

- Jury duty leave

- Voting time leave

- Domestic violence or sexual assault leave

- Volunteer emergency responder leave

- Civil air patrol leave

- Military leave

Family and medical leave

This is a type of required leave that all employers in the state of New Mexico must provide their employees with.

Eligibility for this type of leave is regulated by the Family and Medical Leave Act or FMLA.

The FMLA states that all employees are eligible to use 12 weeks of unpaid, job-protected work absence in a one-year period for the following medical and family-related reasons:

- Care for the employee’s own serious health condition

- Care for an immediate family member with a serious health condition

- Care for the employee’s newly-born child

- Placement for adoption/foster care of a child with the employee

- Any difficulty due to the employee’s immediate family member being a covered military member on active duty

To be eligible, an employee must have worked for the employer for at least a year and at least 1,250 work hours. Note that this leave requirement is applicable to employers with over 50 employees only.

Employers are also required to provide up to 26 weeks of unpaid leave if an employee needs to take care of a member of the Armed Forces with a serious health condition, injury, or undergoing medical treatment or therapy. This is applicable only if said member is an employee’s spouse, parent, child, or next of kin.

Jury duty leave

If an employee in New Mexico is summoned to perform jury duty, their employer must allow them to be absent from work during that time. Employers mustn’t require employees to use their sick, vacation, or any other type of leave for this reason.

The law also states employers can’t penalize or discipline their employees in any way for the acceptance of jury duty — but they don’t have to compensate their employees for this period of absence.

Voting time leave

New Mexico employers must offer 2 hours of paid voting time leave to their employees whose shift:

- Begins within 2 hours of the polls opening

- Ends less than 3 hours before polls close

Domestic violence or sexual assault leave

Employees who are victims of domestic or sexual violence are entitled to this type of unpaid leave for:

- Up to 14 days of intermittent leave in any calendar year

- Up to 8 hours in a day

Specifically, this type of leave is provided for the following reasons:

- To obtain an order of protection or other judicial relief

- To meet with law enforcement officials, attorneys, and advocates

- To attend related court proceedings

Volunteer emergency responder leave

When it comes to employees who are volunteer emergency responders, their employers must offer them up to 10 days per year to respond to an emergency. This is a type of unpaid leave.

Here are some examples of such voluntary positions:

- Firefighters

- Ambulance drivers

- Medical technicians

Civil Air Patrol leave

New Mexico employees who are members of the Civil Air Patrol are entitled to up to 15 days of unpaid leave per year.

The purpose of this leave must be to participate in search and rescue missions.

Military leave

This type of leave is regulated on a federal level, by the Uniformed Services Employment and Reemployment Act.

The act states that all employees in the US must be granted a leave of absence to serve in one of the following:

- The US Armed Forces

- The National Guard

- The state militia

Upon the employee’s return to work, the employee must be entitled to the same pay and other benefits as if they were present at work the entire time.

New Mexico implements an additional requirement for employers — they are not allowed to discharge said employees without cause, for 1 year upon their return to work.

New Mexico non-required leave

There are 4 categories of leave that, by New Mexico state laws, employers are not required to offer to their employees.

Said categories are:

- Sick leave

- Vacation leave

- Holiday leave

- Bereavement leave

It is important to mention that the law also doesn’t prohibit or restrict these types of leave.

If an employer chooses to offer any or all of these types of leave, the exact terms of leave need to be stated in the signed contract of employment.

Sick leave

New Mexico employers are not required to offer sick leave, either paid or unpaid.

Vacation leave

New Mexico employers are not required to offer any paid or unpaid time off for vacations.

Holiday leave

Likewise, employers in New Mexico are not required to offer holiday leave.

Bereavement leave

The same is applicable to bereavement leave — New Mexico employers are not required to offer this type of leave to any of their employees.

Child labor laws in New Mexico

The term “minors'' refers to young people, aged under 18. The main purpose of both federal and New Mexico child labor laws is to prevent the exploitation of minors.

Additionally, their purpose is to help minors put education first — their employment is only meant to enhance their academic and life experience.

Some of the most relevant limitations regarding the employment of minors can be seen in the following categories:

- Maximum number of work hours

- Nightwork

- Restrictions on specific occupations

While different rules and regulations are applicable to different age groups, there is still one thing applicable to all minors — they are forbidden to work in any hazardous positions, according to the federal law.

Next, let’s take a look at some rules and regulations stated in the New Mexico Child Labor Laws.

Specific labor laws for minors in New Mexico

In New Mexico, child labor laws enforce specific rules for different age groups of minors. They put restrictions on the maximum hours of work and nightwork of minors.

To be employed, minors who are under 16 years of age must obtain a Work Permit certificate and proof of age.

Proof of age can be:

- Birth certificate

- Tribal ID

- Passport

- Government-issued identification

For the employment of minors, the following rules apply.

- Minors under 16:

- The maximum number of work hours is 8 hours per day, 40 hours per week — provided that school is not in session.

- When school is in session, the limit is 3 hours per school day — while the total number of hours per week mustn’t exceed 18.

- Nightwork restrictions only apply to these minors — they are prohibited to work between 7 p.m. and 7 a.m.

- The only exception, when they can work until 9 p.m., is in the period from June 1 to Labor Day — i.e. the first Monday in September.

- Minors aged 16 and 17:

- There are no restrictions on the maximum number of working hours.

- There are no restrictions on nightwork.

Prohibited occupations for minors in New Mexico

In compliance with federal restrictions, minors are forbidden to work in any and all occupations that are declared as hazardous.

Here are some examples of hazardous occupations:

- Electrical technicians

- Boiler or engine room operators

- Any work with flammable, toxic, or corrosive substances

- Elevator-related work

- Centrifugal machine operators

- Any and all work including climbing

- Any and all work including power-driven machinery

- Any and all work including glazing and glass cutting

Under New Mexico law, all minors are also forbidden from working in any quarry or mine underground, and around any place where explosives are used.

For minors under 16 years of age in New Mexico, there are additional restrictions — so here’s the full list of state-specific prohibited occupations for them:

- Working around belted machines while in motion

- Working around power-driven woodworking machines

- Working around plants or establishments containing explosive components

- Working around plants or establishments where malt or alcoholic beverages are manufactured, packed, wrapped, or stored

- Working around electrical hazards

- Municipal firefighting

- Door-to-door sales — except for non-profit activities and with parents’ or guardians’ approval

- Any employment dangerous to limbs or injurious to the health or morals of children

Additionally, there is a specific set of rules and regulations regarding the employment of children in the entertainment industry.

For more information, you should visit the New Mexico Administrative Code, Chapter 11, and read about the Child Employment Entertainment Law.

New Mexico Department of Workforce Solutions — Child Labor SectionTermination laws in New Mexico

Like the majority of other states in the US, New Mexico also implements an “employment-at-will” doctrine and policy.

Here’s what “employment-at-will” means for:

- Employers — they can terminate their employees’ work engagement anytime, for any reason, or for no reason at all.

- Employees — they are free to quit a job for any or no reason, with no legal consequences.

There are only 2 exceptions in terms of employers’ reasons for termination:

- It mustn’t be on a discriminatory basis

- It mustn’t be done in retaliation for a rightful action

Final paycheck in New Mexico

Employers in New Mexico are legally required to provide the final paycheck, including all the wages and benefits to everyone whose employment was terminated.

According to the New Mexico Labor wage laws, final paychecks for laid-off or fired employees are due in 5 days, provided the employee in question has a fixed wage rate.

The due date for the final paycheck is 10 days after the termination date for employees whose wages are based on:

- Commission,

- Task, or

- Another method of calculating wages.

For employees who quit their positions, or leave as a consequence of a labor dispute, the due date is the next regularly scheduled payday.

Discrimination laws in New Mexico

According to federal law, discrimination in the workplace is not only unethical but also illegal. There are many bases of discrimination in the workplace forbidden on a federal scale.

The state of New Mexico has expanded on the federal discrimination laws via the New Mexico Human Rights Act.

So, federal and New Mexico-specific laws forbid employers from basing their employment practices on:

- Race

- Color

- Age

- Gender

- Sexual orientation

- Religion

- National origin

- Pregnancy

- Genetic information (including family medical history)

- Physical or mental disability

- Child or spousal support (wage withholding)

- Military or veteran status

- Citizenship and/or immigration status

- Status as a smoker or non-smoker

- Marital status

- Spousal affiliation

Federal law regarding discrimination is enforced through the Equal Employment Opportunity Commission or EEOC, while the state administrative agency is the Human Rights Bureau or HRB.

While the federal law covers only employers with 15 or more employees, the New Mexico anti-discrimination statute covers the workplaces with 4 to 14 employees as well.

Employees who have the reason to believe that they were discriminated against should file a formal complaint to one of the abovementioned agencies. The complaint should be filed within:

- 180 days of the discriminatory act if filed to the HRB, or

- 300 days of the discriminatory act if filed to the EEOC.

Occupational safety in New Mexico

All employees must have a safe and healthy working environment — and the federal and state laws require employees to provide optimal conditions.

The first regulation to mention is the federal Occupational Safety and Health Act (OSHA), passed by Congress in 1970 — but there are some additional requirements for the employers in New Mexico, which we will discuss in the next section.

The federal OSHA states that employers are required to:

- Provide safe and healthy working conditions,

- Continually inspect for flaws and irregularities, and

- Strive to improve working conditions, if possible.

Employers are required to provide several things to ensure workplace safety to their employees:

- Proper training,

- Education, and

- Continuous assistance.

The main goal is — to reduce and further try to eliminate the possibility of workplace injuries, illnesses, and fatalities.

Besides providing necessary training and education for employees, employers must create optimal working conditions — free from any recognized hazards.

Moreover, it is obligatory to conduct research on health and safety conditions regularly, as well as undertake safety demonstrations concerning health matters.

New Mexico OSHA is under the jurisdiction of the Occupational Health and Safety Bureau and covers:

- Private industry entities

- Public entities (city, country, and state governments)

Federal employers and employees may be excluded from the OSHA regulations.

The Bureau has compliance officers who are in charge of implementing and enforcing the New Mexico OSHA.

Apart from scheduled inspections that compliance officers regularly conduct, they are allowed to perform inspections without any notice, at any given time. Unscheduled inspections can be a result of:

- Imminent danger reports

- Fatalities

- Worker complaints

- Referrals

Additions in New Mexico OSHA

Many unique safety standards that are implemented in the state of New Mexico — and those are concerned with the following:

- General Industry,

- Construction, and

- Agriculture.

The General Industry standards include:

- State and local government firefighting

- Workplace violence in convenience stores

- Hazard communication

The Construction standard includes:

- Hazard communication

The Agriculture standard includes:

- Field sanitation

- Short-handled hoes

- First aid

- Hazard communication

Miscellaneous New Mexico labor laws

Here’s what else is regulated by labor laws in New Mexico:

- Whistleblower protection laws

- COBRA laws

- Background check laws

- Credit and investigative check laws

- Arrest and conviction check laws

- Social media laws

- Record-keeping laws

Whistleblower protection laws

The main purpose of this set of laws is to ensure that employees can exercise all of their legal rights without negative repercussions as a result.

The term “whistleblower” refers to employees who have inside knowledge of an illegal practice or a safety hazard in the workplace. They must be able to report it and continue being employed.

Here’s the list of reasons why employees can’t be discriminated against or treated differently in any way, under the Whistleblower protection laws:

- Exercising their rights under the Minimum Wage Act

- Exercising their rights to domestic violence leave

- Filing a claim for occupational disease benefits

- Filing a claim for workers’ compensation

- Filing a complaint and participating in proceedings related to workplace safety (OSHA)

- Filing a complaint, opposing, and participating in proceedings under the New Mexico Human Rights Act

COBRA laws

COBRA or The Consolidated Omnibus Budget Reconciliation Act is a federal law. It allows employees to retain health care insurance and benefits after the termination of employment.

Federal regulations also state the law can be applied to employers with over 20 employees.

Many states have implemented their own regulations, also known as “mini-COBRAs”, to cover the businesses with fewer employees.

The state of New Mexico does have a mini-COBRA law, applicable to businesses that employ less than 20 employees. Their health coverage is extended for up to 6 months after the employment termination date.

Background check laws

Background checks are allowed by all employers (but not required for all occupations) and are subject to the federal Fair Credit Reporting Act.

This act regulates the collection, accuracy, and distribution of information in the Consumer Financial Protection Bureau.

Here’s the full list of positions that do require background checks in New Mexico:

- School personnel

- Childcare center personnel

- Nursing facilities personnel

- Intermediate facilities personnel

- Personnel of facilities for the intellectually disabled

- General acute care facilities personnel

- Psychiatric facilities personnel

- Rehabilitation facilities personnel

- Juvenile detention, correction, and treatment facilities personnel

- Home health agency personnel

- Homemaker agency personnel

- Guardian service providers

- Boarding home personnel

- Adult day care center personnel

- Adult residential care home personnel

- Adult foster care home personnel

- Personnel of case management entities serving people with disabilities

- Personnel of private residences providing personal, adult, and nursing care (provided there are at least 2 care receivers who are not related to the owner of a residential facility)

- Personnel who provide companion, respite, and personal care services

Credit and investigative check laws

The state of New Mexico doesn’t specifically prohibit nor allow employers to perform credit and investigative checks of their applicants and current employees.

However, if employers do conduct credit and investigative checks, they must carefully follow the procedures stated in the Fair Credit Reporting Act.

Arrest and conviction check laws

When it comes to arrest and conviction checks, New Mexico employers are forbidden from asking about the criminal record of their applicants.

So, the initial application mustn't include any questions about the criminal history of a potential employee.

However, if an employer reviews an application and decides to make an offer of employment, they are allowed to ask for this information.

Social media laws

State law protects employees based in New Mexico in terms of their personal social media accounts.

Employers in the state are forbidden to ask their applicants and current employees to disclose the following information about their personal accounts:

- Usernames

- Passwords

Record-keeping laws

Keeping the records of all their employees is an obligation for all New Mexico employers. They must do so for the length of 3 years.

Here’s what types and categories of information such records should hold:

- Employee name

- Social security number

- Occupation of the employee

- Date of birth

- Address including ZIP code

- Regular hourly rate of pay

- Basis on which wages are paid

- A daily record of beginning and ending work, if a split shift is in question

- Total daily or weekly net wages and deductions

- Total gross daily or weekly wages

- Date of each payment

- Records of leaves, notice, and policies under the Family and Medical Leave Act

There are some other record-keeping laws that are applicable to other specific situations. So, here’s what else employers ought to keep on record, and for how long:

- Records of all job-related injuries and illnesses under OSHA — for 5 years

- Summary descriptions and annual reports of benefit plans — for 6 years

- Specifically dangerous instances under OSHA (e.g. covering toxic substance exposure) — for 30 years

Conclusion/Disclaimer

We hope this New Mexico labor laws guide has been helpful. We advise you to make sure you’ve paid attention to the links we’ve provided, as most of them will lead you to the official government websites and other relevant information.

Please note that this guide was written in Q2 2022, so any changes in the labor laws that were included later than that may not be included in this New Mexico labor laws guide.

We strongly advise you to consult with the appropriate institutions and/or certified representatives before acting on any legal matters.

Clockify is not responsible for any losses or risks incurred, should this guide be used without further guidance from legal or tax advisors.

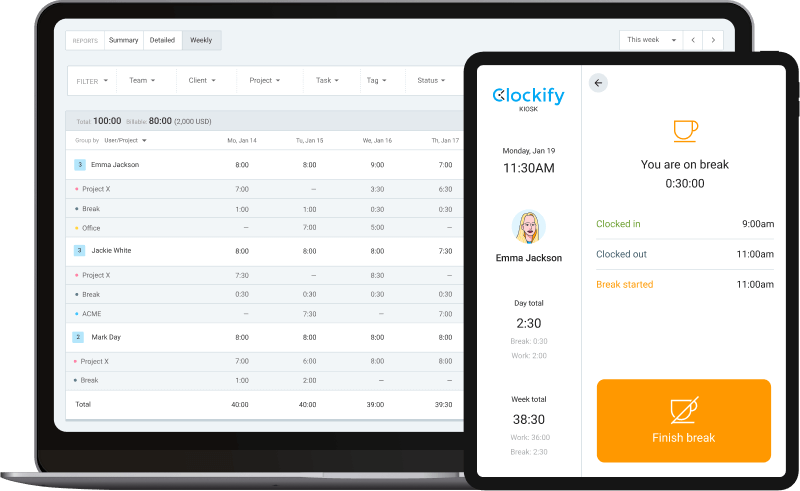

Need a simple time clock for employees?

Clockify allows you to track time, attendance, and costs with just a few clicks, for FREE.

Your team can track work time via web or mobile app personally, or you can set up a time clock kiosk from which employees can clock in and out.

Later, you can approve timesheets and time off, schedule shifts, run time card reports, and export everything for payroll (PDF, Excel, link, or send to QuickBooks).