DCAA-Compliant Timekeeping — Definition, Requirements, and Tips

Defense Contract Audit Agency (DCAA) is a government agency that performs audits for the Department of Defense (DoD) and other federal agencies. These audits ensure that each government contractor adheres to government rules and regulations.

If trying to keep up with all the rules to provide the timekeeping documentation for a successful DCAA audit is stressing you out — read on. Here are the main DCAA requirements, along with tips for staying compliant.

What is DCAA compliance?

DCAA compliance means adhering to the rules established by the Defense Contract Audit Agency (DCAA). When you obtain a government contract, DCAA ensures your company follows the timekeeping and accounting rules.

The DCAA timekeeping requirements regulate the record-keeping of employee working hours. In the government’s view, time-tracking documents provide evidence that no time was wasted and no fraud occurred related to work hours. That’s why it’s vital to keep clear timesheets that document each employee’s work time.

Failing a DCAA audit usually results in consequences — ranging from minor to disastrous. Here’s what might happen if you don’t comply with DCAA requirements:

- Financial penalty,

- Government contract termination,

- Inability to secure future government contracts, and

- Damaged company reputation.

Being DCAA compliant goes hand in hand with Federal Acquisition Regulations (FAR) compliance. FAR ensures customers receive the product or service at the expected quality and by the agreed-upon time.

How does DCAA confirm a company’s compliance?

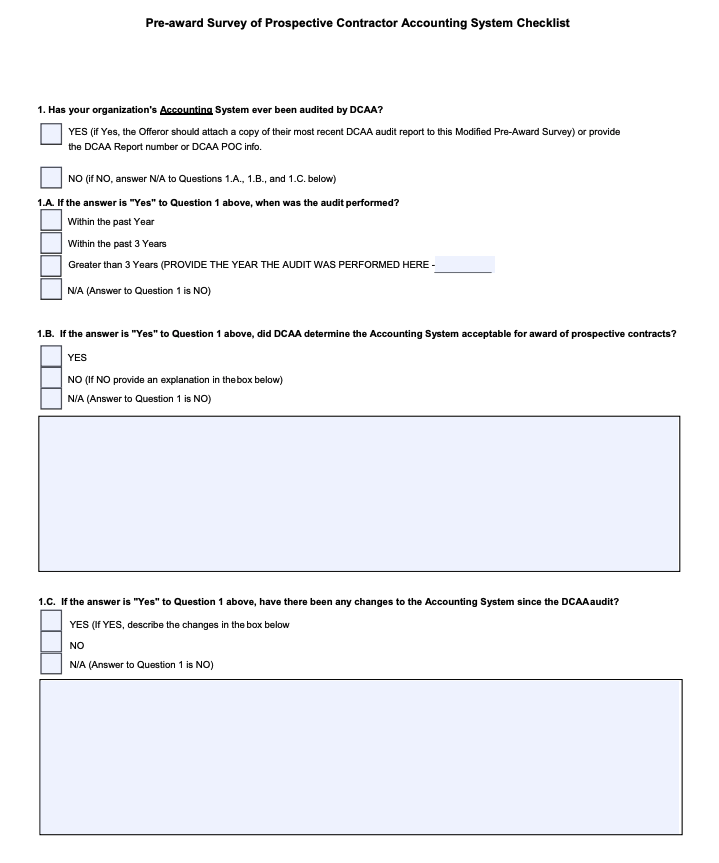

Before you sign a government contract, you have to complete a preaward survey. This survey examines whether the accounting system meets the requirements for the business to be awarded the government contract.

DCAA typically performs audits of cost-related systems (e.g., accounting software) every 4 years. However, if high risks of non-compliance have been identified, audits may be conducted more frequently.

DCAA representatives may visit the company unannounced and talk to employees to check whether everything is in order. This practice is known as a floor check.

According to Braden Perry, a regulatory attorney, you should be ready for DCAA audits at all times:

As the financial controller, you should know that (apart from floor checks) DCAA conducts accounting and time-tracking system audits to verify that your internal processes comply with all DCAA requirements.

So, a DCAA audit examines if businesses on government contracts do the following:

- Practice daily time tracking,

- Keep precise records with an audit trail for all changes,

- Practice extensive reporting,

- Obtain specific supervisor approvals, and more.

Braden also says that the DCAA doesn’t focus on the kind of system you have, but rather that you comply with the rules:

Now, let’s go through the DCAA rules and examine how DCAA-compliant time tracking software can help meet DCAA requirements.

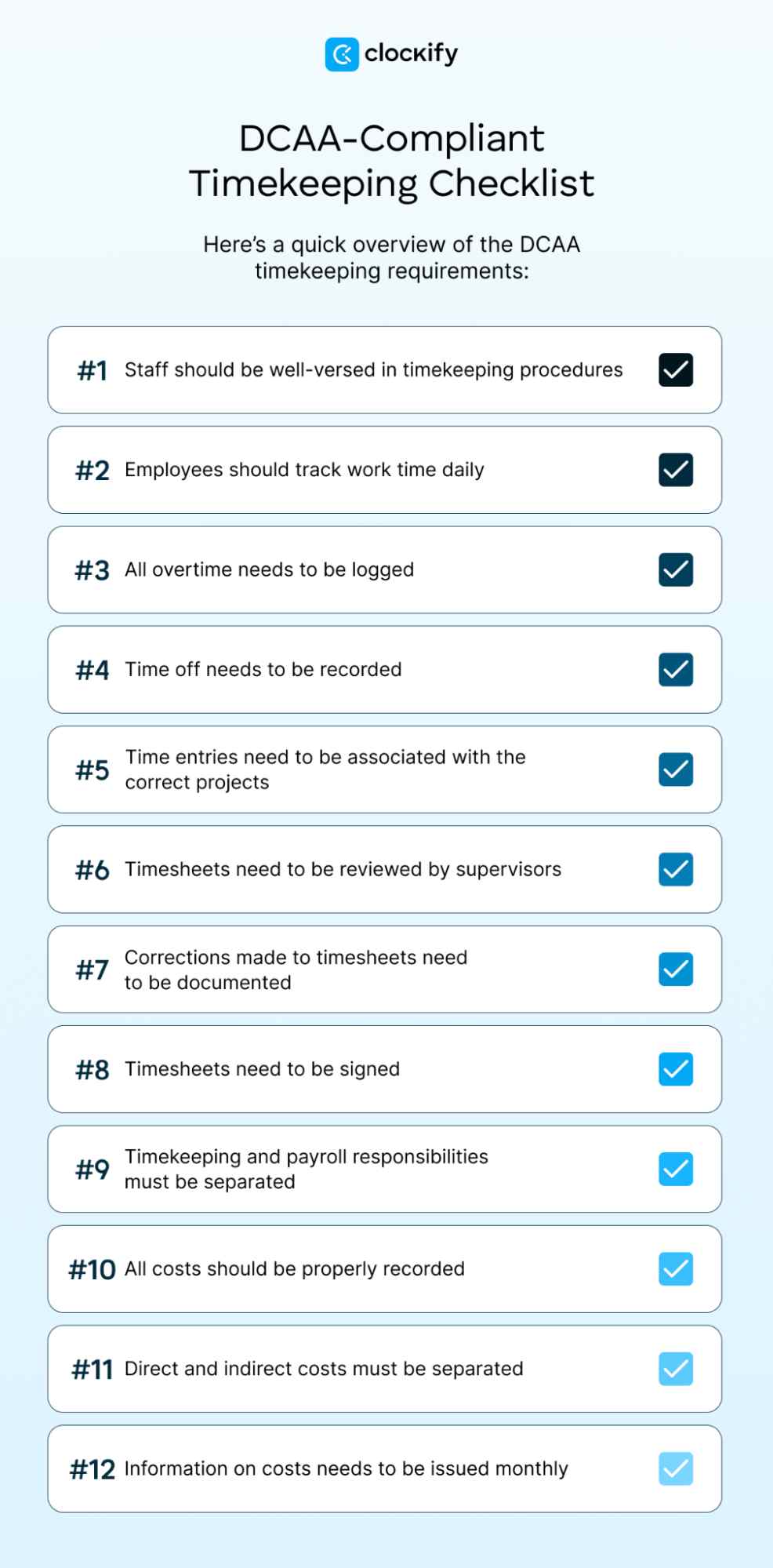

DCAA timekeeping requirements

To gain a deeper understanding of DCAA-compliant timekeeping, let’s review the agency's time-tracking requirements.

NOTE: Once you’ve learned about the general DCAA requirements, it’s advisable to contact your local DCAA field audit office (FAO) for more case-specific information.

#1: Staff should be well-versed in timekeeping procedures

For a successful DCAA audit, your employees have to be familiar with compliant timekeeping. As the VP of operations or in a similar role, you can ensure everyone is aligned by creating a formal timekeeping policy that complies with DCAA requirements.

Your policy should include:

- Expected clock-in and out times,

- Timesheet submission deadlines,

- Timesheet edit and approval rules,

- Time-rounding rules (if applicable),

- Actions to be taken in case of missed clock-ins, and

- Consequences of timesheet tampering.

This policy will serve as a guide for your employees on how to track time properly. At the same time, it will inform DCAA auditors on what to expect from your time-tracking system.

#2: Employees should track work time daily

DCAA requires all employees to track time every day individually in real time. They must log their time only for the current day and refrain from adding backdated or future entries.

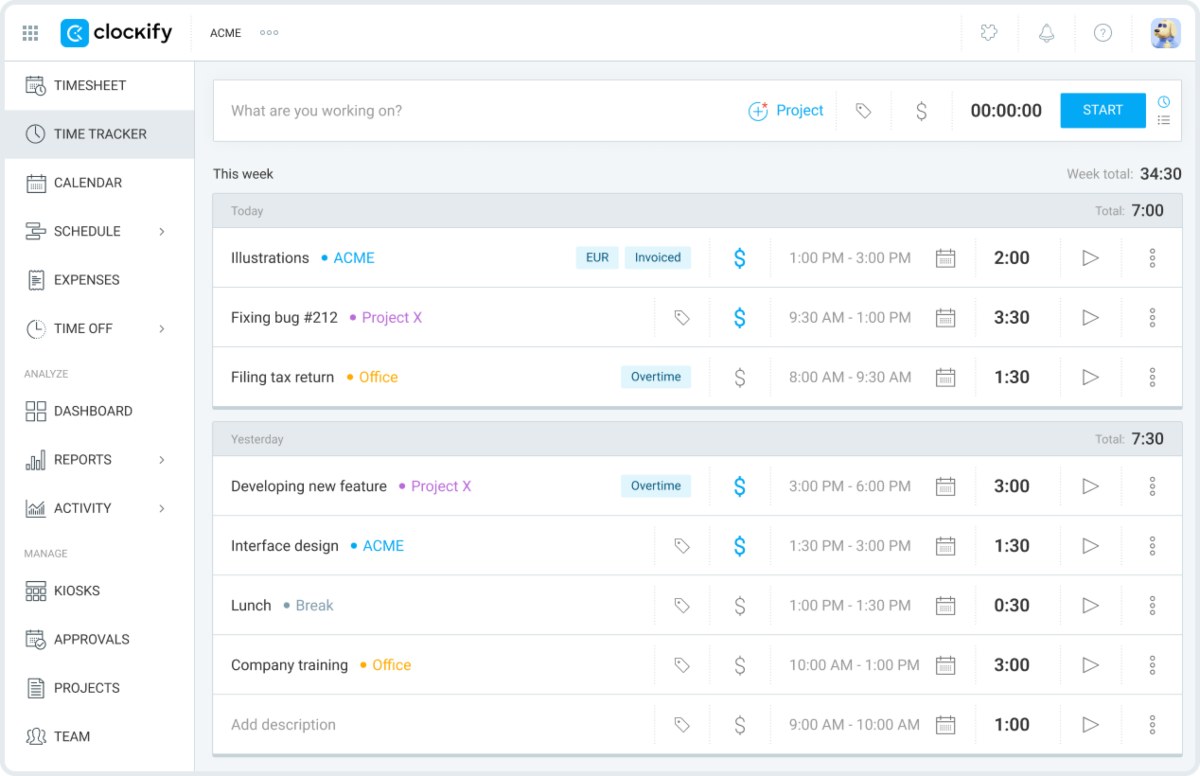

Since all activities should be recorded daily as they happen, it’s best to turn to a digital solution for this purpose — DCAA-compliant timekeeping software, such as Clockify by CAKE.com. It’s easier to use, faster, and more precise than keeping time the traditional way.

With Clockify, employees can automatically create time entries by using the timer. Alternatively, they can manually enter time in the timesheet, removing any doubt about tracking work hours precisely.

#3: All overtime needs to be logged

All overtime must be recorded — no matter if it’s paid or not. Overtime that isn’t paid is known as uncompensated overtime. Only employees exempt from the Fair Labor Standards Act (FLSA) don’t receive additional pay for working more than 40 hours per week.

In contrast, all non-exempt employees must be compensated for overtime work. To ensure their overtime is paid accurately, this time must be logged.

Despite not being paid for overtime, under FAR 52.237-10, the exempt staff’s labor hours must also be clearly separated into regular and overtime hours. That’s because the logged overtime hours are used to calculate the adjusted hourly rate — to ensure transparency and fairness.

Let’s say an exempt employee earns $22.00 per hour. One week, they worked overtime — 43 hours instead of the regular 40. This is how you’d calculate the adjusted hourly rate:

Hourly rate x Regular weekly hours / Actual hours worked that week = Adjusted hourly rate

$22.00 x 40 / 43 = $20.46

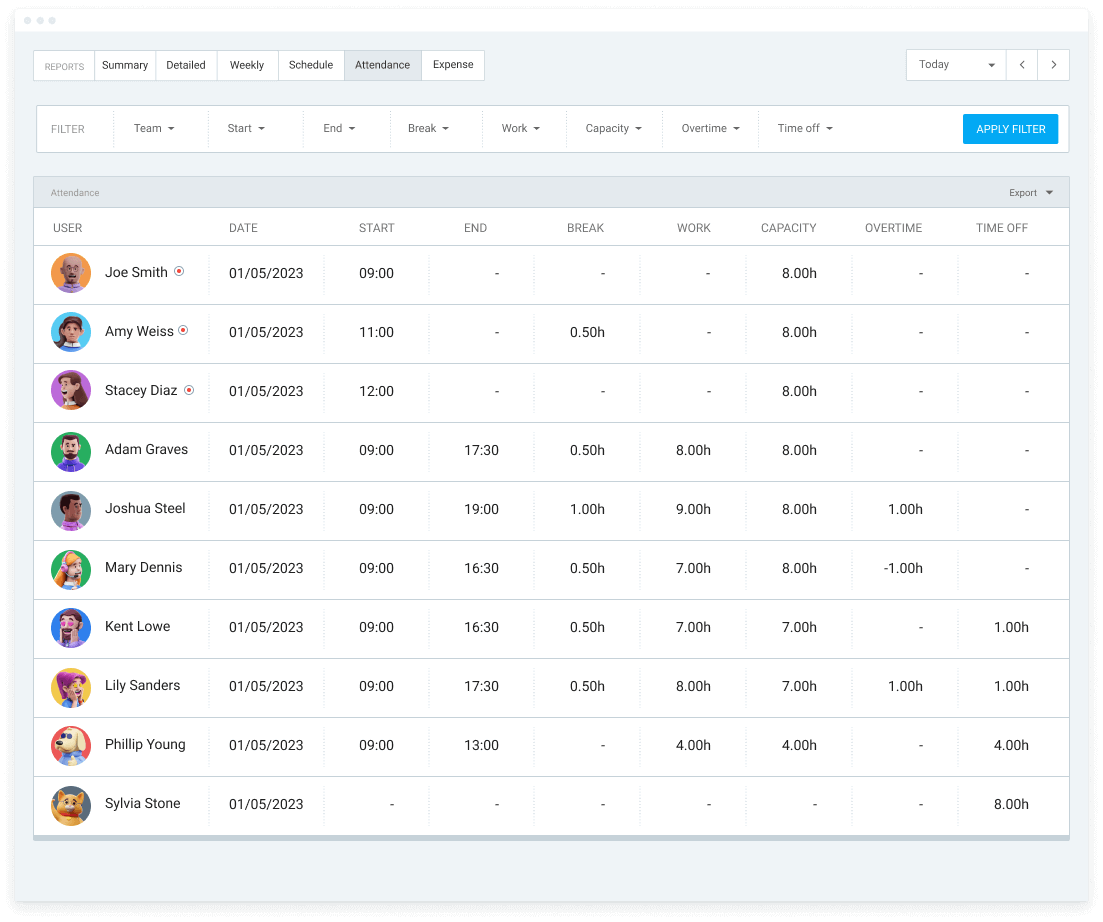

To track overtime effortlessly, use Clockify by CAKE.com. Once you set the daily work capacity for employees, any hours tracked above that capacity will be treated as overtime. Overtime data is available in the attendance report.

Failing to record overtime can be interpreted as fraud. Recording all hours worked, including both compensated and uncompensated overtime, enables the DCAA to determine actual labor costs. This way, the auditors can ensure that there are no billing inaccuracies.

🎓 Key Differences Between Exempt and Nonexempt Employees

#4: Time off needs to be recorded

It’s not enough to just log the time worked — time off must be recorded as well. Depending on the company policy, paid time off can include:

- National holidays,

- Vacation,

- Sick leave,

- Parental leave, and

- Bereavement leave.

By providing data on paid time off, you help prevent labor accounting fraud from the government’s perspective. In general, all work-related time must be reported.

#5: Time entries need to be associated with the correct projects

DCAA requires the company to specify which project each employee worked on. Each time an employee starts a task, they should create a time entry for the project the task belongs to.

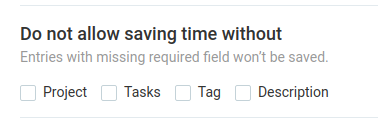

To make sure employees always specify projects in Clockify time entries, go to the workspace settings and select Project as a required field. This way, employees won't be able to track time on an activity unless they select a project.

If you want tasks to be specified, select Task as a required field. Employees won't be able to track time on an entry unless they select a task within their project.

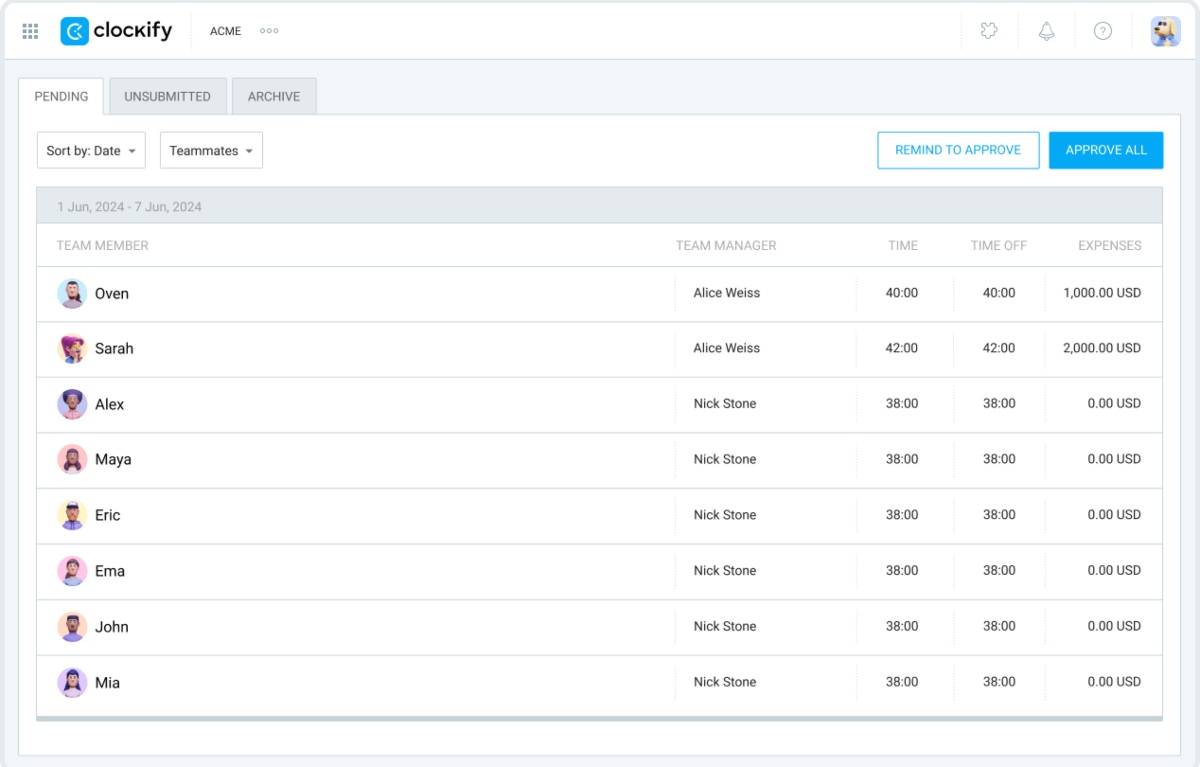

#6: Timesheets need to be reviewed by supervisors

Employees must submit their timesheets for approval. The supervisor then reviews the timesheet to verify that all recorded data is correct. Once the supervisor confirms that the logged hours match the hours worked, they approve the timesheet.

The timesheet approval process is too time-consuming and effort-intensive when you rely on physical timesheets. Timesheets recorded this way are more difficult to verify, and errors are more common.

Instead, you can use Clockify to streamline timesheet approvals. Once employees log time in Clockify, they can instantly submit the hours for approval.

Since the timesheets are digital, the reviewer can spot inconsistencies more easily. If everything is in order, the supervisor can approve all timesheets at once and save a lot of time on admin work.

#7: Corrections made to timesheets need to be documented

Sometimes, timesheets need to be edited after submission to correct errors. In that case, you need to make it clear that changes were made. To properly document the changes, include:

- Original time entry,

- Edited time entry,

- Reasons for correction, and

- Name of the person who made/approved the changes.

To ensure no time entries are edited without permission, use Clockify’s timesheet locking. This way, no one can modify entries after a specified period.

Clockify by CAKE.com also allows you to track all changes via an audit log. By activating this feature, you can see who changed what and when.

#8: Timesheets need to be signed

Employees need to sign their timesheets. This way, they formally agree that the time entries reflect the exact number of hours they actually worked. On top of that, the approver who reviewed the timesheets must co-sign them to confirm the time entries are correct.

#9: Timekeeping and payroll responsibilities must be separated

DCAA mandates that the responsibilities for timekeeping and payroll need to be separated. Payroll staff shouldn’t have any control over employees’ time-tracking data.

When monthly time tracking is complete, the manager can request that all employees generate summary reports of their tracked time and export them as PDFs. Once the manager receives the reports, they can forward them to the accounting staff.

#10: All costs should be properly recorded

The project’s costs need to be logged to ensure only allowable costs are billed to the government. According to FAR 31.201-2, costs are allowable when they’re:

- Reasonable,

- Allocable,

- In accordance with accepted accounting principles, and

- Aligned with contract terms.

Typically, allowable costs include materials used in production, direct labor, direct travel, and other direct in-house costs.

Unallowable costs should be recorded separately from allowable costs. These are costs you don’t charge the government, so they should be excluded from billings. If you bill the government for unallowable costs, you’ll be subject to penalties.

Labor costs can become disallowed if employee work time isn’t accurately tracked. That’s why, as the financial controller or person in charge of finances, you should ensure costs are always recorded and categorized properly.

#11: Direct and indirect costs must be separated

DCAA requires you to clearly distinguish between direct and indirect costs. When it comes to labor costs, direct labor refers to the staff directly involved in providing services or developing products.

For example, a sales agent’s salary at an IT company would be classified as a direct labor cost. That’s because this employee has a direct impact on the company’s revenue.

Indirect labor costs are the wages of employees who aren’t directly involved in product creation or the sale of services. Instead, they support the company by:

- Managing teams,

- Doing administrative work,

- Maintaining equipment, etc.

Timekeeping requirements apply to all employees — regardless of whether they belong to the direct or indirect labor group.

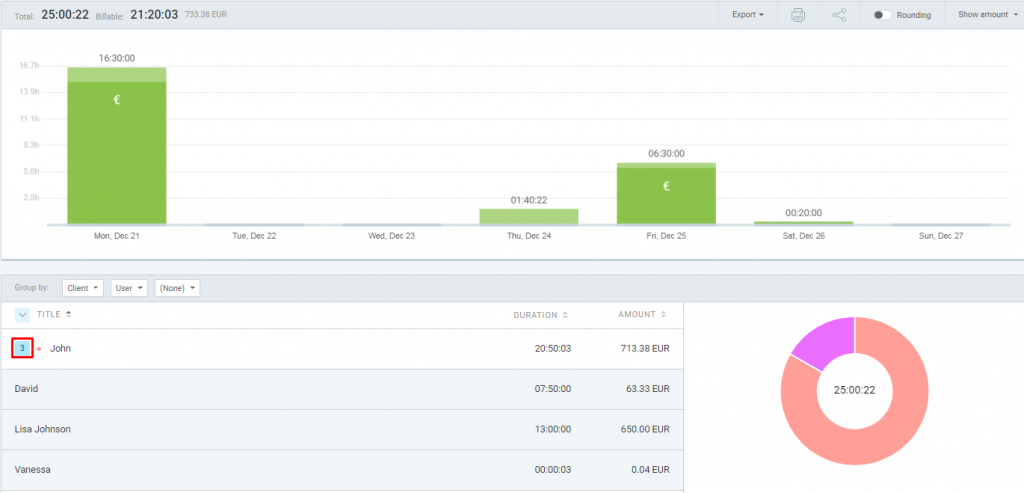

Direct or indirect, Clockify automatically calculates labor costs based on hours worked. You simply define the hourly rate for each employee. Then run a time report to see labor costs alongside hours worked, ensuring the costs you bill the government are accurate.

#12: Information on costs needs to be issued monthly

DCAA requires that cost and billing information be issued at least once a month.

You can easily generate this data monthly in Clockify. Go to the summary report, select the last month in the date picker, and you'll see a chart showing how many hours employees tracked in the previous month.

You’ll get details on how much of the time was billable or non-billable each day of the month. You can also find information about your earnings in the header of the chart.

Once you have the required data, you can export the document as a PDF or Excel file and prepare it for DCAA representatives.

Benefits of DCAA-compliant timekeeping

Following all the DCAA timekeeping requirements has many advantages apart from securing a government contract, including:

- Streamlined processes and workflows — having a strict timekeeping policy helps everyone stay organized, prioritize, and divide their work into more manageable tasks.

- Improved efficiency — daily time tracking allows you to see how employees spend their work hours and determine if there’s room for more efficiency.

- No delayed payments to your company — your time-tracking procedures help you stay on top of all the necessary documentation, such as reports and invoices, which you can promptly send to your clients.

- Higher chances of securing future contracts — passing your DCAA audits with flying colors makes you more likely to land another government contract in the future.

- More transparent operations — employees are in charge of their timesheets and can refer to them at any time.

- Data-driven decisions — having detailed insight into how employees spend their time can help you better prioritize tasks and make informed decisions about future projects.

🎓 Compliance With Timekeeping Laws Using Clockify

FAQ on DCAA compliance

If you need more clarification on DCAA compliance, check out these frequently asked questions.

Is Clockify DCAA compliant?

Yes, Clockify by CAKE.com is a DCAA-compliant time-tracking software solution. Using Clockify helps you comply with all DCAA timekeeping requirements. Employees can track their work hours, and you can assign approvers to review submitted timesheets.

Why is DCAA concerned with timesheets?

DCAA is concerned with timesheets to ensure that government agencies are billed accurately. Timesheets provide transparency into the labor hours you bill to the government.

What are the DCAA timekeeping daily requirements?

DCAA requires employees to log the exact number of hours they worked each day. For DCAA to assess compliance, you need an auditable timekeeping system.

Is Clockify by CAKE.com the best DCAA-compliant timekeeping software?

Clockify is the perfect tool to justify labor hours and help ensure DCAA compliance. Of course, using the software itself doesn’t automatically make you compliant — you still need to make sure you’re following all the DCAA regulations.

However, Clockify makes it easy to:

- Track work hours on specific projects,

- Review timesheets,

- Request PTO,

- Approve or reject PTO requests,

- Lock timesheets, and

- Calculate labor costs.

Logging time using Clockify is quick and easy, and helps you avoid hefty non-compliance fines. So, to maximize adherence to policy and save yourself time and money — try Clockify.

Disclaimer

We hope our DCAA timekeeping compliance guide helped you better understand DCAA requirements. However, keep in mind that this article was written at the end of 2025. Please refer to the official government websites linked in this article; they contain the current DCAA and FAR rules and regulations.

Also, we strongly encourage you to contact your local DCAA field audit office for more information. This article is strictly informative and isn’t to be used as a substitute for any form of legal advice.

Clockify is not responsible for keeping your company DCAA-compliant, but it provides tools to support compliant timekeeping.