What is a pay stub?

A pay stub is a document that consists of all the details regarding employees’ payments.

Employers issue a pay stub on a monthly or a weekly basis, depending on how frequently they pay their employees.

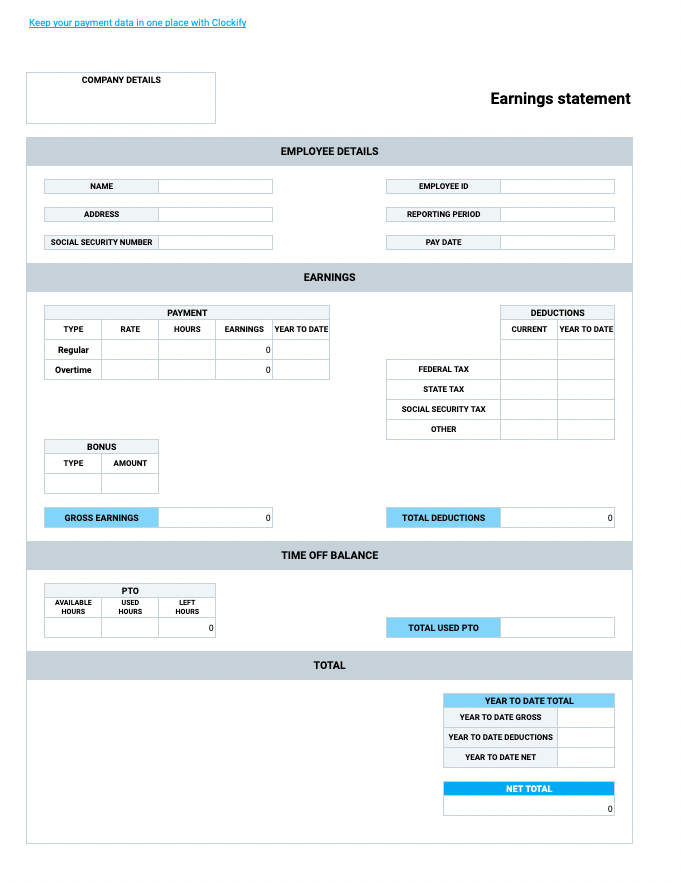

What should a pay stub include?

Although a pay stub might consist of many details that amount to employees’ final net pay, there are several items that every pay stub should include:

- Employer information (company’s name and address),

- Employee information (employee’s name, address, ID number, and Social Security number),

- Reporting period and pay date,

- The hours worked and employee’s hourly rate,

- Bonuses (if applicable),

- Total gross earnings,

- Deductions (including Federal tax, State tax, Social Security tax),

- Total net pay, and

- Year to date total calculations (gross earnings, net earnings, and deductions).

Is it necessary to issue employees' pay stubs?

If you’ve been wondering whether you’re required to issue pay stubs, perhaps you’ll be surprised to find that it depends on the location of your business.

While pay stubs are legally required in Europe, there is no federal law that requires employers to provide pay stubs in the US. However, certain US states do require employers to issue pay stubs, so it’s always best to be familiar with your state labor laws.

Apart from that, certain state laws require employers to provide specific types of pay stubs.

For example, in opt-out states (e.g. Delaware, Minnesota, and Oregon), employers are required to get explicit consent before they decide to change the way they issue pay stubs.

In opt-in states (e.g. Hawaii), employers need to issue employees’ paper pay stubs — unless an employee requests their pay stubs to be provided electronically.

What is the difference between a pay stub and a paycheck?

Although a pay stub might be attached to a paycheck, there is a difference between them.

Paychecks usually only state an employee’s total net pay, while a pay stub contains all the details regarding the payment, including:

- Total net pay,

- Total gross pay,

- Deductions,

- The number of hours worked, etc.

What is the difference between a pay stub and an invoice?

While invoices do contain information regarding payment — such as payment terms and payment method — they are different from pay stubs.

Invoices are mostly issued by independent contractors to request payment from clients for the provided services. Pay stubs, on the other hand, are issued by companies as a part of a payroll process.

Free Invoice Templates for FreelancersWhy do you need pay stub templates?

Whether you’re about to start a new business or you’ve been issuing pay stubs for years, having a pre-made, customizable pay stub template can help you:

- Automate your pay stub issuing process, and

- Save additional time for other priority tasks.

Apart from that, a detailed pay stub template that comes with a calculator can reduce the possibility of making mistakes in final calculations and help you keep all your numbers in check.

Finally, pay stub templates are also practical because you can download, print, or send them out to your employees.

8 Free pay stub templates

Whether you need a basic pay stub template you can edit within seconds, or you’re looking for a detailed template that does most of the payment calculations for you, you don’t need to create every single one from scratch.

We’ve got 8 free pay stub templates that might just become your go-to option whenever you’re about to issue payments:

- Basic Pay stub Template

- Basic Pay stub Template with a calculator

- Pay stub Template with PTO

- Pay stub Template with PTO + calculator

- Pay stub template with overtime

- Pay stub template with overtime + calculator

- Pay stub Template with PTO and overtime

- Pay stub Template with PTO and overtime + calculator

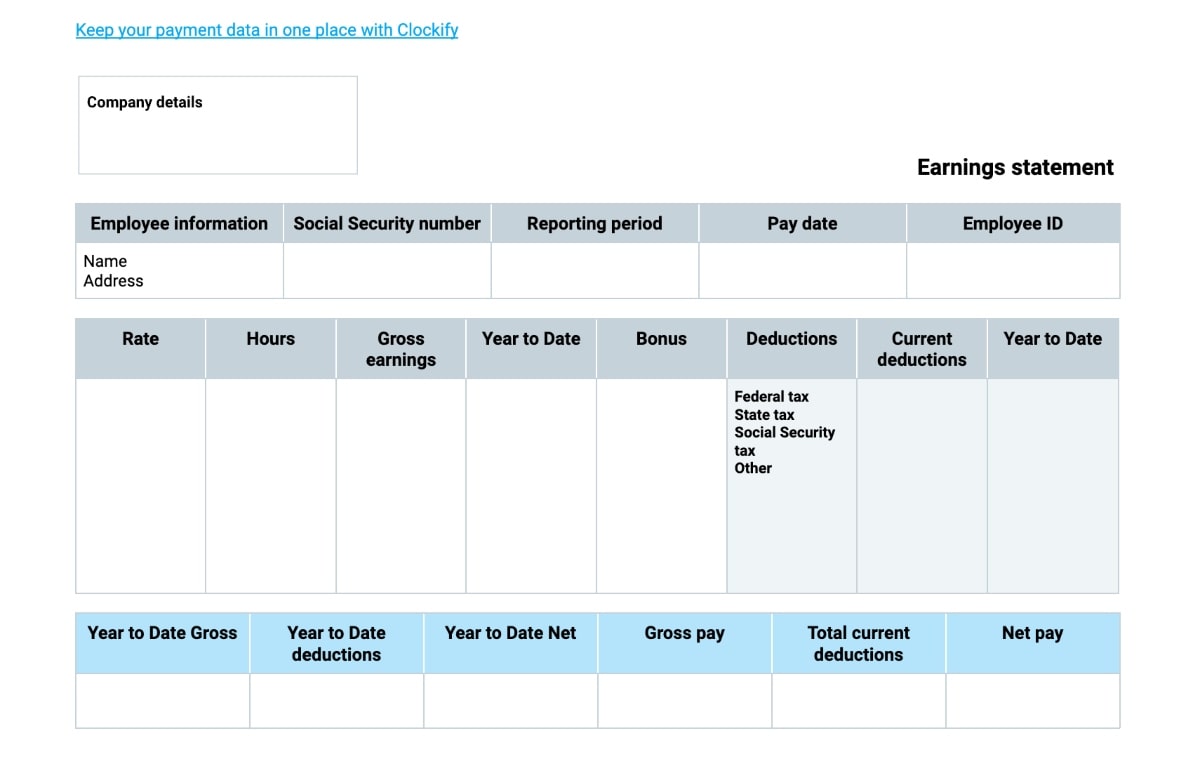

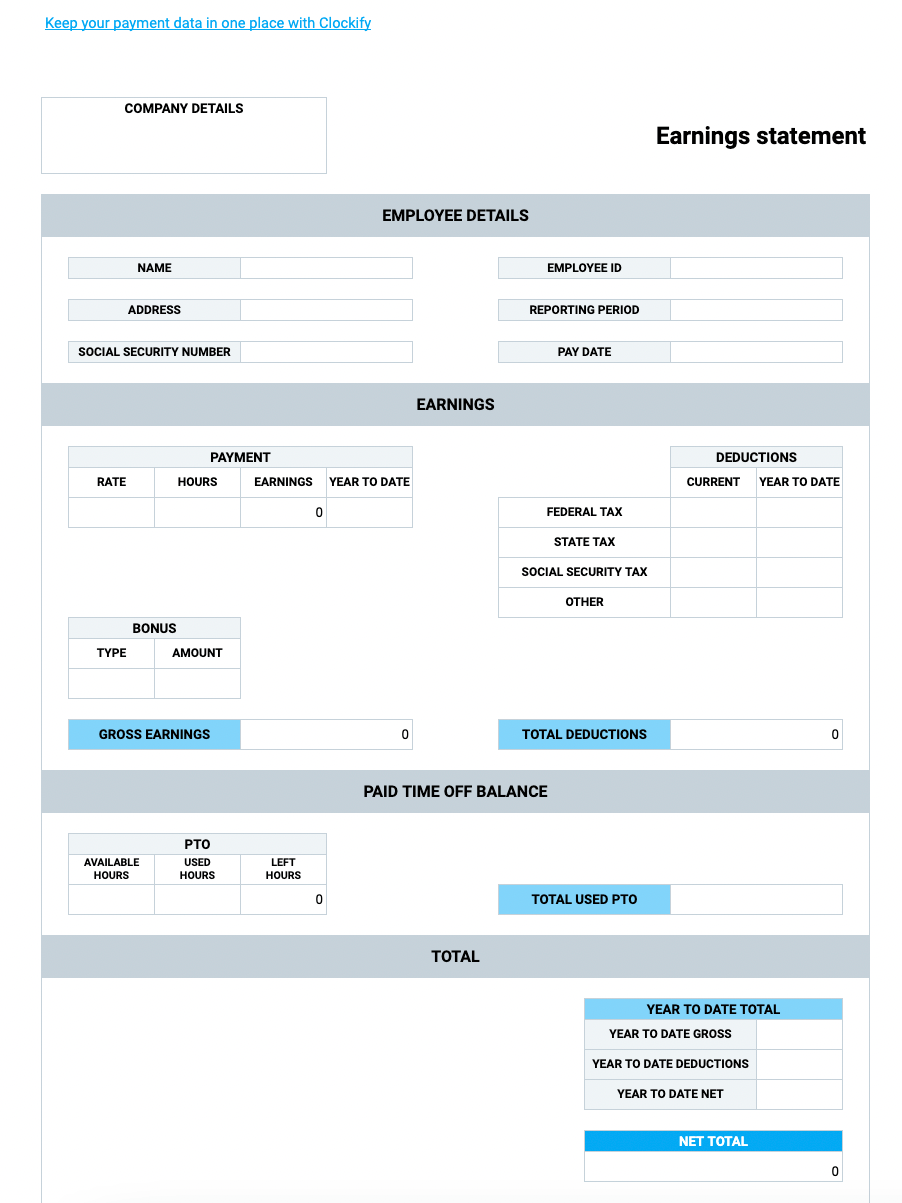

Basic Pay stub Template

If you need a simple pay stub template that you can download and customize within seconds, then the Basic Pay stub Template might be just what you are looking for.

Download Basic Pay stub Template (Google Docs)

What is the Basic Pay stub Template?

The Basic Pay stub template is a ready-made document you can use to speed up your payroll process. Download the template, customize it, and fill it out with relevant payment information.

Why use the Basic Pay stub Template?

If you’re looking for a simple and easy-to-edit template you can reuse whenever you’re about to issue payments, then the Basic Pay stub Template could be a great option.

How best to use the Basic Pay stub Template?

After you’ve downloaded the template, you can start by adding your company’s name and address and all the required employee information (Social Security number, employee ID, etc.).

Then, continue by adding payment information, such as:

- Employee’s hourly rate,

- Total hours worked within the pay period,

- Total gross pay, and

- Year to date gross earnings.

After you’ve filled out all the payment-related information, you’ll need to fill out the Deductions column. Put in all the applicable deductions (Federal tax, State tax, Social Security tax, etc.), add the total sum of all deductions, as well as the year to date deductions sum.

Then, you’ll just need to put in the year to date totals (gross earnings, deductions, and net earnings) as well as the total current deductions, gross pay, and net pay for the particular pay period.

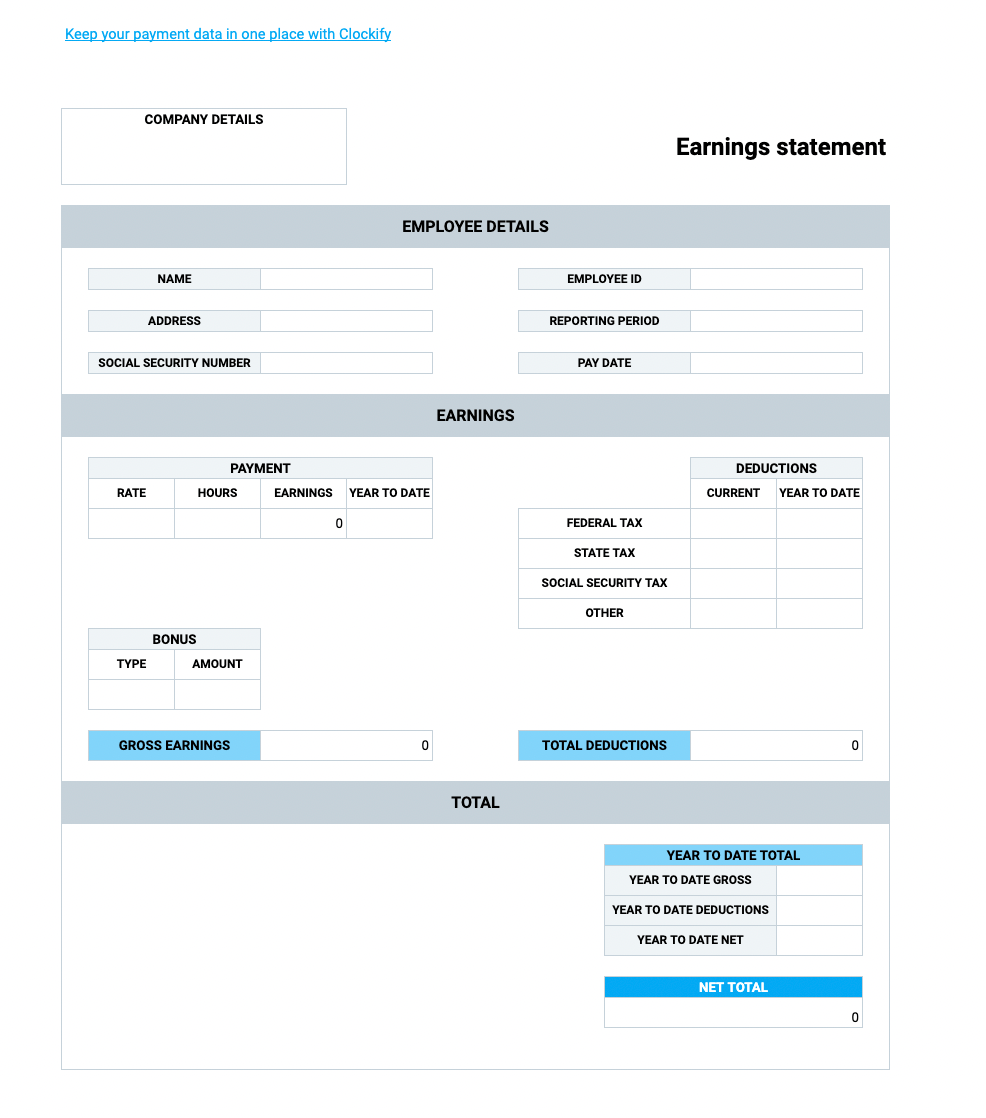

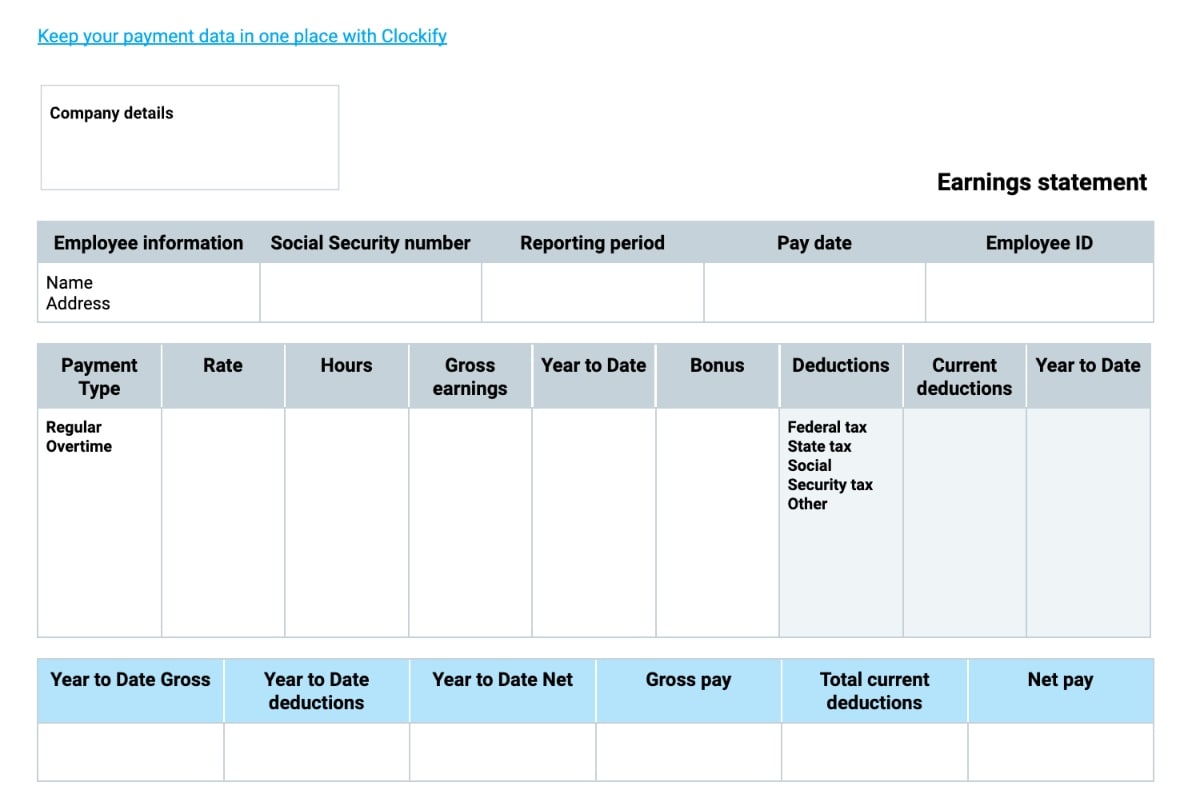

Basic Pay stub Template with a calculator

If you’re in search of a simple-to-use pay stub template that will prevent you from having to manually calculate your employees’ total payment, then this Basic Pay stub Template with a handy calculator can help you reduce the time you need to spend processing pay stubs.

Download Basic Pay stub Template with a calculator (Google Sheets)

What is the Basic Pay stub Template with a calculator?

The Basic Pay stub Template with a calculator is a simple spreadsheet that you can use to obtain accurate numbers without having to do the payment calculations by hand.

Why use the Basic Pay stub Template with a calculator?

If you’d like to minimize the chances of potential errors in your employees’ pay stubs, then the Basic pay stub Template with a calculator can help you achieve just that.

How best to use the Basic Pay stub Template with a calculator?

As soon as you download the template, begin by adding the necessary company details, such as name and address.

Then, continue by filling out the Employee details column. Insert:

- Name,

- Address,

- Social Security number,

- Employee ID,

- The reporting period, and

- The exact pay date.

After you’ve added all the basic information, you’ll need to fill out the Earnings column. Start by adding the payment-related information:

- Employee’s hourly rate,

- Total hours worked within the pay period,

- Year to date gross earnings, and

- Bonus (if applicable).

Now that you’ve submitted the relevant payment information, you’ll see the changes in the Gross earnings row.

Continue filling out the template by doing the same with the Deductions section. Simply, add all the applicable deductions (both current and year to date) — and you’ll notice the sum of deductions automatically calculated in the Total deductions column.

As soon as you’ve filled out the Earnings column, you’ll see the Net total automatically calculated in the Total column. You’re only left to add the year to date gross, year to date deductions, and year to date net — and the pay stub is ready to be issued.

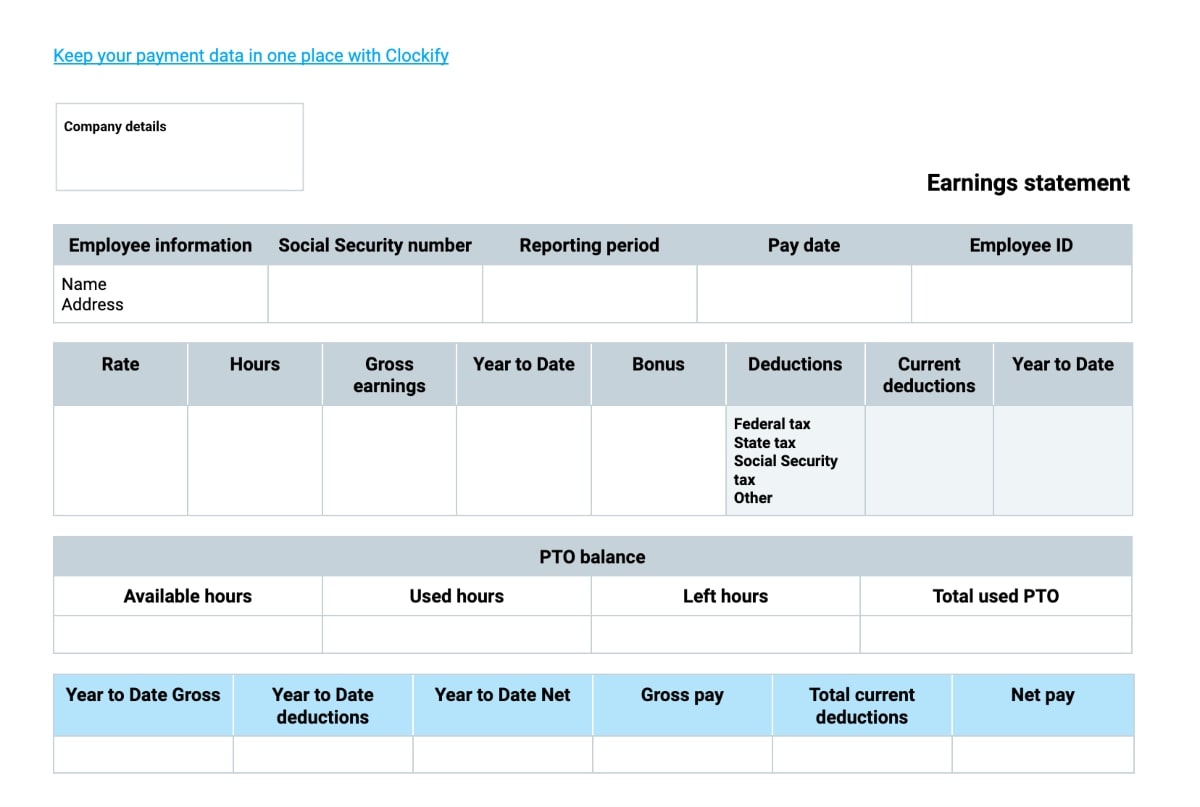

Pay stub Template with PTO

If you have thought that introducing a PTO policy will require you to make significant changes to your payroll processing, think twice. A pay stub template consists of just enough details to help you include PTO in your payment calculations without having to deal with additional paperwork.

Download Pay stub Template with PTO (Google Docs)

What is the Pay stub Template with PTO?

The Pay stub Template with PTO is a customizable, easy-to-use document that helps you simplify your pay stub issuing process.

Why use the Pay stub Template with PTO?

If you’re looking for a ready-made pay stub template, but you’re concerned about including PTO in your payment calculations, then the Pay stub Template with PTO is just right for you.

How best to use the Pay stub Template with PTO?

After you’ve downloaded the template, start by adding the required company details, employee information (name, address, Social Security number, employee ID), the reporting period, and the exact pay date.

Then, continue by adding employee’s:

- Hourly rate,

- Total hours worked,

- Current gross earnings,

- Year to date gross earnings,

- Bonuses (if applicable),

- Current deductions (Federal tax, State tax, Social Security tax, etc.), and

- Year to date deductions.

Next, move on to the PTO balance column. Add the available hours at the beginning of the pay period, used hours during the pay period, the number of hours left, and the total used PTO hours.

Finally, you’ll just need to fill out the last column. Insert the year to date totals (gross earnings, deductions, and net earnings) as well as the total current deductions, gross pay, and net pay for the particular pay period.

Pay stub Template with PTO + calculator

If you’re looking for a detailed pay stub template that includes PTO — but also does the math for you — then the Pay stub Template with PTO + calculator could be a good fit for you.

Download Pay stub Template with PTO + calculator (Google Sheets)

What is the Pay stub Template with PTO + calculator?

The Pay stub Template with PTO + calculator is a customizable, ready-to-use template that helps you automate the process of generating pay stubs.

Why use the Pay stub Template with PTO + calculator?

If you need to include PTO calculations in your pay stub, but you don’t want to waste time calculating everything by hand, then this template might be a great workaround.

How best to use the Pay stub Template with PTO + calculator?

As soon as you download the Pay stub Template with PTO + calculator, you can start adding your company’s details (name and address) and employee details (name, address, Social Security number, and their employee ID).

Then, continue by adding the reporting period and the exact pay date for that particular reporting period.

After that, move on to the Earnings column and start by adding:

- Employee’s hourly rate,

- Total hours worked,

- Year to date gross earnings, and

- Bonus (if applicable).

Immediately after, you’ll see the changes in the Gross earnings column.

Then, add all the applicable deductions (Federal tax, State tax, Social Security tax, etc.) in the Deductions column, and you’ll see the changes in the Total deductions column.

Move on to the Paid time off balance column, add the available hours at the beginning of the pay period, the hours used during the current pay period, and insert the same number in the Total used PTO column. You’ll instantly see the number in the Total gross PTO value column change, and you’ll notice that the number in the Gross earnings column has automatically changed as well.

Continue by adding the year to date gross, year to date deductions, and year to date net.

Finally, you’ll see the Net amount automatically calculated in the Total column.

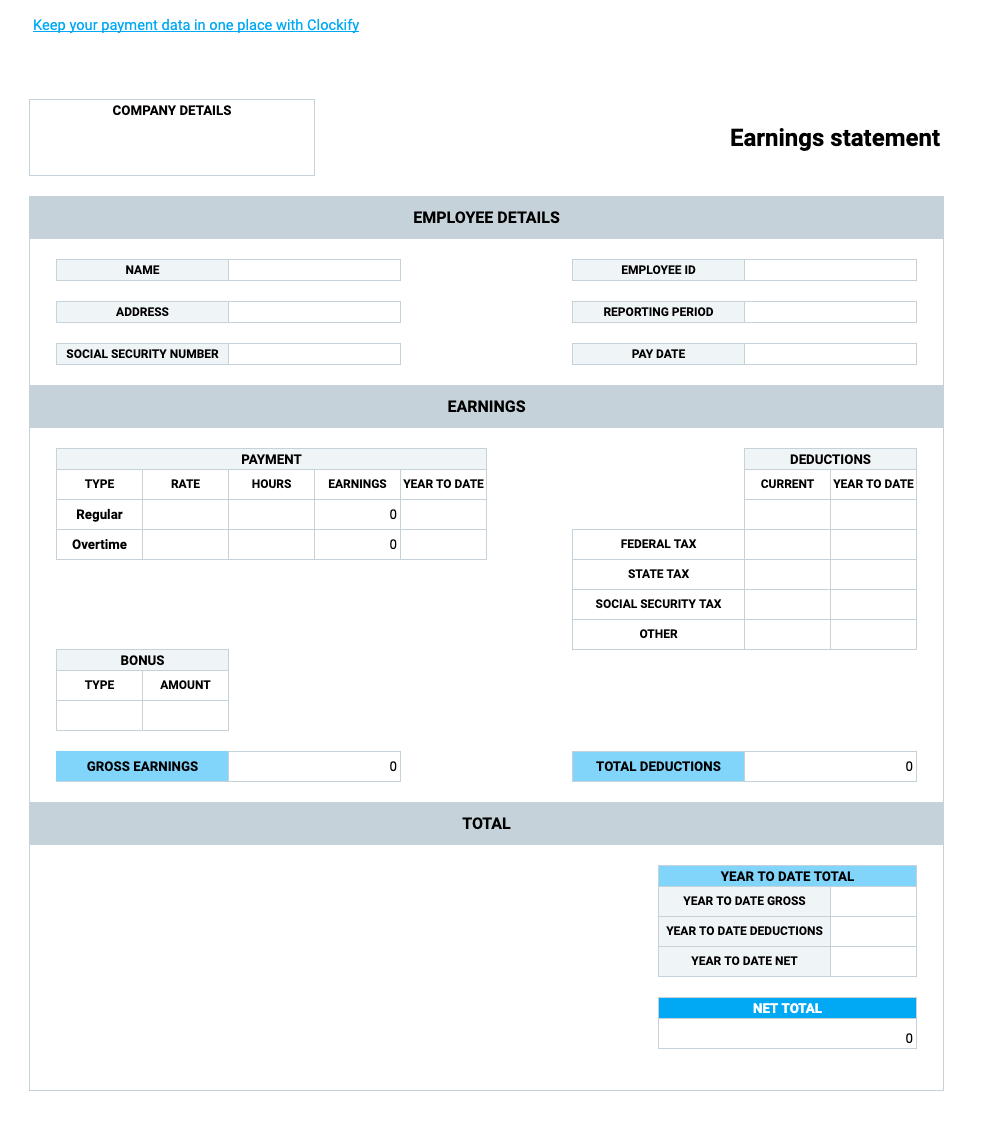

Pay stub Template with overtime

If you’re looking for a speedy way to incorporate employees’ overtime in their pay stubs, then you should try using the Pay stub Template with overtime.

Download Pay stub Template with overtime (Google Docs)

What is the Pay stub Template with overtime?

The Pay stub Template with overtime is a detailed document specifically created to help you speed up your pay stub issuing process while still not leaving out all the relevant information.

Why use the Pay stub Template with overtime?

Use the Pay stub Template with overtime if you’re in search of a comprehensive template that you can customize to fit your payment process.

How best to use the Pay stub Template with overtime?

After you’ve downloaded the template, begin by adding all the required information — your company’s details, employee’s name and address, their Social Security number, and employee ID.

Don’t forget to state the reporting period and the exact pay date.

Then, continue by adding both regular and overtime:

- Hourly rate,

- Total hours worked,

- Current gross earnings,

- Year to date earnings, and

- Bonus (if applicable).

After you’ve added all the earnings-related information, continue by adding both current and year to date deductions.

Finally, fill out the last column by adding:

- Year to date gross,

- Year to date deductions,

- Year to date net,

- Gross pay,

- Total current deductions, and

- Net pay.

Then, after you’re done filling out the last column, your pay stub will be ready to be sent.

Pay stub Template with overtime + calculator

If you need to include employees’ overtime pay in your pay stubs, but you’d like to eliminate the possibility of error in your pay stub calculations, then the Pay stub Template with overtime + calculator can be the perfect solution.

Download Pay stub Template with overtime + calculator (Google Sheets)

What is the Pay stub Template with overtime + calculator?

The Pay stub Template with overtime + calculator is a customizable spreadsheet that you can use to issue pay stubs while spending a minimum amount of time doing calculations.

Why use the Pay stub Template with overtime + calculator?

If you’d like to speed up the process of issuing pay stubs, but you’re required to include overtime hours in your calculations, the Pay stub Template with overtime + calculator is here to help you avoid doing everything from scratch.

How best to use the Pay stub Template with overtime + calculator?

First, start by downloading the template and adding the required company information.

Then, move on to filling out the Employee details column. Add:

- Name,

- Address,

- Social Security number,

- Employee ID,

- Reporting period, and

- Pay date.

After you’ve made sure that you’ve added all the important information, move on to the Earnings column and add both regular and overtime:

- Hourly rate,

- Total hours worked during the pay period, and

- Year to date earnings.

Don’t forget to add bonuses if applicable.

Immediately after, you’ll see the gross amount automatically calculated.

Next, add all the applicable deductions (Federal tax, State tax, Social Security tax, etc.) in the Deductions column, and you’ll see the Total deductions automatically calculated.

Then, you just need to add year to date gross, year to date deductions, and net, and you’ll see the changes in the Net total column.

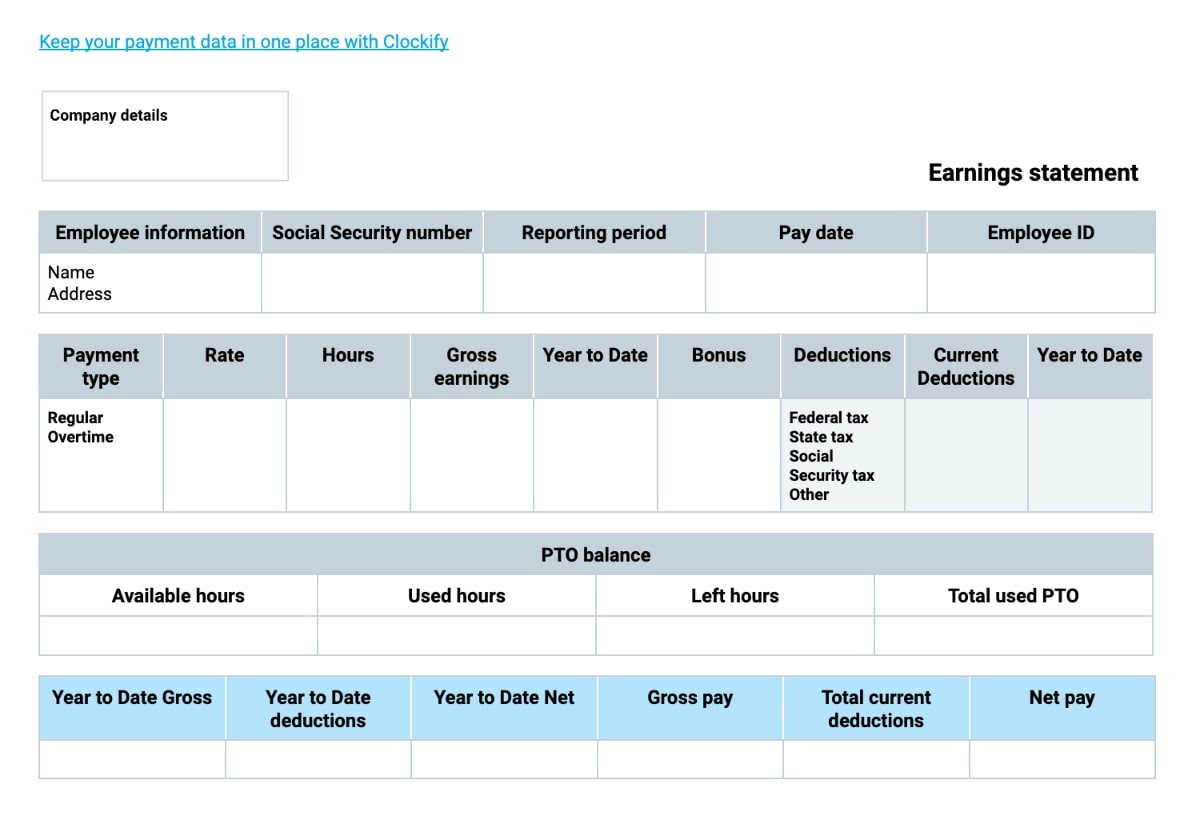

Pay stub Template with PTO and overtime

In case your payroll calculations need to include both PTO and overtime, you must be overwhelmed just by thinking about creating pay stubs with so many different items.

But, this is where the Pay stub Template with PTO and overtime comes to the rescue.

Download Pay stub Template with PTO and overtime (Google Docs)

What is the Pay stub Template with PTO and overtime?

The Pay stub Template with PTO and overtime is a ready-to-use document that you can edit and customize to fit your business and your payroll process.

Why use the Pay stub Template with PTO and overtime?

If you need a pre-built solution to the time-consuming process of creating pay stubs from scratch, then the Pay stub Template with PTO and overtime is a handy solution.

How best to use the Pay stub Template with PTO and overtime?

You can start by downloading the template and filling out the Company details column.

Then, continue by adding all the required employee information, such as:

- Name,

- Address,

- Social Security number,

- Reporting period,

- Pay date, and

- Employee ID.

After you’ve made sure that you’ve finished filling out the first column, you can start adding the payment-related information. Add both regular and overtime:

- Hourly rate,

- Total hours worked during the pay period,

- Gross earnings,

- Year to date gross, and

- Bonus (if applicable).

Don’t forget to put in all the deductions, both current and year to date.

Then, you can move on to the PTO balance column. Start by putting in the number of hours available at the beginning of the pay period, the number of used PTO hours, the number of hours left, and the total used PTO hours.

Finally, move on to the last column and put in:

- Year to date gross,

- Year to date deductions,

- Year to date net,

- Gross pay,

- Total current deductions, and

- Net pay.

After you’re done with the last column, your pay stub is ready to be issued.

Pay stub Template with PTO and overtime + calculator

Doing calculations on top of having to create pay stubs with multiple items can be time-consuming — but having a ready-made template that can do the final calculations can put a stop to wasting unnecessary time.

Download Pay stub Template with PTO and overtime + calculator (Google Sheets)

What is the Pay stub Template with PTO and overtime + calculator?

The Pay stub Template with PTO and overtime + calculator is a detailed spreadsheet that lets you generate pay stubs right away — without having to worry about miscalculations.

Why use the Pay stub Template with PTO and overtime + calculator?

If your employees' contracts include both PTO and overtime — but you still don’t want to give up on issuing pay stubs quickly — then the Pay stub Template with PTO and overtime + calculator could be the solution you were looking for.

How best to use the Pay stub Template with PTO and overtime + calculator?

First, start by downloading the template and adding your company details.

Then, move on to the Employee details column and put in the employee name and address, Social Security number, and ID.

Don’t forget to fill in the Reporting period and the Pay date column too.

After you’re finished with the important information section, you can move on to the Earnings column and start by filling out the Payment column. Here, you’ll need to put in both regular and overtime:

- Hourly rate,

- Total hours worked during the pay period, and

- Year to date earnings.

Don’t forget to fill out the Bonus column — and, immediately after, you’ll see the gross earnings automatically calculated.

Then, after you fill out the Deductions section, you’ll see the total deductions calculated too.

After you’re done with the Earnings column, you can move on to the Time off balance section.

Add the number of hours available at the beginning of the pay period, the number of hours used during the pay period, and put in the same number in the Total used PTO column.

Immediately after, you’ll see that the number in the Total gross PTO value column changed — and you’ll notice that the number in the Gross earnings column has automatically changed too.

Finally, you’ll just need to put in the year to date gross, deductions, and net earnings in the Total column — and you’ll notice the Net total automatically calculated.

Eliminate pay stub errors with Clockify by CAKE.com

Having an option to download a pre-made pay stub template and rapidly wrap up all your payroll-related tasks can certainly put a stop to time wasting — especially if the template comes with a calculator.

But, although calculators are handy for reducing the possibility of sending out incorrect pay stubs, to be able to issue a proper pay stub, you still need to obtain accurate data — and this is where a payroll tracker comes into the picture.

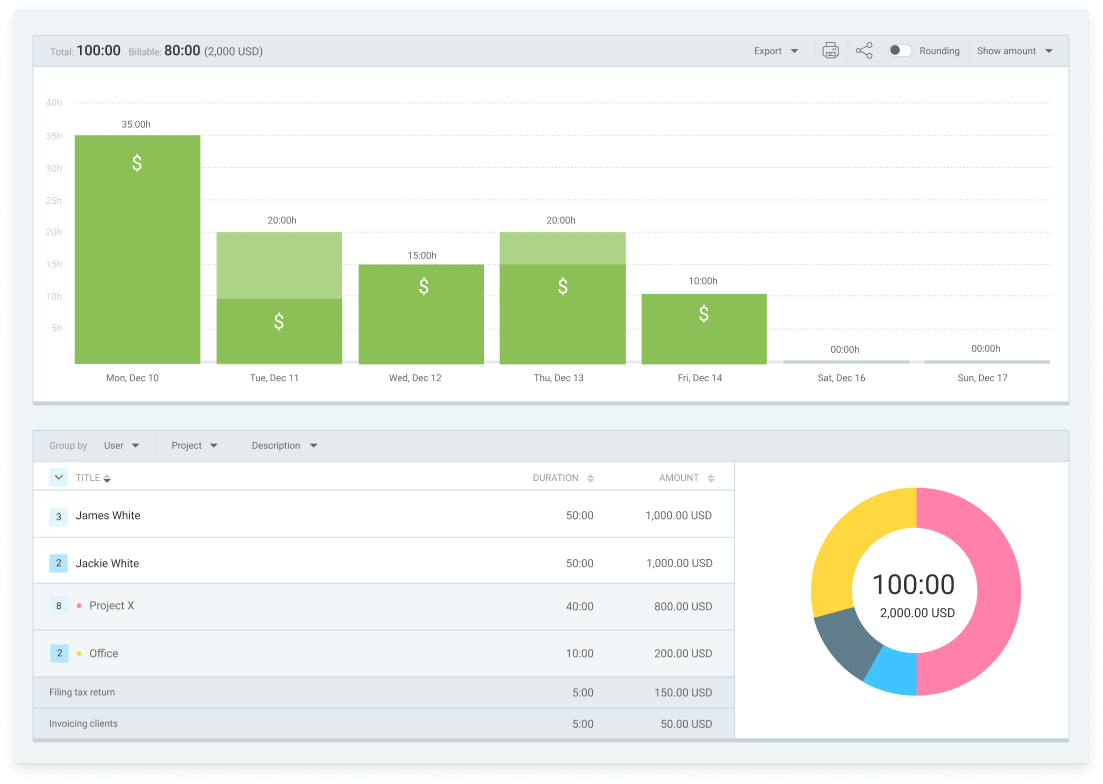

If you use Clockify by CAKE.com for staying on top of your employees’ work hours and hourly rates, you can quickly go over all the relevant information and use it for crafting an accurate pay stub.

You just need to set hourly rates for each employee or a project — and, as soon as an employee logs their work hours, you’d be able to see their total hours worked and gross earnings.

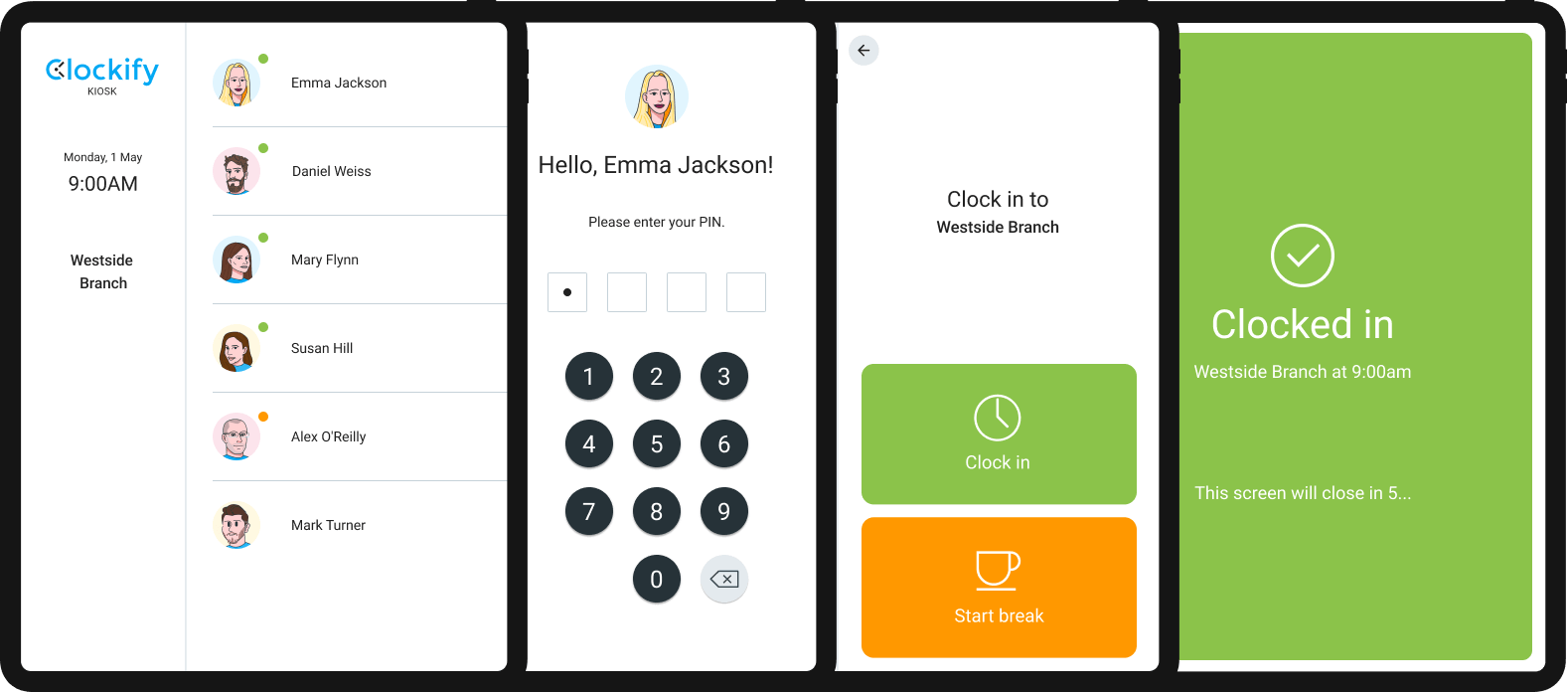

On top of logging their work hours, employees can also clock in and out using a time clock kiosk app.

This way, the process of obtaining accurate data is completely automated, and all the numbers necessary for crafting an accurate pay stub remain available at a glance.

There’s also an option to obtain detailed visual reports that consist of all the necessary payroll information, export them as Excel, PDF, or CSV files, and paste all the relevant data into a pay stub template right away.