Tennessee Labor Laws Guide

Ultimate Tennessee labor law guide: minimum wage, overtime, break, leave, hiring, termination, and miscellaneous labor laws.

| Tennessee Labor Laws FAQ | |

| Tennessee minimum wage | $7.25 |

| Tennessee overtime | 1.5 times the regular wage for any time worked over 40 hours/week ($10.87 for minimum wage workers) |

| Tennessee breaks | 30-minute meal or rest break after every 6 consecutive hours of work |

Wage laws in Tennessee

The state of Tennessee doesn’t have its own wage laws. Therefore, the Fair Labor Standards Act (FLSA) regulates:

- The minimum wage,

- The tipped minimum wage, and

- The subminimum wage (except for the subminimum wage regarding individuals with disabilities, which is regulated by state laws).

| TENNESSEE MINIMUM WAGE | ||

| Regular minimum wage | Tipped minimum wage | Subminimum wage |

| $7.25 | $2.13 | $7.25 (with some exceptions) |

Minimum wage in Tennessee

If a US state government establishes laws that offer additional benefits as opposed to federal laws, they will take precedence.

As the state of Tennessee has no state laws regulating the minimum wage that an employer is required to pay, employees are entitled to the federal minimum wage, which amounts to $7.25 per hour.

Exemptions to the minimum wage in Tennessee

Not all workers are entitled to the federal minimum wage of $7.25 per hour.

Certain employees are referred to as exempt employees — meaning they’re usually paid on a salaried basis and don’t qualify for minimum wage or overtime.

Employees who are exempt from the minimum wage in the state of Tennessee under the FLSA include the following:

- Executive, professional, and administrative employees who earn not less than $1,128 per week,

- Highly compensated employees who earn at least $151,164 per year,

- Farmworkers,

- Babysitters and elderly companions,

- Employees who deliver newspapers,

- Employees in the fishing industry, and

- Seasonal and recreational workers.

Tipped minimum wage in Tennessee

Under federal law, tipped employees are defined as employees who earn at least $30 per month in tips and gratuities.

The federal minimum wage for such employees equals $2.13 per hour. However, the employee’s hourly earnings must equal at least the federal minimum of $7.25 per hour.

If the employee earns less than this, the employer is obligated to make up the difference.

Subminimum wage in Tennessee

The federal law allows employers to pay certain types of employees a subminimum wage, which is lower than the federal minimum.

Employees can pay subminimum wages to student learners, full-time students, or workers with disabilities.

Moreover, employees under 20 years of age can be paid a training wage of $4.25 per hour. This is valid for the first 90 consecutive calendar days of employment, and after that, they’re entitled to the federal minimum wage.

Full-time students working in retail, agriculture, colleges, or universities can be paid at least 85% of the minimum wage under federal law.

Finally, high school students aged 16 years or older who attend vocational schools are entitled to 75% of the minimum wage.

Payment laws in Tennessee

Tennessee employers are required to pay employees all wages earned at least once a month.

Employers who pay their employees once a month must make payments by the fifth day of the following month.

However, employers may pay their employees in 2 or more periods per month — but must comply with the following provisions:

- Compensation earned and unpaid before the first day of a month must be paid out to the employee no later than the twentieth day of the following month, and

- Compensation earned and unpaid before the sixteenth day of a month must be paid out to the employee by the fifth day of the following month.

These payday regulations only apply to private employment.

🎓 Track Employee Payroll with Clockify

Overtime laws in Tennessee

Under federal law, non-exempt US employees working more than 40 hours a week are entitled to overtime pay of 1.5 times their regular pay rate.

These rules also apply to non-exempt employees in Tennessee.

🎓 Track Tennessee overtime with Clockify

Overtime exemptions in Tennessee

Certain types of employees aren’t eligible for overtime and minimum wage protection under the FLSA.

Such employees are called exempt employees, and they usually receive a fixed amount of pay — i.e., a salary.

Some groups of employees who are exempt from overtime and minimum wage protection include:

- Executive, administrative, and professional employees who receive a fixed salary of at least $1,124 per week (or $58,656 per year),

- Computer employees who earn at least $27.63 per hour,

- Highly compensated employees who earn $151,164 per year or more,

- Outside sales employees,

- Agricultural or horticultural employees,

- Taxi drivers,

- Railroad workers,

- Aircraft salesmen,

- Commissioned sales employees in retail or service establishments who receive more than half of their earnings from commissions on goods or services, and

- Motor carrier employees (e.g., drivers, driver’s helpers, loaders, or mechanics providing services in transportation on highways in interstate or foreign commerce).

In April 2024, the US Department of Labor announced a final rule regarding the standard salary threshold for executive, administrative, and professional employees.

According to this rule, the standard salary threshold was increased on January 1, 2025, to $1,128 and will continue to increase every 3 years to adjust for inflation.

Additionally, the standard yearly salary for highly compensated employees was increased to $151,164 per year, effective January 1, 2025.

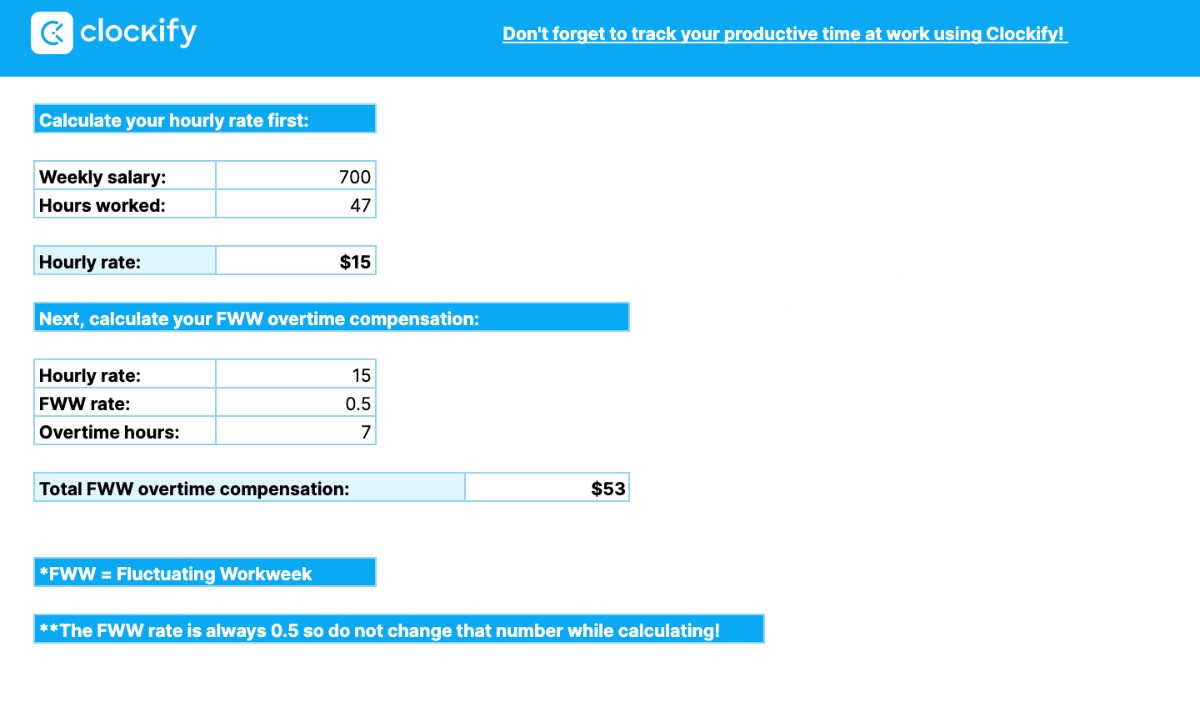

Fluctuating Workweek Method (FWW) in Tennessee

Even though employees who receive a fixed salary aren’t subject to overtime pay, there’s an exemption to this rule.

Thanks to the Fluctuating Workweek Method (FWW), such employees are entitled to overtime pay of one-half (0.5) times the regular hourly rate.

Including the fixed salary requirement, the following are conditions that must be met for the FWW to apply:

- Employees must have a “fluctuating workweek” — sometimes they work more or less than 40 hours a week, and

- Employees must earn at least $7.25 per hour.

Here’s how the Fluctuating Workweek Method (FWW) looks in practice:

Say an employee’s weekly income is $950.

In the preceding week, the employee worked 48 hours.

To calculate overtime hours, first calculate the hourly rate.

Simply divide the weekly salary by the number of hours worked that week:

$950 / 48 = $20 per hour

Next, multiply the hourly rate by 0.5 for every overtime hour during a week:

$20 per hour x 0.5 = $10 for each overtime hour worked

Total overtime compensation goes as follows:

$10 x 8 overtime hours = $80

🎓 Fluctuating Workweek Calculator

Break laws in Tennessee

Employees in Tennessee are entitled to a 30-minute meal or rest break without pay after every 6 consecutive work hours.

Still, Tennessee law distinguishes between employees in terms of granting breaks.

That said, businesses that naturally allow employees to take more breaks than usual and provide “ample opportunity to rest” aren’t obliged to offer meal or rest breaks to employees. Such businesses include food and beverage establishments, security services, and more.

Nevertheless, employers are advised to offer breaks to their employees to maintain productivity in an office environment.

Tennessee breastfeeding laws in the workplace

When it comes to breastfeeding, Tennessee breastfeeding laws allow mothers to express milk in any public or private place where they’re authorized to be. Also, the state of Tennessee’s laws clearly state that breastfeeding shall not be considered public indecency or nudity, obscene, or sexual conduct.

In addition, the federal PUMP Act requires employers to provide breastfeeding employees with a reasonable break and a private room that meets the following criteria:

- It isn’t used as a bathroom,

- It’s shielded from view, and

- It’s free from intrusion.

Breastfeeding mothers are eligible for this type of protection for up to 1 year after the birth of a child.

Leave requirements in Tennessee

There are certain leave benefits that Tennessee employers are obliged to secure for their employees.

But, by law, Tennessee employers aren’t obligated to provide any other leaves of absence.

That’s why we’ve divided types of leave into 2 categories:

- Required leave, and

- Non-required leave.

| TYPES OF LEAVES |

| ✅ REQUIRED LEAVE |

|

Annual leave — Eligible employees may accrue and use annual leave for whatever reason they wish. In Tennessee, employees scheduled to work 1,600 hours or more a year are entitled to paid leave of absence based on such employee’s accrued annual leave. Eligible employees may earn annual leave based on years of service as follows:

Employees who are eligible for annual leave accrual include:

|

| ✅ REQUIRED LEAVE FOR PUBLIC EMPLOYERS ❌ NON-REQUIRED LEAVE FOR PRIVATE EMPLOYERS |

|

Sick leave — Regarding the state of Tennessee sick leave policy, full-time public employees may accrue 1 sick leave day per month, provided such an employee works at least 37.5 hours a week (or 7.5 hours a day). Eligible employees may use sick leave in the following circumstances:

|

| ✅ REQUIRED LEAVE |

|

Maternity leave — Employees who have worked for the same employer for at least 12 months may be granted up to 4 months of leave (paid or unpaid) in the following cases:

|

| ✅ REQUIRED LEAVE |

|

Family and medical leave — Under the federal Family and Medical Leave Act (FMLA), employers must grant eligible employees unpaid time off for specified medical or family reasons, such as:

To qualify for FMLA, employees must have worked for their employer for at least 12 months (1,250 hours) in the previous 12-month period. Employees eligible for FMLA protection include:

|

| ✅ REQUIRED LEAVE FOR PUBLIC EMPLOYERS ❌ NON-REQUIRED LEAVE FOR PRIVATE EMPLOYERS |

|

Holiday leave — The state of Tennessee recognizes the following holidays as paid days off:

*Columbus Day shall be substituted for the Friday after Thanksgiving. If a holiday falls on Saturday, the preceding Friday will be a day off. If a holiday falls on Sunday, the following Monday will be a day off. Yet, only state offices remain closed during said holidays. |

| ✅ REQUIRED LEAVE |

|

Jury duty leave — Jury duty is a civic obligation of each US citizen to serve as a juror on a criminal or civil trial. In Tennessee, public employees who receive a summons from a court are entitled to time off from work, but only if jury duty exceeds 3 hours. Moreover, employees receive the usual compensation for the period of absence due to jury duty service. However, an employer can also deduct the fees or compensation the employee receives for such service. Finally, employers with fewer than 5 employees aren’t supposed to compensate the juror for the jury service. |

| ✅ REQUIRED LEAVE |

|

Voting leave — Each person with the right to vote must be granted a voting leave, with pay, not exceeding 3 hours, for voting. Still, if an employee’s work shift begins 3 or more hours after the opening of the polls or ends 3 or more hours before the closing of the polls, then such an employee isn’t eligible for a voting leave of absence. For instance, if an employee’s work shift begins at 10 a.m., and the polls are open from 7 a.m., the employee may not take paid time off to vote. |

| ✅ REQUIRED LEAVE FOR PUBLIC EMPLOYERS ❌ NON-REQUIRED LEAVE FOR PRIVATE EMPLOYERS |

|

Bereavement leave — Taken in case an immediate family member passes away. In Tennessee, public employees are entitled to 3 paid days of bereavement leave in the event of the death of an employee’s immediate family member. However, an employee must have accrued sick leave days to earn a bereavement leave of absence. Apart from getting 3 days of bereavement leave, an eligible employee may use an additional 2 days of sick leave in the event of a death in the family. |

| ✅ REQUIRED LEAVE FOR PUBLIC EMPLOYERS ❌ NON-REQUIRED LEAVE FOR PRIVATE EMPLOYERS |

|

Educational leave — Any full-time, regular public employee may receive a paid leave of absence to gain education or training related to the agency's needs. Eligible employees may receive 75% of their regular salary during the period of education or training. |

| ✅ REQUIRED LEAVE FOR PUBLIC EMPLOYERS ❌ NON-REQUIRED LEAVE FOR PRIVATE EMPLOYERS |

|

Special leave without pay — Employees may ask for a special leave of absence of more than 1 month in the following cases:

|

| ✅ REQUIRED LEAVE FOR PUBLIC EMPLOYERS ❌ NON-REQUIRED LEAVE FOR PRIVATE EMPLOYERS |

|

Compensatory time — Exempt, non-executive level employees and non-exempt employees who don’t receive overtime in cash may accrue paid time off for hours worked over 37.5 per week. Compensatory time is calculated based on the employee's average rate over the last 3 years of employment or the employee’s hourly rate. The accrual is limited, though. Eligible employees may accrue up to 480 hours of compensatory time. |

| ✅ REQUIRED LEAVE FOR PUBLIC EMPLOYERS ❌ NON-REQUIRED LEAVE FOR PRIVATE EMPLOYERS |

|

Administrative leave —Granted to an employee to participate in a state-administered assessment or at a State of Tennessee job interview. Furthermore, administrative leave may be granted to employees who donate blood platelets through the Apheresis Program, as blood donation is required every 2 weeks. |

| ❌ NON-REQUIRED LEAVE |

|

Donor leave — Employees in Tennessee don’t receive any time off to give blood. They may use their sick, compensatory, or annual leave in case of complications. Still, employees with particular blood types are considered on duty when donating blood. |

Child labor laws in Tenneesse

In Tennessee, employees under the age of 18 are subject to child labor laws.

In the following sections, we’ll be discussing child labor provisions regarding:

- Hour restrictions,

- Break periods, and

- Prohibited occupations.

Work time restrictions for Tennessee minors

Unlike in some other states, Tennessee has work hour limitations when it comes to employing minors aged 16 and 17 years. There are also time restrictions for minors aged 14 and 15.

Time restrictions for minors aged 16 and 17:

- May not work when they’re supposed to be attending classes, and

- May not work between 10 p.m. and 6 a.m. from Sunday to Thursday.*

*Unless they have parental or guardian permission, and in that case, minors may work until midnight but not more than 3 nights.

Time restrictions for minors aged 14 and 15:

- May not work when they’re supposed to be attending classes,

- May not work more than 3 hours a day and 18 hours a week when school is in session, and

- May not work more than 8 hours a day and 40 hours a week when school isn’t in session.

Breaks for Tennessee minors

All employees under 18 years of age must have a 30-minute break without pay for every 6 hours of consecutive work.

Prohibited occupations for Tennessee minors

Tennessee employers who wish to employ minors under 18 years of age must ensure a safe and healthy working environment free of any physical, moral, or emotional hazard.

Prohibited occupations for minors under the age of 18 in Tennessee:

- Coal mine occupation,

- Occupations that involve motor vehicle driving,

- Manufacturing or storing explosives or explosive components,

- Logging and sawmill operation,

- Slaughtering, meat packing, processing, or rendering,

- Brick, tile, and similar product manufacturing,

- Youth peddling, and

- Posing or modeling while engaged in sexual conduct for films, photographs, negatives, slides, or motion pictures.

🎓 Extensive list of prohibited jobs for Tennessee minors

Recordkeeping requirements for Tennessee minors

Under Tennessee law, employers that hire minors must keep a separate record for each minor that includes:

- Employment application,

- Copy of the minor’s birth certificate, driver’s license, ID, or passport to serve as evidence of age,

- Daily time record, and

- Any record that qualifies a minor for exemption.

Moreover, such employers must post a printed notice of the child labor provisions in a conspicuous place where minors are employed.

Hiring laws in Tennessee

Under Tennessee law, all individuals are protected from employment discrimination and are entitled to equal employment opportunities.

Therefore, employers mustn’t discriminate against a job applicant or employee because of their:

- Race,

- Creed,

- Color,

- Religion,

- Sex,

- Age,*

- National origin, and

- Physical, mental, or visual disability.**

*Limited to employees who are at least 40 years old.

**Unless such disability prevents or impairs work performance. Blind persons with guide dogs are also protected under this act.

Yet, it isn’t considered a discriminatory practice when giving preferences in hiring to:

- A discharged veteran (provided that they’re honorably discharged),

- A veteran’s spouse with a service-connected disability, and

- An unremarried widow or widower of a veteran or a member of the United States Armed Forces who died of a service-connected disability or in the line of duty.

The said provisions regarding giving veterans preference only apply to private employment.

Right-to-work law in Tennessee

Employees working in a state that uses a right-to-work law can’t be required or forced to join or not join a labor union as a condition of their employment.

Tennessee adopted this type of law in 1947.

The right-to-work law in Tennessee makes it unlawful for an employer or organization to:

- Refuse to hire a person due to their membership in, resignation from, or refusal to join a labor union or employee organization,

- Enter into a contract or agreement — whether written or oral — providing for exclusion from the employment of a person due to their membership in, resignation from, or refusal to join a labor union or employee organization,

- Deny employment based on payment or failure to pay labor union or employee organization dues, fees, assessments, or other charges, and

- Prohibit a person from withdrawing from a labor union or employee organization (except in cities, towns, municipalities, or counties with a metropolitan government).

If an employer or organization of any kind violates any of the said provisions, they’ll be convicted of a Class A misdemeanor.

Termination laws in Tennessee

All US states recognize the at-will doctrine. At-will means that an employer is legally allowed to end an employment contract with an employee at any time and for any reason or no reason at all. An employee may likewise quit their job at any time and for any reason.

NOTE: Montana’s employment law, often referred to as “The Good Cause law,” states that an employer must have a legitimate reason to terminate an employee’s employment contract after 12 months of work (probationary period).

However, no employer can terminate an employee due to their race, sex, age, religion, color, national origin, or disability.

Such a type of termination is called wrongful termination.

Still, under Tennessee law, certain exceptions exist to the at-will doctrine.

Employees in Tennessee can’t be discharged for:

- Performing military duty,

- Voting in elections,

- Joining or leaving associations voluntarily (in line with freedom of association),

- Wage garnishment (when an employee has unpaid debts, a third party may garnish, i.e., seize property or wages to settle debts),

- Filing workers’ compensation claims (when an employee suffers an injury or illness in the workplace), and

- Performing jury duty.

Final paycheck in Tennessee

Employees who voluntarily resign from a job or are discharged by the employer must be paid all wages earned no later than the next regularly scheduled payday or 21 days after the end of employment — whichever is later.

Health insurance continuation in Tennessee

Upon termination of employment, employees and their dependents may elect to continue their health insurance through the Consolidated Omnibus Budget Reconciliation Act (COBRA) law.

Eligible employees are those who are already participating in the state’s group health, dental, or vision program. Moreover, there are several qualifying events for COBRA, such as:

- Employment termination,

- Reduction in work hours,

- Death of a covered employee,

- Divorce, and

- Death of a child.

Under COBRA, employees may extend their health insurance for up to 36 months.

Employees must be aware that COBRA coverage doesn’t become effective until the employee or dependent makes a written notice within 60 days of a qualifying event.

Occupational safety in Tennessee

When it comes to safe and healthy conditions in the workplace, Tennessee has a state-plan regulatory program called the Tennessee Occupational Safety and Health Administration (TOSHA).

Like the federal OSHA, the Tennessee Occupational Safety and Health Administration (TOSHA) sets and enforces workers’ safety and health standards.

Furthermore, it provides training, education, and consultations to reduce work-related injuries or fatalities.

Who is covered by TOSHA?

TOSHA applies to private-sector workplaces with several exceptions, as well as state and local government employers and employees (except for federal government employers, including the United States Postal Service — USPS).

Miscellaneous Tennessee labor laws

In this section of the guide, we’ll cover some of the miscellaneous labor laws concerning Tennessee, including:

- Whistleblower laws, and

- Recordkeeping laws.

Tennessee whistleblower laws

Whistleblower laws protect and encourage individuals to report a violation of a law or rule to the proper authorities without being retaliated against.

In Tennessee, any employee (private or public) is encouraged to speak out and report illegal activity regarding the criminal or civil code of Tennessee or the US.

Therefore, under Tennessee whistleblower laws, no employee can be discharged for refusing to participate in or speaking out about illegal activity.

Moreover, under TOSHA, an employer can’t take any adverse action against an employee who files a complaint or testifies concerning a violation of occupational safety and health in the workplace.

Any employee who has suffered retaliatory discharge or any other damages will have the right to claim against an employer for causing harm and recover attorney fees and costs.

Tennessee recordkeeping laws

As the State of Tennessee has no recordkeeping laws, the federal provisions apply instead.

With that in mind, under FLSA, all employers must keep the following records of each non-exempt employee for at least 3 years:

- Name, address, birthday (if younger than 19), and sex,

- Occupation,

- Hours worked each day and week,

- Exact time and day of the week when the employee’s workweek begins,

- The basis on which the employee’s wages are paid (e.g., $12 per hour or $400 per week),

- Hourly pay rate,

- Total overtime earnings,

- Additions to or deductions from the employee’s wages,

- Total wages paid each pay period, and

- Date of payment and the pay period.

Although employers may use any timekeeping method under the FLSA, to better manage employee time tracking and eliminate manual or paper timesheets, they may consider using a time tracker and timesheet app.

Required labor law posters in Tennessee

Employees must be aware of their employment rights and other relevant work-related information. Therefore, employers must post necessary employment law posters in a visible and accessible place.

Let’s look at the required labor law posters for Tennessee employers.

Required state posters:

- TOSHA Safety and Health Poster,

- TN Unemployment Insurance Poster,

- Wage Regulation/Child Labor Poster,

- Workers’ Compensation Posting Notice, and

- Discrimination in Employment from the TN Human Rights Commission.

Required federal posters:

Required posters if there are Spanish-speaking employees:

- TOSHA Safety and Health Poster (Spanish),

- TN Unemployment Insurance Poster (Spanish),

- Wage Regulation/Child Labor Poster (Spanish), and

- Workers’ Compensation Posting Notice (Spanish).

Recommended, but not required posters:

- Human Trafficking Poster,

- Right to Work Poster,

- Drug Free Workplace, and

- Fraud Free Workplace.

🎓 Tennessee Department of Labor and Workforce Development required posters

Frequently asked questions about labor laws in Tennessee

To make this guide as comprehensive as possible, we’ve included an FAQ section where we’ll answer common questions about labor laws in Tennessee.

What are Tennessee’s labor laws?

When it comes to labor and employment, Tennessee uses federal and state laws to regulate this matter. Here are some of the most important ones:

- Fair Labor Standards Act (FLSA),

- Family and Medical Leave Act (FMLA),

- Tennessee Occupational Safety and Health Administration (TOSHA),

- Tennessee Child Labor Act,

- Wage Regulations Act,

- Prevailing Wage Act, and

- Tennessee Lawful Employment Act.

Does Tennessee have double-time overtime laws?

No, it doesn’t. The State of Tennessee follows federal overtime laws and doesn’t have a double-time overtime policy. Nonetheless, some employers might include this policy in the employment contract as a separate benefit.

Is it illegal not to pay overtime after 40 work hours in Tennessee?

Yes, it is. Tennessee follows federal overtime laws, which require every employee who works more than 40 hours a week to be compensated for overtime. The overtime premium equals 1.5 times their regular pay rate for each overtime hour.

Is there a late paycheck penalty in Tennessee?

Yes, there is. Employers who don’t pay employees on time may be sanctioned with a Class B misdemeanor and fined $100 to $500.

Moreover, the Commissioner of the Tennessee Department of Labor and Workforce Development can impose a civil penalty of $500 to $1,000 for wilful violations.

Need a simple time clock for employees?

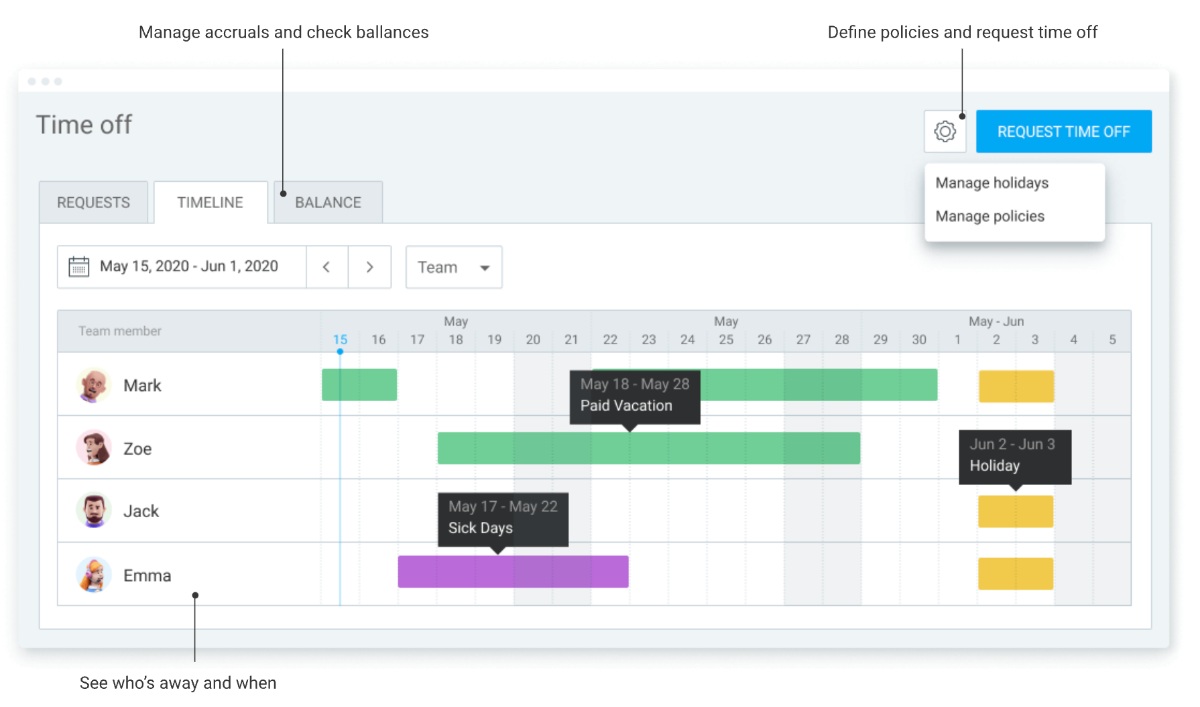

Clockify allows you to track time, attendance, and costs with just a few clicks for FREE.

Your team can track work time personally via the web or mobile app, or you can set up a time clock kiosk from which employees can clock in and out.

Another handy feature that Clockify has is time off. With this feature, employees can easily take time off, and you can always see who is available and when.

Moreover, you can see the total number of accrued leave days for each employee and stay compliant with all the current labor laws in Tennessee.

With Clockify, you can approve timesheets and time off, schedule shifts, run time card reports, and export everything for payroll (PDF, Excel, CSV, link, or send to QuickBooks).

Conclusion/Disclaimer

We hope this Tennessee labor law guide has been helpful. We advise you to pay attention to our links, as most will lead you to the official government websites and other relevant information.

Please note that this guide was written in June 2025, so any changes in the labor laws that were included later than that may not be included in this Tennessee labor laws guide.

We strongly advise you to consult with the appropriate institutions or certified representatives before acting on any legal matters.

Clockify isn’t responsible for any losses or risks incurred should this guide be used without further guidance from legal or tax advisors.