Payroll Statistics for 2026: Tax, Outsourcing, Software, and More

What is the average payroll accuracy rate? How does automating payroll make the process more efficient? And just how much do payroll mistakes cost businesses today?

In this article, we’ll focus on recent payroll data and statistics — as well as surveys, trends, and research related to:

- Payroll processes for small-business owners.

- Practical findings and conclusions about payroll tax.

- How payroll outsourcing affects employers and employees.

- Manual vs automated payroll management through third-party software.

- Payroll errors, the most common problems, costs, and solutions.

Let’s dive right in.

Crucial 2026 payroll statistics

- 88% of small businesses deem the tax laws too complex to manage their own payroll taxes.

- 13.6% more revenue was collected by the IRS in FY 2024 for past-due taxes and penalties.

- 423,450 taxpayers participated in the IRS Direct File pilot in 2024.

- 34% of small businesses use an external firm to prepare payroll.

- Only 21% of small businesses use a third-party platform or software for payroll.

- 25% of employees say tighter data security is the most important improvement they want from their payroll technology.

- 78% is the average payroll accuracy rate globally.

- 18% of employees experienced payroll mistakes 3+ times in a single year.

- 18.7% of employees are “very comfortable” with AI calculating their pay.

- 24% of employees who faced a payroll issue also reported receiving a late payment.

#1: Small business payroll statistics in 2026

This section will cover payroll statistics, with a focus on small businesses for 2026.

39% of all private sector payroll in the US is paid by small businesses

According to the SBA’s Office of Advocacy, small businesses account for more than one-third of the US private-sector payroll, underscoring their critical role in the US economy.

This also implies that nearly 40% of the nation’s spending power relies on the cash flow from businesses that often work on tight cash reserves.

90% of small business owners consult external tax professionals

The most recent NFIB Tax Survey reports that most small business owners work with an external tax professional, primarily because they find the tax code too complex to handle internally.

Unlike large corporations with in-house tax departments, small business owners face a tough choice: risk severe penalties by handling it themselves or pay a premium for external help.

80% of the net new jobs in the US economy were generated by small businesses

As the latest SBA Small Business Profile suggests, approximately 2.6 million new jobs (or 80%) in the US came from small businesses.

This implies that small businesses are competing directly with large corporations for the same talent pool.

Having a professional, seamless payroll and benefits portal is becoming a critical part of employer branding, signaling to candidates that the business is stable, professional, and reliable, regardless of its size.

1 in 3 small businesses report significant supply chain impacts

According to NFIB: Small Business Economic Trends, 33% of all small business owners reported significant or moderate supply chain impacts.

In other words, small businesses are being forced to maintain higher cash reserves or use expensive lines of credit just to bridge the gap between paying employees and receiving delayed customer payments.

As expected, the supply chain chaos often leads to missed deadlines. In turn, maintaining tight control over employee scheduling enables a business owner to provide accurate, data-backed updates to customers about potential delays. This preserves the business-client relationship through transparency rather than guesswork.

12% of small business owners plan to increase total employment in the near future

NFIB’s report also states that more than 10% of small business owners plan to expand their workforces. Although this signals business owner optimism, it also entails increased overhead costs to support the new hires, such as:

- Insurance,

- Software licenses, and

- Office space.

For employee retention and scaling, a streamlined work management system can significantly improve retention rates during the critical first 90 days of employment.

🎓 Employee Time Management Guide for Efficient Teams

1.2 million new small business establishments opened in the last measured period

As per the SBA’s Small Business Profile, the “post-pandemic entrepreneur boom” gave birth to 1.2 million new businesses. This created a massive demand for B2B services related to accurate payroll hour tracking.

New businesses often require external funding to survive their first year. On the other hand, lenders require impeccable financial records. For that purpose, a dedicated time-tracking system provides professional “books” that bankers trust, whereas manual records are prone to errors and can lead to loan rejections.

88% of small businesses deem the tax laws too complex to manage their own payroll taxes

The most recent NFIB survey highlights a pressing small-business payroll statistic: the primary reason small businesses hire tax professionals is the overwhelming complexity of tax law.

If the business owner is the only one with the expertise to navigate complex tax rules, this represents a “key person risk.” The absence of this person could lead to catastrophic failure for the company — this is often the case for small businesses.

Outsourcing or automating compliance ensures the business can continue to operate and pay staff even during an extended absence. In any case, this statistic largely implies that fear of error could be the main factor in payroll outsourcing decisions for small businesses — not the strive for efficiency.

31% of small businesses are now hiring freelancers for specialized skills

According to a recent survey by the Upwork Research Institute, almost 1/3 of small businesses are turning to independent talent.

Many small business owners hire freelancers to avoid the high costs of taxes, insurance, and benefits. This converts a fixed monthly salary cost into a flexible expense they can reduce if business slows, but it exposes them to severe legal penalties for worker misclassification.

When SMB owners control how and when work is done and provide the equipment, government agencies likely consider that worker an employee. This can lead to audits — as well as legal and financial consequences.

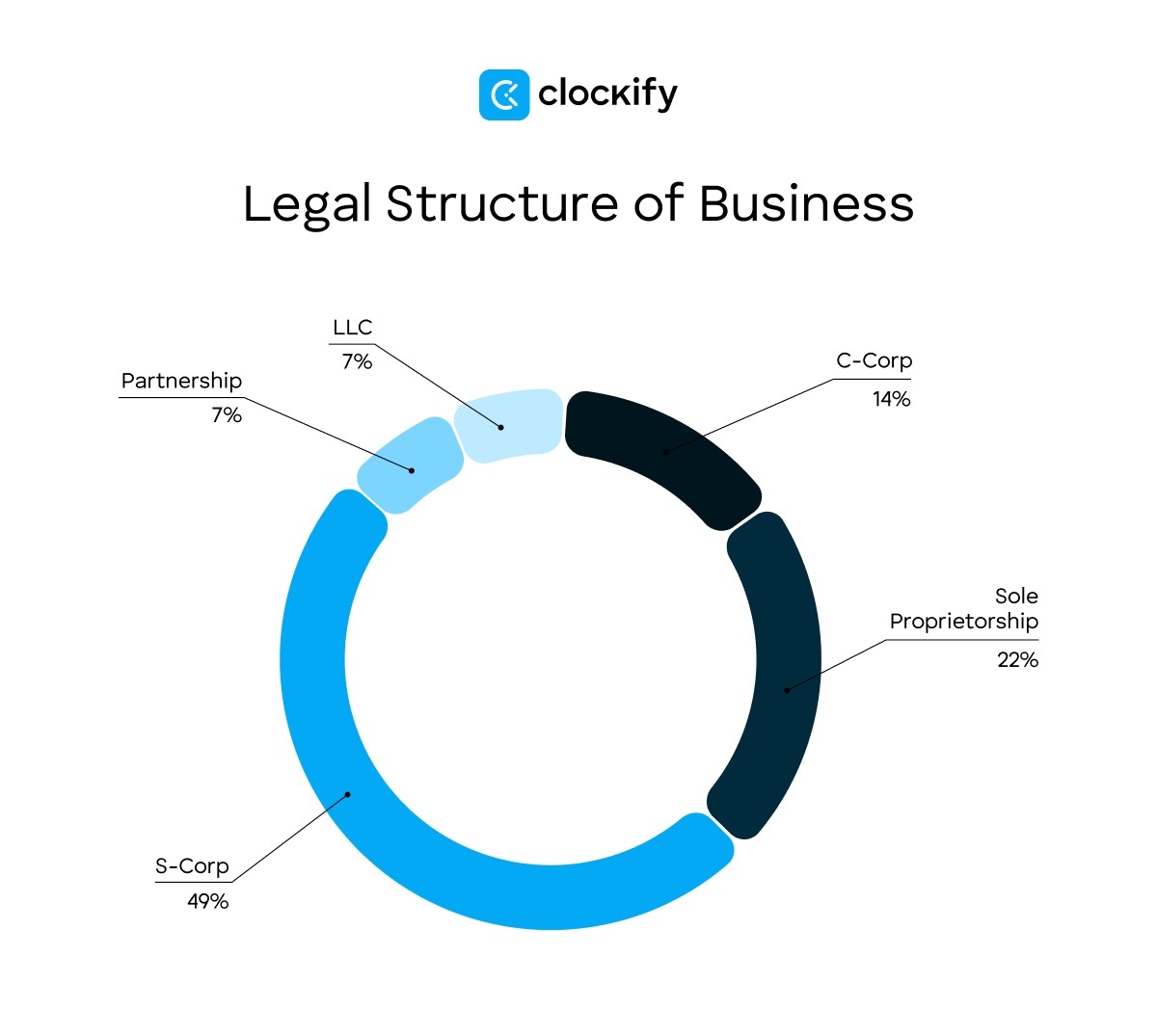

22% of small businesses operate as sole proprietorships

NFIB’s report also states that more than 1/5 of businesses operate as sole proprietorships, where payroll and personal income taxes are often intertwined.

Many sole proprietorships eventually need to convert to an LLC or an S corporation for liability protection.

If payroll and personal funds have been mixed for years, this legal transition is expensive and legally messy. Proper separation through accurate tracking now future-proofs the business for easy legal restructuring later.

Here’s what the business structure looks like, according to the latest available data:

#2: Payroll tax statistics for 2026

In this section, we’ve gathered tax-related payroll statistics and facts.

13.6% more money was collected by the IRS in FY 2024 for past due taxes and penalties

According to the IRS’s recent Data Book News Release, the agency collected $77.6 billion in federal taxes reported or assessed but not paid — 13.6% more than the previous fiscal year.

For several years during and immediately after the pandemic, the IRS suspended many automated collection notices to offer relief. In 2024, that “tax pause” ended.

The IRS now uses automated tools to flag discrepancies more quickly. Businesses that could previously delay tax payments for a few months without notice are now being flagged almost immediately.

🎓 15 Self-Employment Tax Deductions You Must Know

26% more inquiries were made on the Where's My Refund? tool in FY 2024

The Where's My Refund? tool, which enables taxpayers to check the status of their tax refunds, was used over 382 million times.

That’s a 26% increase compared to the prior fiscal year, according to the same IRS news release. The rise highlights just how intensely the workforce focuses on tax liquidity.

12% more taxes were collected through installment agreements in FY 2024

The IRS’s news release also shows an increase in businesses financing their tax liabilities over time. The total amount of individual and SMB taxes collected through installment payments was $16 billion.

This shows that taxpayers want to comply, but they are increasingly lacking the liquidity to do so in a lump sum. It also indicates a cash-flow crisis for both individuals and small businesses that rely on the IRS as a “last-resort lender” — either because bank credit is tight or interest rates are too high.

96% of all funding for the federal government is generated through IRS collections

This fact underscores the pressure on the agency to strictly enforce payroll tax deposits.

The $5.1 trillion in gross revenues account for about 96% of the funding supporting the federal government’s operations, according to the IRS’s recent Data Book.

🎓 How to do payroll for small business

423,450 taxpayers participated in the IRS “Direct File” pilot in 2024

While 423,450 taxpayers logged into the Direct File program, 140,803 of them submitted an accepted return, according to the IRS’s data book. This number signals a shift toward government-run direct reporting, which will eventually affect payroll filing.

As the IRS moves toward direct, real-time data ingestion, businesses relying on paper or manual spreadsheets will eventually be unable to meet federal reporting standards, prompting them to switch to modern digital payroll platforms.

#3: Payroll outsourcing statistics in 2026

This section focuses on payroll outsourcing trends for businesses of various scales.

94% of business leaders request full payroll-HR integration

According to ADP’s Potential of Payroll survey, almost all businesses would like full payroll-HR integration. However, the report also states that only a minority currently has this workflow.

Global companies seeking to solve the data silo problem want payroll to talk to HR so they can answer strategic questions such as "Are we paying our most productive sales people enough to keep them?"

These systems go hand in hand with standardized time-tracking practices to ensure both accurate pay and compliance with tax regulations.

69% of organizations consider outsourcing most or all of their payroll

As ADP’s survey further suggests, most organizations surveyed plan to delegate the majority of payroll tasks to external professionals.

Companies are realizing that their internal payroll teams are slowed by manual data entry and frequent error correction. Outsourcing manual processes frees internal teams to focus on more strategic tasks.

Sales director at a manufacturing company, Ruben Nigaglioni, says the truth about payroll outsourcing isn’t black and white:

By outsourcing payroll, companies aren’t just buying processing power — they’re essentially buying precise data.

In 2026, a more practical approach is to use reliable work-tracking tools that allow leaders to clearly see the total cost of the workforce. This way, leaders can plan budgets efficiently by reallocating funds from administration to strategic growth.

83% of executives leverage AI as part of their outsourced services

The Deloitte Global Outsourcing Survey finds that the vast majority of businesses use AI to improve efficiency, while 20% are already developing strategies to manage these digital workers. This high adoption rate implies that AI is becoming a more widely used tool for payroll. However, the change comes with a caveat, according to our payroll experts.

When asked about AI for payroll, Max Emma, Chief Bookkeeping Officer at an accounting company, told us:

Max emphasizes that you need human review on anything outside standard patterns or “you’ll generate errors faster than manual processing ever did.”

35% of global organizations lack a global insights dashboard

As ADP’s report also points out, many businesses lack a centralized view of their payroll, prompting them to outsource to providers that offer unified reporting.

Without a unified view, executives can’t spot trends in overtime spend, gender pay gaps, or retention risks until weeks after the payroll cycle closes.

This is where time-tracking software like Clockify can help organizations identify trends and better manage their payroll budget. For example, spotting macro-trends such as rising overtime in one region versus underutilization of teams in another makes it easier to optimize an organization’s global labor spend.

Consistent with the previous point, the same report notes that nearly 1/3 of surveyed companies (31%) lack standardized payroll data across regions, further complicating data optimization.

44% of organizations plan to implement workforce management technologies

Nearly half of respondents to PayrollOrg’s Global Workforce Management survey say they plan to implement new technologies to manage their outsourced workforce.

The new tech is needed to track teams where some people are paid by the hour, others by the project, or via third-party platforms. Properly tracking project times is a prerequisite for accurately allocating labor costs and ensuring compliance with various wage and hour regulations.

New workforce management (WFM) technologies provide a form of “digital fence” to monitor work hours in real time, and prevent unauthorized overtime before it happens — rather than just paying for it afterwards.

🎓 Workforce Management – Maximizing Efficiency and Performance

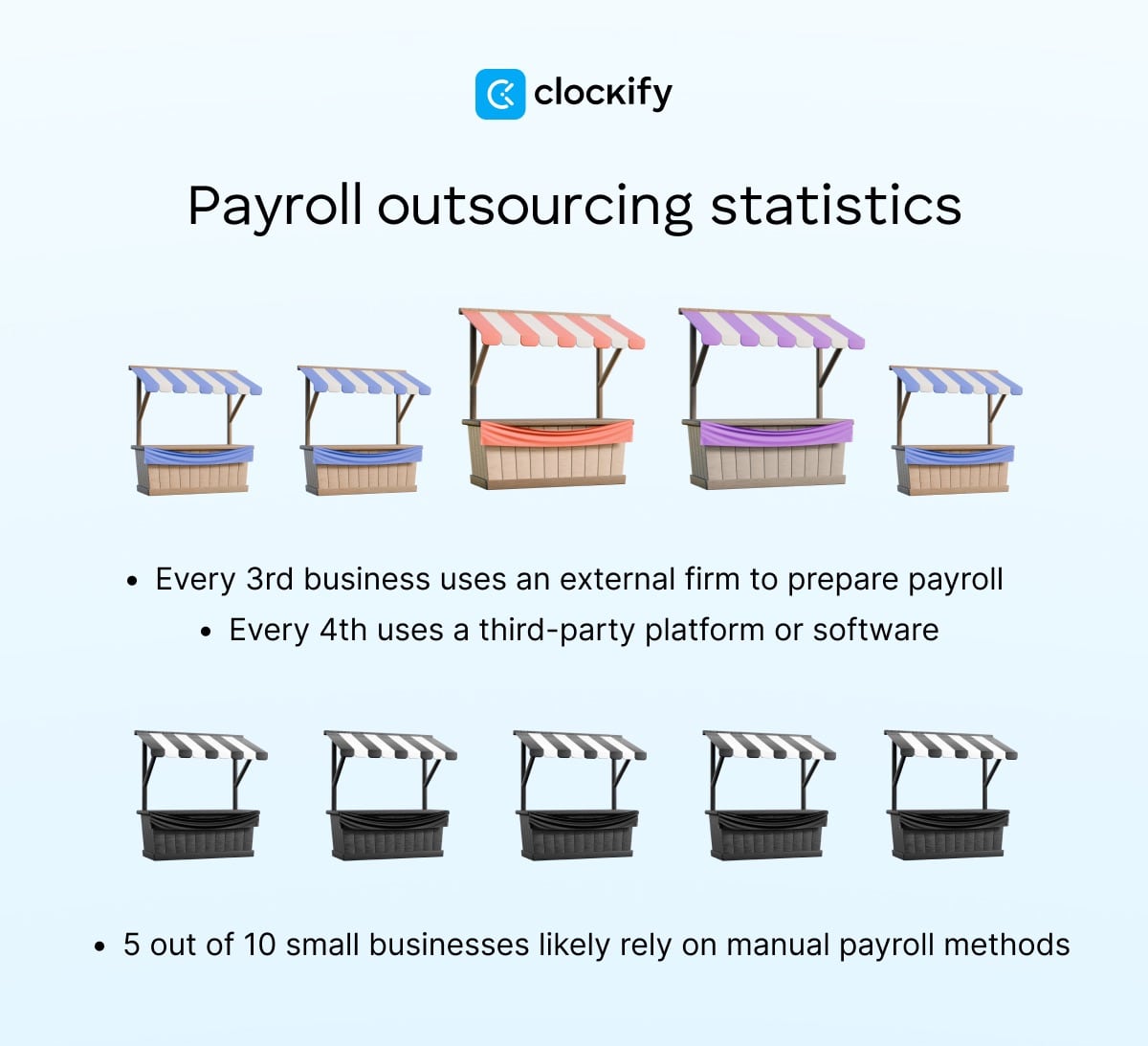

34% of small businesses use an external firm to prepare payroll

According to the 2025 NSBA Small Business Taxation Survey, small businesses rely slightly more on fully outsourcing payroll than on using dedicated payroll apps from an external provider.

Small business owners are often terrified of the IRS. The National Small Business Association’s data consistently shows that tax complexity is a top burdenfor small businesses in particular.

The remaining 45% of small businesses likely use manual methods, such as spreadsheets or pen and paper. This is the danger zone where the vast majority of IRS penalties for miscalculation occur.

Unfortunately, this massive portion of the market (almost half) that doesn’t automate payroll processes is highly vulnerable to simple math errors.

#4: Payroll software statistics in 2026

Let’s now review key statistics and data on payroll-related technologies and payroll management software.

91.9% of Americans now receive their wages via direct deposit

PayrollOrg’s Getting Paid In America survey results show that electronic pay transfer is no longer a perk but a baseline expectation. Today, the vast majority of wages are paid electronically.

This eliminates the time spent printing, signing, and mailing physical checks — and eliminates postage costs.

🎓 Pay Independent Contractors (1099 Workers) in 5 Simple Steps

18.7% of employees are “very comfortable” with AI calculating their pay

The same survey by PayrollOrg also suggests that less than 20% of employees trust automated systems to calculate their pay. This low adoption suggests that, over the next 3-5 years, AI will likely remain a backend tool for anomaly detection rather than the primary tool for payroll tasks.

Today, companies often employ a hybrid system in which AI flags potential errors and anomalies for review, rather than autonomously finalizing pay. This hybrid approach utilizes technology to reduce error while maintaining the human oversight that employees trust.

We asked Guillermo Triana, the CEO of an HR consulting company, how much he relies on AI for payroll. He says he believes in artificial intelligence to do math and identify patterns, yet only to a certain extent:

Guillermo argues that today, AI is a highly advanced calculator without context.

84% of employees report that their employer provides a self-service portal to access pay and benefits

PayrollOrg’s findings also show a large number of employees who responded positively to an online self-service portal for accessing information on pay and benefits. This suggests that employees typically have good experience with a digitized workforce environment — the absence of such systems could even be seen as outdated.

Additionally, if employees can log in to view their timecards and pay stubs, they’re responsible for verifying their hours before the pay period closes. That way, the burden of accuracy shifts from the payroll manager to the workforce.

This verification is best enabled through the use of dedicated attendance-tracking systems that measure:

- Work hours,

- Breaks,

- Overtime, and

- Time off.

26% of organizations prioritize integration of payroll data with other business systems

According to ADP’s survey, about 1/4 of organizations want to integrate payroll data with systems like accounting and time tracking. This would likely solve the common double-entry problem. When payroll isn’t integrated with the accounting or time-tracking software, people have to manually and tediously move the data.

That’s where most time is wasted. The push for integration is a push to eliminate the countless spreadsheets that still hold many businesses together.

Integrating payroll with accounting and time-tracking systems allows businesses to map labor costs to revenue generation in real time. This helps managers see when overtime costs begin to impact profits on specific projects, before they escalate into a budget crisis.

Today, powerful time-tracking tools like Clockify allow businesses to generate reports from tracked time, helping them stay on top of their allocated time and expenses.

25% of employees say tighter data security is the most important improvement they want

The same ADP survey also finds that a quarter of respondents cite robust security as a top area for improvement in payroll software.

Payroll data contains sensitive information such as SSNs, addresses, and bank account details. Since a breach in this area can trigger massive legal penalties under laws such as the CCPA or GDPR, moving to a dedicated, encrypted cloud solution acts as a shield, shifting the security burden to the service provider.

Employees are realizing that their payroll portal is a “high-value target” for cybercriminals today, on par with their bank account.

A secure time-tracking solution paired with a reliable payroll software is the key to accurately measured paychecks that are both error-free and fraud-proof.

52% of employees with on-demand pay access it through a program directly offered by their employer's payroll software

PayrollOrg’s survey suggests that more than half of employees access their on-demand pay through their employer’s payroll software.

Considering that just a few years ago, most on-demand pay came from third-party apps that charged high fees, the shift to employer-offered programs is massive. This shift implies that companies now view daily pay access as a retention tool (similar to health insurance) rather than allowing employees to pay for high-interest apps.

By using a program directly integrated into the payroll software, the employer ensures compliance with tax laws and avoids penalties.

Only 3.3% of employees still receive a paper paycheck

According to a recent survey by Nacha, 3.3% of participants reported receiving a paper check in 2025, a 0.4% decrease from 2024. This fraction represents the portion of the workforce that could benefit from payroll digitalization, in terms of time and cost savings.

An automated payroll system eliminates the disproportionate manual effort required to process these few physical checks, preventing the payroll team from being slowed by check reconciliations and lost-check reissues.

🎓 Here’s Why Using Pen-&-Paper for Timesheets Costs You Money

#5: Payroll error rate statistics for 2026

This section highlights the latest data on common payroll errors across industries.

78% is the average payroll accuracy rate globally

The data from ADP’s Survey indicates that nearly 1 in 4 payroll runs contain data errors or require correction.

In payroll, this low standard is often tolerated because the errors are often fixed after the fact.

However, the fix-it-later culture is expensive. It forces payroll teams to operate in a perpetual cleanup rather than improving their processes. Sadly, this effectively prevents them from working on more strategic initiatives.

1 in 2 HR teams spend 5+ hours per month resolving payroll issues

According to Remote’s State of Payroll Report, 49% of HR teams reported spending 5+ hours per month correcting errors, a significant drain on administrative productivity.

Every hour an HR manager spends explaining a pay stub calculation to an angry employee is an hour they’re not spending on recruiting, training, or culture building — a much more important HR task.

An HR automation tool prevents these issues from occurring in the first place, freeing up 5 hours for HR to focus on more complex, higher-value tasks.

18% of employees experienced payroll mistakes 3+ times in a single year

Remote’s report also states that almost a quarter of respondents show systemic process failures. A single error is a mistake — 3 errors is a broken system.

The companies likely suffer from tech debt, using legacy software that can’t handle modern complexities such as remote work taxation and variable shifts.

As more businesses gravitate towards modern work-time management solutions and payroll software, we’ll likely see a decline in this percentage.

56% of US employees report high levels of stress and anxiety caused by late payments

The report also shows that more than half of surveyed workers have mental health consequences because of late pay — one of the most common payroll complications.

Financial stress is a known productivity killer. An anxious employee is often a distracted employee. By guaranteeing timely payment, employers can remove a major psychological burden, allowing staff to focus entirely on their work rather than constantly worry about their bank balance.

PayrollOrg’s survey reports that 49% of employees say it would be “very difficult” to meet their financial obligations if their paycheck were delayed by just one week. This further underscores how much timeliness matters when it comes to pay.

🎓 Fed up With Late Client Payments? Get Paid Faster With 3 Tips

24% of employees who faced a payroll issue reported receiving a late payment

Remote’s findings suggest that 1/4 of employees experienced both payroll issues and late payments — a direct violation of state labor laws in many jurisdictions.

In many states and countries, late payment is legally treated as non-payment and carries automatic penalties. This fact highlights the danger of manual payroll. If the payroll person gets sick, pay is late.

In contrast, automated systems ensure continuity and compliance regardless of who’s working.

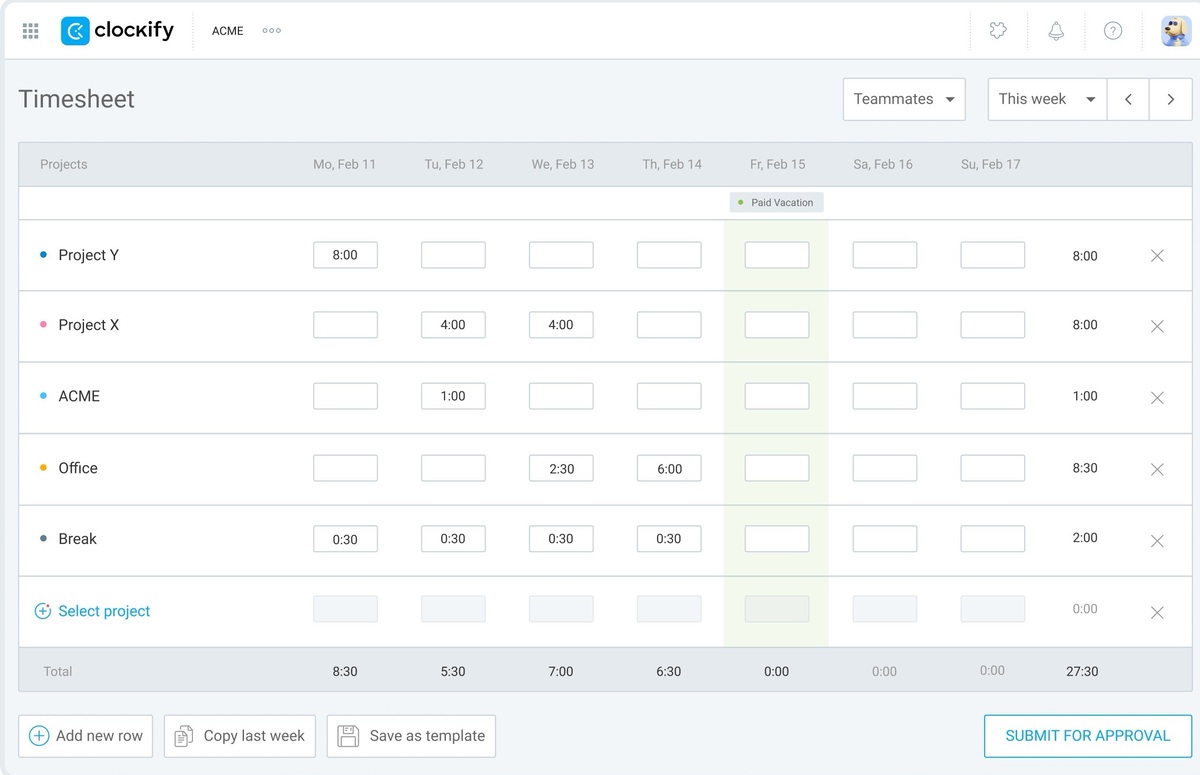

Ensure simple and reliable payroll — with Clockify

Properly tracking your time at work is a prerequisite for enabling accurate, compliant, and timely compensation. Without reliable input (accurate work time), you won’t have reliable output (employee paycheck).

To make your input consistent and precise, use a simple tool like Clockify.

Clockify is a powerful payroll tracker that lets you manage productivity by setting up and tracking billable and unbillable projects, analyzing time spent on tasks, and determining hourly rates.

With its simple interface and easy-to-navigate features, Clockify lets you:

- Track time and attendance — approve and audit time entries for each employee as an admin,

- Generate reports — break down time and costs for projects,

- Forecast project time — stay within budgets and deadlines,

- Export time data — import it into your payroll management system with ease,

- Track time off — add, remove, and approve time off and set holiday policies, etc.

You can count on Clockify’s fully human customer support that’s available 24/7 for users on all plans (free included), as well as personalized onboarding assistance on all paid plans for qualified users.

Keep accurate time, manage your expenses, and lay the groundwork for tax compliance with Clockify by CAKE.com.