You’ve submitted your deliverables and completed a project successfully.

There’s just one problem — the client hasn’t paid you yet.

Regardless of whether the client is forgetful or outright refusing to pay, this is simply unacceptable and frustrating, to say the least.

In these situations, you must learn how to ask for payment politely and professionally to avoid damaging your reputation — but also directly enough to be taken seriously.

To help you, we’ve put together a detailed guide on ways to ask for payment nicely and prevent late payments from clients, including email templates.

Let’s begin!

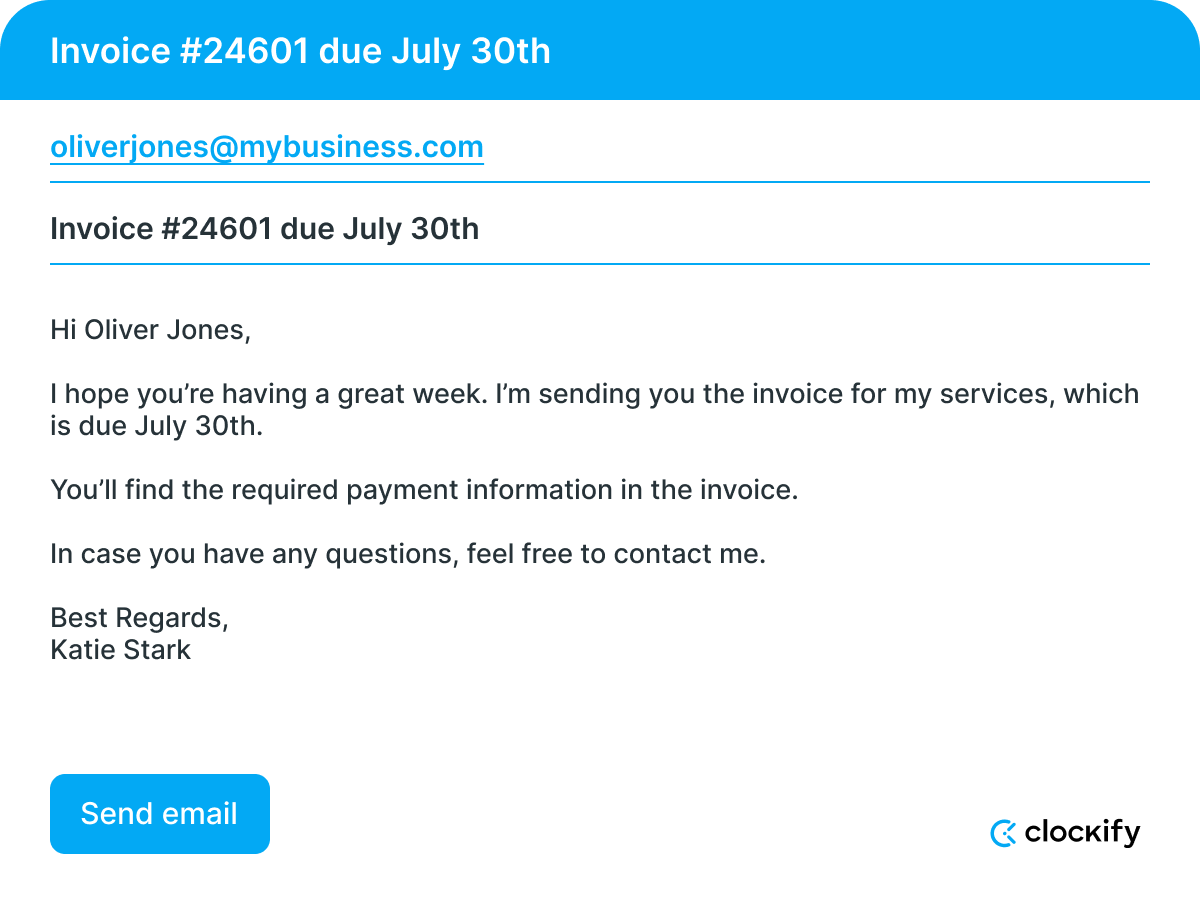

Email template #1: Initial invoice

The purpose of your initial invoice email is to provide your client with the necessary information regarding their payment.

With this in mind, try to be polite, brief, and informative. Apart from that, make sure to include the following information:

- Payment details (if not stated in the invoice already),

- The payment due date, and

- A positive note at the end of the email.

Here’s an example:

⬇️ Download Payment Request Email Template (Initial Invoice) in Google Docs

⬇️ Download Payment Request Email Template (Initial Invoice) in PDF

⬇️ Download Payment Request Email Template (Initial Invoice) in Word

Also, remember to send your invoice at least 2 weeks before the payment due date. This ensures your client has enough time to gather and organize payment documentation needed for paying contractors. This way, you can increase your chances of getting paid on time.

💡 CLOCKIFY PRO TIP

Need more help avoiding late client payments? Check out our guide on getting paid faster:

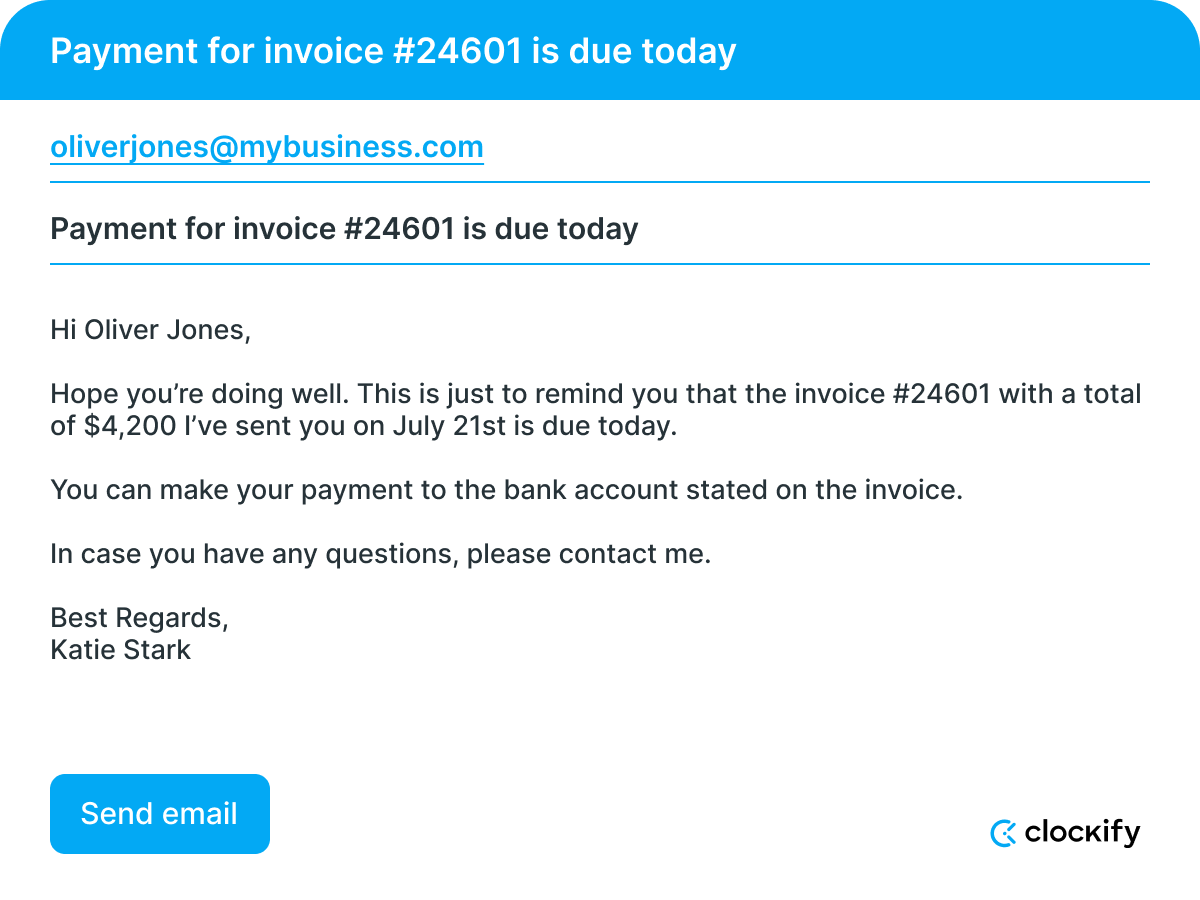

Email template #2: The day of the payment deadline

When the payment deadline arrives and you still haven’t been paid, it’s time to send your first reminder email.

At this point, you should be:

- Friendly,

- Concise, and

- Clear in your call to action.

Seeing as the bill isn’t overdue yet, you should maintain a friendly tone with your client.

The way to go is a clear and concise email with information about the available payment methods and a direct call to meet today’s payment deadline.

Here’s an example of how you can write your first payment reminder:

⬇️ Download Payment Request Email Template (Day of Deadline) in Google Docs

⬇️ Download Payment Request Email Template (Day of Deadline) in PDF

⬇️ Download Payment Request Email Template (Day of Deadline) in Word

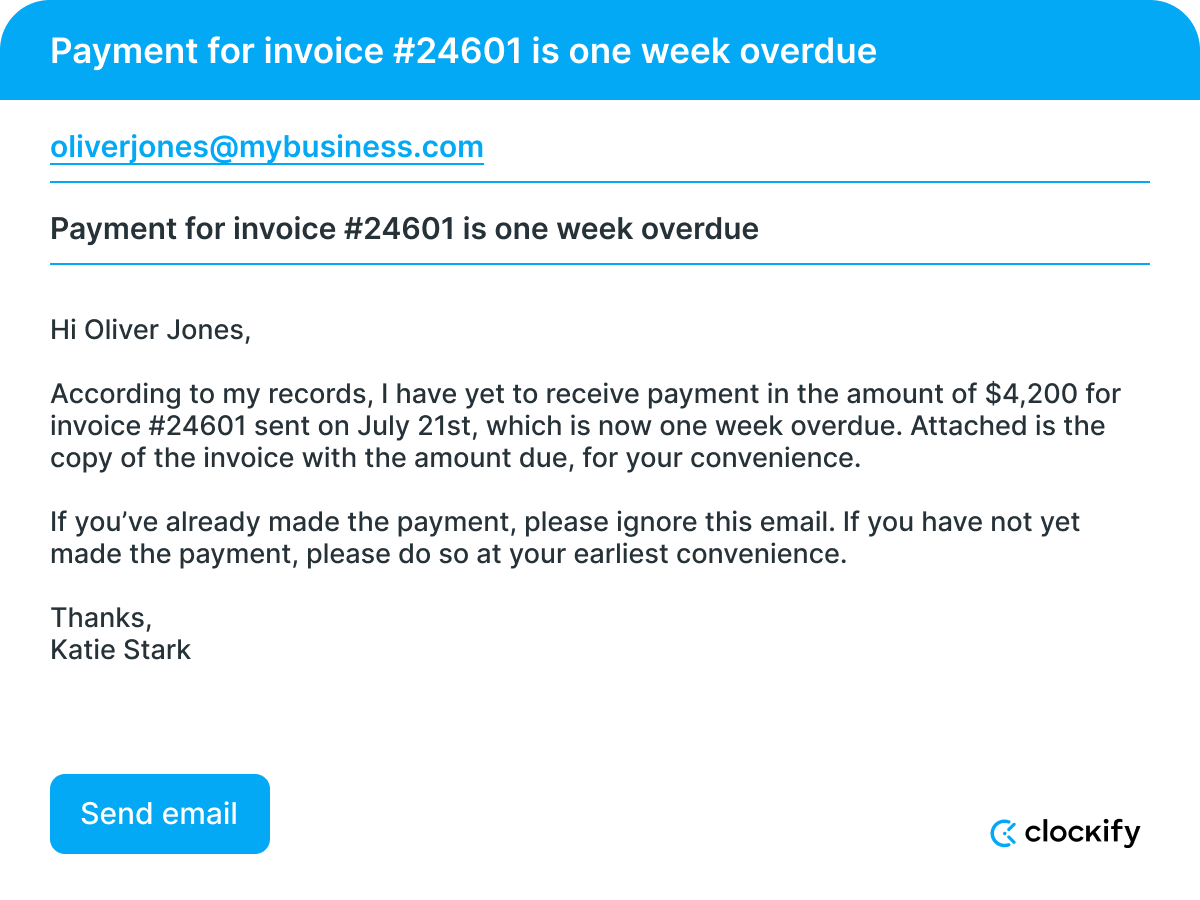

Email template #3: A week after the payment deadline

A week has passed since the payment due date, and you still have an unpaid invoice. It’s time for one of your trademark polite reminders.

When writing this email, you should:

- Be more informative,

- Use a firmer tone, and

- Emphasize that the invoice is a week overdue.

This is your first email about the invoice being overdue — so you’re still giving your client the benefit of the doubt. In such emails, it’s important to keep subject lines neutral to avoid sounding accusatory.

However, repeat the basic invoice information, such as:

- Invoice number,

- Date it was sent to the client, and

- Total amount due.

Also, include a copy of the original invoice in the attachment — in case the client hasn’t received or seen it.

The email reminder can sound something like this:

⬇️ Download Payment Request Email Template (A Week Overdue) in Google Docs

⬇️ Download Payment Request Email Template (A Week Overdue) in PDF

⬇️ Download Payment Request Email Template (A Week Overdue) in Word

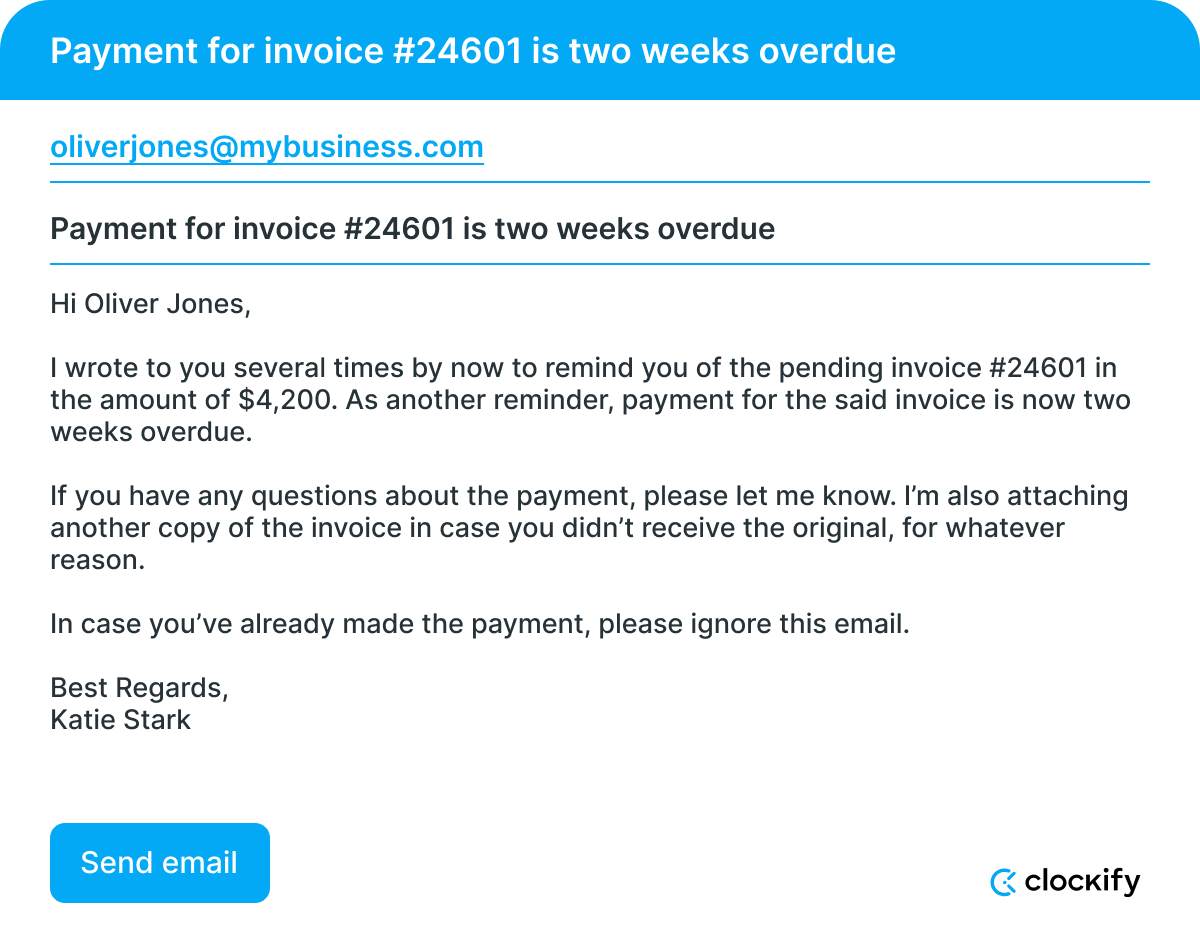

Email template #4: Two weeks after the payment deadline

It’s now 2 weeks past the payment due date, and you’re probably getting anxious. Remember that remaining professional and calm is necessary even at this point.

So, how do you write this email reminder for the payment? Consider the following:

- Be as direct as possible,

- Come up with a clear call to action,

- Ask the client to confirm they received the invoice email,

- Emphasize the time the invoice is overdue, and

- Include a copy of the original invoice in the attachment.

At this stage, you’ll need to be even firmer and more direct.

A clear call to action and asking the client to confirm they received the invoice email will lessen the chances that the client will ignore the email.

Although the benefit of the doubt is mostly gone by now, make sure you’ve attached the invoice again, as another reminder to your client.

This is what a good payment email reminder looks like:

⬇️ Download Payment Request Email Template (2 Weeks Overdue) in Google Docs

⬇️ Download Payment Request Email Template (2 Weeks Overdue) in PDF

⬇️ Download Payment Request Email Template (2 Weeks Overdue) in Word

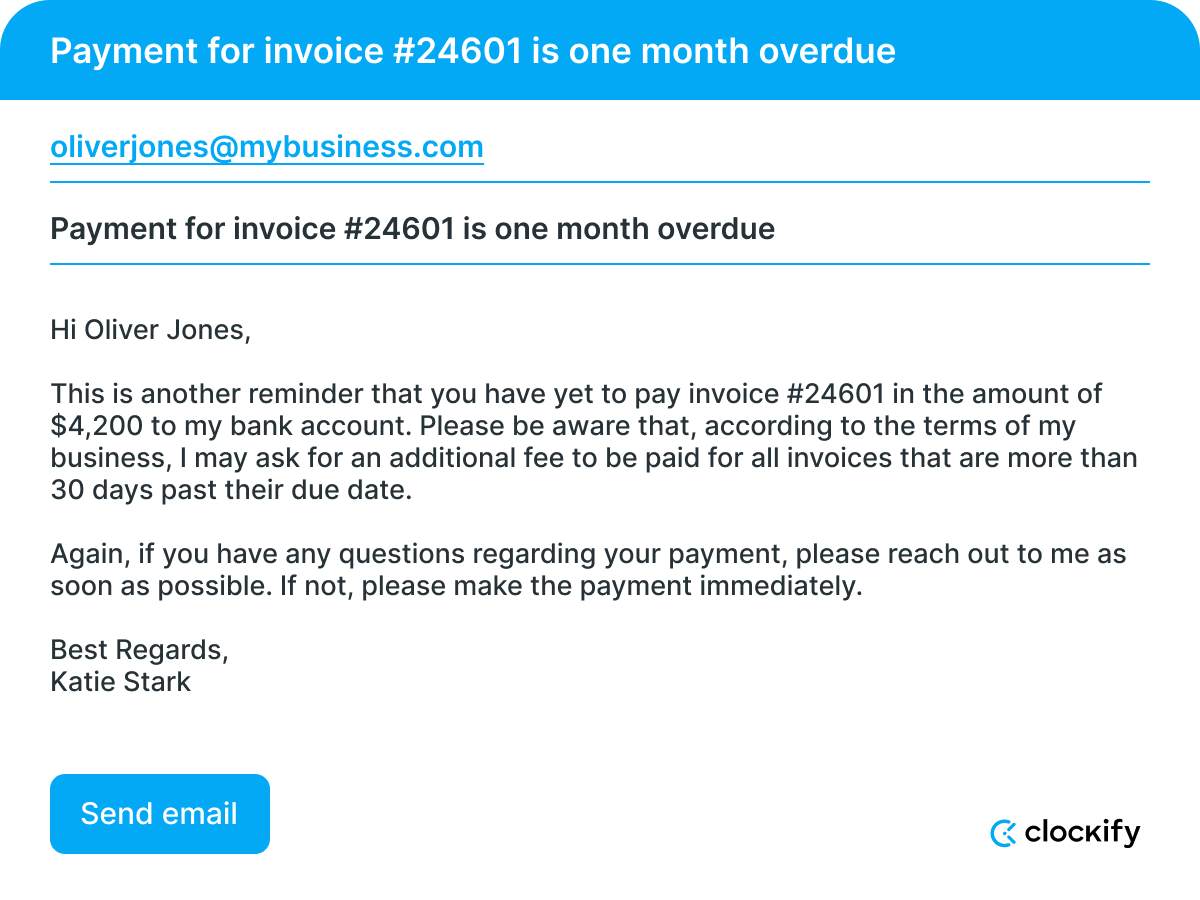

Email template #5: One month after the payment due date

It’s already one month after the payment due date. In this case, you should write another request for payment email and make sure to:

- Be direct and firm,

- Use a tougher approach,

- Remain professional and polite, and

- Avoid making things personal.

Considering that you’ve already sent a few invoice emails that have been ignored, feel free to take a firmer and stricter approach with this message.

Of course, remaining as polite as possible is still a priority.

If your business has a policy for late payments (such as an additional fee), state that in this payment request email, too.

However, avoid direct accusations, legal threats, and an unprofessionally personal tone — you’ll risk ruining your reputation. Plus, you’ll be less likely to get paid.

This final email reminder could look something like this:

⬇️ Download Payment Request Email Template (A Month Overdue) in Google Docs

⬇️ Download Payment Request Email Template (A Month Overdue) in PDF

⬇️ Download Payment Request Email Template (A Month Overdue) in Word

💡 CLOCKIFY PRO TIP

For more useful templates, check out our extensive and free template archive:

When to send a request for payment?

Depending on your agreement with the client, you can send a request for payment:

- After completing the work — if the agreement specifies payment is due upon delivery,

- Before starting the work — if the agreement specifies an upfront payment, or

- Upon hitting a milestone — if the agreement specifies milestone payments throughout the project.

Regardless of the arrangement, never wait too long to send a payment request.

To avoid late payments, a good rule of thumb is to send the invoice first and then a series of short reminders after the payment due date.

These payment reminder emails should be sent:

- On the designated payment date,

- A week after the due date,

- 2 weeks after the due date, and

- A month after the due date.

Of course, an email reminder doesn’t guarantee your client will make their outstanding payment. Let’s explore some options for when the client ignores your emails.

What to do if your client still doesn’t pay?

You’ve taken all the necessary measures and sent dozens of emails, but you still haven’t received the money owed for your services?

You’re not alone. According to a QuickBooks survey, 89% of small businesses say late payments are slowing growth.

Here’s what you could do next:

- Call the client over the phone,

- Ask for updates over text, and

- Send a demand letter and take legal action.

Of course, staying polite is a priority even if you reach the point of contacting an attorney. Your reputation is always on the line, and you should act accordingly.

With that in mind, here are a few tips on how to ask for money politely via phone, text, and letter.

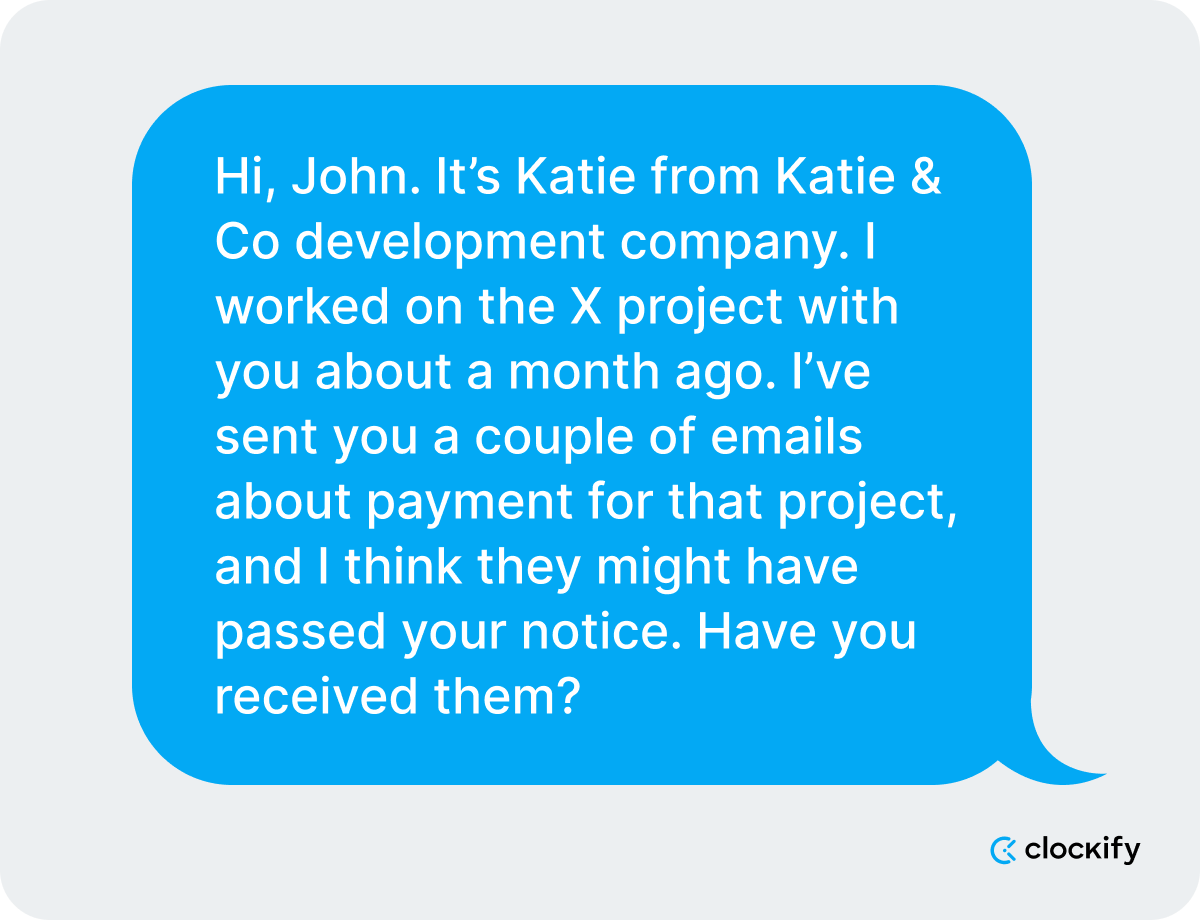

Ask for payment nicely over the phone

When talking to the client over the phone, make sure to:

- Introduce yourself and explain why you’re calling,

- Be concise and polite,

- Try not to use slang words and expressions,

- Don’t make direct accusations about the client not paying you,

- Maintain a polite tone that gives your client the benefit of the doubt, and

- Summarize all details agreed upon before the conversation ends.

If in doubt about what to say, here’s an example of a conversation starter:

Whatever the reason for the outstanding invoices, you’ll likely learn about it over a quick, polite phone call.

You’ll also be able to polish out the details and payment terms quickly because you won’t have to wait long for the reply.

Ask for a status update via text

Unfortunately, your client may not answer the phone for various reasons, including:

- Staying focused on an important meeting,

- Not answering calls from unknown numbers, or

- Preferring texts and emails due to anxiety.

Since you’ve already sent plenty of invoice emails and you’ve tried calling — send a simple text message next.

You can send something like this:

Chances are, once your client realizes who you are, you’ll receive a call from them or a message indicating when it would be a good time to call back.

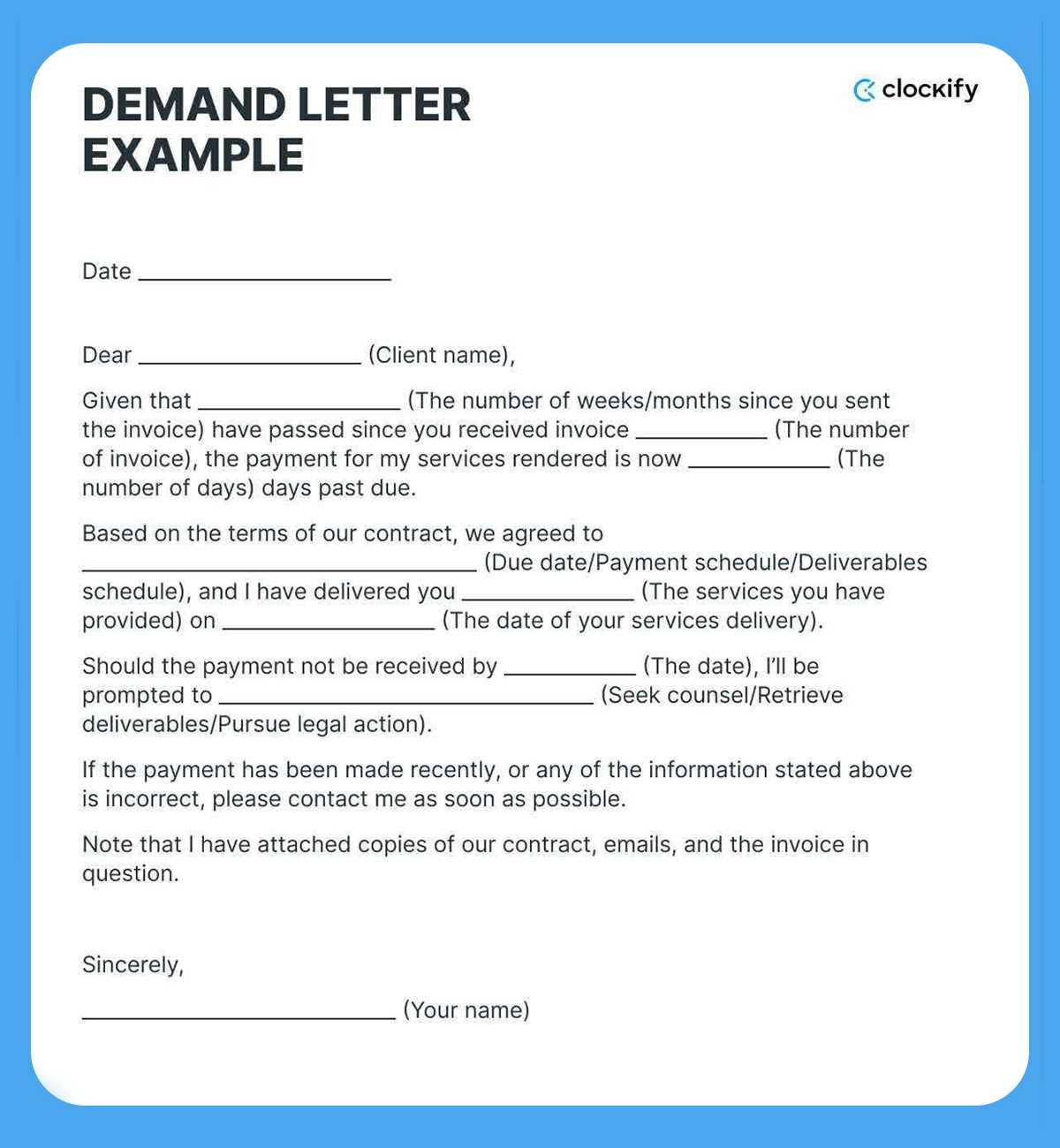

Ask for money politely via a demand letter

If you have tried everything under the sun to ensure you get paid for your work, and your client still has outstanding payments — your next step should be to send a demand letter.

Think of a demand letter as a more formal reminder than an email. This is your last resort to get late payments from clients before taking legal action.

The content of a demand letter is pretty straightforward, but it’s always best to consult with a legal advisor before sending the letter.

While writing a demand letter, include all the payment terms and details, such as:

- Invoice number,

- Initial payment due date,

- The number of days/weeks/months that have passed since you dispatched the original invoice,

- The amount due as of now,

- The date of your service delivery,

- The new payment deadline, and

- The action you intend to take.

Note: Clockify is not responsible for any losses or risks incurred should this example be used without further guidance from legal advisors.

If your client still doesn’t pay for their overdue invoices, your next best shot is to consult a lawyer.

But first, consider whether the payment you’re owed outweighs the costs of legal action.

Useful tips for preventing late payments

To prevent having to deal with unpaid invoices in the first place, we recommend taking a few precautionary steps.

Tip #1: Keep precise records of your work

Getting paid on time is easier if you always have precise and transparent records of your work. This way, you can always prove that:

- You are the one who did the work,

- You finished the work on time, and

- You delivered on what was promised.

To maintain full transparency and accountability with clients, consider using a time tracker to keep accurate logs of your work.

In Clockify, you can:

- Track time on your project-related work,

- Calculate your earnings automatically based on your hourly rates,

- Generate, save, and export time reports you can then send to your client, and

- Have a detailed overview of all your billable hours.

In Clockify’s summary report, you can quickly see how your team spends their work hours. The report shows all time entries in your company, grouped by client, project, user, team, date, or tag.

Clockify by CAKE.com also works as a free time clock app that will make clocking in and clocking out as effective as possible.

💡 CLOCKIFY PRO TIP

If you’ve just landed your first project, you need to be familiar with all the payment terms and processes. Here’s a detailed guide to get you started:

Tip #2: Prepare a contract

Signing a legally binding contract is a great way to avoid not being paid.

When drawing up a contract, always include the following elements:

- The parties involved in the contract,

- The precise project delivery and payment terms (and payment methods),

- A clause resolving the matter of intellectual property upon project completion and until full payment is made,

- Information about a penalty fee in case of overdue payments, and

- A passage clarifying what should be done in case of a dispute.

Even if the contract can’t guarantee the clients will pay you on time, it may encourage them not to delay their payment for too long.

At this point, it’s also wise to consult a legal professional about the elements you should include in your contract.

Tip #3: Ask for an advance deposit

Asking for an advance deposit is another great way to ensure you’ll get paid once you finish the project.

You can even include an advance deposit clause in your contract and let your clients know this is the way you do business.

In essence, clients willing to pay part of the agreed amount in advance are the ones who are taking your collaboration seriously. They’ll most likely pay you in full at the end of the project, too.

Yet, if you still think that an advance deposit might turn away first-time clients who are unfamiliar with your work, you can provide them with an alternative.

You can ask them to pay in smaller installments when you reach certain project milestones.

💡 CLOCKIFY PRO TIP

If you agree to get paid in installments after certain milestones, it’s best to keep track of the entire project from start to finish. Here’s how you can do that easily:

Tip #4: Pick a reliable payment method

To make the entire process of payment easier for both sides, it’s important to find a suitable and reliable payment method.

Your chosen payment processor has to be:

- Efficient — so you can use it without complications,

- Simple — so your client can use it easily, and

- Secure — so both your and your client’s data is protected.

For example, PayPal is an efficient, standard choice, but there are also other useful payment processors you can try out.

However, try to make your pick based on factors relevant to you and your clients, such as:

- Your client’s convenience,

- The region you live in, and

- Your own preferences.

💡 CLOCKIFY PRO TIP

If you’re still struggling to find a great payment processor, take a look at our blog for more information:

Tip #5: Invoice efficiently

A professional-looking invoice will increase the chances of you getting paid.

Fortunately, you can use plenty of invoicing apps to create professional invoices easily.

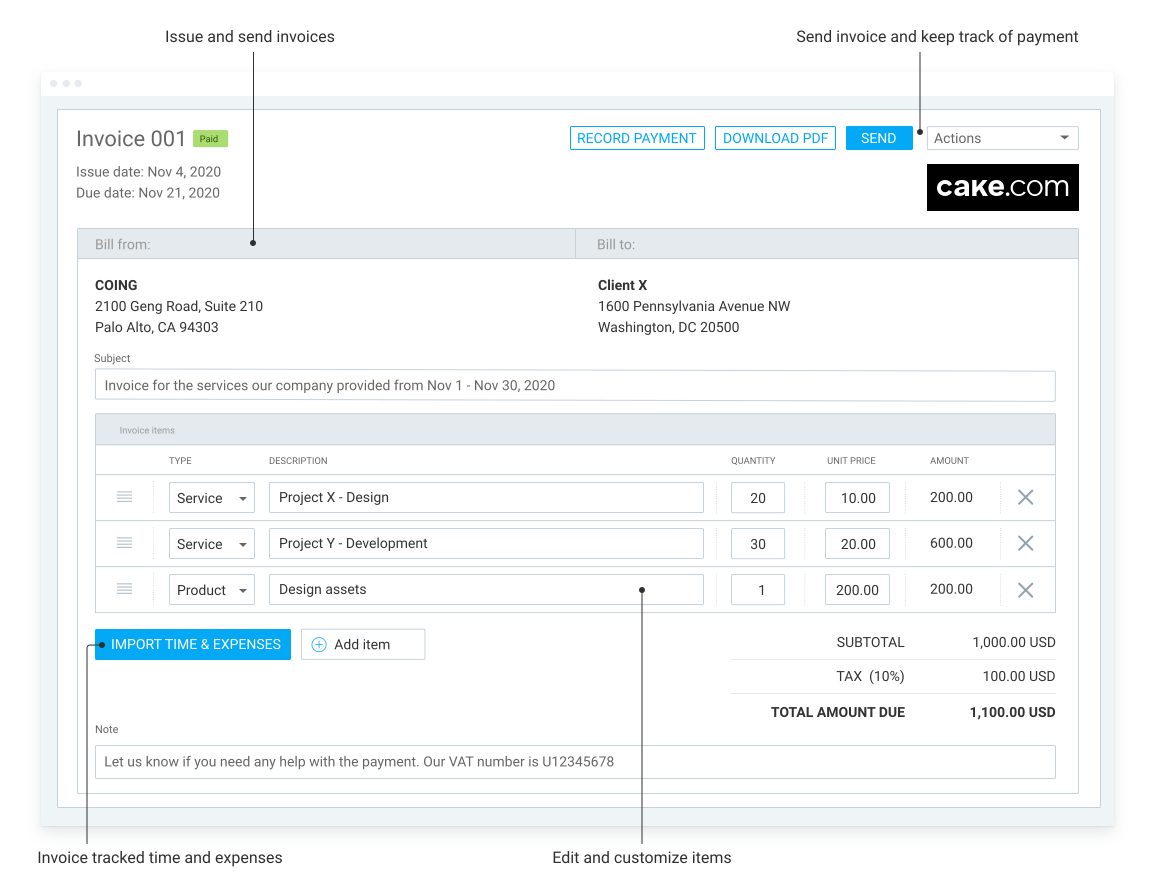

If you use Clockify by CAKE.com to track billable hours, you can create and send your invoice directly from the app.

Based on recorded time entries, Clockify can automatically generate invoices for clients. After that, you simply click Send invoice to share them via email.

Clockify will automatically fill out the client’s contact information from the invoice, and you can easily edit the subject line and body.

As you can see, Clockify simplifies the process of invoicing and billing clients. It also ensures your invoices are accurate by generating them from precise time logs.

💡 CLOCKIFY PRO TIP

If you’ve decided to be a freelancer full-time, here are a few useful tips to start earning more:

Tip #6: Communicate expectations clearly

You don’t want to invest months in a project, only to end up empty-handed because the client wasn’t satisfied with the outcome.

This isn’t a legitimate reason not to pay for a service. But, if you haven’t drawn a legally binding contract, your hard work could go to waste.

To avoid such situations, discuss every aspect of your project with the client upfront.

Hop on a quick call, walk them through all the milestones, deadlines, and goals of the project, and clarify if any part of the deal sounds confusing.

Also, check in with your client to keep them updated on your progress. This will help you avoid re-doing tasks if you weren’t exactly on the same page.

💡 CLOCKIFY PRO TIP

Showing your value to clients can be hard, even when you’re doing a great job. To help you demonstrate your value and present your work, check out a few useful tips in this article:

Tip #7: Agree on milestone payments

If you’ve landed your job on a freelance platform, you might have had this payment option set up by default.

For example, if you are about to start a 100-page translation, your client could pay a portion of the total budget once you submit the first 25 pages. After you finish the next 25 pages, the client issues the second payment, and so on.

This way, you eliminate potential misunderstandings about the outcome of the project and avoid dealing with missed payments.

💡 CLOCKIFY PRO TIP

Staying on top of payments while balancing multiple freelancing gigs can be a handful. Take a look at the apps that make the process easier:

Tip #8: Research the client

If you haven’t worked with a certain client before, try to find out more about them prior to taking on any work.

A simple Google search could reveal your client’s reputation. Also, you might find reviews of other freelancers or companies who’ve worked with that client before on social media. See if they mention dealing with outstanding payments or other communication issues.

Such information will save you the trouble of chasing after late payments by avoiding problematic clients altogether.

Tip #9: Protect your work

Inserting a watermark before being fully compensated helps you get paid on time. However, depending on your line of work, this might not always be possible.

Alternatively, you could limit access to your work and combine this with milestone payments or an advance deposit. In practice, you’d only release a section of your work before you receive payment.

Clients are more likely to pay on time if your deliverables are tied to their timely payments.

Use Clockify by CAKE.com to track work, manage invoices, and minimize late payments

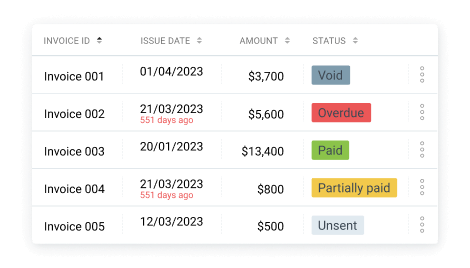

Besides tracking your billable hours and sharing invoices, you can also use Clockify to:

- Create detailed invoices based on your tracked time,

- Manage and track the status of your invoices, and

- Mark invoices based on their payment status.

From the Invoice tab, you can see all invoices at a glance and label them as paid, sent, unsent, overdue, or void. This screen also shows the payment amounts and due dates, making missing payments easy to spot.

That way, you’ll know exactly who you need to (re-)ask for payment and who’s proven to be a reliable client. Needless to say — you’ll save yourself some headaches.