As a business owner, you need to take care of expenses of various kinds. And, while dealing with different business expenses, you’ve probably heard about the term “arrears in payroll” from your accountant — but you weren’t sure what it meant.

Well, if you compensate your employees for the hours worked after the due date for that compensation has passed, that’s arrears in payroll.

To help you better understand arrears in payroll, we created a short guide to explain not only this term but also some other expressions such as “paying in advance” and “paying in current” — so stay tuned.

In this blog post, we’ll also cover the following topics:

- What does arrears mean in payroll,

- The difference between payroll in arrears and current and advance payments,

- An example of paying in arrears,

- The advantages and disadvantages of paying employees in arrears, and

- Frequently asked questions about arrears and arrears in payroll.

So, let’s start.

What does arrears mean in payroll?

If you’re running payroll for last week instead of the current week, that’s considered payroll in arrears.

In other words, your employees are not paid at the end of the set pay period, that is, at the end of their workweek, but they’ll have to wait a few days after the pay period ends to get their pay.

Most businesses compensate employees this way because it’s easier for them to calculate total wages for the current pay period.

Apart from the hours worked, while calculating payment, an employer also has to take into account other factors, such as:

- All the taxes that need to be paid,

- Paid time off (PTO),

- Sick leave,

- Tips,

- Commissions, or

- Overtime.

You can also compensate your employees in other ways, so let’s see the differences between paying in arrears, paying in current, and paying in advance in the following paragraph.

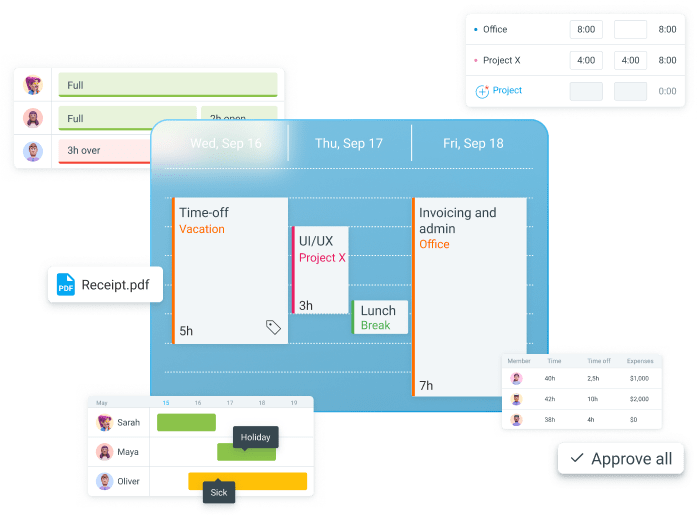

💡 Clockify Pro Tip

If you need help with keeping track of your employees’ time off, here are some free PTO templates you can use to ensure that your time off system runs smoothly:

Payroll in arrears vs. current vs. advance: What are the differences?

As we already mentioned, paying in arrears means that you, for example, run payroll for last week instead of the current week.

When you pay your employees in current, on the other hand, you pay them the day the set pay period ends.

Paying in current can be a bit tricky for employers because they need to calculate the estimated number of hours the employee will work during that pay period. Calculating the estimated number of hours worked means that the employer will have to guess how many hours the employee will work, which may differ from the actual hours worked.

For example, if an employee’s workweek is from Monday to Sunday, and the end of their pay period is on Friday, to pay them that same day, the employer would have to calculate hours earlier (for Saturday and Sunday) and guess how many hours worked there will be in the end.

Paying in advance would be the complete opposite of paying in arrears. When an employer pays the employee in advance, it means that the employee is paid ahead of the normal pay schedule.

For example, an employee can take something called salary advance. This term refers to the situation where the employer can give their employee a percentage of their salary before their usual payday.

This way, the employee receives their payment before the usual pay period ends.

💡 Clockify Pro Tip

Do you need a free tool to help you with accounting tasks such as handling and processing payroll and taxes? To choose the right accounting software for your business, take a look at the blog post below:

What is an example of paying in arrears?

To explain paying in arrears in more detail, let’s take a look at the example of this payment method.

Let’s say John works at the coffee shop and he works his usual 8 a.m.–5 p.m. shift on Monday, Tuesday, Wednesday, and Thursday, but he decides to take a day off on Friday.

Sunday would be the day the workweek ends, so his employer usually calculates John’s wages on the same day. This time, his employer also includes paid time off in their calculation (in this example, the day off is Friday).

In this case, John doesn’t get paid right away. He gets paid five days after the end of the previous workweek, that is, he receives his payment the following Friday. In other words, John is paid in arrears.

If you’re wondering why John wasn’t paid right away, we’ll explain it in a bit.

Paying in arrears is more convenient for John’s employer, since they can take some time to consider factors such as paid time off before doing the final pay calculation.

💡 Clockify Pro Tip

Have you ever wondered which tools you can use to keep track of your team’s vacation and other types of leave? Check out our blog post on this subject, and find out.

What are the advantages of paying employees in arrears?

There are several notable advantages of paying employees in arrears, so let’s learn more about them.

Advantage #1: Paying in arrears helps employers include all the factors

Paying employees in arrears gives employers more time to calculate all the factors, such as overtime, paid time off, or commissions, before issuing payments.

To find out more about this topic, we’ve reached out to Wendy Ha, the Founder, Principal Consultant, and Advisor at AgileCPA.

Wendy is a Chartered Professional Accountant (CPA) and Certified Management Accountant (CMA) with over 10 years of experience as a finance and accounting leader.

In her professional opinion, paying employees in arrears allows for more time to accurately calculate variable pay (i.e., commissions):

“For example, say a technology salesperson closed a deal on Jan 13th and the person is generally entitled to a 10% commission. If the payment is in the following week, the finance team can take their time to calculate and obtain all the necessary approvals to release the commission.”

Advantage #2: Paying in arrears reduces inaccuracies

If we compare it to paying in current where the employer may record the employee’s hours while they are still working, paying in arrears provides enough time to track and calculate the hours more precisely.

According to Wendy, there are certain instances where employers have to pay their employees in arrears:

“If the employers have hourly employees and want to pay by direct deposit, they have to pay in arrears. For example, say at a retail clothing company, it is impossible to pay hourly employees for Jan 14th if the pay date is the same day. The retail store wouldn’t know how many hours they’ve worked that day. Also, the company won’t be able to direct deposit the funds because typically, the final payroll amounts have to be submitted the day before.”

Advantage #3: Paying in arrears helps businesses with their cash flow

Companies often pay in arrears because it gives them time to be more flexible with their cash flows. According to the British Business Bank, “cash flow is a measurement of the amount of cash that comes into and out of your business in a particular period of time.”

Again, let’s see how Wendy explains this advantage:

“Delaying the payment can help the business with cash flow. Since service is rendered by the employees, the company might receive payment from their clients already. Delaying the payroll by 1 or 2 weeks will help with cash flow, especially if the company has other financial obligations they need to make.”

What are the disadvantages of paying employees in arrears?

When it comes to paying employees in arrears, there are also some disadvantages, so let’s see them.

Disadvantage #1: Paying in arrears leads to employees waiting for their payment

When you’ve just finished a tough week at work, what can certainly lift your spirits is being able to access that hard-earned money right away. Paying in arrears prevents employees from doing so, which is why some employees may find it a less desirable compensation option.

Disadvantage #2: Paying in arrears can be a difficult change for employees who got used to being paid in current

Any transition can be a little difficult for employees, especially when it comes to payroll. If you decide you want to switch to arrears payment, you need to be aware of the potential consequences this may have for your employees. Perhaps your employees have become accustomed to the current payment system, and the transition from paying in current to paying in arrears is not something they anticipated.

Having to go one or two weeks without pay can affect your employees’ finances. Moreover, to keep a good relationship with your employees but also prevent financial hardships they may encounter, you’ll also probably have to provide them with some type of transition payment (this is a one-time payment in the form of an advance, for example).

Frequently asked questions about arrears and arrears in payroll

If you want to learn more about arrears and arrears in payroll, check out these frequently asked questions we’ve singled out for you.

Arrears in payroll vs. being paid in arrears: what is the difference?

As we’ve already mentioned, arrears in payroll refer to the situation where employees are compensated for the hours worked in the previous pay period instead of the current pay period.

But, what about being paid in arrears?

According to Forbes, being paid in arrears means “to pay for goods or services after the terms have been met or the due date has passed.” For example, if you’re behind on your electricity bill, and your house has already been supplied with electricity, that means your electricity bill is being paid in arrears.

💡 Clockify Pro Tip

If you’re a small business owner, and you want to learn how you can manage the payroll process more easily, take a look at the following blog post on payroll management:

What does arrears mean in accounting?

Arrears in accounting can occur in several cases, and the first case we’ll mention is the case of being paid in arrears — for example, when your business pays your vendor in arrears.

Let’s say you own a restaurant, and you purchase your vegetables from a certain vendor.

Although you have established payment terms with your vendor — to pay them before January 30th — you failed to do so. You received your vegetables, but you missed the deadline for payment, so now you’ll have to pay your vendor in arrears.

In other words, if you, as a business owner, are behind on payments you owe your vendors, that’s payment in arrears.

Vendors can sometimes make you pay a late fee, so keep that in mind when deciding whether paying in arrears is the best option for your business.

Aside from paying vendors in arrears, other cases of arrears in accounting can be grouped into 3 types of arrears:

- Annuity in arrears — As Forbes explains, “if the annuity payment is made at the end of a fixed period, rather than at the start, it is referred to as an annuity in arrears.” For example, mortgage payments are considered an annuity in arrears.

- Calls in arrears — Calls in arrears occur in a situation where there are a few shareholders of a company, and one of them fails to pay the due amount of shares on call.

- Dividends in arrears — When a company has dividends in arrears, it means that it failed to issue a dividend payment by the due date to preferred shareholders — that is, to those shareholders that have priority in contrast to common shareholders over a corporation’s profits.

💡 Clockify Pro Tip

Whether you’re a CFO for a company or your own small business, bookkeeping is a huge undertaking. To learn more about how you can track time better while doing bookkeeping and ease at least one of your responsibilities, read our blog post below:

How to reduce the risks of billing in arrears?

Apart from paying employees in arrears, there’s also something called billing in arrears.

When you bill in arrears, you bill your client or customer after you have provided them with services or goods.

To help you reduce the risks of billing in arrears, such as the risk of missing payments, or even prevent certain risks, we’ve listed some handy tips.

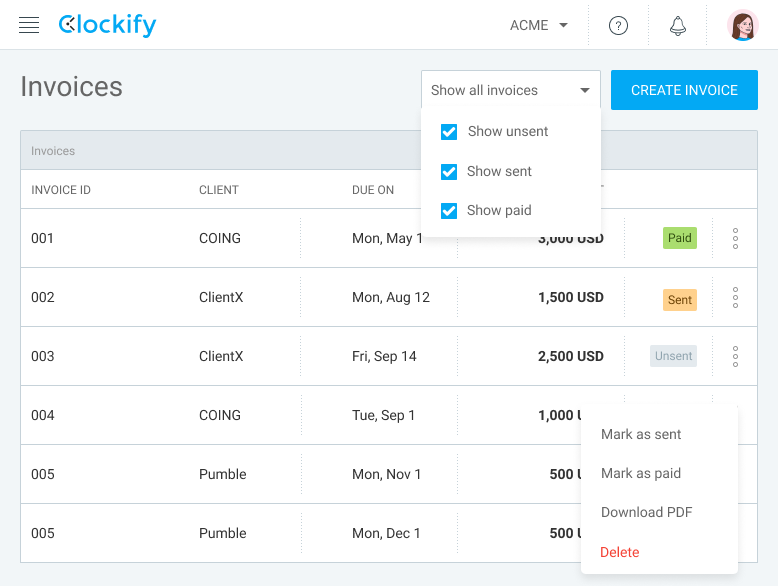

Tip #1: Use invoicing software to keep track of your invoices

Using invoicing software helps reduce the risks of billing in arrears because it allows you to keep track of all your invoices in one place.

As a matter of fact, the right invoicing software gives you a detailed overview of both your paid and overdue invoices.

In Clockify by CAKE.com, for example, you can mark invoices as either Sent or Unsent, and if a due date for a sent invoice passes, the invoice automatically gets Overdue status.

You can also use the Reminder email as a friendly note of the invoice that is past due time.

All of these options can simplify tracking your client’s payments and reduce the risks that sometimes come with being paid in arrears.

💡 Clockify Pro Tip

You did your part of the deal and finished the project within the deadline, but your client hasn’t paid you yet? If you want to learn how you can ask for payment professionally and what email templates you can use for that, check out our blog post below:

Tip #2: Conduct credit checks on potential clients

To avoid dealing with unreliable clients, you can conduct credit checks on them to evaluate whether they can pay consistently on time.

An employer can check someone’s credit history by looking at their credit report — credit reports list your:

- Bill payment history,

- Loans,

- Current debt, and

- Other financial information.

This way, you reduce the possibility of receiving late or missing payments and putting your business finances at risk.

Conclusion: Before paying in arrears, evaluate whether this system works for you

As you can see, paying employees a few days after the end of the pay period is a useful practice for employers because they get more time to calculate their employees’ hours worked more accurately.

Employees, on the other hand, may not always be in favor of this payment system. Sometimes they’ll need some time to adjust to being paid later than usual, especially if they’re used to a different payment schedule.

Still, if you decide to pay your employees in arrears, you need to be aware of both the advantages and disadvantages that this payment method can bring. That way, you can decide if paying in arrears is the best solution for your business or if you should go for another option.

Ultimately, however you decide to pay your employees, try to choose the payment system that’s most convenient for all the parties involved.