Did you know that an average of 17% of restaurant owners shut down their businesses in their first year? Even though that doesn’t seem like a huge number, the restaurant business failure rate could be lower.

To prevent such scenarios and ensure your restaurant thrives in the competitive market — you must make an effort to stay afloat in challenging times.

The key to keeping a lucrative, long-lasting restaurant business is proper restaurant budgeting meant to help you control the rising business costs.

Moreover, restaurant budgeting will keep you from overspending on unnecessary business activities, such as ineffective marketing campaigns or expensive menus.

To make sure you have an in-depth understanding of how restaurant budgeting works, in this blog post we will:

- Explain what restaurant budgeting really is,

- Give you a detailed restaurant budget breakdown of expenses,

- Provide the necessary steps and tips for proper restaurant budgeting, and

- Clarify how restaurant budgeting and forecasting are related.

What is a restaurant budget?

A restaurant budget is critical for the success of any type of restaurant because it helps in estimating whether the business will be profitable or suffer a loss.

It also assists you in monitoring your expenses and revenue in order to see whether you’re meeting the budget benchmarks you’ve set — i.e., the revenue and expense targets for the upcoming year.

Restaurant owners should be aware of the importance of creating a restaurant budget since it serves as a financial plan for improving business performance and maintaining profitability.

Track restaurant costs with Clockify

What is included in a restaurant budget?

A restaurant budget consists of 4 parts that business operators need to keep an eye on:

- Restaurant sales — Represent the total number of daily customers multiplied by your forecasted check average (total revenue acquired by sales of food, and beverages),

- Prime cost — The sum of the cost of goods sold, and labor costs including wages, employee benefits, payroll taxes, etc.,

- Controllable income — Includes all the operating expenses such as food supplies, preventative equipment maintenance, utilities, rent, marketing, etc., and

- Net income — The amount of money that you get after paying all the expenses.

What are the top 3 expenses of the restaurant business?

The types of restaurant expenses vary depending on factors such as whether you’re leasing or owning the commercial space, the type of necessary equipment, the size of your operation, the location, and others.

However, the restaurant expenses you can expect are pretty much fixed and are related to:

- Food, labor, and rent expenses (primary costs), and

- Additional operating expenses (marketing and advertising, repairs and maintenance, daily administration, utilities, and legal and accounting fees).

Now, let’s delve into the three largest restaurant expenses categories a bit further.

Restaurant expense #1: Food expenses

The food costs include three elements:

- Food cost percentage — The amount of money spent on food ingredients in relation to the revenue acquired from selling the menu dishes,

- Food ingredients — The substances that are used for preparing the dishes, and

- Food sales — The revenue received from the sales of the menu dishes.

The food cost percentage indicates how much money the restaurant is making (or losing) on the sold dishes.

In other words, it is the amount of money spent on all the necessary ingredients to prepare the food served in the restaurant, and that has a direct effect on the profitability of the restaurant.

Calculating food costs is important because it helps in determining whether food cost targets (i.e., the food cost percentage projected for a specific period based on the number of sold menu dishes) are being met.

There is no right food cost percentage, however, restaurant owners and operators should keep it from 28% to 35% of their total revenue. Keep in mind that the same numbers won’t apply to every restaurant — the exact percentage will depend on the type of food being served and operating expenses.

Restaurant expense #2: Labor expenses

Labor is also one of the largest and most significant expenses of any restaurant business. Examples of labor costs mostly include employee-related costs, like:

- Salaries,

- Benefits,

- Payroll taxes,

- Service commissions,

- Overtime,

- Health care,

- Retirement plans,

- Bonuses,

- Time off (sick and vacation days),

- Meals,

- Training,

- Work uniforms, etc.

How to calculate labor expenses?

Calculating your labor expenses helps you determine the labor cost percentage — the ratio between your total revenue and labor costs.

The labor cost percentage can be calculated as:

- A percentage of sales — For instance, your gross sales are $800,000 and the total labor cost is $240,000. Divide the labor cost by gross sales and multiply by 100.

$240,000 / $800,000 x 100 = 30%

The final number (30%) is your labor cost percentage (the total amount of money spent on labor costs against the total revenue).

- A percentage of total operating costs — Represent the ongoing costs related to the operation of the restaurant. If your labor costs are $12,000 per month and total operating cost is $19,000 per month, you need to divide labor cost by total operating costs.

$12,000 / $19,000 x 100 = 63%

You can also calculate labor costs by hours worked. This method lets you separate employees into different operational groups (servers, bartenders, cooks, etc.). The goal is to measure the cost per hour for each group. For example, if you have 7 cooks each working 40 hours per week and their average hourly wage is $15, here’s how to calculate cost by hours worked. You first calculate weekly hours worked by group:

Number of workers x number of hours worked = weekly hours worked by group

7 cooks x 40 hours each = 280 weekly hours worked by group

Next, you take weekly hours worked by group and multiply the number by an average hourly wage:

280 hrs/week x $15 average hourly wage = $4,200

Finally, to get an average cost per hour worked, you take total wages per week and divide the number by 52 weeks in a year:

$4,200 total wages per week / 52 weeks = $80.8

Restaurant expense #3: Rent expenses

Rent is a fixed expense that any restaurant owner must pay for the commercial space in which they’re operating their business.

How much you’ll pay per month for your commercial space will vary based on:

- The location (the total cost of renting a space may vary largely between cities, areas within cities, and industries),

- The condition of your space, and

- How much square footage you lease.

Bear in mind that the total occupancy costs are not limited to base rent only but also include expense reimbursements such as:

- Common area maintenance (CAM) fees,

- Real estate taxes,

- Personal property taxes,

- Insurance on building and contents,

- Depreciation, and

- Amortization.

According to statistics, the total occupancy cost should be anywhere from 6% to 10% of your gross sales. However, the exact numbers will depend on your unique business situation.

How to calculate rent expenses?

Determining the right rent fee for your restaurant is important for business success.

So, if the price per square foot is $15 and the total square footage of the unit is 2,500 square feet, you can calculate the annual gross rent costs like this:

Rentable square feet x Each unit of usable square feet available

$15 x 2,500 = $37,500

Next, to calculate the monthly rent costs, you simply divide the annual gross rent costs by 12:

Annual gross rent /12 months

$37,500 / 12 = $3,125

💡 Clockify Pro Tip

If you’re looking for a more accurate way to calculate your paycheck, it’s time to understand the difference between gross pay and net pay first:

Why is establishing a precise restaurant budget important?

The answer is pretty straightforward — you need a restaurant budget because it serves as your guiding roadmap in spending money wisely, being aware of how your business is operating, and making sure you meet your financial goals. If you don’t have a restaurant budget plan, you have no control over your business, and you’re more than likely to fail.

Here are the top benefits of establishing a restaurant budget.

Benefit #1: Restaurant budgeting helps you keep track of income and expenses

Monitoring your income and expenses will help you make informed decisions about how to allocate your resources. Moreover, measuring your sales against your costs will help you determine how much money your restaurant is making.

Having a clearly defined budget will help you figure out whether your restaurant costs are higher than your earnings. If that’s the case, you might need to increase the prices on your menu or find alternative marketing strategies to attract customers.

All in all, tracking your income and expenses will make sure you stay on top of your finances.

Manage your expenses with Clockify

Benefit #2: Restaurant budgeting allows you to make proactive decisions about growing your restaurant

To retain competitive advantage and be successful, managers need to quickly adapt to change in this rapidly changing business environment.

With restaurant budgeting, you’re becoming a manager who proactively anticipates challenges and takes the necessary steps to prevent them from arising in the first place.

Moreover, proactive restaurant managers take account of the future, rather than focusing on the current business situation. This includes making proactive decisions about:

- Staffing,

- Inventory,

- Menu updates,

- Marketing campaigns,

- Customer trends, and

- Technology.

Benefit #3: Restaurant budgeting stops you from overspending

Budgeting gives restaurant owners a clearer picture of the costs that may arise during business operations. Moreover, budgeting also helps them plan and prioritize expenditures.

A proper restaurant budget plan will eliminate overspending on expenses like:

- Janitorial supplies, or

- Marketing campaigns.

For example, it might seem very tempting to overspend on marketing, especially if you don’t know a lot about it. In the urge to drive more profit for your business, you might even hire a costly marketing agency or pay for expensive ads.

However, it’s important to know that there are other low-cost marketing methods you can try to drive traffic in the long run (organic reach, low-cost social media ads, blog posts, or flyers). This way, you will save money for primary restaurant costs, such as food and labor.

How do you budget for a restaurant?

As stated above, creating a restaurant budget is crucial in order to stay on top of your finances and keep the business running smoothly. There are a few steps to creating a restaurant budget that will work for your business. Let’s dive deeper into each of the steps for creating a realistic budget for your restaurant.

Step #1: Start with the cost of rent

Starting a restaurant is a challenging task because it requires a great deal of effort and resources.

And it all starts with determining the real costs of operating a restaurant — first and foremost, the cost of rent.

We reached out to Izzy Kharasch — a president at Hospitality Works and a restaurant consultant with over 30 years in the field of food service management in the US and Europe — to tell us more about how the cost of rent dictates the amount the restaurant should earn to be profitable:

“I like to build the first draft based on the rent/mortgage. I have found that successful businesses have a rent of 6% to 8%. Using our 4,000 sq. as an example, if the rent is $7,000 per month then the business must generate $1,200,000 to be profitable.”

If you’ve been operating your restaurant for a certain period of time, you can use data from previous years to help you project the numbers for the next year.

Step #2: Keep a detailed inventory of all current expenses and revenue streams

As we already mentioned, plenty of costs associated with running a restaurant business are already fixed, which means they can be easily predicted — because they stay the same every month (e.g., rent or insurance).

However, regarding restaurant expenses, you will also have to deal with:

- Variable costs (food or repairs), and

- Semi-variable costs (employee salaries or utilities).

These types of costs are harder to predict thus making the budgeting process even more difficult.

Luckily, you don’t need a financial background to monitor these expenses — keep books of what you spend on a daily, weekly, or monthly basis. For example, recording all your expenditures and income in a spreadsheet can help you calculate the total costs for the current month and see how much profit you have earned in a given time period.

💡 Clockify Pro Tip

Tracking your expenses doesn’t need to be hard. Here’s how to do it:

Step #3: Analyze and compare your sales and costs

Comparing your monthly expenses and sales will give you a clearer picture of your business’s financial position.

It will also help you determine:

- The general profitability of your business, and

- The profitability of specific menu items or specific days of the week.

Tracking the cost vs. sales ratio is very important, especially in today’s volatile environment because it gives you greater control in running your business successfully.

When analyzing your cost and sales figures, you will easily notice if the costs surpass the sales and whether you need to make adjustments.

Additional tips for creating a restaurant budget

If you are looking for more tips on creating a restaurant budget, here are a few pointers. The following tips will ensure a smooth operation of your restaurant business.

Tip #1: Revise the numbers and analyze your performance

Operating a profitable restaurant can be a daunting task. In fact, it takes a sheer amount of work to drive profit.

As your restaurant business grows, it’s becoming crucial to reevaluate its performance and subsequently decide how to proceed in order to achieve profitability. One way to analyze your restaurant’s performance is to look at existing company reports. This will give you an idea of how and where to start and which areas to focus on.

Manage costs easily with Clockify

Making the time to evaluate your business performance regularly can help you spot anomalies along the way and is valuable to your bottom line. You can’t always be sure how your business is doing until you analyze your actual results (budget and expenses) against your estimated results (estimated budget or expenses).

Izzy Kharasch shares two quick examples about creating a restaurant budget using the same $1.2 million (the amount we have to generate to keep the business profitable).

“Let’s take the $1.2 million and divide that by 52 weeks ($1.200,000/52=$23.076). Thus, we must bring in $23,000 per week. If we are a fine dining restaurant with a check average of $70 per guest then we must bring in 330 guests per week ($23,076/$70=329.65). If we are a casual restaurant with a check average of $40 per guest then we must bring in 576 guests per week ($23,076/$40=576). The key to success is running the numbers and really analyzing your position.”

So, you will need to record important business metrics, including:

- The number of guests,

- Number of weeks,

- Check average per guest, and

- Price per square foot.

You can organize all these numbers (related to your costs and profits) into spreadsheets or a specialized accounting software for more accurate tracking.

Tip #2: Make adjustments as necessary if costs surpass sales

Unfortunately, many restaurant operators realize that they are losing money late because they’re not paying enough attention to the operating costs, such as:

- Salary and employee benefits,

- Rent or property purchase,

- Advertising and marketing,

- Property taxes,

- Utilities,

- Facility or equipment maintenance, and

- Accounting and legal fees.

Therefore, it pays off to get a deep understanding of how your costs are doing to see how they’re affecting your business profitability.

To run a successful restaurant business, it takes constant monitoring and adjusting whenever operating costs exceed the amount of money your business is making. After all, your restaurant needs to be making profit, not losing money.

If your operating expenses surpass the sales figures, it’s more than clear that you must make changes to your restaurant budgeting plan, thus, you can either choose to:

- Increase your sales (acquire new customers, boost the number of existing customers, or increase menu prices),

- Reduce your costs (find more affordable food or beverage suppliers, reduce the staff, save on utility bills, or track your employees’ hours), or

- Combine both strategies.

Regardless of which strategy you choose, it’s important to be consistent.

Tip #3: Use restaurant budgeting software to help with financial tracking

When you are running a restaurant business, there are a lot of day-to-day processes you need to look for, including:

- Accounting,

- Budgeting,

- Inventory management,

- Order management,

- Payroll planning,

- Employee attendance,

- Cost analysis, and

- Employee scheduling.

But, luckily, restaurant management software like Clockify by CAKE.com can help you stay on top of all restaurant operations.

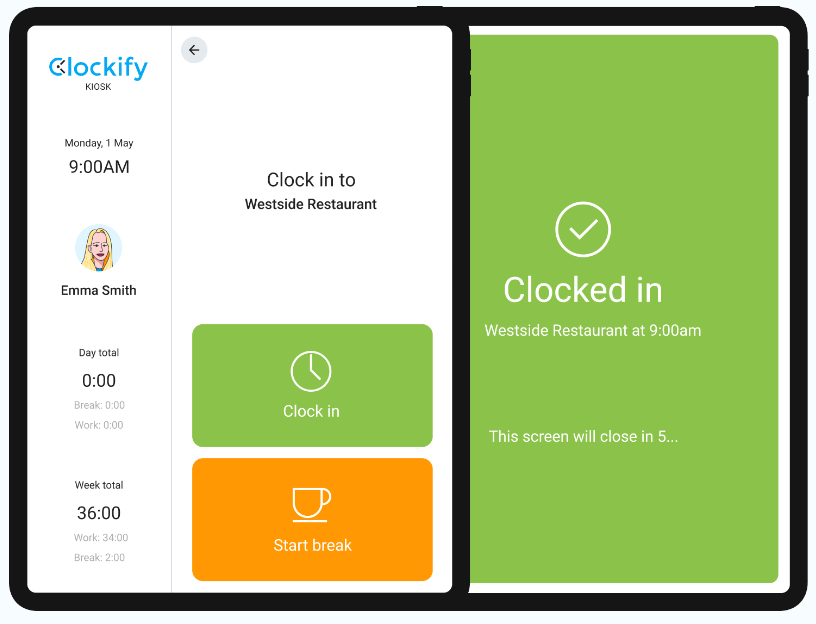

Clockify has a time clock option for mobile or desktop devices. Each restaurant employee can log in and clock their working hours via a timer. They can clock in (enter) the time when their shift begins and clock out once they are finished with work.

Moreover, having all employee’s hours properly tracked in one single dashboard allows you to better calculate employee payroll. This, in turn, ensures an uninterrupted workflow in the restaurant because employees will be accurately compensated for working specific days or times.

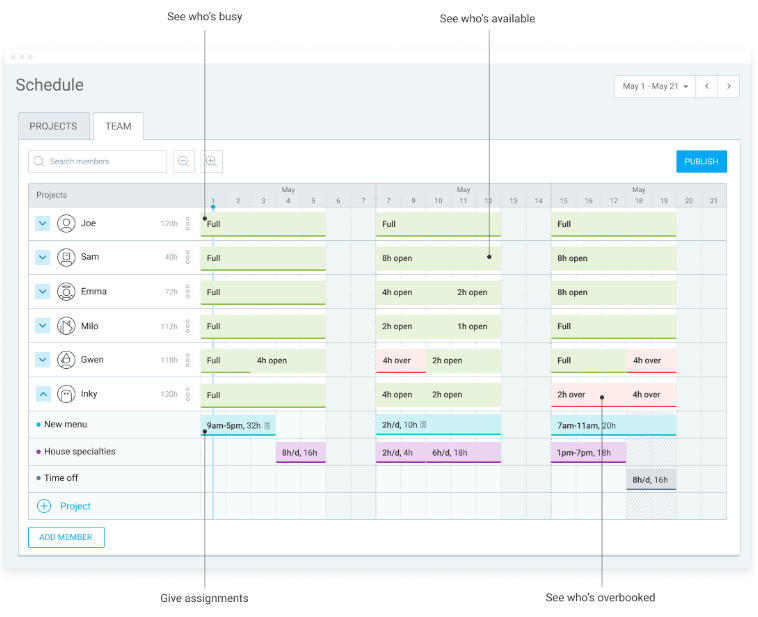

You can also see who’s available and who’s busy, which will help you delegate any additional tasks that may appear during shifts.

Tip #4: Use a restaurant budgeting template

Creating a restaurant budgeting template from scratch can feel stressful, especially for new restaurant owners.

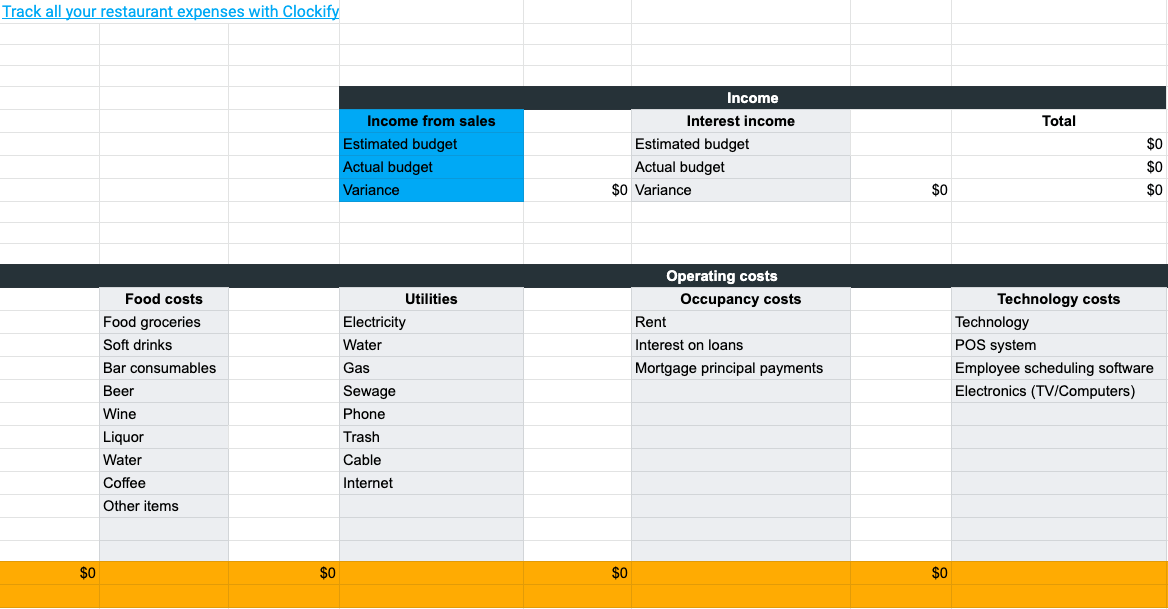

This is where our free downloadable template comes in handy.

We’ve created a restaurant budgeting template that you can download and use anytime you need. This template will give you a basic, visual plan of the potential and actual income and expenses, so that you can keep updated with the financial situation of your restaurant.

⏬ Download a free restaurant budget template

The template includes separate calculations for your actual income versus your forecasted income (plus the difference between the two) in an easy-to-use Google Sheet. You will also find sections for different types of operating expenses including:

- Labor,

- Food,

- Rent,

- Utilities,

- Marketing,

- Repairs and maintenance,

- Technology, and others.

All in all, Clockify restaurant budgeting template will help you:

- Keep track of your restaurant expenses,

- Compare your budget against your expenses,

- Determine whether you’re budgeting correctly,

- Set financial goals for the future,

- Improve your spending habits, and

- Maximize your profits.

How to forecast restaurant sales?

Restaurant budgeting and sales forecasting guide business owners in running a successful restaurant.

In fact, smart sales forecasting can help you find the right balance between your restaurant’s sales and costs. A combination of both methods powers you to determine possible cost leaks and eliminate them before it’s too late.

Overall, restaurant sales forecasting helps you with:

- Optimizing inventory management,

- Informed planning about staffing, hiring, and marketing,

- Profit projections for the upcoming period of time, and

- Goal setting based on the predicted profits and costs.

So, how do you conduct a restaurant sales forecast for an existing restaurant? We’ll explain in the following lines.

💡 Clockify Pro Tip

Learn how to estimate future sales revenue to see whether you’ll hit the expected target by using the following forecasting models:

Tip #1: Calculate your restaurant’s daily capacity

We’ll try to estimate the number of customers per day by using an example. Let’s say that your restaurant has 12 tables suitable for sitting 4 people each.

In an ideal situation, all of these 12 tables would be full during a certain hour (if it takes about an hour to have lunch), so we can estimate 48 (12 tables × 4 people) daily lunch servings on average. So, you can predict that the kitchen will be serving 48 customers.

If each table serves 2 parties (a group of restaurant guests) each day, this means that an entire lunch time service would bring in 96 customers.

4 customers x 12 tables x 2 turns = 96 customers

If the average lunch price is $30 per person, your restaurant’s sales forecast for a busy afternoon can be calculated like this:

Sales forecast = table count x seat allotment x average lunch price x table turn

12 tables x 4 guests per table x $30 per guest x 2 turns per night = $2,880

So, at full capacity, your restaurant would expect food sales of $2,880. However, your business won’t always be operating at full capacity. By implementing the same process, you will be able to estimate the sales for less busy days, half capacity, or any time period you like.

Tip #2: Monitor past sales data

Analyzing past sales performance will help you in identifying fluctuations in different time periods and determining the number of sales during a given year.

To make sales forecasting easier, you can use predetermined metrics from your point-of-sale system (or POS, a software that helps your restaurant accept payments from customers and manage sales transactions), which will give you an idea of your restaurant’s sales history.

Some POS systems even have inventory management software that allows you to see:

- What’s left in stock,

- Which orders are coming in, and

- When to order more items.

Furthermore, by looking at past data, you can better understand your restaurant’s sales trends, including:

- What meals your customers like the most at your restaurant,

- What days of the week are usually the busiest, and

- What dish is the most ordered.

Then, you can forecast future sales based on these trends and prepare for the upcoming period.

Tip #3: Pay attention to external factors that may impact your restaurant profit

Many external factors can influence your restaurant business, including:

- Social (e.g., changes in consumer preferences or behavior that might influence restaurant sales),

- Economic (e.g., changes in tax rates, unemployment, interest rates, or inflation),

- Political (e.g., new legislation that affects businesses’ rights such as consumer, employment, or intellectual property laws),

- Technological (e.g., advancements in automation, e-commerce, and digital media), and

- Competitive factors (e.g., the influence of the competition from changes in price, product, or business strategy).

All of these factors can shape the business environment in which the restaurant operates and affect how it plans and performs.

Even though you can’t control their impact, you should know that they can still have an influence on your sales. Thus, to get a more accurate sales forecast, it’s important to analyze the ongoing situation. For example, you can monitor your competitors’ performance and strategies to see how they’re doing in the industry.

In times of economic uncertainty, restaurant owners should also get ready for significant economic changes that can hit their future sales. This means closely monitoring:

- Past or current price fluctuations,

- Rising inflation, and

- Minimum wage changes.

All of this information will help you make data-driven business decisions.

However, take in mind that you’ll need to revisit your forecast at least once a month and make adjustments if necessary. For example, if you notice that your competitors are selling food at significantly higher prices, you may want to revise your pricing strategy to reflect a higher unit cost.

Elevate your restaurant business with Clockify by CAKE.com

To keep your restaurant business above water, you need to track expenses — including labor, rent, and food.

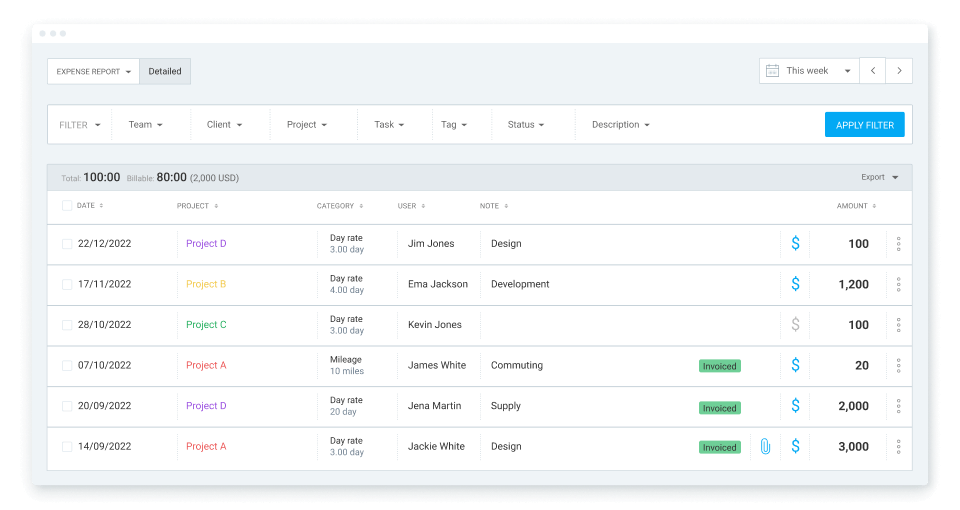

With an expense tracking tool like Clockify, you get exhaustive reports that include:

- Receipts,

- Dates,

- Projects,

- Categories,

- Users,

- Notes, and more.

You can even use countless filters to sort expenses by client, team, or task.

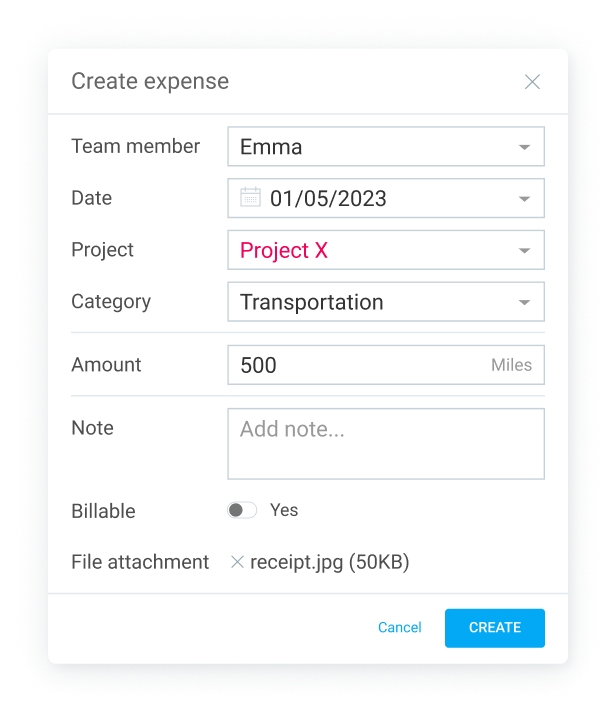

Here’s what sorting expenses looks like in Clockify:

In fact, you can get as detailed as you want with your expense tracking. When creating your expenses, you can record costs by sum ($20) or unit (20 miles).

With this feature, you’ll simplify how your restaurant business works by adding the appropriate amount for each expense.

Moreover, if you’d like to track expenses in Clockify, but you also need a project management app and a team chat app altogether — check out the newest bundle plan, offering Clockify with 2 more apps at a special price.

Streamline your restaurant business operations and stay on top of your expenses.