North Carolina Labor Laws Guide

| North Carolina Labor Laws FAQ | |

| North Carolina minimum wage | $7.25 |

| North Carolina overtime | 1.5 times the regular wage for any time worked over 40 hours/week ($10.87 for minimum wage workers) |

| North Carolina breaks | Breaks not required by law |

North Carolina labor laws are mostly aligned with federal regulations. However, there are certain instances where state laws apply, such as leaves of absence and workplace safety, among others. This North Carolina labor law guide will cover the following areas:

- Wages, overtime, and breaks,

- Leave requirements,

- Child labor laws,

- Hiring and termination laws,

- Occupational safety laws,

- Miscellaneous labor laws, and

- General questions regarding North Carolina labor laws.

North Carolina wage laws

As there are no state laws that offer additional benefits, North Carolina employees are subject to federal provisions concerning wages.

The following are the regulations concerning:

- The state minimum wage,

- The tipped hourly wage, and

- The subminimum wage in North Carolina.

| NORTH CAROLINA MINIMUM WAGE | ||

| Regular minimum wage | Tipped minimum wage | Subminimum wage |

| $7.25 | $2.13 | $4.25 |

North Carolina minimum wage in 2025

In 2009, the federal minimum wage was increased to $7.25 and has remained unchanged for years, continuing the trend into 2025. As North Carolina has no state laws regarding minimum wage, their employees are entitled to the federal rate.

Exceptions to the minimum wage in North Carolina

The Federal Fair Labor Standards Act (FLSA) has declared certain occupations exempt from the minimum wage law:

- Bona fide executives, administrative workers, learned and creative professionals who are paid on a salary basis and earn not less than $1,128 per week,

- Computer employees who earn $1,128 per week,

- Highly compensated employees who earn $151,164 per year,

- Outside sales employees,

- Minors, and

- Tipped employees.

Tipped minimum wage in North Carolina

In North Carolina, a tipped employee is an employee who earns more than $30 in tips per month.

As far as the minimum wage for tipped employees is concerned, they’re entitled to the federal compensation of $2.13 per hour.

Even though an employer may pay a tipped employee as little as $2.13 an hour, the tipped employee‘s total earnings per hour must equal the federal minimum of $7.25. The employer is the one who is obliged to make up the difference.

North Carolina subminimum wage

When it comes to youth wages, North Carolina once again adopts the federal minimum wage requirements.

Under FLSA, employees under 20 years of age must be paid not less than $4.25 per hour during the first 90 days of employment.

When such a period expires or when a worker turns 20, the minimum wage of $7.25 takes effect.

Furthermore, full-time students may be paid 85% of the minimum wage under federal law.

North Carolina payment law

Employers in North Carolina have the freedom to choose how frequently they want to run payroll. Based on North Carolina’s payment laws, employers can choose one of the following methods:

- Daily — Employees are paid each day,

- Weekly — Employees are paid once a week (52 paychecks per year),

- Biweekly — Employees are paid every other week (26 paychecks per year),

- Semi-monthly — Employees are paid twice a month (24 paychecks per year), and

- Monthly — Employees are paid once a month (12 paychecks per year).

Meanwhile, bonus or commission-based employees in North Carolina may receive their paychecks as infrequently as once a year.

🎓 Track employee payroll with Clockify

North Carolina overtime laws

By federal law, eligible employees who work more than 40 hours per week qualify for overtime pay at a rate of one and one-half (1.5) times the regular rate of pay.

In addition, federal law doesn’t require overtime pay for working on weekends, holidays, or any other day of rest.

🎓 Track North Carolina overtime with Clockify

Overtime exceptions and exemptions in North Carolina

However, certain employees and occupations are exempt from overtime pay under federal law:

- Bona fide executives, administrative employees, learned, and creative professionals who earn a salary and make not less than $1,128 per week,

- Computer employees who earn $1,128 per week,

- Highly compensated employees who make more than $151,164 per year, and

- Outside sales employees

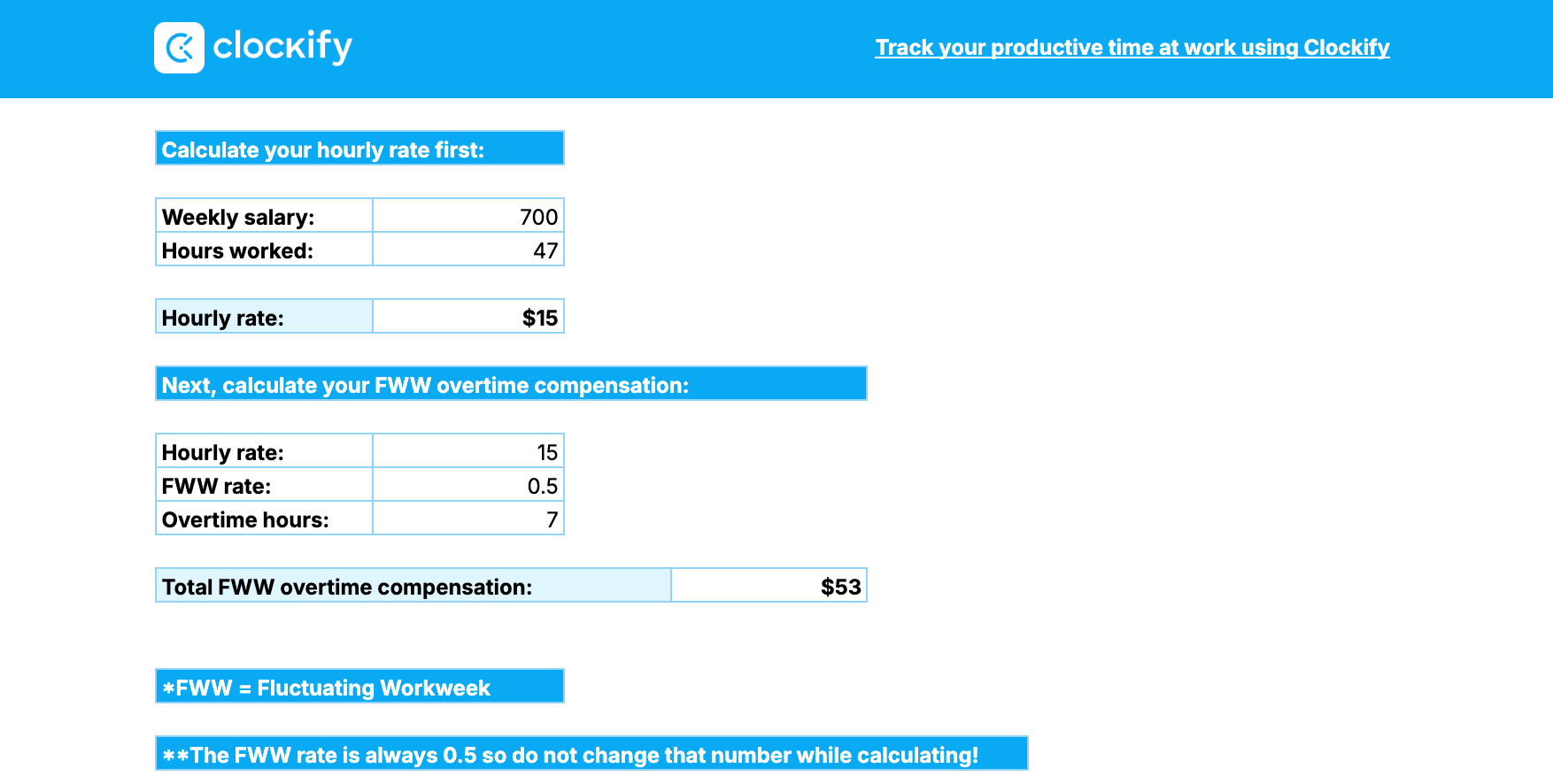

Fluctuating Workweek Method (FWW) in North Carolina

Although most salaried workers are exempt from overtime pay, the Fluctuating Workweek Method (FWW) qualifies some salaried employees for overtime pay of one-half (0.5) times their regular hourly rate.

Who is eligible for FWW? Here’s the list:

- Employees who receive a fixed salary,

- Employees whose work hours fluctuate from week to week (sometimes they work more or less than 40 hours a week), and

- Employees who earn at least $7.25 per hour.

How to calculate FWW overtime pay?

Let’s say an employee’s weekly income is $700, and in the preceding week, the employee worked 47 hours.

To be able to calculate FWW overtime hours, you need to calculate the hourly rate first.

Simply divide the weekly salary by the number of hours worked for that week:

$700 / 47 = $15 per hour

Next, multiply the hourly rate by 0.5 for every overtime hour during the week:

$15 per hour x 0.5 = $7.5 for each overtime hour worked

Total overtime compensation goes as follows:

$7.5 x 7 overtime hours = $53

🎓 Fluctuating Workweek Calculator

North Carolina break laws

Neither the North Carolina Wage and Hour Act nor the federal Fair Labor Standards Act (FLSA) require an employer to provide employees 16 years of age or older with rest or meal breaks.

However, as a measure to battle burnout and increase employee productivity, most employers choose to offer a break. The general consensus is that a 30-minute break should be taken every 8 hours.

It’s important to note that if an employer chooses to offer a break and validates it through their own policies, they’re legal and valid in the eyes of the court and will be subject to penalties if any violations occur.

Exceptions to break laws in North Carolina

When provided, breaks lasting more than 20 minutes aren’t compensable unless employees are required to work during break time — telephone operators, for instance.

Moreover, employers in North Carolina aren’t required to provide a breakroom or a smoke break with a separate smoking room within the area.

North Carolina breastfeeding laws

Even though mothers in North Carolina have the right to breastfeed in public, there’s no state law concerning breastfeeding in the workplace.

Therefore, under federal law, non-exempt employees are entitled to “reasonable break time to express breast milk” for 1 year after the child’s birth.

Moreover, employers must provide a separate room — other than a bathroom — that can be used solely for breastfeeding.

North Carolina leave requirements

The state of North Carolina allows its workers to maintain a healthy work-life balance by offering them desirable time-off benefits. There are 2 types of leaves that employers offer:

- Required leave

- Non-required leave

| TYPES OF LEAVES |

| ✅ REQUIRED LEAVE |

|

Holiday leave (state employees) — State employees are assigned 12 paid holidays a year. Those who are required to work on holidays receive holiday premium pay equal to one-half (0.5) of their regular hourly rate (plus their regular salary). The following is a holiday schedule with the observance dates for the year 2025:

|

| ✅ REQUIRED LEAVE |

|

Vacation leave (state employees) — Full-time permanent, probationary, and time-limited employees have the right to vacation leave, which depends on their length of total state service:

|

| ✅ REQUIRED LEAVE |

|

Family and Medical Leave Act (FMLA) — A federal law that offers eligible employees unpaid job-protected leave of up to 12 weeks in any 12-month period. When to use the FMLA? Eligible reasons for using family or medical leave include:

Who can use the FMLA? Here’s the list:

|

| ✅ REQUIRED LEAVE |

|

Family illness leave — When the FMLA benefit is exhausted, the Family Illness Leave Policy comes into force. Therefore, eligible employees have the right to 52 weeks of unpaid leave during a 5-year period. Family illness leave can be taken to care for an immediate family member (child, parent, or spouse) and cannot be used for the employee’s own illness. Who can use the Family Illness Leave? Here’s the list:

|

| ✅ REQUIRED LEAVE |

|

Paid Parental Leave (state employees) — The Paid Parental Leave benefit gives new parents (by birth, adoption, or foster care) 8 weeks of paid leave to recover or bond with the newborn. The leave is compensated at 100% of the employee’s regular pay. |

| ✅ REQUIRED LEAVE |

|

Voluntary shared leave — In case an eligible employee or the employee’s immediate family member has a prolonged medical condition, they may receive an additional 1,040 to 2,080 hours of voluntary shared leave in 2025. State employees may donate their leave only in cases where they have a sufficient leave balance. Additionally, they may donate their vacation, bonus, or sick leave to another immediate family member or a non-family member as well. |

| ✅ REQUIRED LEAVE |

|

Community Service Leave (state employees) — This type of leave is intended for state employees who wish to volunteer in schools, communities, non-profit organizations, etc. Below, you can see different types of employees and the leave benefits they’re entitled to:

When to use Community Service Leave? Here’s a list of examples:

|

| ✅ REQUIRED LEAVE |

|

Military leave — North Carolina state employees are granted different types of military leave for the following:

|

| ✅ REQUIRED LEAVE |

|

Civil leave — In North Carolina, there are 2 types of civil leave:

However, there are differences between jury duty and court attendance responsibilities, as well as leave options. Non-job-related civil leave is available to full-time, part-time (half-time or more), permanent, probationary, or time-limited employees. When serving on a jury, said employees receive:

Together with the eligible employees mentioned above, employees with a temporary, intermittent, or part-time (less than half-time) status are also eligible for job-related civil leave. When attending court in connection with official duties, eligible employees:

|

| ✅ REQUIRED LEAVE |

|

Blood, bone marrow, and organ donorship leave — North Carolina employees are encouraged to participate in donorship programs by getting reasonable paid time off for the following:

Moreover, organ donors may receive up to 30 days of paid leave. |

| ✅ REQUIRED LEAVE |

|

American Red Cross Disaster Service Leave — Disaster service volunteers of the American Red Cross may be granted up to 15 workdays of paid leave in 12 months. |

| ❌ NON-REQUIRED LEAVE |

|

Sick leave — Employees who are eligible for sick leave in North Carolina include:

Sick leave may be used for:

* Immediate family members include a spouse, parent, child, sibling, grandparent, or great-grandparent/child. |

| ❌ NON-REQUIRED LEAVE |

|

Holiday leave (private employers) — Unlike state employees, private employees aren’t entitled to time off on holidays under federal or state law in North Carolina. |

| ❌ NON-REQUIRED LEAVE |

|

Bereavement leave — Such leave is taken following the death of an immediate family member, close friend, relative, or similar. |

| ❌ NON-REQUIRED LEAVE |

|

Vacation leave (private employers) — Just like with holiday leave — private employers aren’t obligated to provide employees with vacation leave — whether paid or unpaid. |

| ❌ NON-REQUIRED LEAVE |

|

Voting leave — Again, employees in North Carolina don’t receive leaves of absence for the purpose of voting. |

Child labor laws in North Carolina

To make sure minors work in a healthy and hazard-free environment, employers in North Carolina must comply with the federal provisions regarding child labor.

Those provisions include:

- Work time restrictions,

- Breaks for minors, and

- Prohibited occupations for minors.

Work time restrictions for North Carolina minors

When it comes to work hour regulations for minors in North Carolina, federal laws apply.

Minors aged 13 and less are not permitted to work under federal law, except when:

- Working for parents,

- Delivering newspapers, or

- Working in the entertainment industry.

The following are hour restrictions concerning 14 and 15-year-olds:

- May work no more than 3 hours a day on a school day,

- May work no more than 8 hours a day on a non-school day,

- May work a maximum of 18 hours per week when school is in session,

- May work a maximum of 40 hours per week when school is not in session, and

- May work between 7 a.m. and 7 p.m. (except from June 1 through Labor Day, when they can work until 9 p.m. on a non-school day).

Under federal law, there are no time restrictions for minors aged 16 and 17.

Still, North Carolina law proposes that minors enrolled in grades 12 or lower can’t work between 11 p.m. and 5 a.m. preceding a school day — unless they have written permission from their parents and principal.

Breaks for North Carolina minors

Following federal provisions, minors must get a 30-minute break after every 5 consecutive hours of work.

Prohibited occupations for North Carolina minors

North Carolina law prohibits youth under the age of 18 from working in any of the following occupations:

- Welding, brazing, and torch cutting,

- Working with silicon dioxide, quartz, or asbestos,

- Any work involving exposure to lead, benzene, or their compounds,

- Working in canneries, seafood, or poultry industries,

- Any work involving the risk of falling from a height of 10 feet or more,

- Working as an electrician or an electrician’s helper,

- Any work in confined spaces, and

- Any work requiring the use of respirators.

In addition to the North Carolina hazardous and detrimental occupations prohibited to minors under 18 years of age, the federal provisions regarding prohibited occupations also apply.

🎓 Prohibited Occupations for Non-Agricultural Employees under 18 years of age under FLSA

Even though the FLSA forbids employees younger than 18 from driving a motor vehicle, the North Carolina Wage and Hour Act (WHA) allows 16 and 17-year-olds to drive a motor vehicle for business purposes.

Minors aged 16 and 17 may drive a motor vehicle to perform job-related duties provided that:

- The driving is done within a 25-mile radius of the business, and

- They don’t use public roads and highways.

Moreover, minors aged 14 to 17 may work in a workroom with tanning beds — provided that the tanning beds aren’t operating at that time.

North Carolina hiring laws

North Carolina employers who employ more than 15 or more workers must provide equal opportunity to all persons seeking employment.

Under federal and state laws, employment practices in North Carolina mustn’t be based on:

- Race,

- Color,

- National origin,

- Religion*,

- Sex*,

- Age*,

- Disability**,

- Genetic information, and

- Political affiliation.

* It is lawful to employ an individual based on their religion, sex, or age when such qualifications are bona fide occupational requirements — i.e., necessary for a certain business or job position.

** This applies to any physical or mental impairment.

Yet, North Carolina veterans are given preference in employment as a way of showing appreciation for their service to the State.

Said employment practices include, but are not limited to, the following:

- Recruitment process,

- Wage determination,

- Promotion,

- Work evaluation, and

- Termination of employment.

Right to work law in North Carolina

North Carolina is one of the many “right-to-work” states. This means that employees have the freedom to decide whether or not to join a labor union.

By the North Carolina right-to-work law, the following applies:

- An employee can’t be forced to become or remain a member of any labor union or organization as a condition of employment.

- An employer can’t require an employee to abstain or refrain from membership in any labor union or organization as a condition of employment.

- An employee can’t be forced to pay any dues, fees, or other charges to a labor union or organization as a condition of employment.

If a person does suffer any employment discrimination damages due to their membership or nonmembership in a labor union or organization, that person may start a court proceeding in this state.

North Carolina termination laws

North Carolina is an employment-at-will state, meaning an employer may terminate an employee at any time and for any reason at all.

However, it’s illegal for an employer to terminate an employee on the basis of:

- Age,

- Sex,

- Religion,

- Color,

- Disability, and

- Pregnancy.

Also, an employer mustn’t take any adverse action against an employee who reports any violation, makes a complaint, files a charge of discrimination, or similar.

Finally, an employee may also resign from a job penalty-free and without incurring any loss at any time and for any reason.

North Carolina final paycheck

Whether an employee resigns from a job or gets terminated, the employer is responsible for paying all wages due on or before the next payday.

Health benefits continuation in North Carolina

North Carolina applies both federal and state laws concerning health insurance coverage for terminated employees.

Pursuant to the State Continuation Law of North Carolina, any employee who has been terminated from a job — whether voluntarily or involuntarily — has the right to continue their health insurance for up to 18 months. In addition, their dependents are also eligible for the same health continuation benefits.

The benefits that the North Carolina State Continuation law offers are the following:

- Hospital benefits,

- Surgical benefits, and

- Major medical benefits.

However, the State Continuation Law doesn’t cover dental, vision care, and prescription drug benefits.

At the same time, the federal Continuation of Health Coverage (COBRA) is also applicable in North Carolina. Still, it only covers employees who work in businesses with more than 20 employees.

Eligible employees and their dependents may continue their health benefits for up to 18 months.

Occupational safety in North Carolina

North Carolina has its own state plan that addresses workplace safety.

Even though the North Carolina State Plan is approved by the federal Occupational Safety and Health Administration (OSHA) — federal OSHA still has the power to monitor the State Plan.

The division responsible for occupational safety and health is called the North CarolinaOccupational Safety and Health (NC OSH), which primarily covers the private sector (with some exceptions, such as contract workers, railroad employment, and maritime employment).

Therefore, federal OSHA covers the issues not covered by the State Plan.

Apart from following all OSHA standards, the NC OSH Division has some distinctive standards of its own regarding the following:

- Hazardous Waste Operations and Emergency Response,

- Communication Towers,

- Electric Power Generation, Transmission, and Distribution,

- Steel Erection,

- Personal Protective Equipment and Life-Saving Equipment,

- Bloodborne Pathogens,

- Communication Towers,

- Blasting and Use of Explosives,

- Non-Ionizing Radiation, and

- Field Sanitation.

Moreover, the North Carolina State Plane offers on-site consultations and organizes regular programs focused on reducing injuries and fatalities in the workplace.

Miscellaneous North Carolina labor laws

Last but not least, we’ll cover some of the miscellaneous labor laws concerning North Carolina, including:

- Whistleblower laws, and

- Recordkeeping laws.

North Carolina whistleblower law

As far as the whistleblower law in North Carolina is concerned, the North Carolina False Claims Act protects any individual who files a lawsuit against a person who:

- Knowingly presents a false or fraudulent claim for compensation,

- Knowingly uses a false record or statement material to a false or fraudulent claim,

- Knowingly uses a false record to pay or transmit money or property to the State, or

- Knowingly avoids or decreases the amount that needs to be paid to the State.

Any person who commits any of the said acts will be liable to the State for:

- Three times the actual amount,

- Costs of a civil action, and

- Civil penalties ranging from $5,500 to $11,000 for each violation.

At the same time, the whistleblower who reports any of the said violations may receive 15% to 25% of the settlement of the claim if the State decides to process the claim.

In case the State doesn’t decide to intervene, the whistleblower may proceed with an action on their own and receive between 25% and 30% of the amount recovered.

Moreover, any whistleblower who suffers any adverse employment action (discharging, suspending, harassing, etc.) due to their whistleblowing is entitled to:

- Be placed back into their former job position,

- Two times the amount of back pay plus the interest, and

- Compensation for any damages suffered due to discrimination, including attorney fees and litigation costs.

For a whistleblower to qualify for protection and compensation, a complaint must be filed within 6 years of the alleged violation.

North Carolina recordkeeping laws

Each department, agency, institution, commission, and bureau in North Carolina is responsible for maintaining the following employee records for a minimum of 5 years:

- Name,

- Age,

- Date of employment,

- Contract terms,

- Current position and title,

- Salary,

- Date and amount of each increase or decrease in salary,

- Date and type of each promotion, demotion, dismissal, transfer, suspension, separation, or any other change in position, and

- Currently assigned office or station of the employee.

Any person who wishes to inspect, examine, or copy any of the said records is allowed to do so during business hours.

Finally, these provisions also apply to all employers with minor employees under the age of 18.

Frequently asked questions about North Carolina labor laws

Even though the laws in the state of North Carolina are largely in line with the federal regulations and recommendations, there might still be some unanswered questions that might intrigue you. That’s why we’ve prepared a section just for that.

Read on!

How many hours can you work in NC without a break?

As there are no laws governing breaks in North Carolina, federal regulations apply, which clearly state that employers aren’t obligated to provide a break during a work shift, except for employees under 16 years of age, for whom a 30-minute break after 5 hours of work is mandatory.

Is working 32 hours considered full-time in NC?

In a similar fashion, the state of North Carolina has no regulations on the exact number of hours necessary for an employee to be considered a full-time worker. Therefore, we must rely on federal rules — the IRS considers anyone who works at least 30 hours per week a full-time employee.

However, the Department of Labor mostly leaves it up to the employer, but the general consensus is that a full-time employee is anyone who works between 30 and 40 hours.

What is the longest shift you can work without a break?

According to federal regulations, there’s no limit to how many hours you can work in a single shift. However, it’s a common practice to offer breaks, especially if the job entails physical labor.

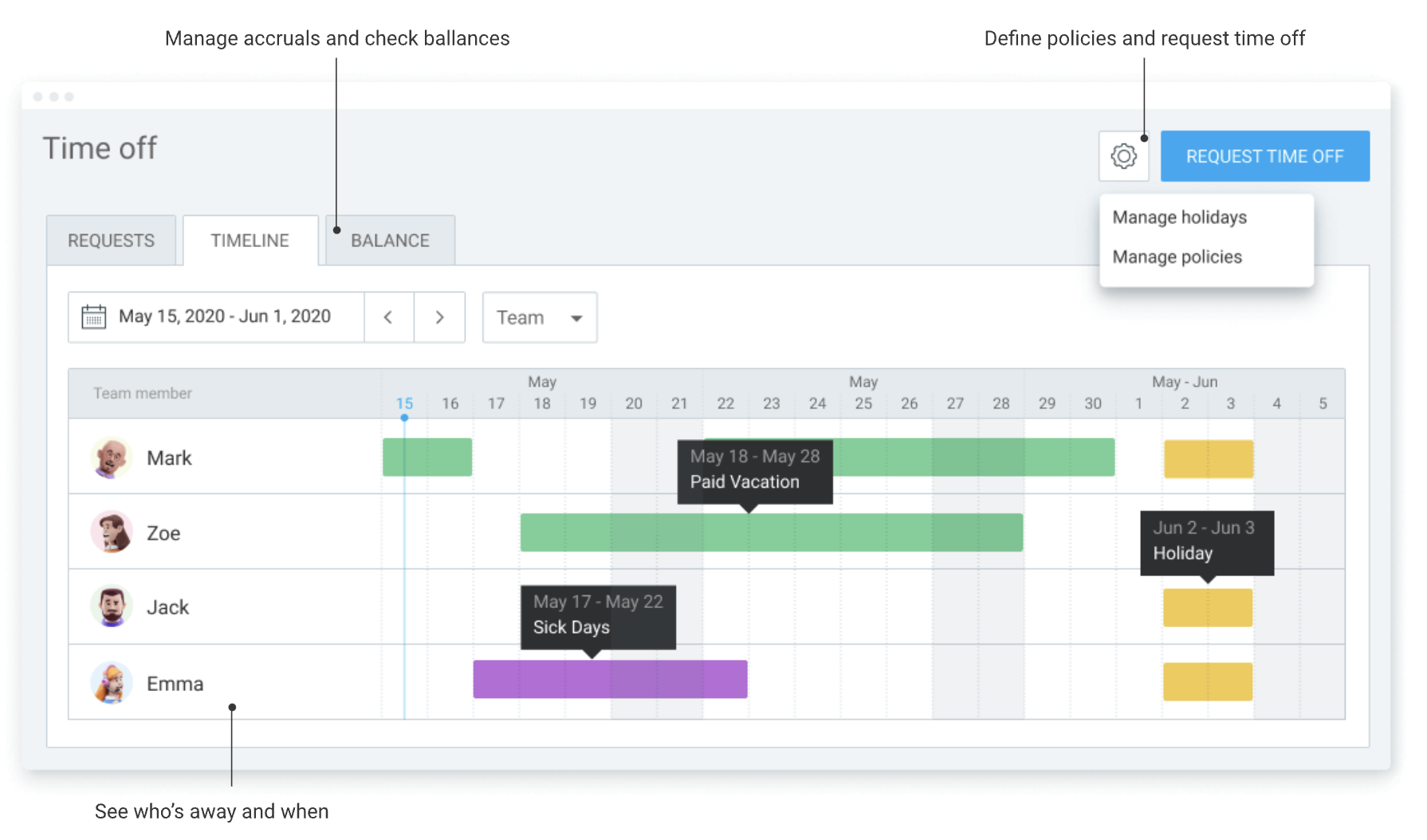

Looking for a simple time tracking solution? Try Clockify

Clockify is a simple and reliable time tracker that allows you to track attendance and costs with just a few clicks, all for free.

Your team can personally track work time via the web or mobile app, or you can set up a time clock kiosk from which employees can clock in and out.

Later, you can approve timesheets and time off, schedule shifts, run time card reports, and export everything for payroll (PDF, Excel, link, or send to QuickBooks).

In addition to reliable time tracking, Clockify gives you several great options for managing your employees.

One such feature is time off, which allows you to track employee time off and see who is available for work.

Conclusion/Disclaimer

We hope this North Carolina labor law guide has been helpful. We advise you to make sure you’ve paid attention to the links we’ve provided, as most of them will lead you to the official government websites and other relevant information.

Please note that this guide was written in June 2025, so any changes in the labor laws that were included later than that may not be included in this North Carolina labor laws guide.

We strongly advise you to consult with the appropriate institutions and/or certified representatives before acting on any legal matters.

Clockify is not responsible for any losses or risks incurred should this guide be used without further guidance from legal or tax advisors.