Overtime occurs when employees work beyond their usual work hours. The federal government regulates overtime in the US, and certain states have their own overtime laws and regulations.

It’s crucial to understand and adhere to various overtime regulations in the US. This includes a comprehensive knowledge of overtime laws on both the federal and state levels, empowering you to stay compliant and protect your rights as an employee or employer.

To help you with this, we’ve written this in-depth article to cover:

- Definition of overtime laws,

- Federal overtime regulations,

- United States overtime laws by state for 2025, and

- Additional overtime provisions.

*Note: The information regarding overtime laws and regulations in the US has been checked and updated for 2025.

- Under federal law, overtime is defined as work an employee performs beyond 40 hours in a regular workweek.

- Some states have daily overtime limits, meaning an employee is eligible for overtime pay after working a certain number of hours (usually 8 hours) in a day.

- Overtime pay is compensated at a rate of 1.5 times the regular hourly rate.

- Certain categories of employees are exempt from overtime pay rules.

- In addition to federal law, many states have their own overtime regulations.

What are overtime laws?

Overtime laws are regulations that determine overtime payment rates and working hour limits for employees who work beyond their regular workweek or workday.

Federal law defines overtime as work that exceeds 40 hours in a workweek, while a workweek is defined as a recurring period of 168 hours (7 days).

Employees who work overtime are entitled to overtime pay, which equals 1.5 times their regular rate of pay for each hour worked over 40 in a workweek.

As for statistics, on average, Americans spend more than 8 hours a day working — 8 hours and 30 minutes, to be exact. So, overtime is a regular occurrence for most US workers.

Overtime laws are designed to ensure workers are fairly compensated for their additional efforts, protecting them from being overworked and underpaid. This fairness in the system provides a sense of reassurance and security to both employees and employers.

Overtime laws by state

The following table shows overtime laws by state in the US.

The table provides information on whether a specific state has its own overtime law or relies entirely on federal regulations. It also shows what is considered overtime according to daily or weekly limits for working hours.

Every hour worked above the daily or weekly limit set counts as overtime.

| State | State Overtime law | Daily work hours limit | Weekly work hours limit | Overtime rate |

|---|---|---|---|---|

| Alabama | No, federal rules apply. | No limit set | 40 hours | 1.5 times the regular hourly rate. |

| Alaska | Yes | 8 hours | 40 hours | 1.5 times the regular hourly rate. |

| Arizona | No, federal rules apply. | No limit set | 40 hours | 1.5 times the regular hourly rate. |

| Arkansas | Yes | No limit set | 40 hours | 1.5 times the regular hourly rate. |

| California | Yes | 8 hours — regular overtime. 12 hours — double overtime (exceptions may apply for certain employees in the healthcare industry, camp counselors, etc.) | 40 hours/6-day workweek | – 1.5 times the regular hourly rate for hours worked beyond 8 hours during the first 6 days of work, 2 times the regular rate after 12 hours of work; – 1.5 times the regular hourly rate for the first 8 hours worked on the 7th consecutive day and 2 times the regular rate after 8 hours of work. |

| Colorado | Yes | 12 hours | 40 hours | 1.5 times the regular hourly rate. |

| Connecticut | Yes | No limit set | 40 hours | 1.5 times the regular hourly rate. |

| Delaware | No, federal rules apply. | No limit set | 40 hours | 1.5 times the regular hourly rate. |

| District of Columbia | Yes | No limit set | 40 hours | 1.5 times the regular hourly rate. |

| Florida | No, federal rules apply. | No limit set | 40 hours | 1.5 times the regular hourly rate. |

| Georgia | No, federal rules apply. | No limit set | 40 hours | 1.5 times the regular hourly rate. |

| Hawaii | Yes | No limit set | 40 hours | 1.5 times the regular hourly rate. |

| Idaho | No, federal rules apply. | No limit set | 40 hours | 1.5 times the regular hourly rate. |

| Illinois | Yes | No limit set | 40 hours | 1.5 times the regular hourly rate. |

| Indiana | Yes | No limit set | 40 hours | 1.5 times the regular hourly rate. |

| Iowa | No, federal rules apply. | No limit set | 40 hours | 1.5 times the regular hourly rate. |

| Kansas | Yes | No limit set | 46 hours | 1.5 times the regular hourly rate. |

| Kentucky | Yes | No limit set | 40 hours/6-day workweek | 1.5 times the regular hourly rate. |

| Louisiana | No, federal rules apply. | No limit set | 40 hours | 1.5 times the regular hourly rate. |

| Maine | Yes | No limit set | 40 hours | 1.5 times the regular hourly rate. |

| Maryland | Yes | No limit set | 40 hours (48 hours and 60 hours for specific groups of workers) | 1.5 times the regular hourly rate. |

| Massachusetts | Yes | 8 hours | 40 hours | 1.5 times the regular hourly rate. |

| Michigan | Yes | No limit set | 40 hours | 1.5 times the regular hourly rate. |

| Minnesota | Yes | No limit set | 48 hours | 1.5 times the regular hourly rate. |

| Mississippi | No, federal rules apply. | No limit set | 40 hours | 1.5 times the regular hourly rate. |

| Missouri | Yes | No limit set | 40 hours | 1.5 times the regular hourly rate. |

| Montana | Yes | No limit set | 40 hours | 1.5 times the regular hourly rate. |

| Nebraska | No, federal rules apply. | No limit set | 40 hours | 1.5 times the regular hourly rate. |

| Nevada | Yes | 8 hours | 40 hours | 1.5 times the regular hourly rate. |

| New Hampshire | No, federal rules apply. | No limit set | 40 hours | 1.5 times the regular hourly rate. |

| New Jersey | Yes | No limit set | 40 hours | 1.5 times the regular hourly rate. |

| New Mexico | Yes | No limit set | 40 hours | 1.5 times the regular hourly rate. |

| New York | Yes | No limit set | 40 hours (minimum salary for eligibility is different in New York City, Long Island, and Westchester), and 60 hours (farm workers) | 1.5 times the regular hourly rate. |

| North Carolina | Yes | No limit set | 40 hours | 1.5 times the regular hourly rate. |

| North Dakota | Yes | No limit set | 40 hours | 1.5 times the regular hourly rate. |

| Ohio | Yes | No limit set | 40 hours | 1.5 times the regular hourly rate. |

| Oklahoma | No, federal rules apply. | No limit set | 40 hours | 1.5 times the regular hourly rate. |

| Oregon | Yes | No limit set | 40 hours (10-hour rule applies to employees working in seafood processing industries, canneries, driers, etc.) | 1.5 times the regular hourly rate. |

| Pennsylvania | Yes | No limit set | 40 hours | 1.5 times the regular hourly rate. |

| Rhode Island | Yes | No limit set | 40 hours | 1.5 times the regular hourly rate. |

| South Carolina | No, federal rules apply. | No limit set | 40 hours | 1.5 times the regular hourly rate. |

| South Dakota | No, federal rules apply. | No limit set | 40 hours | 1.5 times the regular hourly rate. |

| Tennessee | No, federal rules apply. | No limit set | 40 hours | 1.5 times the regular hourly rate. |

| Texas | No, federal rules apply. | No limit set | 40 hours | 1.5 times the regular hourly rate. |

| Utah | No, federal rules apply. | No limit set | 40 hours | 1.5 times the regular hourly rate. |

| Vermont | Yes | No limit set | 40 hours | 1.5 times the regular hourly rate. |

| Virginia | Yes | No limit set | 40 hours | 1.5 times the regular hourly rate. |

| Washington | Yes | No limit set | 40 hours | 1.5 times the regular hourly rate. |

| West Virginia | Yes | No limit set | 40 hours | 1.5 times the regular hourly rate. |

| Wisconsin | Yes | No limit set | 40 hours | 1.5 times the regular hourly rate. |

| Wyoming | No, federal rules apply. | No limit set | 40 hours | 1.5 times the regular hourly rate. |

Overtime laws for US territories

The table below shows info on overtime laws for permanently inhabited US territories.

| State | Daily work hours limit | Weekly work hours limit | Overtime rate |

|---|---|---|---|

| American Samoa | No limit set | 40 hours | 1.5 times the regular hourly rate. |

| Guam | No limit set | 40 hours | 1.5 times the regular hourly rate. |

| Northern Mariana Islands | No limit set | 40 hours | 1.5 times the regular hourly rate. |

| Puerto Rico | 8 hours | 40 hours | 1.5 times the regular hourly rate. |

| Virgin Islands | 8 hours | 40 hours (or 7th consecutive workday) | 1.5 times the regular hourly rate. |

Every US state has a weekly overtime limit, which means that an employee can work more than 8 hours on certain days and still not be paid overtime if their total work hours for the week don’t exceed the limit of 40 hours.

However, states like Alaska, California, Colorado, and Nevada determine limits on the number of hours an employee can work in a day before becoming eligible for overtime. Therefore, even if employees have fewer hours than their weekly limit, they can receive overtime compensation for any hour worked beyond 8 hours per day.

Moreover, certain states regulate the number of days in a workweek. For example, in California and Kentucky, a workweek consists of 6 consecutive days. Every hour worked on the 7th consecutive day counts as overtime.

🎓 Everything You Need to Know About the 4-Day Work Week Concept│What Is the 2-2-3 Work Schedule and Why Is It Useful?

What are the federal overtime laws?

According to the Fair Labor Standards Act (FLSA) overtime regulations, all covered employees must receive pay for overtime work. Federal regulations define overtime as time worked over 40 hours during a workweek.

The rate for overtime is 1.5 times the regular hourly pay rate:

Hourly rate x 1.5 = Overtime rate

Furthermore, FLSA covers employees working in the following organizations:

- Companies with sales volume or business done of at least $500,000, and

- Businesses providing medical or nursing care, hospitals, schools, and government agencies.

Furthermore, workers involved in interstate commerce and domestic service employees are also covered by the FLSA.

Who is exempt from overtime pay in the US?

Exempt employees are ineligible for overtime pay even if they work beyond the weekly or daily overtime hours cap. The FLSA determines this list of exemptions.

According to the Department of Labor’s final rule, the following employees are exempt from overtime regulations:

- Executive employees who earn at least $1,128 per week,

- Administrative employees who earn at least $1,128 per week,

- Professional employees who earn at least $1,128 per week,

- Computer employees who earn at least $27.63 per hour,

- Outside sales employees, and

- Highly compensated employees who earn at least $151,164 per year.

The FLSA further defines the requirements that must be met for an employee to be considered exempt for each exemption category. These requirements mainly include the type of job performed, job duties, and salary level.

🎓 Key Differences Between Exempt and Nonexempt Employees

Frequently asked questions about overtime laws in the US

In case you’re still wondering about specifics regarding overtime, we’ve compiled some of the most frequently asked questions on United States overtime laws and answered them for you.

When did overtime start in the USA?

The first official overtime regulation on the federal level came with the passing of the Fair Labor Standards Act (FLSA). The act came into effect in 1938, and it contained provisions on:

- Minimum wage,

- Child labor, and

- Overtime pay.

Initially, the FLSA defined overtime as any hours worked above a 44-hour workweek. Two years later, the FLSA issued an amendment reducing the limit to 40 hours per week.

The FLSA overtime regulations have been amended multiple times over the years. The amendments mainly changed overtime exemptions, particularly the ones concerning salary levels for exempt employees.

🎓 Fair Labor Standards Act (FLSA) Regulations

What states have the best overtime laws?

Overtime laws are similar in most states since most follow the FLSA’s 40-hour rule. However, some states have introduced their own regulations on daily and weekly overtime, improving their overtime conditions.

In states with weekly overtime rules, employees can work as many hours as required per day. However, they won’t be compensated for overtime if their weekly work hours don’t add up to more than 40 hours.

By setting daily overtime regulations, these states have ensured their workers are adequately compensated for each hour worked beyond their regular working hours.

States with daily overtime pay rules include:

- Alaska,

- California,

- Colorado,

- Massachusetts, and

- Nevada.

How to determine whether state or federal overtime laws apply?

Defense attorney and partner at Schmidt and Clark LLP, Mike Schmidt, explains that the federal law applies to FLSA-covered employees:

“Generally, it depends on 2 main factors: the type of work you do and your employer’s annual revenue. If your job involves activities like interstate commerce, production of goods for interstate commerce, or if you work for a company with an annual revenue of at least $500,000, then federal overtime laws, outlined in the Fair Labor Standards Act (FLSA), are likely to apply.”

Schmidt adds that, in case an employee isn’t covered by the FLSA or lives in a state with its own overtime regulations, they have to look into the state law as these regulations might be more favorable:

“Some states have their own overtime laws that might be more generous to employees than federal laws. For instance, California has daily overtime laws, which means you could be entitled to overtime pay if you work more than a certain number of hours in a single day, regardless of your weekly total.”

How does overtime work in California?

In California, every hour worked beyond 8 hours a day is considered overtime. The overtime rate per hour is 1.5 times the regular hourly rate for work beyond 8 hours and up to (and including) 12 hours a day.

Employees who work 12 hours or more a day are entitled to double overtime, which is 2 times the regular hourly rate.

In addition, California’s regular workweek consists of 6 days, so working the 7th consecutive day counts as overtime.

The first 8 hours worked on the 7th day are paid 1.5 times the regular hourly rate, while hours worked beyond 8 hours are compensated at 2 times the regular hourly rate.

How is overtime calculated based on federal regulations?

On the federal level, every hour worked beyond 40 hours in a week is paid at 1.5 times the regular hourly rate.

Let’s say your hourly rate is $30, and you worked 42 hours during the week. That’s 40 regular working hours and 2 extra hours of overtime. Your weekly pay for regular hours worked will be as follows:

$30 x 40 hours of regular work = $1,200 (regular pay)

The remaining 2 hours are calculated as overtime:

$30 x 1.5 (the overtime rate) x 2 hours of overtime = $90

So, your total earnings for that week will be:

$1,200 + $90 = $1,290

Overtime work is calculated differently in states that allow a longer regular workweek (above 40 hours), such as Kansas and Minnesota. Moreover, in states where there is daily overtime, you should also be mindful of the hours worked during the day.

How to calculate overtime in states with daily overtime?

In states with daily overtime, any hour worked beyond 8 or 12 hours per day (depending on the state) is considered overtime. This means employees can be paid for overtime even if they don’t work beyond 40 hours during the week.

Let’s assume that an employee in Nevada who is paid an hourly rate of $40 worked 8 hours on Monday, Tuesday, and Wednesday, 10 hours on Thursday, and 6 hours on Friday.

Their work hours during the week are:

8 hours x 3 days + 10 hours + 6 hours = 40 hours

So, looking at the weekly overtime limit in Nevada only, we might conclude that this employee isn’t eligible for overtime pay, as they didn’t work more than 40 hours during the week.

However, Nevada’s overtime regulations include daily overtime, with the limit set to 8 hours a day. This employee worked 10 hours on Thursday, which means they worked 2 overtime hours and are eligible for overtime pay.

So, we’ll calculate their weekly pay by first adding up regular hours worked:

8 hours x 4 (Mon-Thu) + 6 hours (Fri) = 38 hours

Their pay for regular hours worked is:

38 hours x $40 = $1,520

Then, we should add the overtime. The overtime hourly pay for this worker is:

$40 x 1.5 = $60

An employee worked 2 hours of overtime on Thursday:

2 hours x $60 = $120

Their weekly earnings are:

$1,520 (regular hours) + $120 (overtime hours) = $1,640 (total compensation)

So, this employee earned $1,640 during the week in question.

How much overtime is too much?

Federal regulations don’t impose a limit on the overtime hours an employee aged 16 or above can work.

However, certain states have regulations that limit the number of working days in a week to 6. These states are:

- Illinois,

- New York (for certain occupations),

- Wisconsin (minors and workers in factory and retail establishments), and

- California (with exceptions).

Moreover, in California, workers can refuse to work more than 72 hours a week without being sanctioned.

In Maine, employees can’t work more than 80 hours of overtime in a 2-week period.

Is overtime mandatory in the US?

Although overtime isn’t mandatory in the United States, employees must be properly compensated for overtime work in accordance with federal or state laws.

🎓 Mandatory Overtime: What You Need to Know

Is unpaid overtime illegal in the US?

Yes, it’s illegal not to pay the overtime rate to a US employee who worked overtime in a specific week. This regulation, however, applies only to covered, non-exempt employees.

🎓 Working Overtime Without Pay – Know Your Rights and Options

Do salaried employees get overtime in the US?

Most salaried employees in the United States are exempt from federal overtime regulations and aren’t eligible for overtime pay.

However, as of January 2025, most salaried white-collar workers (executive, administrative, professional, and outside sales employees) who make less than $1,128 per week, which is $58,656 yearly before taxes, are eligible for overtime pay.

Note: This is just an informational text. For more on exemption categories and criteria, visit the official Department of Labor website.

What is the 7-minute rule for overtime?

The 7-minute rule allows employers to round work time to the nearest increment in a 15-minute period — also known as time rounding.

If an employee clocks in between the first and seventh minute, the employer can round their work time down. However, when an employee clocks in between the 8th and 14th minute, the employer must round the time up.

For example, an employee who clocks in at 8:03 will have their time rounded to 8:00. On the other hand, if an employee clocks in at 8:09, their time will be rounded to 8:15.

This allows employers to make easier payroll calculations.

Track overtime hours with Clockify

Tracking work hours is crucial when calculating payroll. It ensures that all employees are compensated fairly and in accordance with their work hours.

When tracking work hours, it’s important to pay attention to overtime hours, as they are compensated at a higher rate according to state and federal laws.

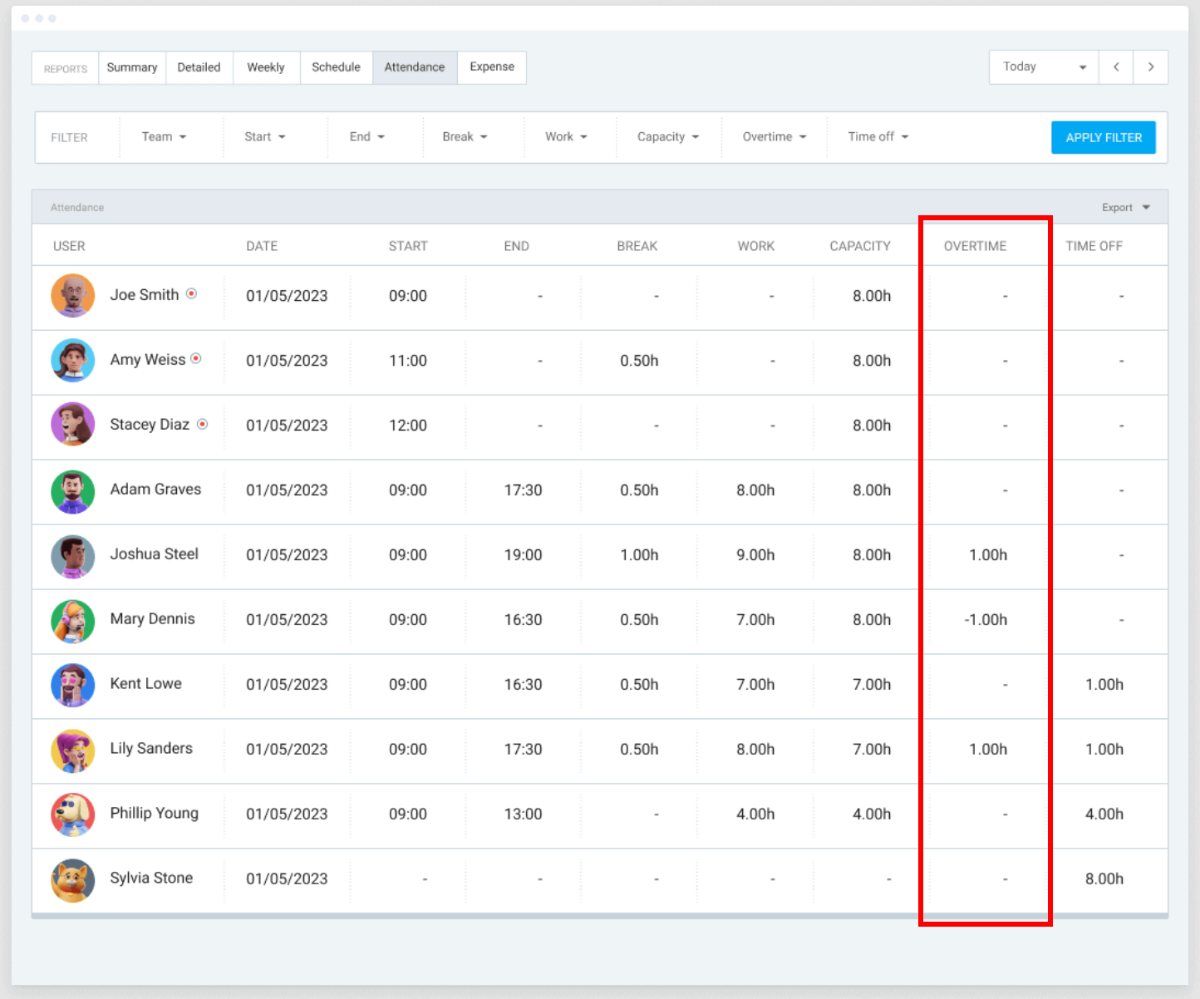

To ensure you track overtime hours properly, try using a time tracking software such as Clockify.

Clockify is a robust and no-nonsense time tracking tool that allows you to track employee attendance and work hours.

With Clockify’s attendance feature, you can easily view employee:

- Start/end time,

- Breaks,

- Work time,

- Capacity,

- Overtime, and

- Time off.

Start tracking time today!

Conclusion/Disclaimer

Hopefully, our guide helped you understand federal and state overtime laws in the United States.

You can get more information on overtime laws for each state by following the official links:

- Provided as sources in this article, and

- Used as sources in the State Labor Laws.

Please bear in mind — this article was written in Q1 of 2025. Thus, it may not include changes introduced after it was published.

We strongly advise you to consult the appropriate institutions and/or certified representatives before acting on any legal matters.

Clockify isn’t responsible for any losses or risks incurred should this guide be used without legal guidance.

How we reviewed this post: Our writers & editors monitor the posts and update them when new information becomes available, to keep them fresh and relevant. Updated: February 24, 2025

Updated: February 24, 2025