Getting paid shouldn’t be the hardest part of your job.

Still, many freelancers and small business owners face the same frustrating cycle — you track hours in one app, calculate rates in another, and manually create invoices that somehow miss billable time.

Here, we’ll show you how to automate client invoicing with Clockify — from tracking your first billable hour to getting paid faster with professional, accurate invoices.

What’s client invoicing and why automate it?

Client invoicing is the process of billing clients for services rendered or products delivered. In short, a professional invoice documents:

- What you did,

- When you did it,

- How much time it took, and

- What the client owes.

Also, here’s why automation matters:

#1: Manual invoicing eats your time — between tracking hours in spreadsheets, calculating totals, formatting documents, and emailing clients, you’re spending hours each month on administrative instead of billable work.

#2: You’re losing money — manual time tracking leads to underreporting of hours. That’s revenue disappearing because you forgot to log a client call or rounded down your time. Annually, inaccurate or missing timesheets cost professional service firms more than $63K per employee.

#3: Late payments hurt cash flow — without automated reminders and a streamlined payment process, you’re chasing clients for money instead of focusing on your next project.

#4: Your records are scattered — come tax season, you’re digging through emails, bank statements, and half-forgotten spreadsheets, trying to reconstruct your income and expenses.

Client invoicing software like Clockify by CAKE.com solves these problems by connecting your time tracking directly to your invoices.

What information should you include in a professional invoice?

A professional invoice protects both you and your client. It creates a clear record of work completed and payment expected. That said, every invoice should include:

- Your business information — your name or business name, address, phone number, and email. If you have a business registration number or tax ID, include that, too.

- Client information — client’s name or company name, address, and contact details.

- Invoice number — a unique identifier for your and your client’s records (e.g., INV-001).

- Invoice date and due date — when you issued the invoice and when payment is expected.

- Itemized services or products — what you did, how long it took, and your rate (e.g., “homepage redesign — 8 hours at $100/hour”).

- Total amount due — the bottom line, including any taxes if applicable.

- Payment terms — whatever you agreed upon (like Net 15 or Net 30, for example). Add a late fee policy if you have one.

- Payment methods — how clients can pay you (e.g., bank transfer details, payment platform links, etc.).

Clockify automatically populates most of this information from your tracked time and project details, so you’re not starting from scratch every time.

How to use automatic client invoicing in Clockify by CAKE.com

Losing track of billable hours, chasing down late payments, and the administrative burden of manually creating invoices for every client project can quickly eat up your profitability.

To keep your peace of mind, a user-friendly time tracking and invoicing software like Clockify can transform your workflow. Use it to turn tracked billable hours into detailed invoices in minutes.

#1: Track billable hours and log expenses

The biggest issue for those who create invoices manually is gathering all the data. Clockify lets you capture this data as you work.

Here’s how:

Start the timer — when you begin work on a client task, simply start the timer in the Clockify desktop, mobile, or browser app. Also, link the time entry to the correct client and project.

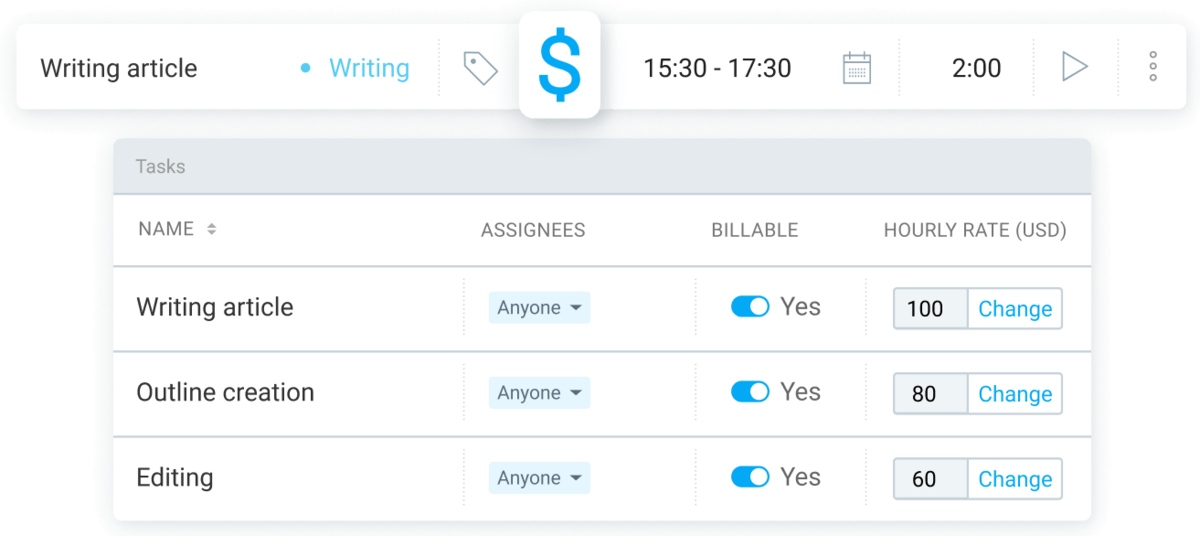

Mark as billable — make sure the time entries are marked as billable. This separates the work you need to charge for from internal or non-billable admin time, preventing errors and ensuring accurate billing.

Use descriptive entries — a vague time entry can lead to client disputes. Instead, use detailed descriptions (e.g., “Drafting initial marketing strategy for winter holiday 2025 campaign”) that will then appear directly on the invoice, providing justification for your charges.

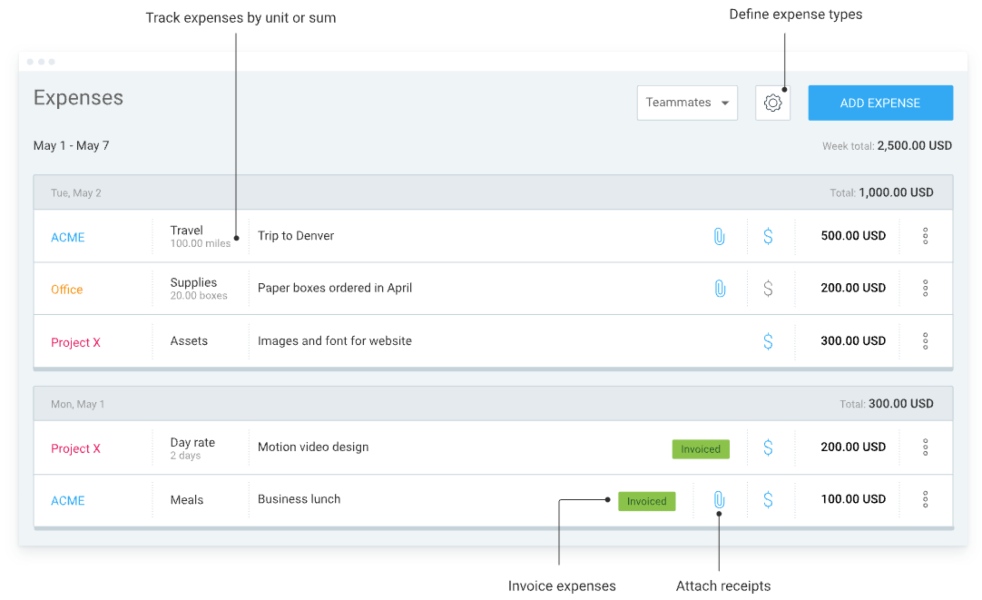

Also, some billable expenses get forgotten too often, such as materials, software subscriptions needed for a project, or even travel. Not to mention they’re a pain to track in a separate spreadsheet.

As a simple billing software for clients, Clockify by CAKE.com allows you to log expenses directly to a project, including a description and a receipt attachment.

When you link expenses to the correct client and project from the start, you’ll ensure every cost is accounted for and included when you generate the invoice.

By using Clockify to track every hour and expense, you build a solid audit trail. This helps you justify your invoice and removes the basis for client disputes, ensuring you get paid for all the work you perform.

Track time and expenses in Clockify

#2: Generate and customize your invoice

Stop dreading invoicing your clients every time you complete a project or approach the billing cycle. With Clockify’s automatic invoicing, the whole process moves from tedious data gathering to quick click-and-review.

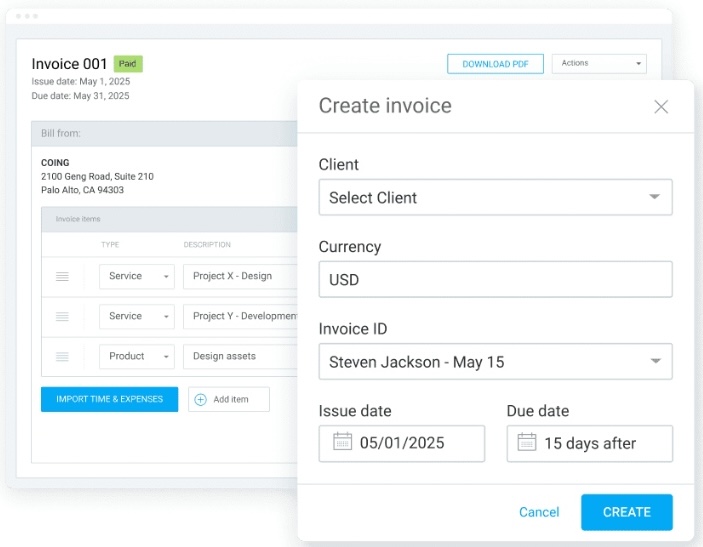

Here’s how to make an invoice in Clockify:

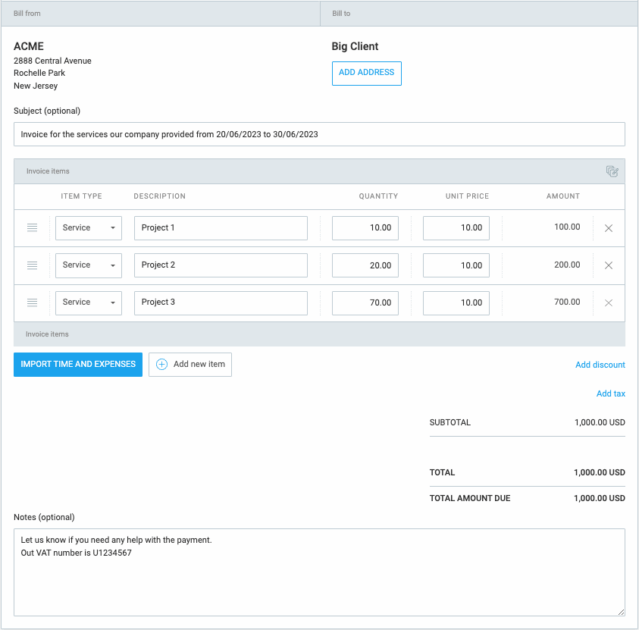

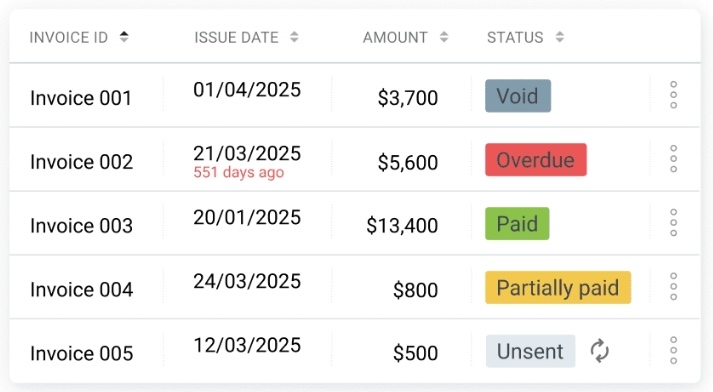

- Click Create invoice — go to the Invoices section in Clockify and initiate the process.

- Select the client — choose the client and change currency, invoice number, and issue/due dates if necessary.

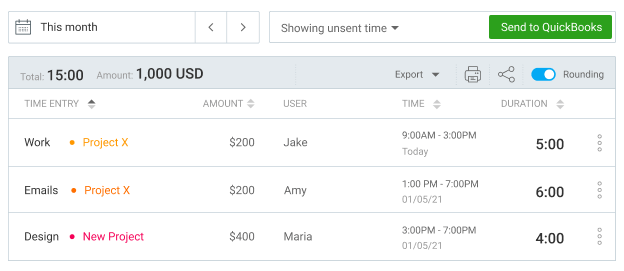

- Import tracked time and expenses — automatically pull all the tracked uninvoiced billable hours and expenses for specific client projects and date range.

- Write your payment terms — add your payment terms in the notes section (like accepted payment methods, instructions on how to make a payment, etc.).

- Review and adjust — remove or add items before finalizing the invoice, including discounts and taxes, etc.

When you run a small business, looking professional can make all the difference in gaining client trust. Clockify’s online invoice generator helps you project a polished image.

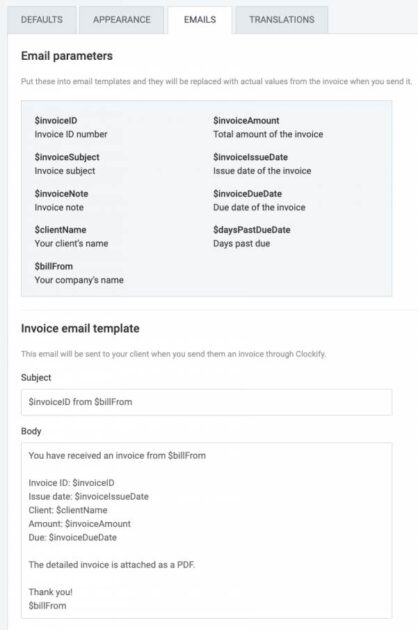

You can upload your company logo and change up the email template you use when sending the invoice to clients. And for more invoice template customization options, check out our Marketplace add-ons.

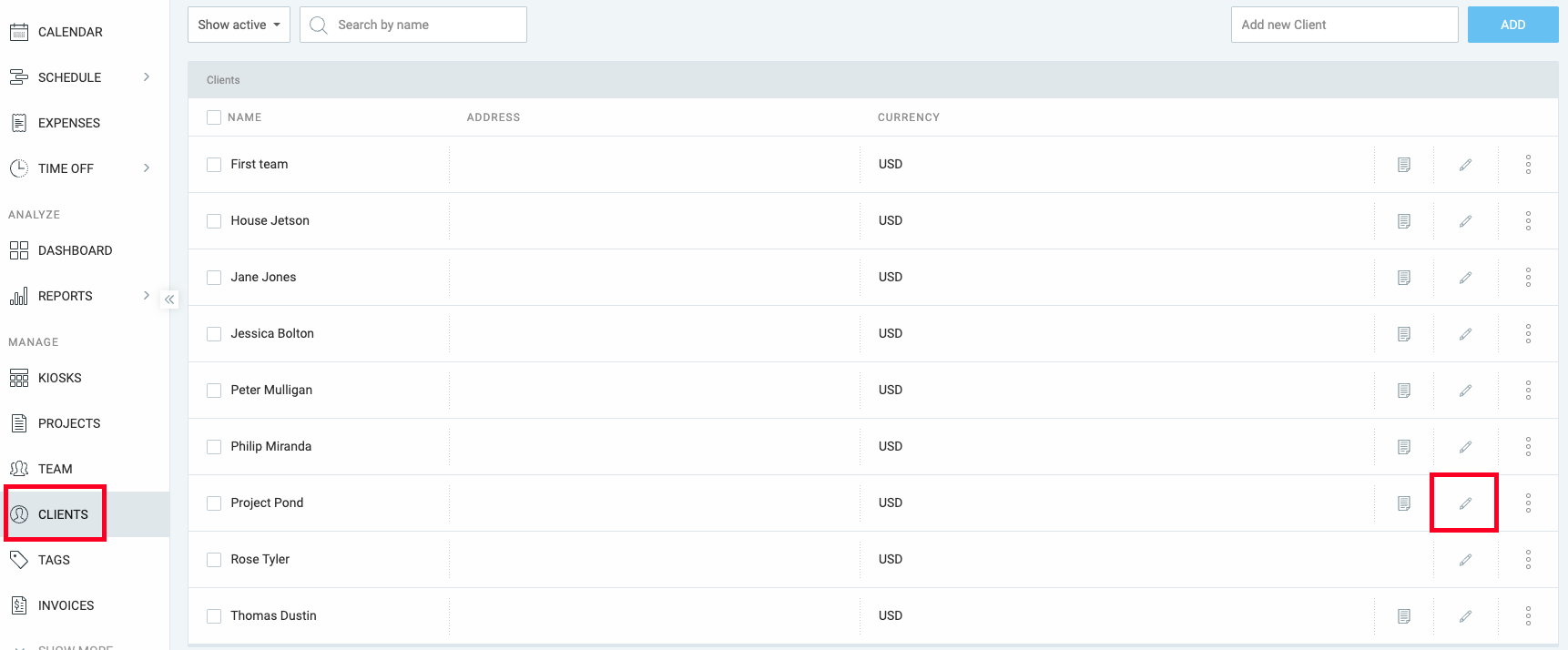

If you’re juggling multiple clients, Clockify’s client management software capabilities keep you organized — all client-specific data is stored in one place. To generate a new invoice, all you have to do is select the client name from the dropdown menu.

💡 CLOCKIFY PRO TIP

Read about how Rachael McDiarmid, the Director of RM Marketing Services, uses Clockify to manage hundreds of clients:

#3: Automate delivery and payment

The automation of client invoicing in Clockify doesn’t stop with invoice creation. The real efficiency comes from automating the next steps:

- Sending,

- Receiving payment, and

- Following up.

Once the invoice is generated, you can send it via email directly from the platform. It can be sent as a PDF attachment. Clockify immediately updates the invoice status, giving you a clear financial overview.

Speaking of finances, getting paid faster is critical for your financial health. That’s where Clockify integrations can make the payment process even smoother. For instance, integrate Clockify with QuickBooks or with PayPal via Zapier.

Integrations remove friction in the payment process, making it very convenient for your clients and speeding up your payment cycle.

Business growth strategist and founder of a marketing firm for service businesses, Jensen Savage, says that dedicated software to automate invoicing has been extremely helpful for both efficiency and cash flow:

“Before automating our invoicing, my team and I spent a lot of time manually preparing invoices and chasing down clients when payments were past due.”

Now, Jensen says everything is streamlined — recurring invoices are sent automatically, and clients can even elect to keep a payment on file to be charged each month automatically.

💡 CLOCKIFY PRO TIP

Zapier acts as a middleman between Clockify and 2,900+ other apps! Check out this article to learn more about your options:

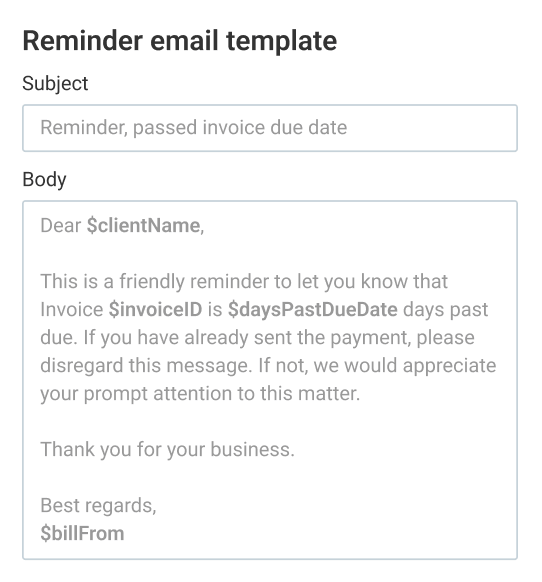

Clockify by CAKE.com also allows you to schedule automatic email reminders for invoices that are near or past their due date. This way, the system handles the awkward follow-up, so you don’t have to manually track and email clients to ask for payment.

By integrating time tracking, invoice generation, sending, and automated reminders into one fluid workflow, you dramatically reduce the time (and stress!) spent on admin work.

Automate invoicing with Clockify

#4: Manage finances and taxes

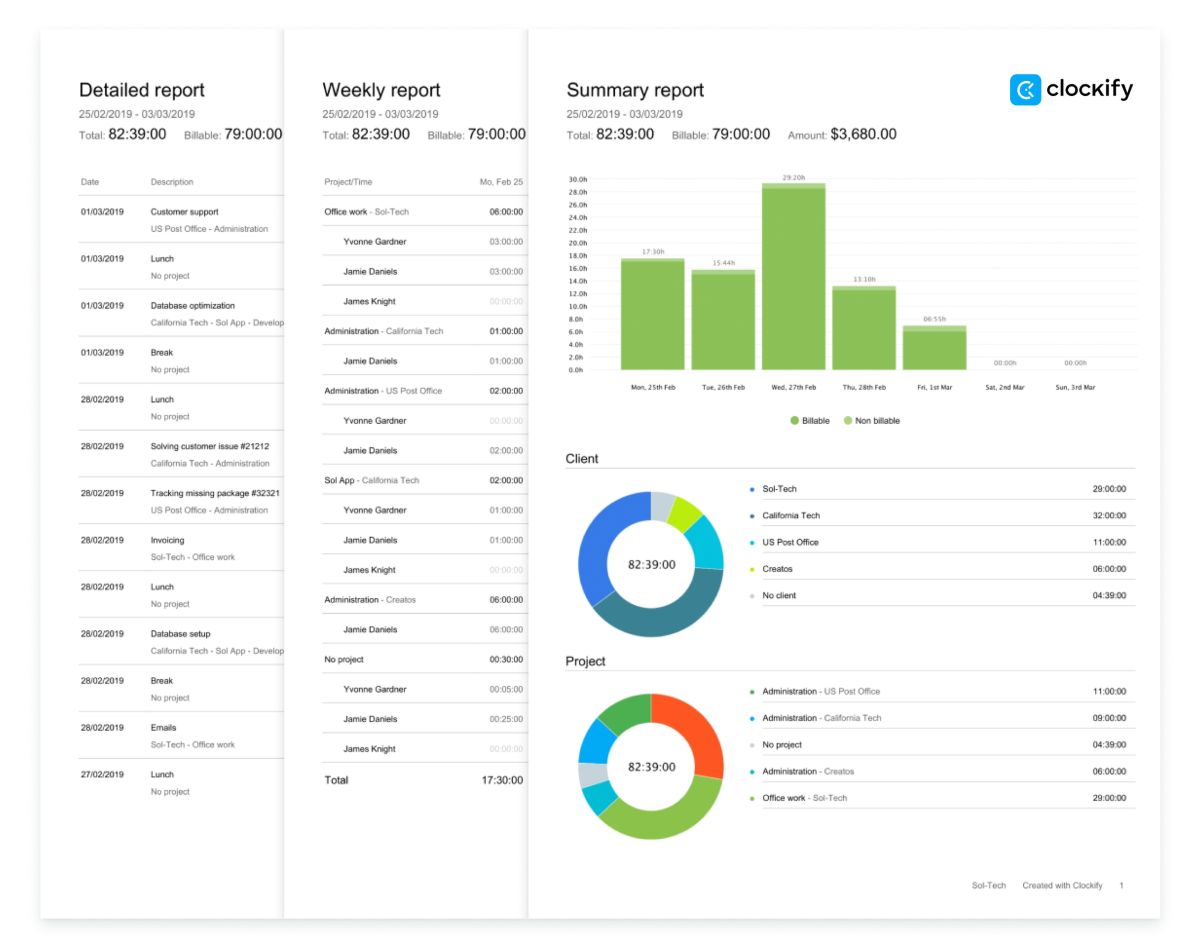

Clockify invoicing software for small businesses helps you gain clear insight into your financial health. Thanks to powerful reporting features, you can stay on top of your cash flow management. For example, the dashboard will show the breakdown between billable and non-billable hours — and your earnings within a specific time period.

With the summary report, you can get more information on specific projects, users, clients, dates, and related earnings. And in the detailed report, you can differentiate between invoiced and uninvoiced time entries.

You even have the option to get a full expense report and send it to your client together with the invoice. All reports can be exported to PDF, CSV, and Excel.

By having all your billable hours, expenses, and a record of paid/unpaid invoices in one place, you can greatly simplify your finances, making tax season far less stressful and confusing.

Founder and CEO of a tax and accounting firm, J.R. Faris, reveals that invoice automation has revolutionized their business performance:

“It has allowed our accountants to focus more of their time on valuable consulting work, which enhances their relationship with their clients. It has also had an enormous impact on our accuracy as our billing errors were reduced by approximately 70% in one quarter.”

J.R. also says that the automated reminders to their clients generated a 30% increase in on-time payments, which created predictability with revenue and cash flow.

💡 CLOCKIFY PRO TIP

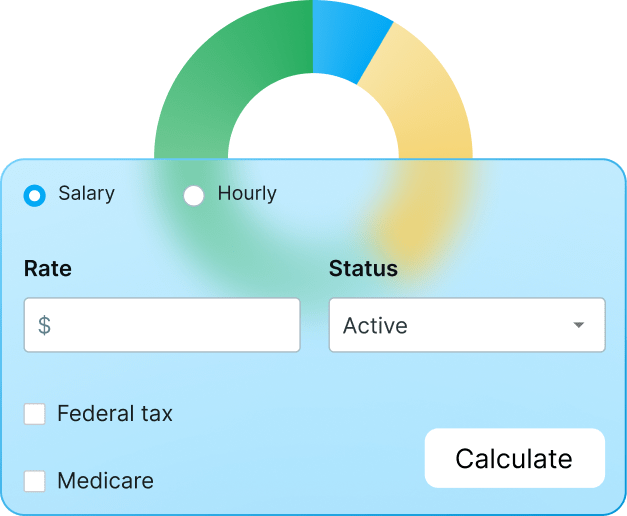

Learn how to pay taxes as an independent contractor and use our free self-employment tax calculator:

FAQs about client invoicing

Find more information about billing your clients and automatic invoicing in this section.

What are common types of invoices?

The most common types of invoices include:

- Pro forma — an estimated invoice sent before the work starts,

- Interim — an invoice sent during a long project for partial payment,

- Recurring — an invoice sent automatically at regular intervals for retainer work,

- Final — an invoice sent upon completion of service.

💡 CLOCKIFY PRO TIP

Check out this article to better understand how recurring billing works and its biggest cons and pros:

How do I set clear payment terms?

Payment terms are the conditions under which you’ll accept the payment — and they should be discussed from the very beginning. Make them clear and non-negotiable (e.g., Payment due Net 30).

Also, be specific about accepted payment methods and late fees. When using Clockify by CAKE.com as your invoice app, you can always enter all this information in the Notes section of your invoice.

What’s the difference between an invoice and a receipt?

An invoice is a request for payment sent by the seller to the buyer.

⬇️ Download Free Invoice Templates for Freelancers

A receipt is confirmation of payment sent by the seller to the buyer after the payment has been made.

How do I track my time and expenses for a client project?

The most effective method is to use a powerful and dedicated system like Clockify.

Start a timer when you begin work and log any related expenses instantly. Ensure all time entries are linked to the specific client and project and marked as billable.

How do I automate the invoicing process?

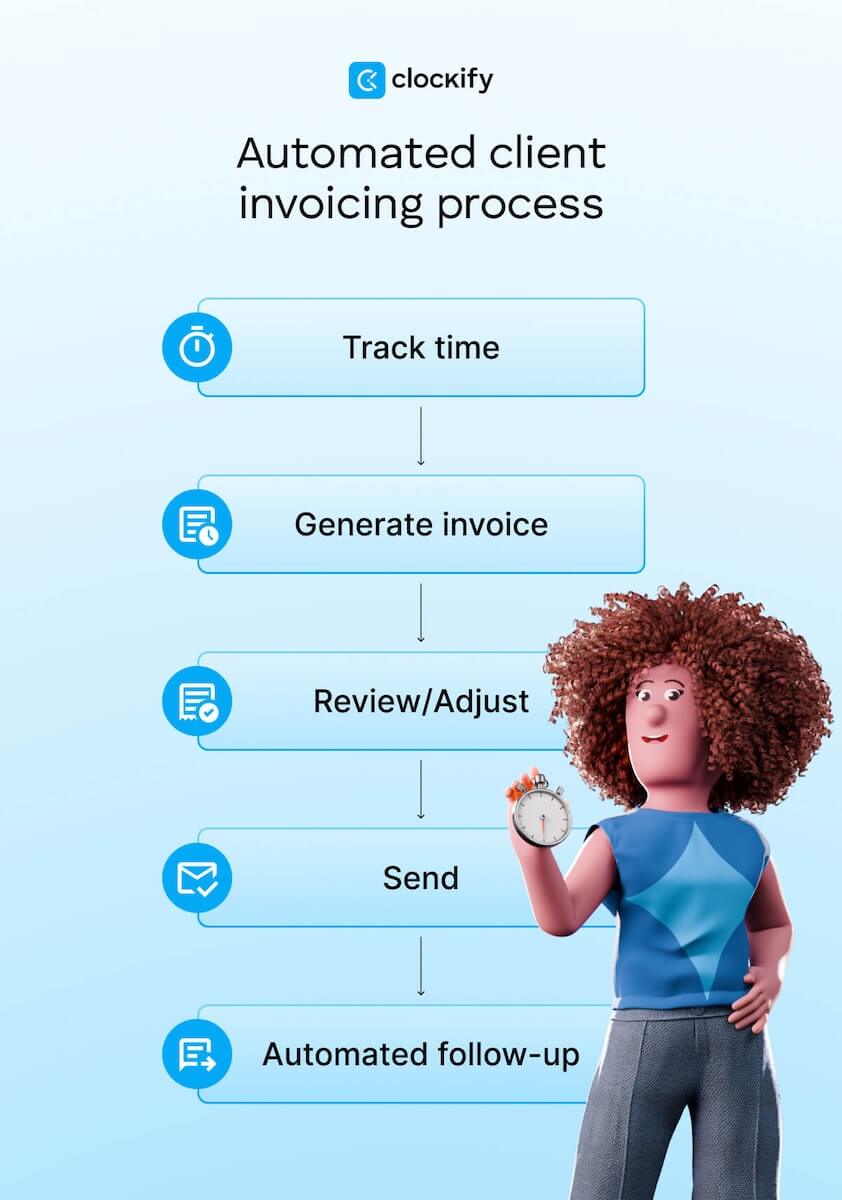

To automate client invoicing, use no-nonsense software like Clockify that automatically connects time/expense tracking to invoice generation. The process flow should look something like this:

Marketing director of a PR company, Leury Pichardo, believes that the true value of automated invoicing lies in reclaiming your focus:

“The crazy thing isn’t just the time you get back…. it’s the headspace that you free up. Suddenly, you’re not spending your best energy worrying about cash flow. You’re using it to plot your next move.”

Leury says that’s “the real payoff” because you stop being an administrator and get back to being a founder.

How can I manage multiple clients and projects without getting disorganized?

Use a single time and billing software for clients, such as Clockify, to centralize all your data.

With projects, tasks, and client tags, you can organize every time entry and expense. Thanks to this, you get to instantly pull up all relevant data for any client.

💡 CLOCKIFY PRO TIP

Check out our list of the best tools to track billable hours and provide clients with clear invoices and reports:

Simplify client invoicing with Clockify by CAKE.com

With Clockify as your time tracking and client invoicing tool, you can finally stop losing money to forgotten hours.

Clockify connects your time tracking data directly to a professional invoice creator, so you get paid accurately for every hour worked — with minimal admin effort.

But small business optimization goes beyond just billing. To manage your entire operation with confidence, you need an integrated suite of tools. CAKE.com Productivity Bundle includes enterprise-level features of 3 essential tools — at a fraction of the price:

- Clockify for time tracking, expense logging, and effortless automatic invoicing,

- Plaky for flexible project management and task organization, and

- Pumble for efficient team communication and collaboration.

Automate more than just client invoicing — think along the lines of the entire business foundation. As we at CAKE.com like to say, “Don’t settle for pieces. Get the whole cake.”