Virginia Labor Laws Guide

Ultimate Virginia labor law guide: minimum wage, overtime, break, leave, hiring, termination, and miscellaneous labor laws.

| Virginia Labor Laws FAQ | |

| Virginia minimum wage | $12.41 |

| Virginia overtime laws | 1.5 times the minimum wage for any time worked over 40 hours/week ($18.61 for minimum wage workers) |

| Virginia break laws | Meal break for minors under 16: 30 min per 5 hours |

Virginia mostly has its own laws concerning labor, but in some instances, this state follows federal regulations instead. The rule of law is administered and regulated by the Virginia Department of Labor and Industry.

In this Virginia labor laws guide, we’ll be looking at the following areas:

- Wages, overtime, and breaks,

- Leave requirements,

- Child labor laws,

- Hiring and termination laws,

- Occupational safety laws, and

- Miscellaneous labor laws.

Virginia wage laws

We’ll first cover Virginia’s most important laws and regulations regarding minimum, tipped, and subminimum wages.

| Virginia minimum wage | ||

| Regular minimum wage | Tipped minimum wage | Subminimum wage |

| $12.41 | No established tipped minimum wage — the total of the tips and what employers provide must equal at least the regular minimum wage of $11 | Training wage — $4.25. Student workers employed on a part-time basis — 85% of regular minimum wage ($9.35) |

Virginia minimum wage

The term minimum wage refers to the lowest hourly rate at which employees can be compensated for their work.

Wages are regulated by the Fair Labor Standards Act (FLSA) at the federal level, but each state has the right to set its minimum wage higher than the federal minimum of $7.25, which Virginia did.

As of January 1, 2025, Virginia’s minimum wage is $12.41, but it’s set to increase on January 1, 2026.

Let’s see what else is relevant in terms of fair compensation for Virginia employees.

Tipped minimum wage in Virginia

According to federal law and the Internal Revenue Service (IRS), tips are amounts of money that customers freely provide to employees.

However, the tipped minimum wage isn’t regulated under Virginia laws, so the federal rules apply — tipped employees are entitled to at least $2.13 per hour. Therefore, employers can offer a tipped position to employees, but the total of tips earned and what employers contribute must at least amount to the regular minimum wage of $12.41.

Virginia law doesn’t regulate tip pooling (or tip sharing), a common practice related to tips. This means that Virginia employers can require employees to participate in tip pools.

The practice refers to all tipped employees sharing a portion of their tips for a part to be distributed to employees who usually don’t receive tips, such as:

- Cooks,

- Line cooks,

- Prep-cooks,

- Dishwashers, etc.

Additionally, even if an employer doesn’t require tip pooling, employees can enter into agreements about tip distribution among themselves.

Exceptions to the minimum wage in Virginia

Particular employment or personal statuses are exempt from the law regarding minimum wage in Virginia.

Here’s a list of all the exemptions to the minimum wage in Virginia:

- White-collar employees (i.e., bona fide executives, administrative workers, and professionals),

- Outside salespeople — provided they are compensated on a commission basis, by piecework, or flat rate schedules,

- Farm workers,

- Volunteers engaged in the activities of educational, charitable, religious, and nonprofit organizations,

- Caddies on golf courses,

- Operators of taxicabs,

- Minors employed by their parents or guardians,

- Workers who are confined in penal and correctional facilities,

- Summer camp workers,

- Minors under 16, regardless of the employer and job,

- Student workers participating in bona fide educational programs,

- Minors enrolled in secondary and trade schools, or other institutions of education — provided they work up to 20 hours per week,

- Any person who is enrolled in secondary and trade schools, or other institutions of education — provided they are employed by the same institution,

- Babysitters who work up to 10 hours per week,

- Any person participating as an au pair in the US Department of State’s Exchange Visitor Program (living in a host family),

- Any person employed as a temporary foreign worker, etc.

Subminimum wage in Virginia

The minimum wage for certain categories of workers — such as student workers in Virginia — is commonly referred to as the subminimum wage.

The term subminimum already implies that employers are allowed to pay such employees a lower hourly wage than the minimum wage.

In Virginia, there are only 2 categories of employees who can be paid at a rate lower than the state minimum:

- Student workers employed on a part-time basis, and

- Trainees under 20 years of age, for the first 90 days of employment.

Employers must compensate student workers at a rate of at least 85% of the standard minimum wage.

The number translates to a requirement of at least $10.54 per hour.

Employers must compensate trainees under 20 years of age at a rate of at least $4.35. This is applicable only for the first 90 days of employment.

Apart from those 2 categories of employees, all other non-exempt employees are entitled to at least the standard minimum wage.

Virginia payment laws

When it comes to pay frequency in Virginia, employers are required by law to provide regular compensation to:

- Salaried employees at least once per month,

- Hourly employees at least once every two weeks or twice in each month, and

- Employees who earn at least 150% of the state-defined average weekly wage may be compensated monthly.

Employers can choose the manner of wage payments and pay their employees in the following ways:

- Cash,

- Checks,

- Direct deposit system, ATMs, or other means of electronic transfer, and

- Payroll cards.

Deductions from wages are allowed only if legally required (e.g., taxes) or if an employee agrees in writing. Each paycheck must define both the amount and the purpose of the deductions.

🎓 Track employee payroll with Clockify

Virginia overtime laws

Regulations established by the FLSA define a working week as any seven consecutive 24-hour periods. During this period, employees who work up to 40 hours are compensated for their work at least at an hourly rate of the minimum wage, as defined by the Virginia constitution.

Any hours exceeding 40 count as overtime and must be compensated at a higher hourly rate.

Non-exempt employees who do exceed that number are entitled to 1.5 times their regular rate.

In other words, overtime pay currently translates to $18.6 for minimum wage employees.

Some occupations and conditions can overrule this 1.5 rate requirement.

We’ll explain everything in the following sections, so read on and find out who is eligible for overtime compensation in Virginia.

🎓 Track Virginia overtime with Clockify

Overtime exceptions and exemptions for white-collar employees in Virginia

Following the federal requirements on the overtime exemptions, 4 main categories of employees aren’t protected by the law, as they fit into the larger category of white-collar occupation exemptions.

When it comes to overtime, provided they earn at least $1,128 per week, white-collar employees don’t have to be paid a 1.5 rate for working over 40 hours.

White-collar employees are the ones working in any of the following categories:

- Administration — people who perform non-manual work related to business operations, management policies, or administrative training (provided that no more than 20% of the time is spent on activities unrelated to the position) — this category includes accountants, HR team members, market research analysts, etc.

- Executives — business, general, and executive managers who directly manage at least 2 employees.

- Professionals — people whose position requires advanced knowledge and extensive education (e.g., software analysts, software engineers, artists, certified teachers, and other creative work requiring talent, invention, or imagination).

- Outside sales — outside sales representatives who visit potential and existing customers at their premises.

Virginia overtime restrictions for specific occupations

Besides the federal government exemptions listed above, the state enforces overtime restrictions on some other, more specific occupations.

Overtime and minimum wage exemptions overlap, but there are additional occupations that are exempt from overtime only.

Here’s the complete list of overtime exemptions in Virginia:

- Farm workers,

- Volunteers engaged in the activities of educational, charitable, religious, and nonprofit organizations,

- Caddies on golf courses,

- Taxicab drivers,

- Minors employed by their parents or guardians,

- Workers who are confined in penal and correctional facilities,

- Summer camp workers,

- Minors under 16, regardless of their employer or job type,

- Student workers participating in bona fide educational programs,

- Minors who are enrolled in secondary and trade schools, or other institutions of education — provided they work up to 20 hours per week,

- Any person who is enrolled in secondary and trade schools, or other institutions of education — provided they are employed by the said institution,

- Babysitters who work up to 10 hours per week,

- Any person participating as an au pair in the US Department of State’s Exchange Visitor Program,

- Any person employed as a temporary foreign worker,

- Salespeople, vehicle parts people, and mechanics who are primarily engaged in selling or servicing automobiles, trucks, and farm implements — provided they are employed by non-manufacturing establishments, and

- Salespeople who are primarily engaged in selling trailers, boats, and aircraft — provided they are employed by non-manufacturing establishments.

Virginia break laws

No Virginia state law requires employers to provide a rest or meal period to their employees (excluding minors), so the federal rules apply. Therefore, a break can be:

- Under 20 minutes (this break must be paid), and

- 30 minutes or more (this break can be unpaid).

Still, employees under 18 are entitled to a meal break of 30 minutes per every 5-hour shift.

🎓 Track employee productivity with Clockify

Breastfeeding laws in Virginia

All working mothers who gave birth recently and are still lactating and breastfeeding are entitled to take a break for this purpose under the federal PUMP Act.

Under this law, employers must provide reasonable break time for an employee to express breast milk for their child in a private space that must be shielded from view and free from intrusion (and other than a bathroom).

Employers must provide such a location in the nearest possible proximity to the working environment.

Virginia leave requirements

Federal law clearly regulates which types of leave employers must provide, and there are no negative consequences for employees upon their return to work.

According to the US Department of Labor, there are 2 broad categories of leave of absence:

- Required leave, and

- Non-required leave.

However, the types of leave included in the 2 categories aren’t predetermined by the federal law, as each state regulates them differently.

Let’s see how Virginia regulates leaves of absence.

🎓 Track employee time off with Clockify

Virginia required leave

While employers must offer and provide required leave to all their employees, they don’t necessarily have to compensate them for that period.

Still, some company policies will offer paid required leave.

Here’s the list of 5 types of leave that employers in Virginia are required to offer by law:

- Family and medical leave,

- Jury duty leave,

- Crime victim leave, and

- Military leave.

Family and medical leave

This is a type of required leave that all employers in the state of Virginia must provide to their employees. Eligibility for this type of leave is regulated by the Family and Medical Leave Act (FMLA).

The FMLA states that all employees are eligible to use 12 weeks of unpaid, job-protected work absence in a 1-year period, for many household and medical-related reasons.

Those reasons include:

- Care of the employee’s own serious health condition,

- Care of an immediate family member with a serious health condition,

- Care of the employee’s own newly-born child,

- Placement for adoption/foster care of a child with the employee, and

- Any difficulty due to the employee’s immediate family member who is a covered military member on active duty.

To be eligible, an employee must have worked for the employer for at least a year and at least 1,250 work hours within 12 months. Note that this applies only to employers with over 50 employees at the federal level. For Virginia, the same is applicable at the state level.

Additionally, Congress amended the FMLA in 2008 to protect the families of the Armed Services.

Since then, employers have also been required to provide up to 26 weeks of unpaid leave if an employee needs to take care of a member of the Armed Forces with a serious health condition or injury or is undergoing medical treatment or therapy.

This is applicable only if said member is an employee’s spouse, parent, child, or next of kin.

Jury duty leave

Under Virginia law, if an employee is summoned to jury duty, employers must allow them to be absent from work during that time.

Employers must not require employees to use their sick, vacation, or other types of leave for this reason.

The law also states that employers can’t penalize or discipline their employees for accepting jury duty, but they don’t have to compensate their employees for this period.

Employers aren’t allowed to require employees who spent 4 hours or more on jury duty to work a shift under the following conditions:

- Starting on or after 5 p.m. on the same day, and

- Starting before 3 a.m. on the following day.

Crime victim leave

Under state law, for employees who are victims of a crime, employers are required to leave for participating in, preparing for, and attending proceedings related to the crime. This leave doesn’t have to be compensated.

Employees are required to provide a copy of the notice of a scheduled criminal proceeding.

Military leave

This type of leave is regulated at the federal level by the Uniformed Services Employment and Reemployment Act. The act states that all employees in the US must be granted a leave of absence to serve in one of the following:

- The US Armed Forces,

- The National Guard, and

- The state militia.

Upon returning to work, employees must be entitled to the same pay increases and other benefits as if they had been at work the whole time.

Virginia implements an additional requirement for employers — the same must be applied to the members of the Civil Air Patrol. Their leave of absence is capped at:

- 10 days per year for training, and

- 30 days per year for responding to duty.

Virginia non-required leave

There are also 5 categories of leave that, by Virginia state laws, employers aren’t required to offer to their employees. The said categories are:

- Sick leave,

- Vacation leave,

- Holiday leave,

- Voting leave, and

- Bereavement leave.

It’s important to mention that the law also doesn’t prohibit or restrict the employer from providing these types of leave.

If an employer chooses to offer any or all, the exact terms need to be stated in the signed contract of employment.

Sick leave

All employees in Virginia are eligible to accrue 1 hour of paid sick leave for every 30 hours worked. However, an employee may only accrue and use 40 hours of paid sick leave (unless the employment agreement stipulates otherwise).

Vacation leave

Virginia employers aren’t required to offer paid or unpaid vacation time.

If an employer establishes a vacation policy, they must comply with all their own established conditions.

Holiday leave

State employees in Virginia are entitled to 12 paid holidays in a calendar year, including:

- New Year’s Day,

- Martin Luther King, Jr. Day,

- Presidents Day,

- Memorial Day,

- Juneteenth,

- Independence Day,

- Labor Day,

- Columbus Day,

- Election Day,

- Veterans Day,

- Thanksgiving (2 days), and

- Christmas Day.

If a private employer offers holiday leave as part of its company policy, the exact terms must be stated in the contract of employment.

Voting leave

In Virginia, private employers aren’t required to offer time off to vote. Therefore, such employees have to vote outside of work hours. Still, there are specific protections for election officials who don’t have to use their personal leave to take time to vote and can’t be required to start to work on Election Day if their shift begins after 5 p.m. or before 3 a.m. the following day.

Bereavement leave

Under Virginia law, all employers who employ 50 or more employees must give their employees up to 10 days of unpaid leave within 12 months for the following reasons:

- Attending the funeral,

- Making funeral arrangements,

- Grieving,

- Absences due to events such as miscarriage, unsuccessful reproductive procedures, stillbirth, etc.

Child labor laws in Virginia

The term minors refers to young people aged under 18.

The primary purpose of both federal and Virginia child labor laws is to prevent the exploitation of minors, as well as to help minors put education first; thus, their employment is only meant to enhance their academic and life experience.

Some of the most relevant limitations regarding the employment of minors can be seen in the following categories:

- Maximum number of work hours,

- Nightwork, and

- Restrictions on specific occupations.

While different rules and regulations apply to different age groups, one rule applies to all age groups — according to federal law, minors are forbidden from working in hazardous positions.

Next, let’s look at some rules and regulations stated in the Virginia Child Labor Laws.

Labor laws specific to minors

In Virginia, child labor laws enforce specific rules for different age groups:

- Minors under 16, and

- Minors aged 16 and 17.

The 2 categories put restrictions on the maximum hours of work and nightwork of minors.

To be employed, minors under 16 must obtain a Work Permit and/or an Age Certification document.

The maximum number of work time for minors under 16 years of age — provided that school isn’t in session — is:

- 8 hours per day,

- 40 hours per week, and

- No more than 6 days per week.

When school is in session, the limit is 3 hours per school day, while the total number of hours for school weeks mustn’t exceed 18.

Virginia doesn’t restrict maximum working hours for minors between 16 and 17, provided the minor complies with the compulsory school attendance law.

Nightwork restrictions only apply to minors under 16 years of age, who are prohibited from working between 7 p.m. and 7 a.m. when school is in session.

When school isn’t in session, minors under 16 can work until 9 p.m.

For ages 16 and 17, Virginia has no restrictions on nightwork.

Prohibited occupations for minors on a federal level

Certain occupations are strictly prohibited for minors.

In compliance with federal restrictions, minors are forbidden from working in any occupations that are declared hazardous.

Here are some examples of hazardous occupations and activities:

- Electrical technicians,

- Boiler or engine room operators,

- Any work with flammable, toxic, or corrosive substances,

- Elevator-related work,

- Centrifugal machine operators,

- Any work that involves climbing,

- Any work that involves glazing and glass cutting, etc.

Additional prohibited occupations for minors in Virginia

For minors in Virginia, there are additional restrictions, so here are some other, state-specific prohibited occupations:

- Motor vehicle occupations,

- Logging and saw-milling operations and occupations,

- Manufacturing and storage occupations involving explosives,

- Power-driven hoisting apparatus occupations,

- Power-driven bakery machine occupations,

- Fire fighting,

- Occupations in excavation operations,

- Occupations in connection with any mining operations,

- Occupations involving exposure to radioactive substances, etc.

Termination laws in Virginia

Like the majority of other states in the US, Virginia also implements an employment-at-will doctrine and policy.

Here’s what it means for both employers and employees:

- Employers can terminate their employees’ work engagement anytime, for any reason, or perhaps for no reason at all, and

- Employees are free to leave their job for any or no reason with no legal consequences.

There are only 2 exceptions in terms of employers’ reasons for termination:

- It mustn’t be based on discrimination, and

- It mustn’t be retaliation for a rightful action (i.e., whistleblowing).

Final paycheck in Virginia

Employers in Virginia are legally required to provide a final paycheck, including all wages and benefits, to everyone whose employment was terminated or who has resigned.

According to the Virginia labor wage laws,final paychecks for employees are due either on the regularly scheduled payday or before that date.

Discrimination laws in Virginia

According to federal law, discrimination in the workplace isn’t only unethical but also illegal.

There are many bases of discrimination in the workplace that are forbidden on a federal scale — but the state of Virginia has determined additional ones under the Virginia Human Rights Act, including:

- Race,

- Color,

- Age,

- Gender,

- Sexual orientation,

- Religion,

- National origin,

- Pregnancy,

- Genetic information (including family medical history),

- Physical or mental disability,

- Child or spousal withholding,

- Military or veteran status,

- Citizenship or immigration status,

- Expunged criminal records,

- Non-conviction arrest records,

- Status as a smoker or non-smoker, and

- Lactation.

Occupational safety in Virginia

All employees must have a safe and healthy working environment.

The specific conditions for such an environment are regulated by the federal Occupational Safety and Health Act (OSHA), passed by Congress in 1970 — but there are some additional requirements for employers in Virginia.

OSHA states that employers are required to:

- Provide safe and healthy working conditions,

- Inspect for flaws and irregularities continually, and

- Strive to improve the conditions, if possible.

Employers are required to provide several things to ensure workplace safety for their employees, including:

- Proper training,

- Education, and

- Continuous assistance.

OSHA’s main goal is to reduce and, ultimately, eliminate the possibility of workplace injuries, illnesses, and fatalities.

Besides providing necessary training and education for employees, employers must create optimal working conditions — free from any recognized hazards that may cause harm.

Moreover, it’s obligatory to conduct safety and health research regularly and undertake safety demonstrations concerning health matters.

The Virginia Occupational Safety and Health (VOSH) is under the jurisdiction of the Occupational Safety and Health Administration and is responsible for regulating the workplace safety of all workers in Virginia.

Federal employers and employees may be excluded from the OSHA regulations.

The Administration has compliance officers in charge of implementing and enforcing the Virginia OSHA.

Apart from scheduled inspections that compliance officers regularly conduct, they are allowed to conduct inspections without any notice, at any given time.

Unscheduled inspections can be a result of:

- Imminent danger reports,

- Fatalities,

- Worker complaints, and

- Referrals.

Additions in Virginia OSHA

Some unique safety standards are implemented in the state of Virginia, and those are categorized into:

- General Industry,

- Construction, and

- Agriculture-related standards.

General Industry additions in Virginia OSHA

The term “General Industry” refers to standards and directives applicable to all industry types except agriculture, maritime, and construction industries.

The General Industry standards include:

- Reverse signal operation safety requirements for vehicles, machinery, and equipment for General Industry,

- Telecommunications, in terms of electrical hazards,

- Confined spaces in the telecommunications industry,

- Tree trimming operations, and

- Overhead High Voltage Line Safety Act.

🎓 OSHA General Industry Digest

Construction additions in Virginia OSHA

Construction is an industry comprising a wide variety of activities, such as construction, alteration, and repair. Workers in this industry are often exposed to serious hazards and work with heavy machinery.

As a result, many specific OSHA standards are designed to eliminate such hazards.

The Construction standard includes:

- Medical services and first aid,

- Sanitation,

- Steel erection,

- Reverse signal operation safety requirements for vehicles, machinery, and equipment for the construction industry, and

- Overhead High Voltage Line Safety Act.

🎓 OSHA publications for the Construction Industry

Agriculture additions in Virginia OSHA

One of the major industries in the US is agriculture, which includes:

- Growing and harvesting crops, and

- Keeping livestock, poultry, and other animals in order to provide products.

Farmworkers can be at high risk for injuries, lung and skin diseases, and even certain cancer types — due to prolonged sun and chemical exposure.

These specific OSHA standards help agriculture employers and employees create a safe and healthy work environment.

The Agriculture standard includes only one additional OSHA regulation — field sanitation.

🎓 Hazards and controls in agricultural operations

Miscellaneous Virginia labor laws

The above-listed sections were concerned with the most important and common categories of labor laws relevant in Virginia.

Now, we’ll mention several additional laws that can’t be categorized into any of the above sections.

Here’s what else is regulated by the rule of law in Virginia:

- Whistleblower protection laws,

- COBRA laws,

- Background check laws,

- Credit and investigative check laws,

- Arrest and conviction check laws,

- Drug and alcohol testing laws,

- Social media laws,

- Hiring of veterans laws, and

- Record-keeping laws.

Whistleblower protection laws

The main purpose of this set of laws is to ensure that employees can exercise all of their legal rights without negative repercussions as a result.

The term whistleblower refers to employees who have inside knowledge of an illegal practice or a safety hazard in the workplace. They must be able to report it and continue being employed.

Here’s the list of reasons based on which employees can’t be discriminated against, or treated differently in any way:

- Exercising their rights regarding workplace safety (OSHA), and

- Opposing a violation of the Virginia Fraud Against Taxpayers Act.

COBRA laws

COBRA is a law that operates at the federal level. The Consolidated Omnibus Budget Reconciliation Act (COBRA) allows employees to retain health care insurance and benefits after the termination of employment.

Federal regulations also state that the law can be applied to employers with over 20 employees. So, many states have implemented their own regulations, also known as “mini-COBRAs,” to cover businesses with fewer than 20 employees.

Virginia has a mini-COBRA law that applies to businesses with fewer than 20 employees. Their health coverage is extended for up to 12 months after the employment termination date.

Background check laws

Background checks are allowed for all employers (but not required for all occupations) and are subject to the federal Fair Credit Reporting Act.

This act regulates the collection, accuracy, and distribution of information by the Consumer Financial Protection Bureau — all employers must ensure they adhere to those requirements.

Here’s the full list of positions that require background checks in Virginia:

- School personnel — including personnel in private schools,

- Nursing homes personnel — including volunteers,

- Assisted living facilities personnel,

- Adult day care centers personnel,

- Child welfare agencies personnel, provided the employee is involved in day-to-day operations, or if they spend time alone with children,

- Family day homes personnel, provided the employee is involved in day-to-day operations, or if they spend time alone with children,

- Hospital personnel, provided the employee will have access to controlled substances and isn’t licensed by the Board of Pharmacy,

- Hospice and home care organizations personnel,

- Community group homes personnel — including volunteers,

- Firearm sellers,

- Law enforcement personnel — including jail officers,

- Behavioral health and developmental services personnel — including providers of such services in personal homes,

- People in shared living arrangements who provide medical assistance services,

- Children residential facilities personnel — including volunteers who spend time alone with children,

- Corporate officers, owners, administrators, and any other people who are authorized to conduct safety training courses, and

- Private security businesses personnel.

Credit and investigative check laws

Virginia doesn’t specifically allow or prohibit employers from conducting credit and investigative checks for employment purposes.

That means employers may obtain credit reports on all their applicants and employees if they consider that information relevant.

Arrest and conviction check laws

Virginia doesn’t specifically allow or prohibit employers from conducting arrest and conviction checks for employment purposes.

The only exception employers are prohibited from asking applicants about is applicants’ expunged criminal records.

Drug and alcohol testing laws

The state of Virginia doesn’t specifically allow or prohibit employers from testing their applicants and employees for drugs.

Therefore, employers are free to subject their applicants and employees to a breathalyzer test. If there’s a lack of reasonable doubt, applicants or employees can be subject to the test only with their explicit consent.

The only exception is the category of state contractors and subcontractors with a salary of more than $10,000. Such employers must ensure that the workplace is drug-free during contract performance.

Social media laws

Under state law, Virginia employers are prohibited from asking their employees or applicants to disclose information about their personal social media accounts.

In Virginia, it’s illegal for an employer to:

- Ask an employee for their social media usernames and/or passwords, or other means of authentication,

- Add an employee to the list of contacts associated with their personal social media account, and

- Take action against or penalize an employee in any way for exercising their rights under this section.

Hiring of veterans laws

There is a state law concerning all Virginia veterans, as well as the spouses of veterans with a service-connected total disability.

This law allows employers to give preference to such applicants and employees for hiring or promotion-related decisions.

Record-keeping laws

All Virginia employers are required to keep records of all their employees for 3 years.

So, what types and categories of information should such records consist of? Here’s the full list:

- Employee name,

- Social security number,

- Occupation of the employee,

- Date of birth,

- Address — including ZIP code,

- Regular hourly rate of pay,

- Basis on which wages are paid,

- A daily record of beginning and ending work, if a split shift is in question,

- Total daily or weekly net wages and deductions,

- Total gross daily or weekly wages,

- Date of each payment, and

- Records of leaves, notices, and policies under the Family and Medical Leave Act.

Some other record-keeping laws apply to specific situations. So, here’s what else employers ought to keep on record, and for how long:

- Seniority and merit systems — for 2 years,

- Records of all job-related injuries and illnesses under OSHA — for 5 years,

- Summary descriptions and annual reports of benefit plans — for 6 years, and

- Specifically dangerous instances under OSHA (e.g., toxic substance exposure) — for 30 years.

Frequently asked questions about Virginia labor laws

If we haven’t answered some of your questions about living and working in Virginia, here’s an additional section with extra information.

What are the labor laws of Virginia?

Labor laws in Virginia regulate the rights and responsibilities of both employees and employers in the workplace.

Labor laws in Virginia may include (not limited to) laws regarding:

- Hourly wages and overtime hours (including exceptions),

- Payment laws,

- Leave requirements,

- Child labor,

- Hazardous jobs,

- Discrimination in the workplace laws, and others.

By following such laws, employees can work in a safe environment, while businesses ensure smooth operation and compliance at all times.

How long can you work without a break in Virginia?

There’s no state law regarding providing regular breaks in a workday in Virginia. Still, on a federal level, an employee has the right to a break under the following conditions:

- Under 20 minutes (paid break), and

- 30 minutes or more (unpaid break).

How many days in a row can you work without a day off in Virginia?

There’s no limit on how many days you can work in a row, provided you’re timely and fairly compensated (including all benefits and overtime).

Can you be forced to work overtime in Virginia?

Your employer can expect you to work overtime hours in Virginia. However, you have to be compensated for all the hours worked over 40 a week (which is considered overtime) at 1.5 times your regular hourly rate.

What is the WARN law in Virginia?

The WARN law, or the Worker Adjustment and Retraining Notification Act, is a federal law that obliges eligible employers to notify their employees in case of workforce reductions. Since Virginia doesn’t have a state-based WARN law, it follows the provisions of the federal law.

Under this law, employers are obliged to notify their employees 60 days in advance if a facility is shut down or there’s a mass layoff.

Use Clockify to stay compliant with Virginia labor laws

If you want to ensure you follow all the above-mentioned laws and regulations in Virginia, opt for Clockify.

Clockify is a reliable time tracking tool, but it also allows you to:

- See clock-in and clock-out times,

- Track overtime hours,

- Manage payroll processing,

- Store timesheets and reports safely in the cloud, and much more.

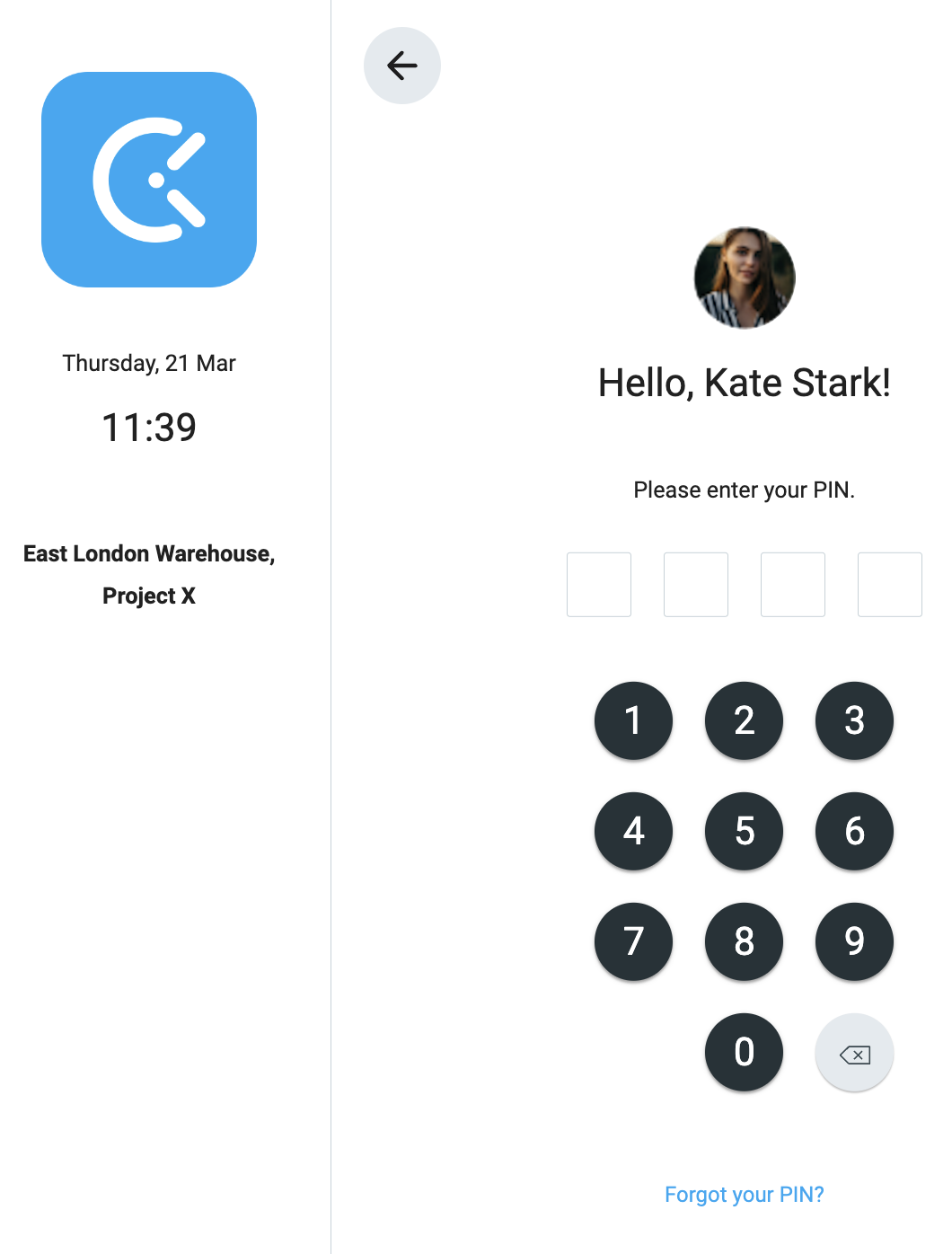

For a seamless clocking-in/clocking-out experience, your employees can use the Clockify kiosk. With it, employees simply clock in with a PIN code from a shared device, as shown in the picture below.

The great thing about this feature is that you can use the Clockify kiosk on any device (tablet, computer, or phone). Also, when Kiosk PIN is enabled, only people who know the Universal PIN can clock in for others.

Later, Clockify shows the total hours worked each day and week, thanks to its powerful reporting feature.

This way, you as an employer can comply with recordkeeping and wage laws easily and headache-free.

Conclusion/Disclaimer

We hope this Virginia labor law guide has been helpful. We advise you to make sure you’ve paid attention to the links we’ve provided, as most of them will lead you to the official government websites and other relevant information.

Please note that this guide was written in Q2 2025, so any changes in the labor laws that were included later than that may not be included in this Virginia labor laws guide.

We strongly advise you to consult with the appropriate institutions and/or certified representatives before acting on any legal matters.

Clockify isn’t responsible for any losses or risks incurred if this guide is used without further guidance from legal or tax advisors.