From bulky and inconvenient methods such as pen and paper to managing payroll automatically — payroll systems have advanced a lot over time. Payroll management is a responsible and demanding job, but with the help of new technologies, companies can breathe a sigh of relief.

We did the heavy lifting and a thorough research about the most reliable payroll software in 2023 for small business owners.

In this text, we’ll help you:

- Understand what payroll software is,

- Learn about the benefits and importance of using a technology-based system for handling payroll, and finally

- Find reliable payroll software for your business.

WHY TRUST US?

The apps we talk about are selected, tested, and written about by human reviewers who follow strict review and editorial guidelines. We pick solutions that are practical, purposeful, and can offer real value for the specific use case or business context we’re covering — while also being justified in their pricing. Our methodology is transparent, clear, and available to everyone:

What is payroll software?

Payroll software presents a contemporary, highly efficient, and time-saving tool for handling business payments. Quality payroll software can completely change the way businesses handle employee payments in terms of:

- Automating payroll processing,

- Saving precious time,

- Reducing costs, and

- Making sure taxes are filed and employees are paid accurately and timely.

Payroll processing can be quite distressing to small business owners since it requires keeping up with federal, state, and local laws regarding payroll taxes apart from paying employees and data keeping. Reliable payroll software helps ensure such processes are automatic, accurate, and compliant with tax regulations and requirements.

💡Clockify Pro Tip

To find out more about the essentials on how to do payroll as a small business owner, don’t miss to check out a detailed guide below:

Benefits of using payroll software

Not only do technology platforms help small businesses grow and run smoothly, but they also pave the way for a steady and thriving future. Namely, starting from 2020, small businesses that use different software for handling their affairs have seen growth in:

- Sales — 82% of small businesses,

- Profits — 84%, and

- Even employment — 74%.

If you are still managing your business manually — perhaps these numbers will change the way you think. But, apart from having a significant impact on the overall growth of your business, the following are additional advantages of using technology when running a small business (for payroll purposes, more specifically).

Benefit #1: In-house payroll processing

When you use specific payroll software for handling your payments, you don’t need to hire an outsourcing company to carry out the payments instead.

This means significant cost reduction, developing a payroll system that fits your business, and having a better insight into your payroll history and tax liability. After all, you have your own team of financial professionals or the HR department that you can trust your business with.

💡Clockify Pro Tip

Whether you want to track employee payroll or you are in search of a reliable tracker where your employees may log billable hours (and much more), try using an app that will automate the process of payments:

Benefit #2: Process automation

Spreadsheets (and not to mention pen and paper) are a matter of the past. In fact, with the arrival of digital tools for handling payments the process of payroll became much more efficient and time-saving. Everything you need is embedded in one place, which streamlines payroll processing without losing precious resources.

Benefit #3: Fewer mistakes

Mistakes in payroll processing are sometimes inevitable, but payroll software minimizes such occurrences notably. The right payroll software helps you get a better grasp of your payroll data and information. Moreover, the risks of any errors regarding payroll tax submissions are less likely to happen.

💡Clockify Pro Tip

Speaking of mistakes in the workplace, filling out timesheets inaccurately is something that happens more often than you would think. Read the following text to find out more about the most common timesheets errors and how to minimize them:

Benefit #4: Cost effectiveness

This may (or may not) sound like a surprise to you, but yes, efficient payroll software may pinch pennies in your pocket. Choosing quality payroll software that fits your business needs will pay for itself eventually — no more time wastage, paying for payroll services or doing things manually.

The prices of payroll software mainly depend on the plan you choose for your business and how many employees you have. A standard payroll software plan that costs, for instance, a fixed amount of $30 a month (plus $5 per each employee) is way more affordable than paying for a payroll accountant per hour. In fact, according to Upwork, certain accountants charge up to $35 per hour for handling payrolls. In line with that, choosing the right software will promise you fixed costs at all times.

💡Clockify Pro Tip

If you are in search of an accounting tool to speed up your accounting tasks, take a look at the top free accounting software tools:

How we picked the best payroll software for small businesses?

In a sea of numerous tools and apps for handling payroll, you must be extra cautious when choosing the right for your business purposes. After all, poor quality software can cost you money, time, and nerves!

To move back to the story of how we singled out some favorites, here are some ground rules we sticked to when choosing a perfect payroll software:

- We looked for software that would do most of the payroll-related tasks automatically,

- We included payroll software that’s user-friendly and easy to navigate,

- We singled out payroll software reliable enough to store data and mail payslips securely,

- We paid special attention to payroll software that can help with keeping up with the changes in tax laws and regulations (owing to the IRS is what we all really want to avoid),

- We selected payroll software that comes with the option of generating automatic reports, and

- Last but not least, we included software with time tracking options since tracked work hours can later be used for timesheets, invoices, PTO, reports, and more.

Sticking to the rules we laid out above, here is the list of the best payroll software currently available on the market.

Overview of the best payroll software for small businesses in 2023

To help you choose the most suitable payroll software that fits your needs, we did thorough research and selected 8 payroll software that we believe are most efficient for running a small business.

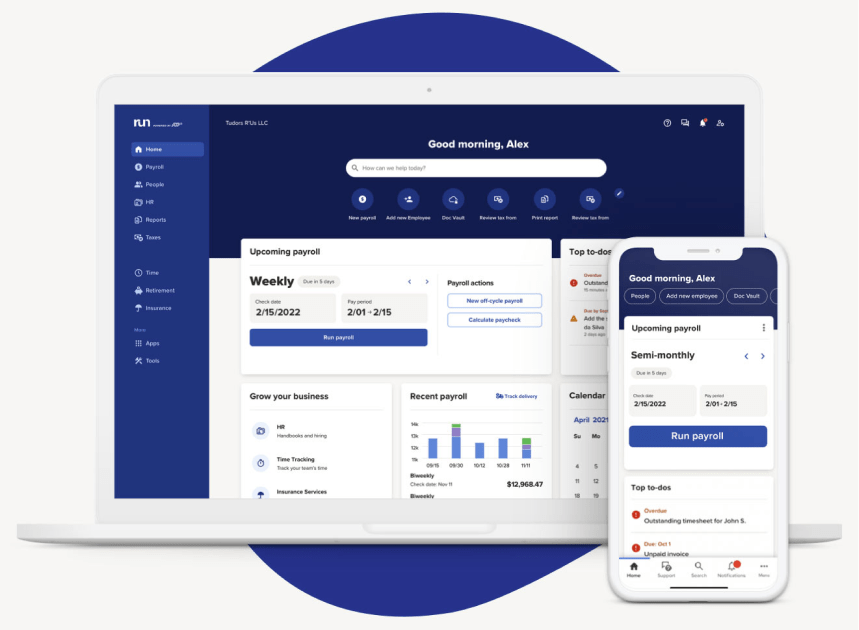

1. RUN Powered by ADP — best for different size businesses

RUN by ADP presents the perfect HR and payroll solution trusted by more than 1,000,000 clients.

What is RUN by ADP about?

RUN by ADP is a perfectly designed, all-in-one platform for managing and paying employees hassle-free. This tool will help you stay on top of many administrative tasks, including payroll management.

Why use RUN by ADP?

RUN by ADP provides you with different business plans to help you manage your business, no matter the size of it.

Whether you are a small, midsized, or large business with 1,000+ employees — RUN by ADP has got you covered. Apart from facilitating the process of handling employee payrolls, RUN helps you file payroll taxes accurately and ensures you stay compliant with changing payroll regulations.

Moreover, RUN by ADP offers employee and manager self-service (either online or via mobile phone), customer support available 24/7, numerous integrations with different software (time tracking, HR, ERPs), and much more.

Depending on your needs and the size of your business, RUN offers different plans to its customers. However, you’ll have to contact their support for more details on this matter. They have 24/7 support that will help you find the package that’s right for your business.

| Type of plan and availability | Run by ADP pricing and platforms |

|---|---|

| Free plan | No |

| Free trial | Yes (for 3 months) |

| Cheapest paid plan | Contact support for more info |

| Availability | Android, iOS, Web, Mac, Windows |

2. Gusto — best for easy navigation

An award-winning payroll, HR, benefits, employee management (and more) software. Gusto is an all-in-one app that keeps your team happy and productive.

What is Gusto about?

Gusto is another amazing software that streamlines payment operations by automatically calculating and syncing your employees’ work hours, PTO, and holidays with payroll.

Why use Gusto?

With Gusto, you are a few clicks away from running your employees’ payrolls and filing taxes in a timely and accurate manner. Gusto’s Run payroll feature provides employers with a clear overview of everyone’s hours and wages — both salaried and hourly employees. Another important thing to mention is Gusto comes with the option to withhold taxes stress-free and remain compliant with tax laws in your state.

| Type of plan and availability | Gusto pricing and platforms |

|---|---|

| Free plan | No |

| Free trial | Yes |

| Cheapest paid plan | $40/month + $6/month per person |

| Availability | iOS, Android, Web, Mac, Windows |

3. Rippling — best for IT management

Rippling is another payroll software worth-mentioning due to its single system for running a business — from hiring and managing to paying employees and automatic tax filing.

What is Rippling about?

Rippling lets employers manage employee payroll, benefits, expenses, devices, apps, and more. Furthermore, Rippling is a great solution for automatic tax filing.

Why use Rippling?

Rippling is an all-in-one app that lets you manage all your employee data and operations. Employers with 2 to 2,000+ employees using Rippling have the option to manage, update, and report on anything.

With Rippling, you can automate any manual processes, whether that be in:

- HR,

- IT,

- Finance, or

- Engineering.

From I–9s to W–2s, Rippling calculates and files your payroll taxes adhering to any federal, state, or local agencies.

| Type of plan and availability | Rippling pricing and platforms |

|---|---|

| Free plan | No |

| Free trial | No |

| Cheapest paid plan | Contact Rippling’s sales team |

| Availability | Web, iOS, Android, Mac, Windows, Linux |

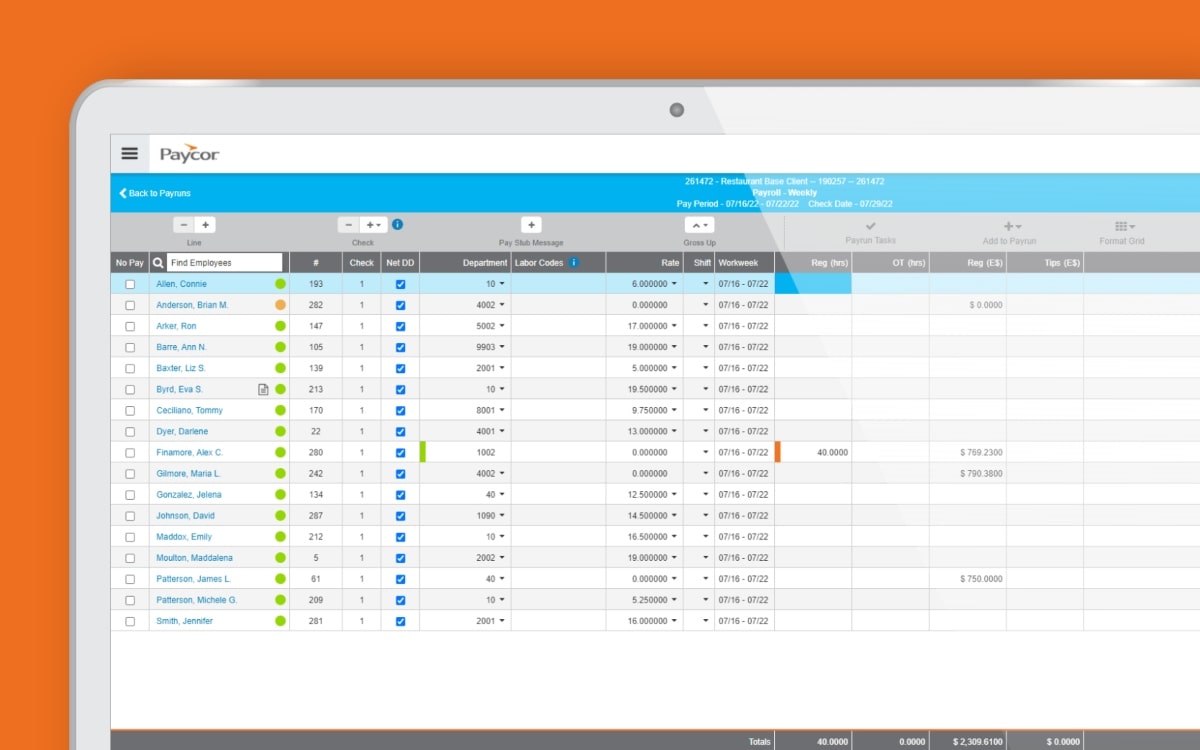

4. Paycor — best for staying compliant with tax regulations

Paycor lets you manage every aspect of your workforce. Give your employees a secure location for accessing their payroll information.

What is Paycor about?

Paycor’s simple yet effective interface offers multiple features, including payroll processing, clocking in/out, tax filing, and more.

Why use Paycor?

Handling payrolls in Paycor will let you keep up with federal, state, and local laws. On the dashboard, you’ll be able to see a breakdown of both employee and employer tax liability.

Paycor is more than just payroll software. With Paycor, employees are able to:

- Log their hours easily,

- Request time off,

- See their pay stubs and benefits, and much more.

Additionally, Paycor provides employers with real-time data insights and detailed reports.

| Type of plan and availability | Paycor pricing and platforms |

|---|---|

| Free plan | No |

| Free trial | Yes |

| Cheapest paid plan | From $99/month |

| Availability | iOS, Android, Web, Mac, Windows |

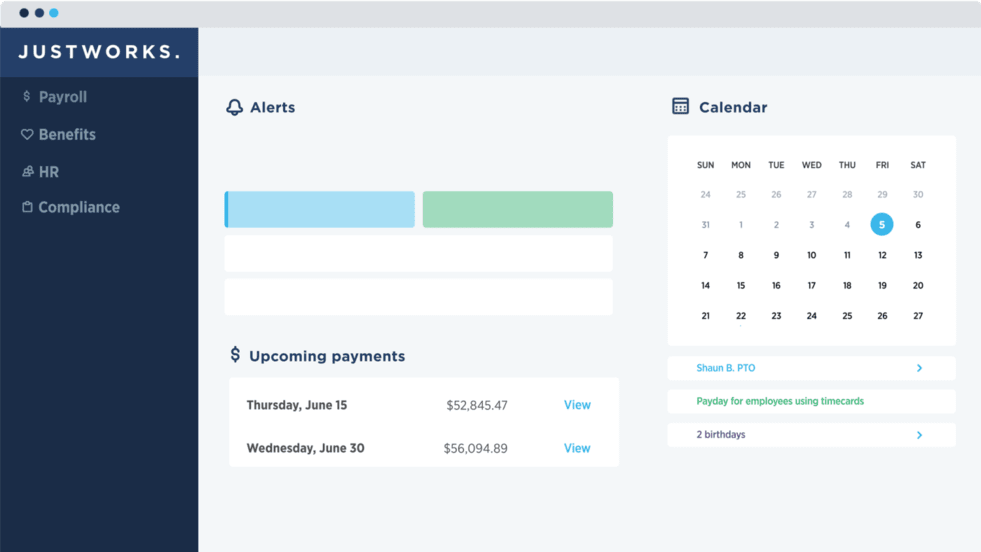

5. Justworks — best for filing taxes and having insights into employee benefits

Run your business with simple software that provides payroll, employee benefits, HR services, compliance, and more.

What is Justworks about?

Justworks lets employees track work hours and sync timesheets to payroll. Moreover, employers will no longer have to worry about employee benefit deductions and tax withholdings if they opt for this app.

Why use Justworks?

Justworks’s easy-to-use interface lets employers see information about upcoming payments and all the necessary details related to employee paychecks, such as:

- Date,

- Delivery method,

- Pay type, and more.

Additionally, the Justworks Plus plan gives you access to healthcare coverage (dental or vision insurance plans), 401(k) savings plans, and COBRA administration. On top of that, Justworks is a perfect solution for small businesses and startups.

| Type of plan and availability | Justworks pricing and platforms |

|---|---|

| Free plan | No |

| Free trial | No |

| Cheapest paid plan | $59/month ($49/month for the 50th employee onwards) |

| Availability | iOS, Android, Web, Mac, Windows |

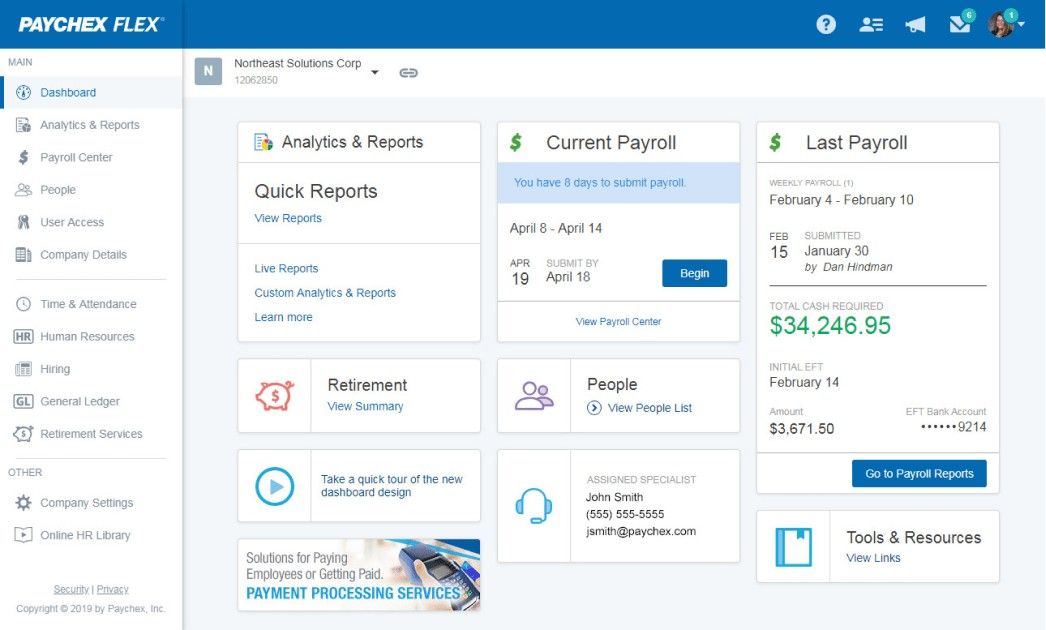

6. Paychex — best for customer support

Paychex presents a single platform for payroll, HR, and benefits.

What is Paychex about?

Paychex is another great solution for payroll, HR, hiring, and managing employees. Paychex eases the burden of being informed about the ever-changing payroll tax rates, making payments to employees, and calculating tax liabilities.

Why use Paychex?

Whether you’re self-employed or a business owner with up to 20 or 1,000+ employees, Paychex will provide HR and payroll solutions either way. Paychex’s neat and easy-to-use interface provides employers with:

- Fast and accurate payroll processing,

- A great customer support service,

- The option to calculate and submit payroll taxes,

- Easy HR tasks handling, and more.

| Type of plan and availability | Paychex pricing and platforms |

|---|---|

| Free plan | No |

| Free trial | Yes |

| Cheapest paid plan | $39/month (+ $5 per employee) |

| Availability | iOS, Android, Mac, Windows, Web |

7. Patriot Software — best affordable software

Patriot allows small business owners to have all the info at their fingertips, whether that’s payroll, tax payments, or even accounting.

What is Patriot Software about?

Patriot is both payroll and accounting software. When it comes to payroll, it provides accurate payment processing and filing payroll taxes for businesses of all types — self-employed or businesses with 2 or 1,000+ employees.

Why use Patriot Software?

Patriot offers everything you need for running a small business in one platform:

- Keeping track of employees and data,

- Customizable and unlimited payroll,

- Calculating taxes,

- Financial reports, and much more.

What’s more, this software provides easier and more affordable accounting for small businesses. With the accounting feature, employers are able to:

- Track the money going in and out,

- Record payments,

- Create custom invoices,

- File 1099 forms electronically, etc.

| Type of plan and availability | Patriot Software pricing and platforms |

|---|---|

| Free plan | No |

| Free trial | Yes |

| Cheapest paid plan | Payroll Software starting at $17/month (+ $4 per employee) Accounting Software starting at $20/month |

| Availability | Web, Mac, Windows |

8. Bonus app: Clockify — best for time tracking

Clockify by CAKE.com is primarily a time tracking app that lets you track work hours across projects. It’s time tracking software used by millions every day.

What is Clockify by CAKE.com about?

Clockify doesn’t provide payroll features per se, it is based on tracking employee work hours (you can choose from different tracking options) and creating automatic timesheets.

Thanks to the report feature in Clockify, employers can have a clear insight into logged hours, overtime work, and even time off. Employers can later export payroll data in any format they need — PDF, CSV, or Excel.

Why use Clockify by CAKE.com?

By simply tracking your or your employees’ work hours, Clockify lets you automatically:

- Create timesheets,

- Send reminders if an employee forgets to log their work hours,

- Create instant invoices, and

- Export payroll hour reports.

Moreover, Clockify gives you the option to set hourly rates for projects or tasks and distinguish between billable and nonbillable hours.

Since it offers an array of features, Clockify is a perfect fit for consultants, accountants, small and medium businesses. You may choose between different plans and find the pricing plan that fits your needs.

| Type of plan and availability | Clockify by CAKE.com pricing and platforms |

|---|---|

| Free plan | Yes |

| Free trial | Yes |

| Cheapest paid plan | $3.99/month/user |

| Availability | Android, iOS, Web, Mac, Windows, Linux |

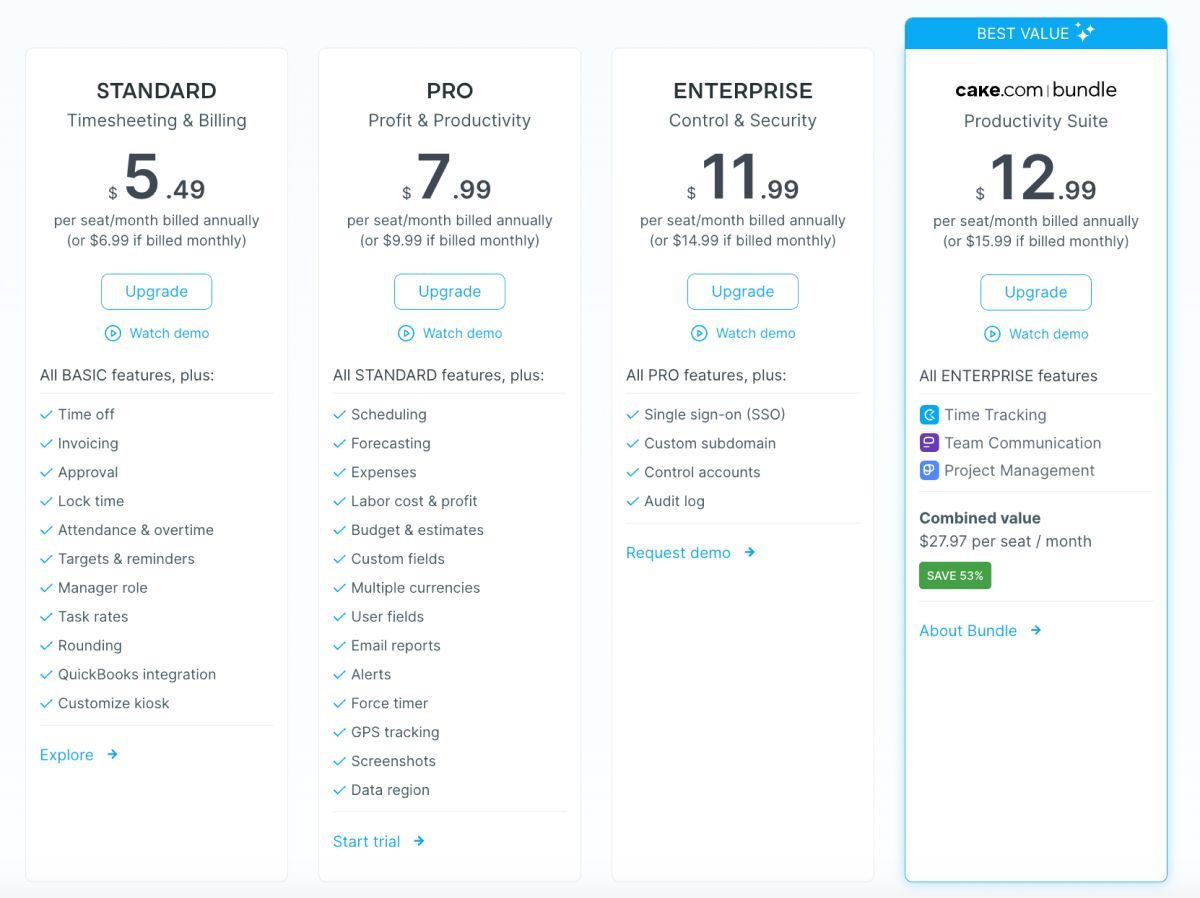

To learn more about Clockify pricing, plans, and related features, take a look at the image below:

Wrapping up: Payroll software simplifies employee and payroll management, reduces errors, and saves precious resources

After reading about the importance and benefits of using payroll software, we hope that we have eliminated any doubts that you may (or may not) have had regarding payroll software’s efficiency and accuracy. Remember — the best payroll software must:

- Provide automatic processing,

- Be reliable and compliant with tax regulations, and

- Provide features such as invoicing, creating reports, and time tracking.

Still, keep in mind that a perfect payroll software must first and foremost meet your specific business needs! We hope we’ve helped you find a perfect fit for your needs. Happy payroll handling!